Bitcoin vs. Dogecoin: Is DOGE poised to defeat BTC with a 2400% rally?

- Between the first week of January and now, DOGE has increased by around 480%.

- It saw more positive trends in November.

Dogecoin [DOGE] has captured market attention once again, with technical indicators and price action suggesting a potential breakout against Bitcoin [BTC].

A chart analysis revealed a bullish pattern that could propel DOGE by as much as 2,400%. Recent on-chain data analysis showed positive trends, adding further weight to this potential upward move.

Dogecoin vs. Bitcoin

Dogecoin’s chart showed a clear breakout from a multi-year descending channel. This breakout, marked by strong upward momentum, positioned DOGE for a potential price surge.

The measured move from the breakout projected a target of 0.00009375 Bitcoin, implying a staggering 2,400% rally from current levels.

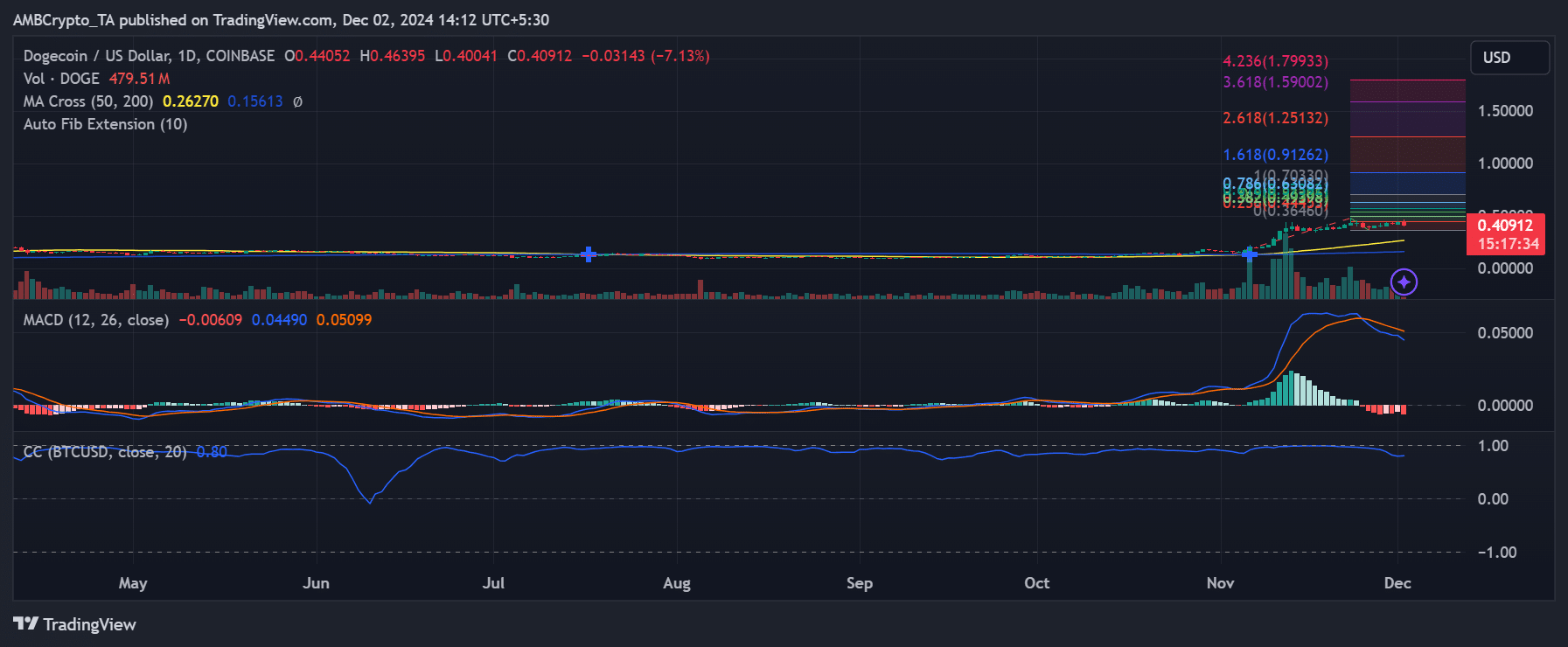

The MACD (Moving Average Convergence Divergence) indicator on the DOGE/USD daily chart supported this bullish sentiment. The MACD line has crossed above the signal line, signaling increasing upward momentum.

The histogram shows slight consolidation – this is typical during early breakout phases. Additionally, the 200-day moving average provided strong support around $0.26, reinforcing the possibility of sustained bullish momentum.

