Bitcoin whale buys $31M BTC as prices crash – Is a reversal incoming?

- BTC’s exchange reserve was at its lowest level in recent months at press time, indicating whale accumulation.

- If BTC’s price falls below the $56,500 level, there is a high possibility it could fall to $54,000 or $52,000 levels.

The current market sentiment appears extremely bearish, while crypto whales are capitalizing on this opportunity and heavily accumulating.

On 4th September, the on-chain analytic firm lookonchain made a post on X (previously Twitter) which said that a Bitcoin [BTC] whale bought 545 BTC worth $30.82 million as the price fell notably.

Whale activity amid price drop

The post on X also noted that this whale has purchased nearly 862 BTC worth $49 million at an average price of $56,993 level over the last three days. This is not the only time whales have taken advantage of a price dip as an opportunity.

Recently, the on-chain analytic firm Santiment shared a post on X, noting that whales and sharks holding between 10 to 10K BTC have accumulated 133.3K BTC from small traders who have been dumping in panic over the past month.

The significant accumulation of whales and sharks during the recent market downturn suggests a potential long-term buying opportunity.

Bitcoin technical analysis and upcoming levels

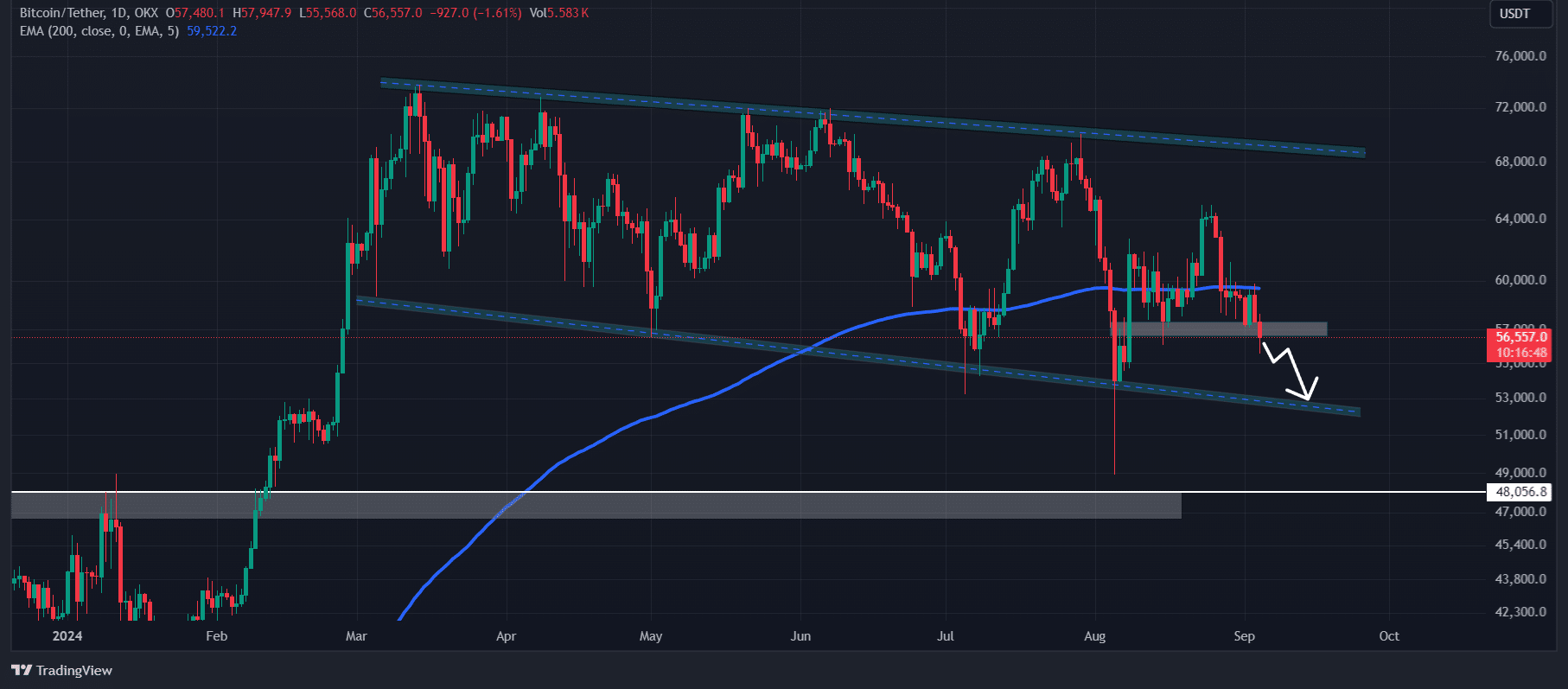

According to the expert technical analysis, Bitcoin appears bearish as it broke down a strong consolidation near the crucial support of $57,000.

