Bitcoin transaction volume plummets to 2023 lows – Bearish trend ahead?

- Bitcoin’s transaction volume has declined sharply, reaching levels last seen in 2023, indicating reduced network activity.

- Open interest trends suggested traders are cautious, while BTC price struggles to maintain key support levels near $86K.

Bitcoin’s [BTC] transaction volume has dropped to levels not seen since early 2023, raising concerns about the market’s strength.

The decline in transaction activity comes at a critical juncture as BTC faces increasing resistance near the $86,000 mark. Could this signal the start of a bearish trend, or is the market merely consolidating before another move?

A sharp decline in Bitcoin transactions sparks concern

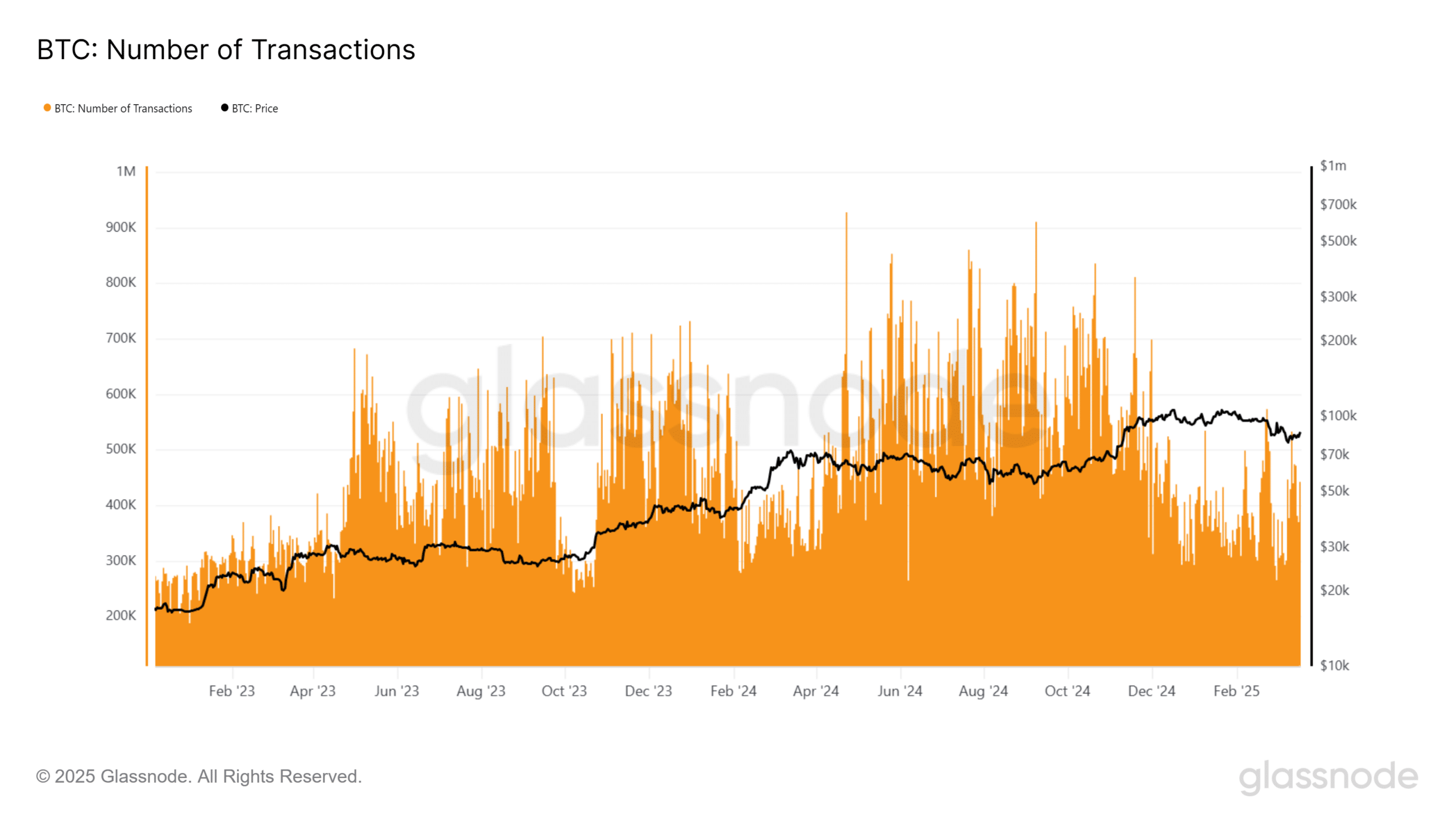

Recent data from Glassnode highlights a significant drop in BTC’s transaction volume.

