Bitcoin vs. Ethereum: Higher fees spark debate as demand booms

- Bitcoin transaction fees hit an all-time of $80 million.

- Stacks exec believes fees will go even higher as BTC L2 expands.

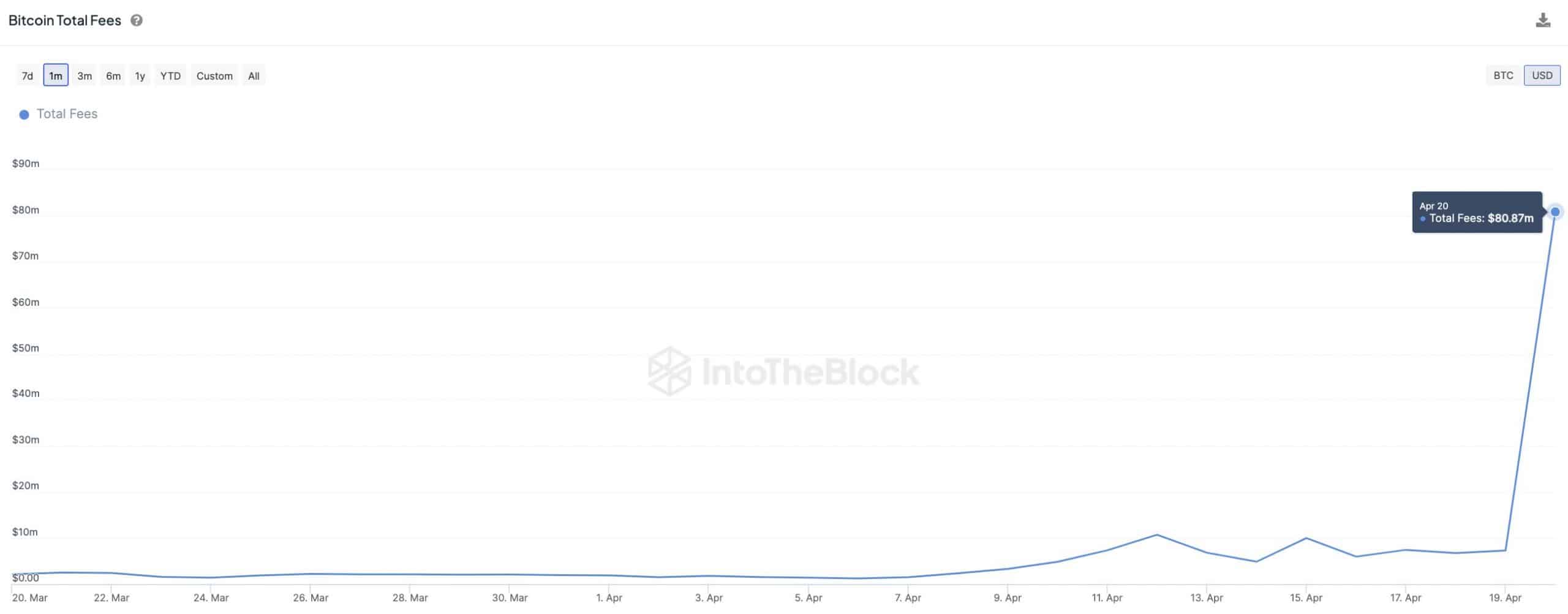

Bitcoin [BTC] miners have been more profitable after the fourth halving. On 20th April, BTC hit record fees of over $80 million, outpacing its previous all-time high in 2017, according to IntoTheBlock’s Head of Research, Lucas Outumuro;

“The $80M in daily fees is approximately 4x larger than the previous ATH set in December 2017. The average $BTC transaction fee was a whopping $128, dwarfing the $30 peak reached during the first Ordinals frenzy.”

The higher-than-average transaction fees have attracted debate on demand for block space between Ethereum [ETH] and Bitcoin networks.

BTC vs. ETH: Runes effect?

Referencing BTC’s higher-than-normal $128 average fees, a pseudonymous crypto analyst claimed that the Bitcoin network now has more demand for block space than Ethereum. He stated;

“The average fee to send value on Ethereum network is about $0.50 right now (single digits gwei). On Bitcoin network it’s $20. That’s a 40x difference in demand for BTC blockspace. Huge alpha there.”

It’s worth noting that the spike in BTC fees also coincided with the launch of Runes Protocol, a new Bitcoin fungible token standard.

