Bitcoin

Bitcoin turns bullish: Is it decoupling from the altcoins?

Bitcoin’s surging demand was motivated by a sharp rise in network profitability.

- Bitcoin was up 12.61% in the last seven days.

- Bitcoin’s supply on exchanges dipped sharply over the week, suggesting strong accumulation.

Bullish momentum was back into the Bitcoin [BTC] market as the king coin broke out of a month-long range to sail as high as $48K the past week.

As of this writing, the world’s largest cryptocurrency was exchanging hands at $48,313, up 12.61% in the last seven days, according to CoinMarketCap.

The rally ended the prolonged low volatility phase and brought traders into action.

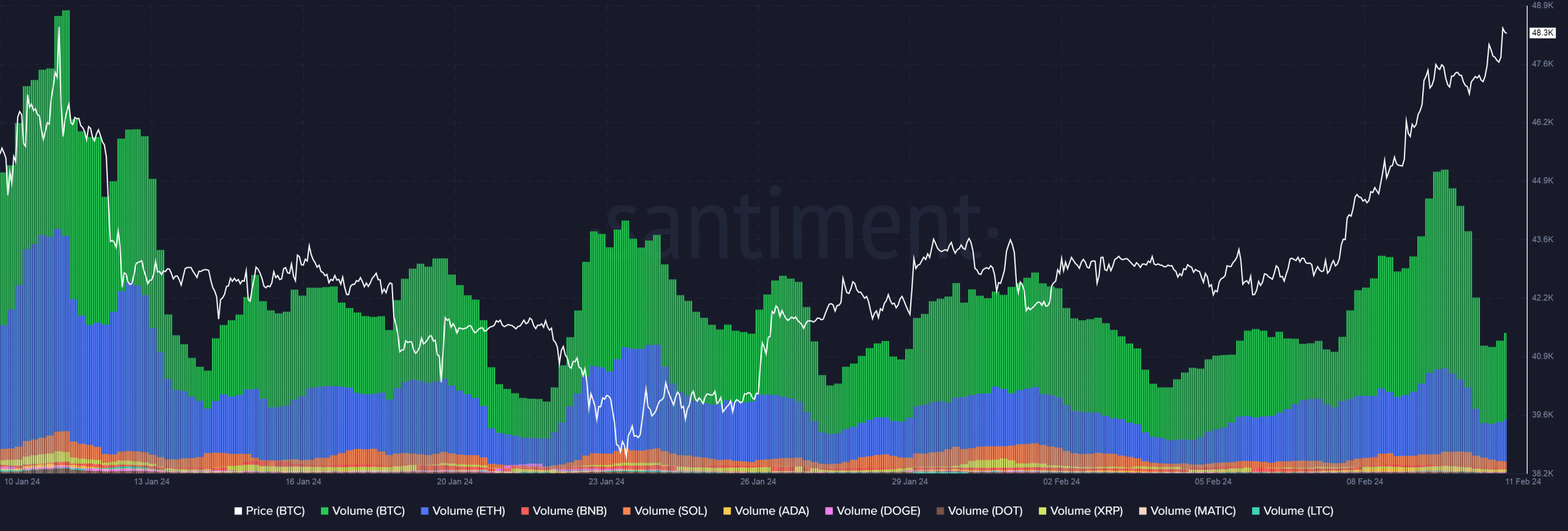

According to on-chain analytics firm Santiment, Bitcoin’s daily trading volume hit $39.31 billion on the 10th of February, the highest in four weeks.

Interestingly, the rest of the crypto market, including Ethereum [ETH], remained subdued in comparison to Bitcoin’s frantic trading activity.

This indicated the possible decoupling of Bitcoin from the rest of the market.

Bitcoin investors go on a stockpiling spree

Bitcoin’s strong accumulation spurred the upward momentum. As per AMBCrypto’s scrutiny of Santiment’s data, Bitcoin’s Supply on Exchanges dipped sharply over the week.

Moreover, the Exchange Flow Balance was negative over the last 3–4 days, meaning that more BTC flowed out of exchanges than flowed in.

This was an indication that investors were getting confidence in Bitcoin’s highly-anticipated super cycle in 2024 and hence began to add to their holdings.

Unrealized profits increase

The accumulation was also motivated by a sharp rise in network profitability. As of this writing, BTC holders on average will earn profits of 12.37% on their investments.

However, the readings of the MVRV indicator should be taken with a pinch of salt. The more it increases, the more likely traders have historically demonstrated their willingness to sell.

Large whale transactions did increase when prices rallied, but there wasn’t a major jump when compared to data from the previous two weeks.

Bullish narrative gets stronger

Bitcoin’s press time state led many popular names in the industry to go bullish on the coin.

Inasmuch, anonymous analyst PlanB, the creator of the stock-to-flow (S/F) deflection model, said that a bull market was “inevitable.”

? 95% of all bitcoin in profit: bull market inevitable pic.twitter.com/2TVNzGym8x

— PlanB (@100trillionUSD) February 10, 2024

Read Bitcoin’s [BTC] Price Prediction 2024-25

The broader market sentiment was tilted towards greed, according to the latest reading of Bitcoin Fear and Greed Index.

This meant that more accumulation may occur in the short future, keeping Bitcoin on track to reach $50,000.