Bitcoin vs Ethereum – Here’s why Raoul Pal is backing ETH in a post-election race

- Bitcoin surpassed its previous all-time high post-election, while Ethereum approached the $3k resistance

- Raoul Pal predicts Ethereum could outpace Bitcoin due to evolving regulations and DeFi growth

Donald Trump’s victory as the 47th president of the United States has sent positive waves throughout the cryptocurrency market, with some coins surging to new heights.

Bitcoin and Ethereum’s price action analyzed

Bitcoin [BTC], in particular, capitalized on the post-election momentum, breaking through its previous all-time high which had been set earlier in March.

At the time of writing, Bitcoin was trading at $76,121.63, following a 1.58% hike in the last 24 hours and an 8.68% surge over the past week.

Similarly, Ethereum [ETH], the second-largest cryptocurrency by market cap, surpassed its critical $2,500 resistance level and was trading at $2,926.80. At the time of writing, it had gained by over 12% on the weekly charts.

These developments, together, pointed to a sustained bullish trend for the market’s leading cryptocurrencies in the wake of Trump’s election victory.

Bitcoin outpaces Ethereum, but Raoul Pal believes otherwise

When comparing the price movements of Bitcoin and ETH, it is clear that Bitcoin has exceeded expectations, surpassing its previous all-time high. On the contrary, Ethereum, which was widely expected to break the $4,000 barrier, is yet to achieve that milestone.

Amidst this, Raoul Pal made an argument where he suggested that ETH could soon outpace Bitcoin in terms of performance.

He said,

“I’ve been expecting $ETH to start gaining lost ground on BTC. It’s partly driven by the risk taking cycle but it’s also driven by the election.”

What are the factors he used to support his argument?

Pal further highlighted several factors that could drive Ethereum’s potential outperformance over Bitcoin.

He noted the positive evolution of the crypto regulatory framework, which is expected to continue improving in the near future. Hence, as regulations become clearer and more established, Pal believes that ETH, with its dominant role in the decentralized finance (DeFi) space, is well-positioned to reap the benefits.

Additionally, DeFi tokens are gaining traction, offering lucrative opportunities, and Ethereum’s foundational role in this ecosystem enhances its value.

Finally, ETH’s strong reputation for security and trust makes it a strong contender for integration into traditional finance, where its flexibility and scalability could attract institutional adoption.

What’s more?

He concluded his argument by stating,

“My view is that ETH begins to outpace BTC for the rest of the cycle but underperforms SOL and $SOL underperforms $SUI as SUI is in the ultimate performance stage of adoption – early > proven.”

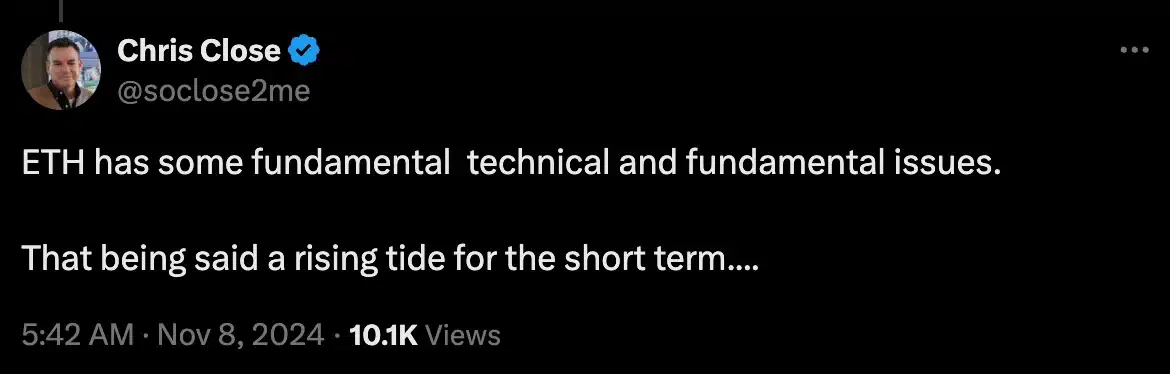

Here, it’s worth noting that Pal’s thoughts were met with criticism from Chris Close who said,

Nonetheless, Pal remained firm in his argument and responded by saying,

“We all have issues my friend. It doesn’t hold us back from greatness.”

Ergo, on the back of Ethereum’s positive momentum and ongoing efforts to break through $3k, the next few days will reveal whether it can sustain this upward trajectory or not.