Bitcoin vs Gold: Is the “digital gold” outperforming its real-world counterpart

- BTC recorded better growth than Gold since the U.S. banking crisis.

- BTC has shown increased decoupling from Gold in recent months.

Ravaged by the bear market phase of 2022, the world’s largest digital asset by market cap Bitcoin [BTC] saw a relief rally in 2023, resulting in a 50% year-to-date (YTD) price increase.

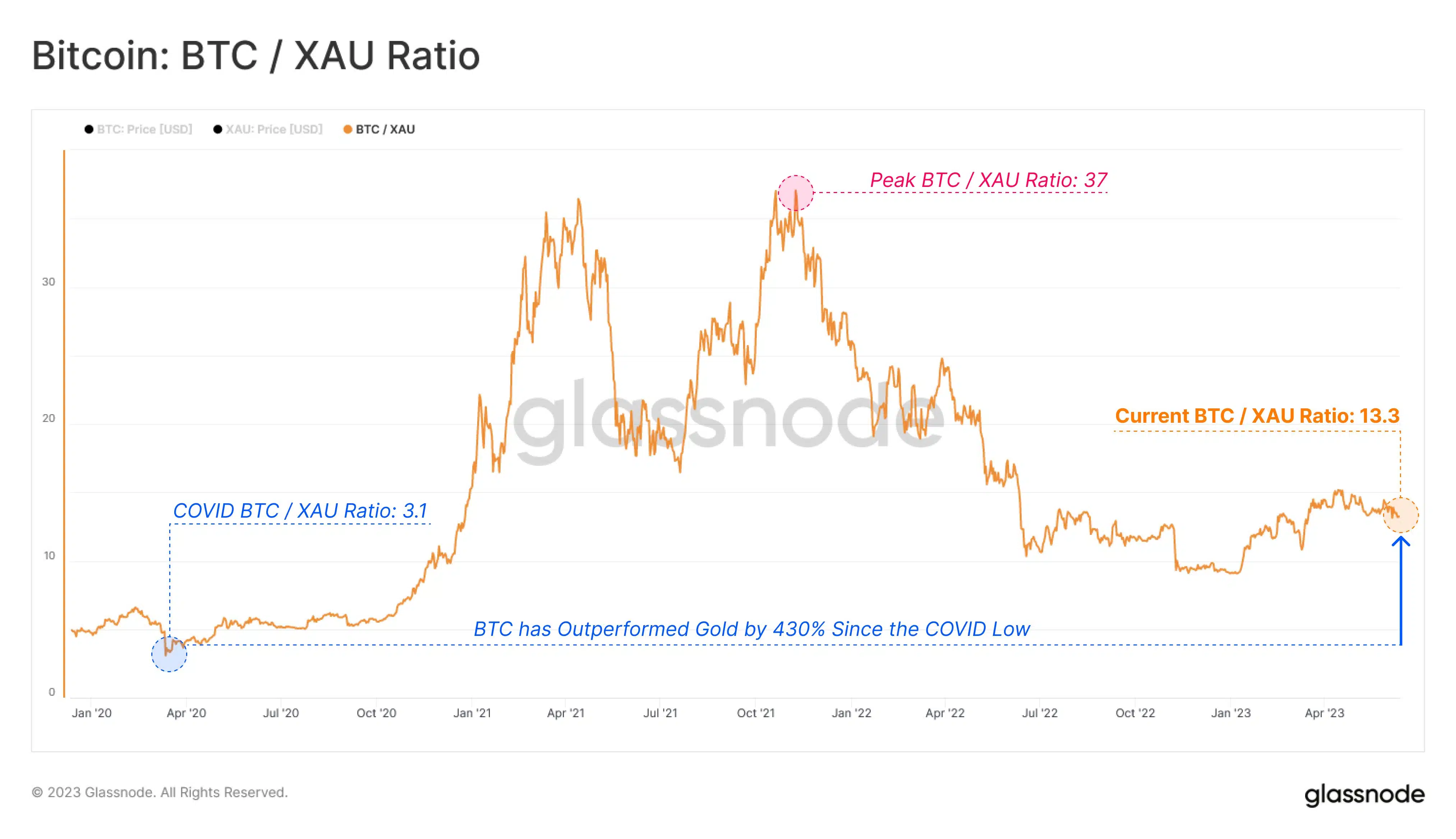

Notably, this bull run has boosted its value relative to Gold [XAU]. According to a tweet by on-chain analytics firm Glassnode dated 14 June, it required 13.3 ounces of Gold to buy a single Bitcoin, a significant increase of 46% seen since the start of the year.

While this was still a far cry from the peak BTC/XAU ratio of 37 attained during the 2021 bull market, when compared from the Covid-19 low, it reflected a massive growth of 430%.

How much are 1,10,100 BTCs worth today?

Digital Gold winning against real Gold?

On analyzing the price trajectories of the two assets YTD, it was revealed that the “digital gold” outperformed its real-world counterpart comprehensively. While BTC as noted above, soaked 50% gains, Gold could only manage a jump of 6.4% since the start of 2023.

