Bitcoin whale confidence grows as BTC nears $60K – Should you buy the dip?

- Whale cohorts have tried to absorb aggressive selling, seizing the “dip”.

- However, they may not have established a market bottom, yet.

Bitcoin [BTC] is at a critical crossroads as bulls struggle to break resistance after a September rally brought prices close to $65K.

Priced at $60,480 at press time, the anticipated repetition of the late July cycle hasn’t materialized, with bears retreating and bulls targeting the next resistance at $68K.

Bearish pressure remains, raising fears of a deeper pullback; if bulls falter, BTC could retrace to around $55K. However, a significant event has sparked optimism, fueling speculation that this influx of demand could catalyze a short-squeeze.

Bitcoin whale confidence rises

Whale cohorts holding 1K to 10K BTC have displayed confidence in Bitcoin’s future gains, purchasing over 50K BTC in the last 10 days, valued at approximately $3.14B.

Interestingly, this buying surge coincided with a period when Bitcoin faced pressure from short-sellers after rising close to $63K. These purchases have prevented a significant pullback, aiding Bitcoin’s ascent toward the $65K resistance.

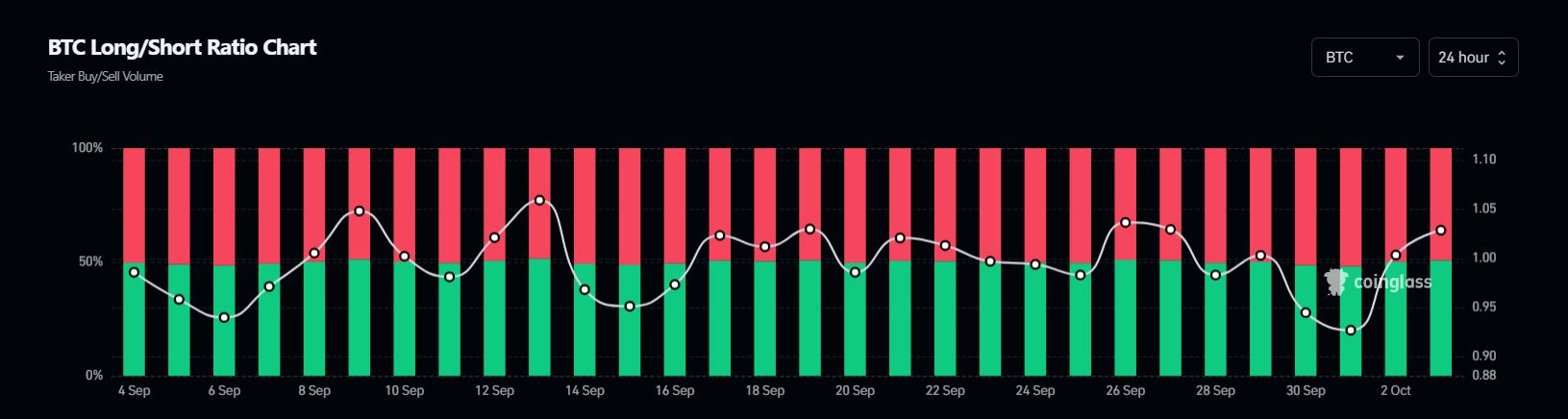

Put simply, shorts regained control in the derivatives market during the mid-September rally, exerting pressure on BTC for a pullback. However, whale accumulation absorbed this pressure, creating a situation ripe for a short-squeeze.

If a similar trend unfolds, short liquidations could be triggered, potentially becoming a catalyst for a significant rebound.