The correlation coefficient (CC) between Bitcoin (BTC/USD) and Dogecoin (DOGE/USD) sat at -0.80 at press time, indicating an inverse relationship.

As Bitcoin consolidated near $95,000, Dogecoin appeared primed to capitalize on market liquidity shifting towards altcoins, a trend commonly observed in bull cycles.

Surge in daily active addresses

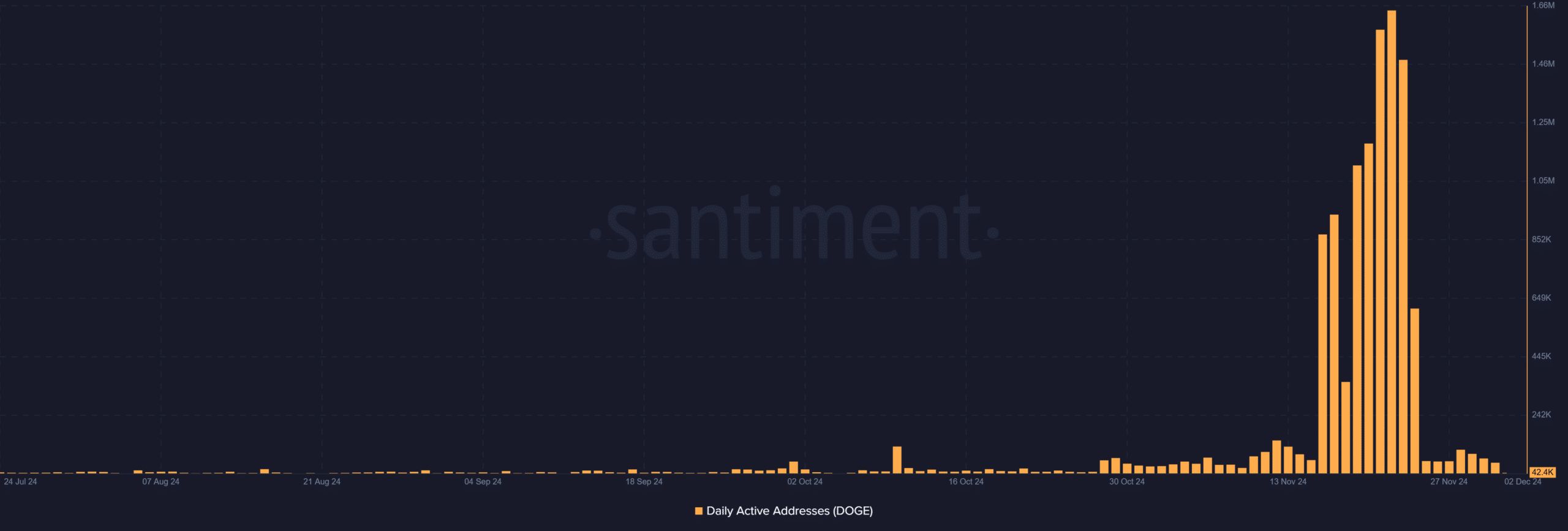

AMBCrypto’s look at Santiment data highlighted a notable surge in Dogecoin’s daily active addresses in late November, peaking at over 1.6 million. This is a significant increase compared to the subdued activity levels seen earlier in the year.

Historically, spikes in active addresses have preceded substantial price rallies, suggesting renewed investor interest and network activity.

Additionally, whale activity is picking up, with large transactions becoming more frequent. This indicates that institutional players or high-net-worth individuals are positioning themselves for potential price

movements. The alignment of on-chain activity with technical breakout signals further supports the bullish outlook for Dogecoin.

Dogecoin market sentiment and price projections

Market sentiment around Dogecoin remains optimistic, with social metrics reflecting increased discussions and mentions of DOGE.

This aligns with the token’s historical tendency to thrive in hype-driven environments, amplifying its potential rally.

Using Fibonacci extensions from the recent low, Dogecoin faces resistance at $0.78 (2.618 Fibonacci level), with a long-term target of $1.79 at the 4.236 extension.

This projection aligns with the breakout target on the DOGE/BTC chart, reinforcing the possibility of exponential gains. However, traders should remain cautious of profit-taking at key psychological levels, such as $1.

Realistic or not, here’s DOGE market cap in BTC’s terms

Dogecoin is on the verge of what could be a massive breakout, supported by positive technical indicators.

As Bitcoin consolidates, Dogecoin’s inverse correlation with BTC adds further intrigue, positioning it as a standout performer in the altcoin space.