If BTC price closes a daily candle below the $56,500 level, there is a high possibility it could fall to $54,000 or $52,000 levels in the coming days.

Currently, BTC is trading below the 200 Exponential Moving Average (EMA) on a daily time frame suggesting the asset is in the downtrend.

However, the Relative Strength Index (RSI) is in the oversold territory, signaling a potential price reversal.

Major liquidation levels

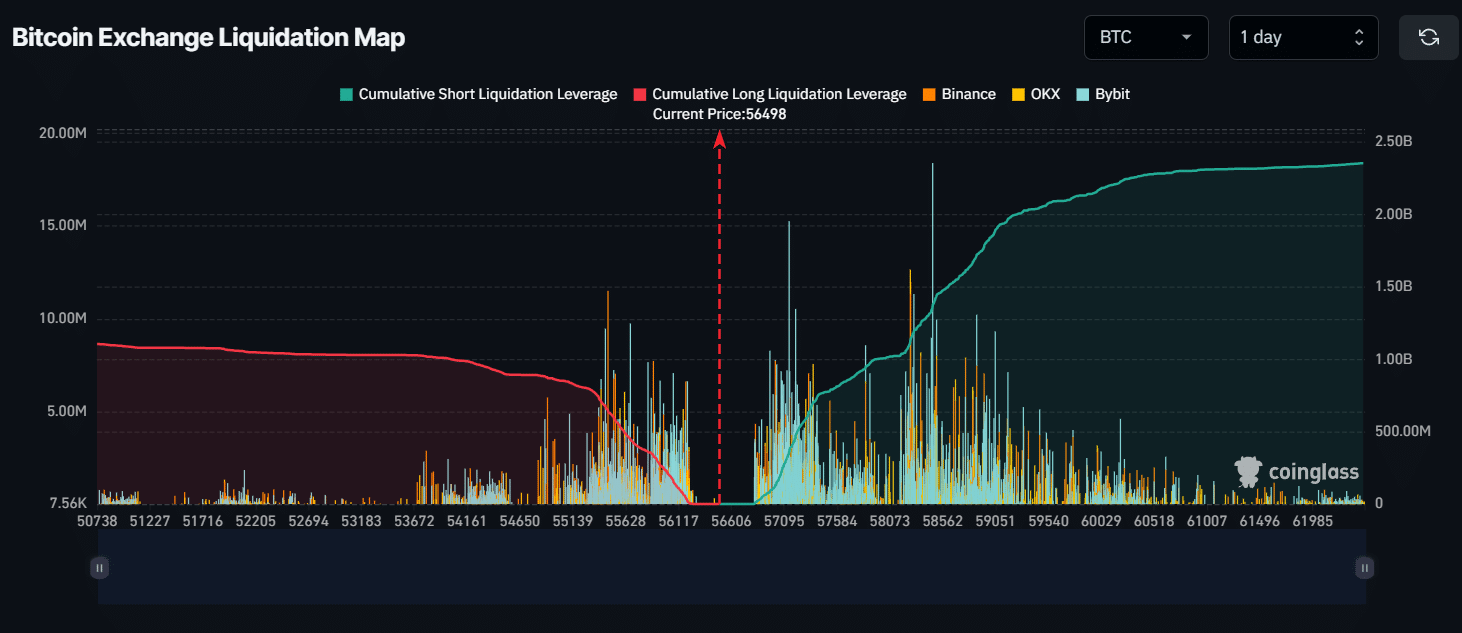

As of press time, the major liquidation levels were $55,450 on the lower side and $58,450 on the higher side, as these traders are over-leveraged at these levels, according to Coinglass data.

If the market sentiment remains bearish and the price falls to the $55,450 level, nearly $650 million worth of long positions will be liquidated.

Conversely, if the sentiments shift and the price rises to the $58,450 level, approximately $1.32 billion worth of short positions will be liquidated.

Data shows short sellers are currently dominating the asset and have the potential to liquidate more long positions. This thesis will only work if BTC closes a daily candle below the $56,550 level.

