Bitcoin whales’ buying frenzy – What it means for you and your holdings

- Though whales have been buying, selling sentiment remains dominant in the market

- Few metrics and indicators hinted at a price drop too

Bitcoin [BTC] managed to reclaim $70k a few days ago, but the trend didn’t last as the crypto’s price soon started to decline on the charts. While that happened, whales grabbed the opportunity to accumulate more BTC at a lower price. Ergo, the question – Does this point to yet another bull rally?

Bitcoin whales back in action

CoinMarketCap’s data revealed that BTC’s price gained bullish momentum last week, allowing it to touch $70k on 21 May. The bulls could not sustain the pump, however, resulting in BTC once again falling under $69k. Whales tapped this opportunity to buy BTC while its price was low.

In fact, Ali, a popular crypto-analyst, recently shared a tweet highlighting the fact that BTC whales purchased over 20,000 BTC – Worth $1.34 billion.

Abramchart, an analyst and author at CryptoQuant, also shared an analysis that painted a similar picture. According to the same, the whales’ appetite for buying Bitcoin has returned strongly after a two-month decline in buying interest since March. This development indicated that BTC’s current prices are suitable for purchasing and accumulating.

AMBCrypto then checked CryptoQuant’s data to find out whether buying sentiment was dominant overall in the market. We found that while whales bought, retail investors might have been selling BTC as the coin’s exchange reserve has been increasing. Apart from that, both BTC’s Korea Premium and Coinbase Premium were red. This clearly meant that selling sentiment was dominant among U.S and Korean investors.

Will whales push Bitcoin up?

The accumulation from whales did help BTC as in the last 24 hours, the crypto climbed by 2.6%. At the time of writing, Bitcoin was trading at $68,797.25 with a market capitalization of over $1.36 trillion.

However, whales’ efforts might not be enough to sustain this uptrend. BTC’s aSORP was red, meaning that more investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Additionally, its NULP suggested that investors are now in a belief phase where they are in a state of high unrealized profits – A bearish signal.

Is your portfolio green? Check the Bitcoin Profit Calculator

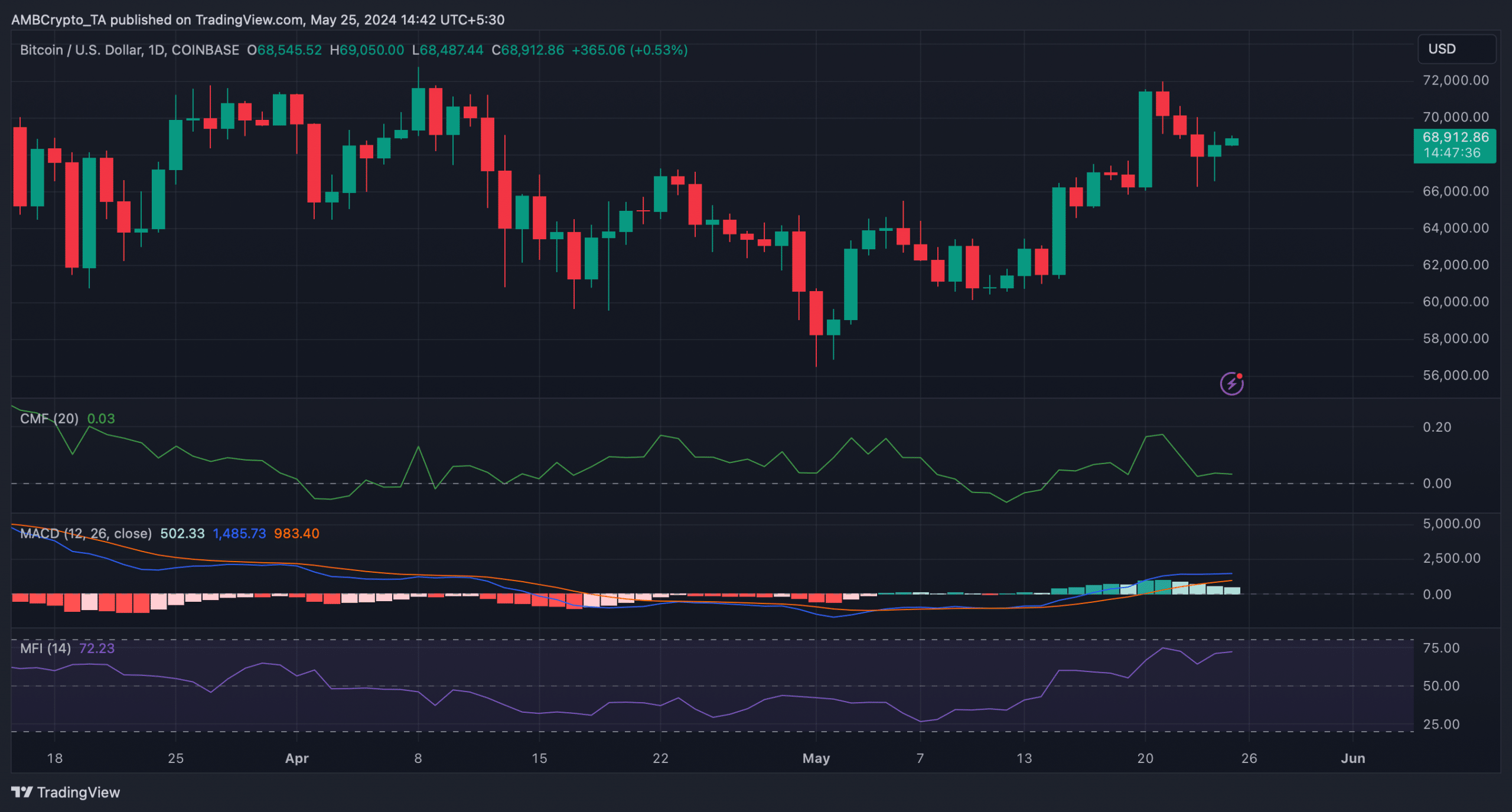

To better understand whether BTC is expecting a price correction, AMBCrypto analyzed its daily chart.

As per our analysis, BTC’s MACD displayed the possibility of a bearish crossover in the coming days. Its Chaikin Money Flow (CMF) also moved sideways near the neutral zone.

On the contrary, the Money Flow Index (MFI) looked bullish as it registered a sharp uptick.