To put things into perspective, Bitcoin’s growing value vis à vis Gold meant that the market could start to prefer the digital asset over the precious metal as a hedge against inflation. This could reinforce BTC’s long-supported narrative of being a safe-haven asset.

A safe-haven asset is one whose value is anticipated to remain stable or increase through periods of economic downturns. And BTC proved its mettle during the U.S. banking crisis of March, having grown 21% since then. On the other hand, the yellow metal could only grow by 4% since the turmoil.

However, given BTC’s reputation as a volatile asset, investors should take this development with a grain of salt. With the broader crypto market suffering from the hostilities of U.S. regulatory environment, the gains made by BTC in 2023 could be reversed quickly.

Are your BTC holdings flashing green? Check the Profit Calculator

Bitcoin and Gold stay insulated

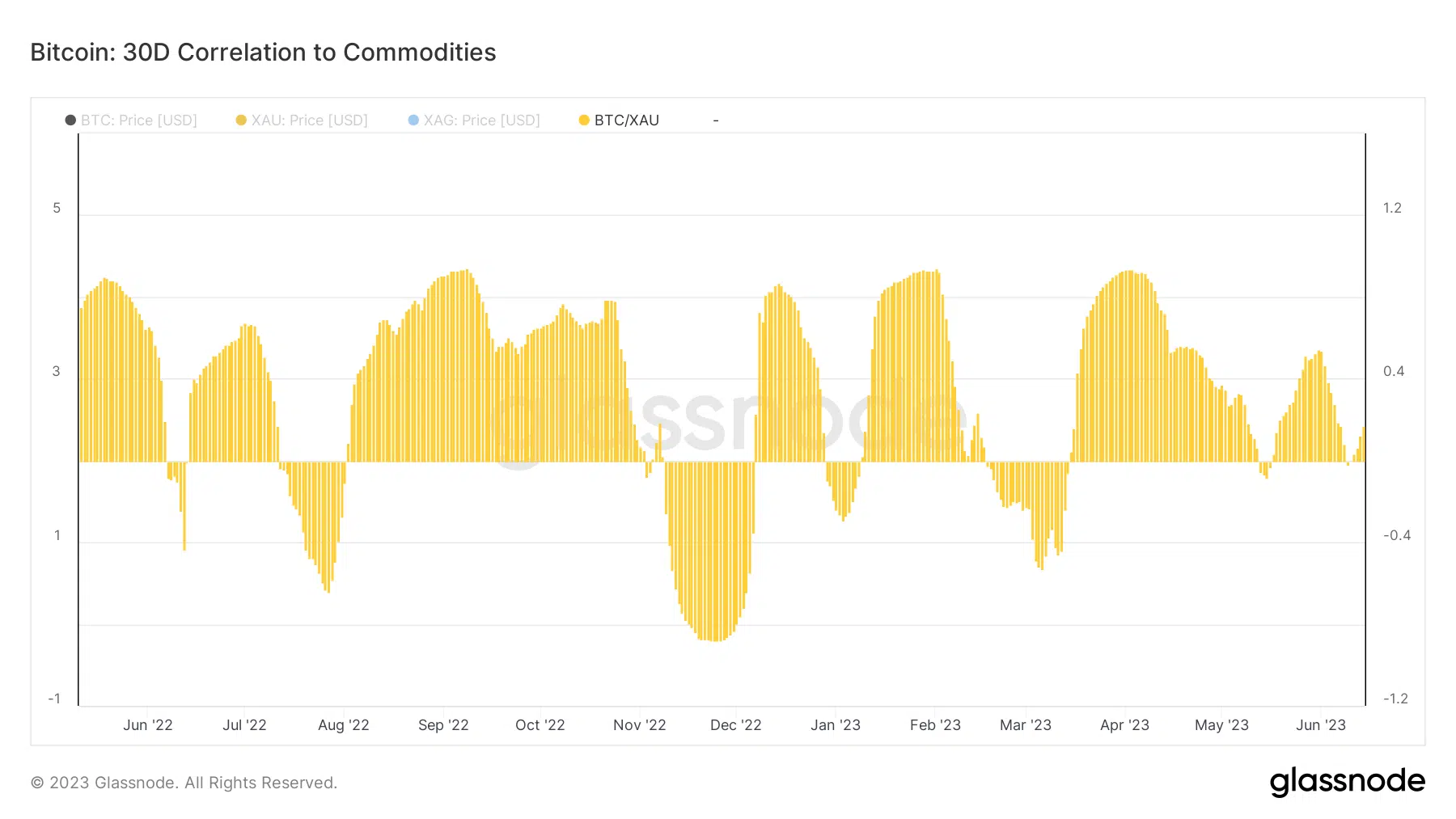

In recent months, Bitcoin has shown increased decoupling from Gold. The BTC/XAU correlation dipped to 0.17 as of 14 June, per Glassnode data. This was a steep retracement from the multi-year highs seen during April.

It meant Bitcoin was seen as an independent asset class with its own fundamentals rather than getting impacted by headwinds in the real world.