Putting short positions at risk

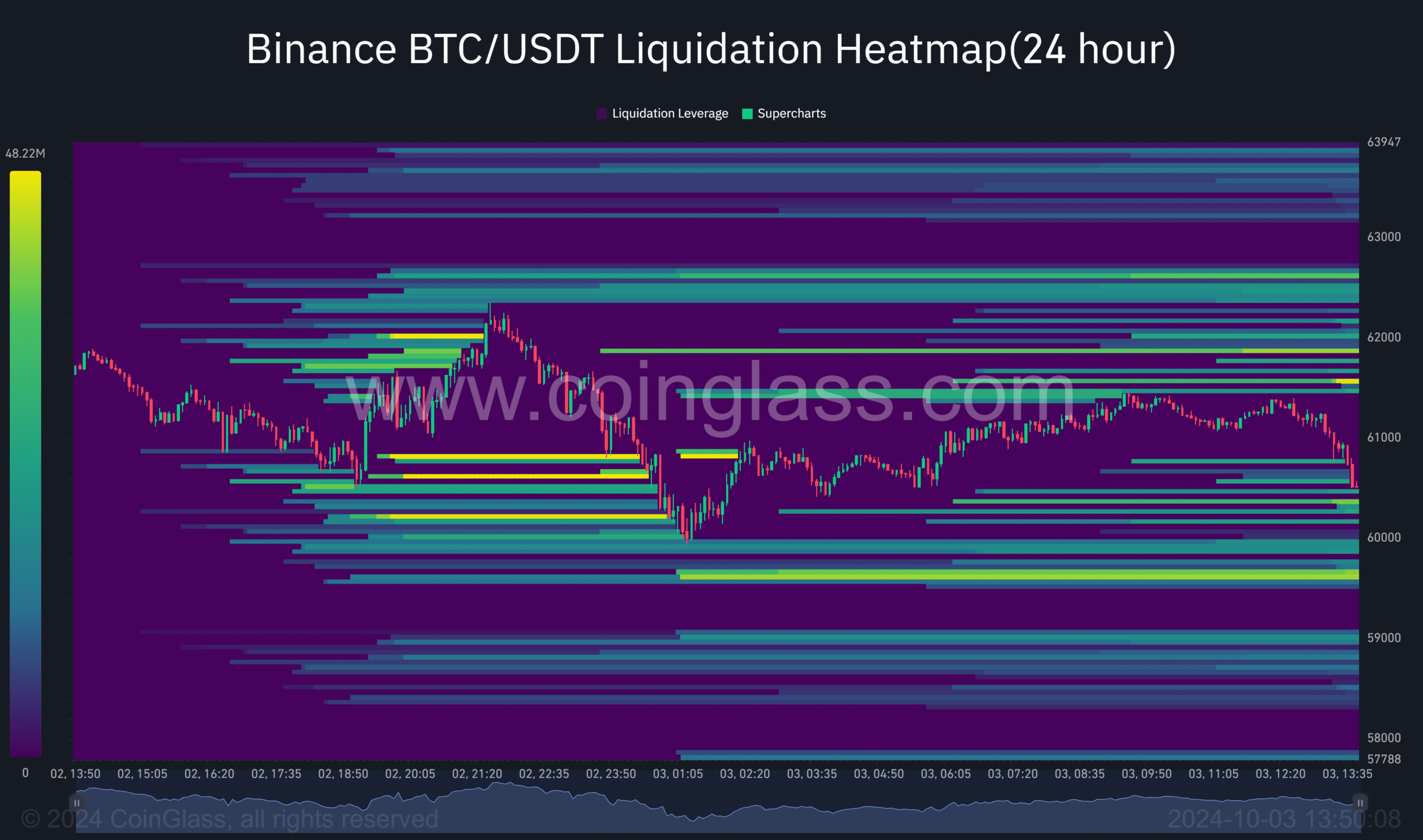

At present, a rebound to $61K presents a strong liquidity pocket, holding approximately $40M in leverage. A close near that range would jeopardize short sellers, forcing their positions to close and swinging BTC upwards.

A “flip” would signal a market bottom

Typically, whale accumulation patterns often align with Bitcoin testing a market bottom.

According to AMBCrypto, a retreat back to $60K was essential to shake off weak hands – those who acquired BTC at an earlier support of $55K – prompting them to cash in on their gains and exit the cycle.

Now, the key is to flip the $60K resistance into support, encouraging new buyers to enter the market. This shift would enable whales to target the market bottom and push BTC closer to $66K.