However, another user, Adriano Feria, downplayed Bitcoin’s higher fees and stated,

“BTC’s fees are still $20 because LN (Lighting Network) is garbage, and there are no other alternatives.”

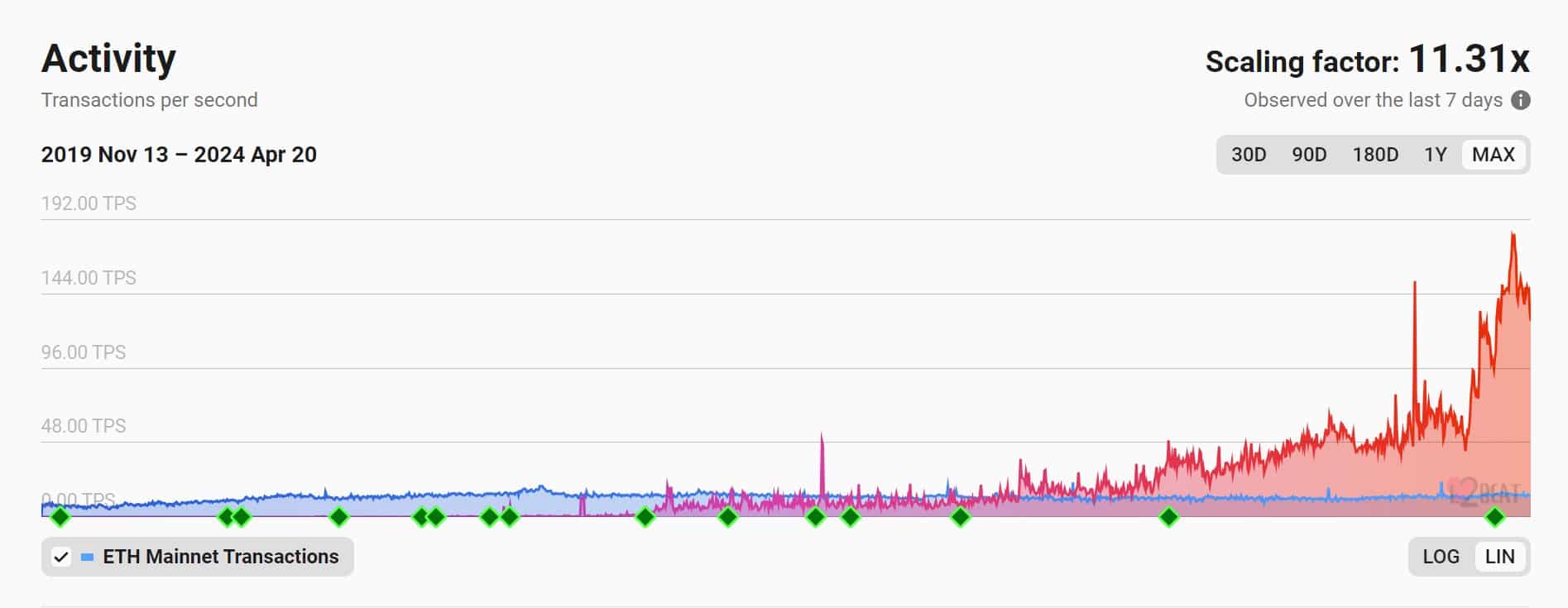

Feria added that blobs have positively impacted Ethereum and shifted demand to L2s;

“Demand for transactions secured by ETH are at an ATH, but they are just shifting to L2s.”

Nevertheless, other analysts and execs expect Bitcoin to record more fees as Runes Protocol gains more traction and BTC L2s heat up.

On Runes’ impact on BTC fees, Outumuro added;

“24 hours after the halving, inflationary rewards have dropped by 50%, but transaction fees spiked 1,200% due to Runes. Miners made a record $100M+ in revenue on 4/20.”

Right now, Runes Protocol is dominated by memecoins. However, the upcoming Nakamoto upgrade of the Bitcoin layer-2 scaling solution, Stacks [STX], could further fuel activity and fees.

Stacks co-founder, Ali Muneeb recently highlighted that;

“Remember when we told you that Bitcoin fees will do a 500x? Yeah, we’ve been working on Bitcoin L2s for a reason. Happy halving, everyone! Next stop, Nakamoto.”

Merlin Chain, another BTC L2, went live on 19th April and now leads in terms of TVL (Total Value Locked) per DefiLlama data.

If the BTC L2 ecosystem re-ignites interest in the network, BTC transaction fees could remain higher.