At its peak in mid-2024, Bitcoin saw over 700K daily transactions, a sharp contrast to the current levels, which have fallen below 400K. Historically, a drop in transaction volume has often preceded periods of price stagnation or corrections.

This reduction in transaction count suggests that network activity is slowing, which could indicate reduced market participation.

If the trend continues, Bitcoin may struggle to maintain its current price levels, as a lack of demand could weaken support zones.

Open Interest and volume confirm weakening momentum

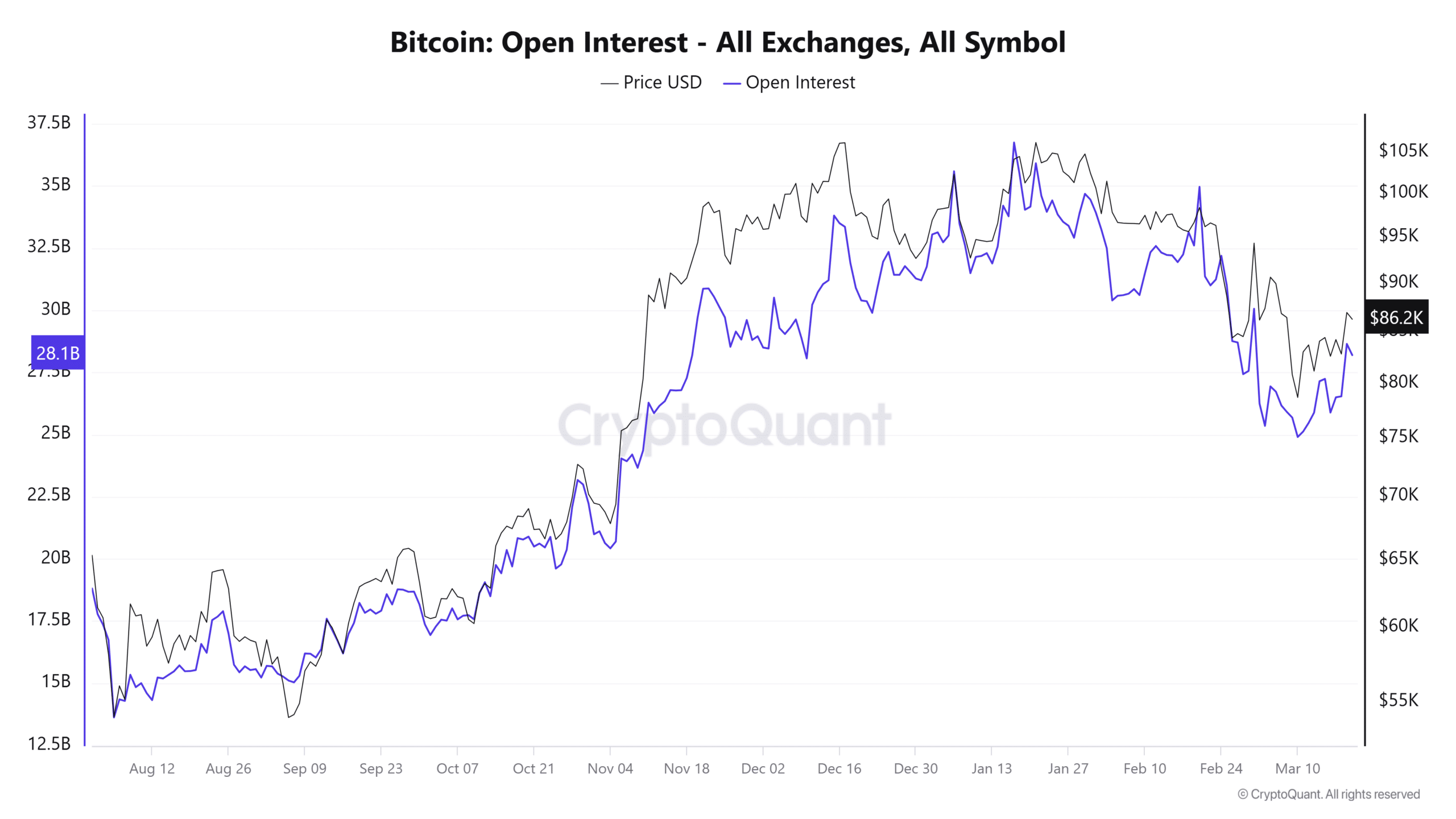

A broader analysis of market indicators reveals further bearish signals. According to CryptoQuant, Bitcoin’s Open Interest (OI) has also declined significantly.