On-chain metrics show bullish signs

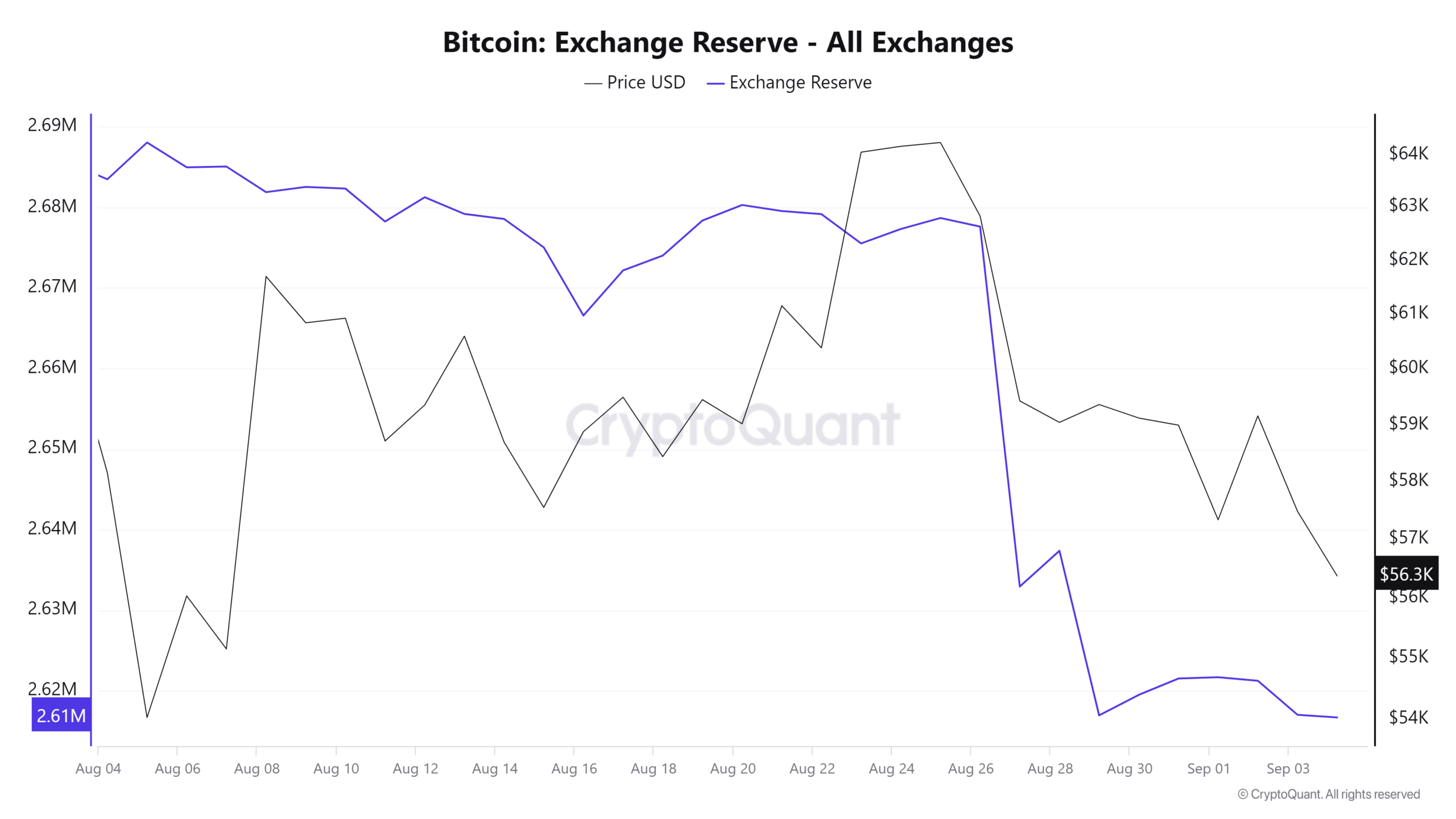

CryptoQuant’s on-chain metrics such as BTC exchange reserve and exchange inflow are flashing a bullish outlook for BTC.

According to the on-chain data, BTC’s exchange reserve is currently at its lowest level in recent months, indicating whale and institutional accumulation. Additionally, it signals a potential buying opportunity.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Whereas, BTC’s exchange inflow has been continuously falling in recent months, reflecting buying pressure from investors and institutions.

At press time, BTC is currently trading near $56,550 and has experienced a price decline of over 4.5% in the last 24 hours. Meanwhile, its open interest dropped by 4.65% during the same period, indicating a lowering in investor and trader interest.