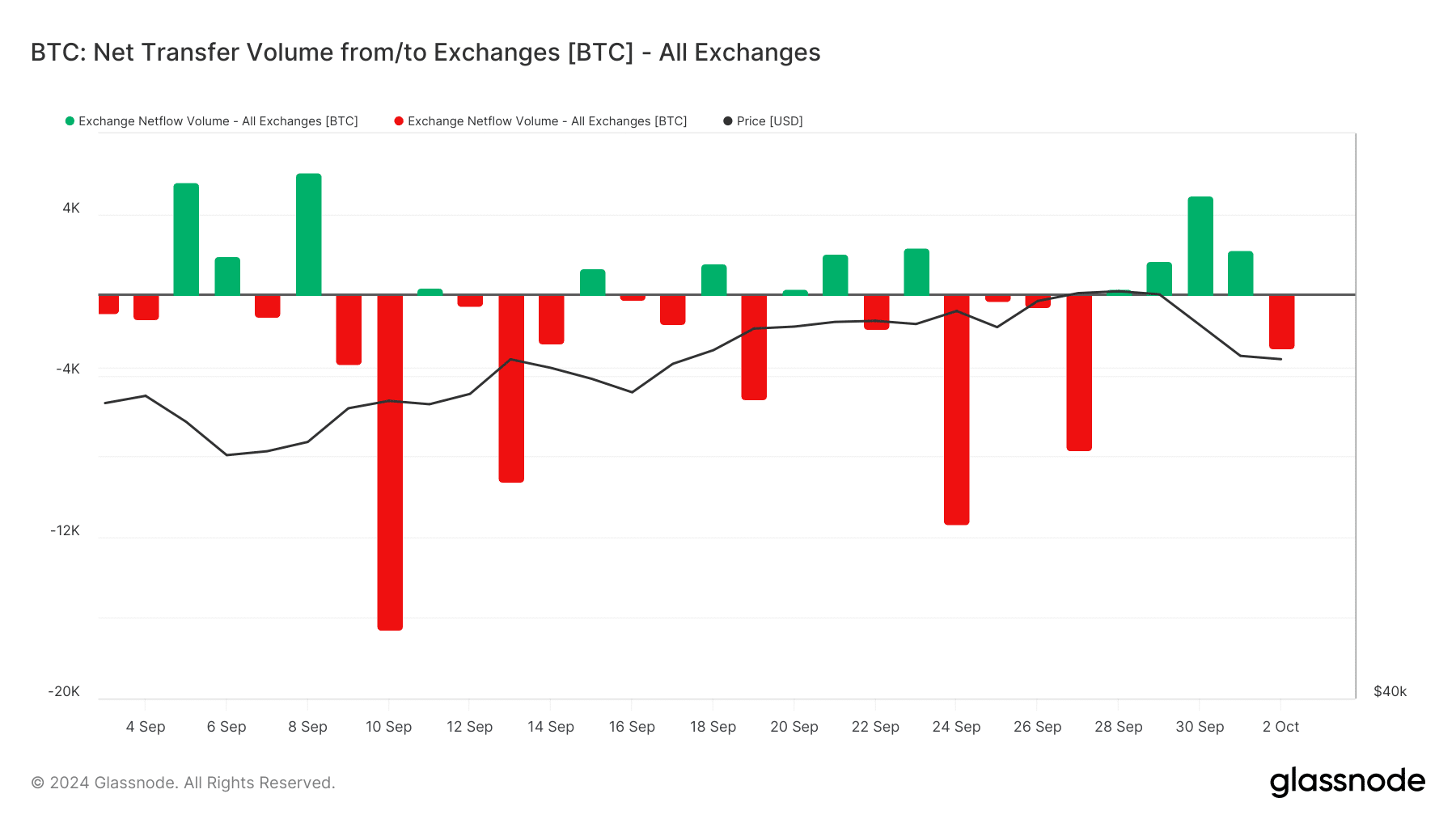

While net outflows have regained control after three days of rising BTC supply, suggesting that $60K presents a strong buy-the-dip opportunity, a more robust push is needed to confirm a bull rally.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In short, if bulls capitalize on this price point with aggressive buying and flip $60K into support, a rebound could drive BTC back to $66K.

Otherwise, if bearish sentiment prevails without any party to absorb pressure, fear could trigger panic selling, allowing shorts to maintain control and potentially pushing BTC down to around $55K – setting the stage for the next market bottom.