OI across exchanges was at $86.2 billion, at press time, down from highs above $100 billion earlier in the year.

Although the OI has significantly increased in the last few days, the comparison suggests that traders are reducing their leveraged positions. This trend could lead to lower volatility and a diminished speculative buying appetite.

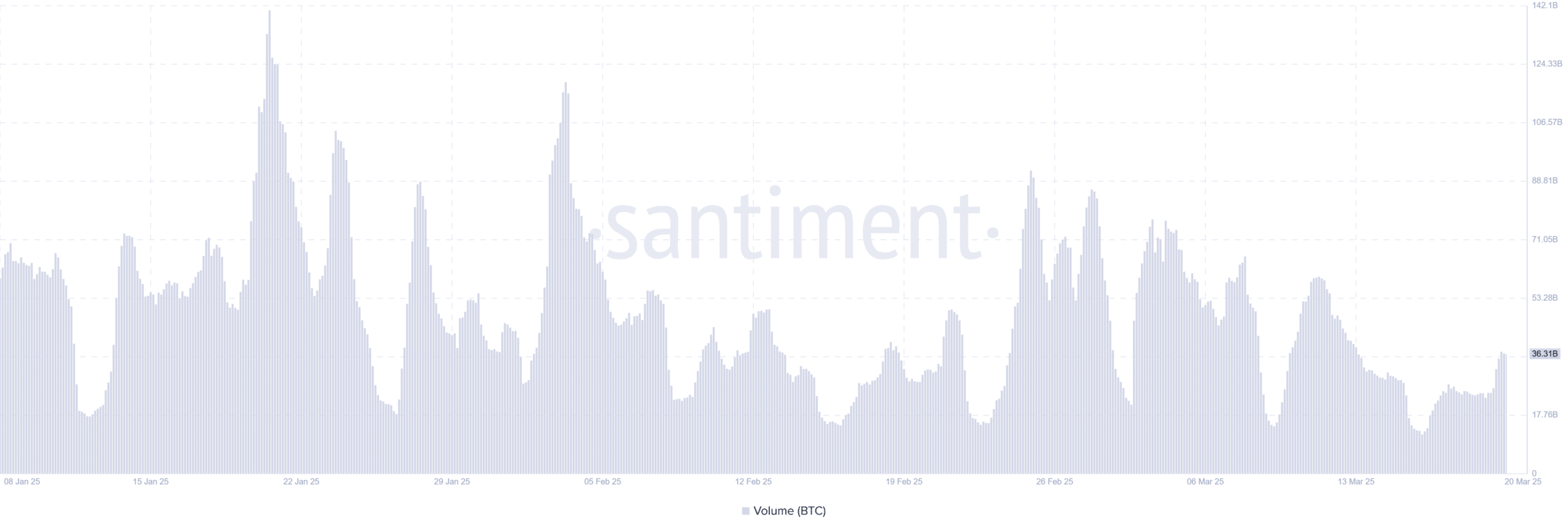

Meanwhile, as tracked by Santiment, Bitcoin’s trading volume has also seen a notable drop. BTC volume recently touched 36.31 billion, a sharp decline from its February highs.

The lower volume confirms that fewer traders are actively engaging with BTC at its current price, increasing the likelihood of a downside move if buyers fail to step in.

Key levels to watch

At the time of writing, Bitcoin was trading at around $85,856, facing resistance at $86,877. The 50-day Moving Average was at $85,873, acting as a crucial pivot point. Failing to hold above this level could send BTC back toward support at $80,000.

Conversely, if BTC breaks past $87,500, it could challenge the $90,000 level, which remains a psychological barrier.

While a price breakdown is not yet confirmed, traders should keep a close eye on transaction volume and OI for signs of further deterioration.

Bitcoin could enter a prolonged consolidation phase or even a bearish correction in the coming weeks if network activity fails to recover.