Bitcoin

Bitcoin whales continue to accumulate despite price declines – Why?

Bitcoin whales have been accumulating, but more BTCs continue to flow into exchanges.

- Whales have accumulated over 22,000 BTCs in the past week.

- BTC was trading at around 42,400, with a slight recovery.

Bitcoin [BTC] whales have responded with a mixed sentiment to the recent price fluctuations. Despite a general increase in whale addresses, the latest exchange flow presents a contrasting narrative.

Bitcoin whales continue accumulating

According to a recent IntoTheBlock post, Bitcoin whales accumulated over 22,000 BTC in the past week. The increased accumulation was despite the recent decline in BTC’s price.

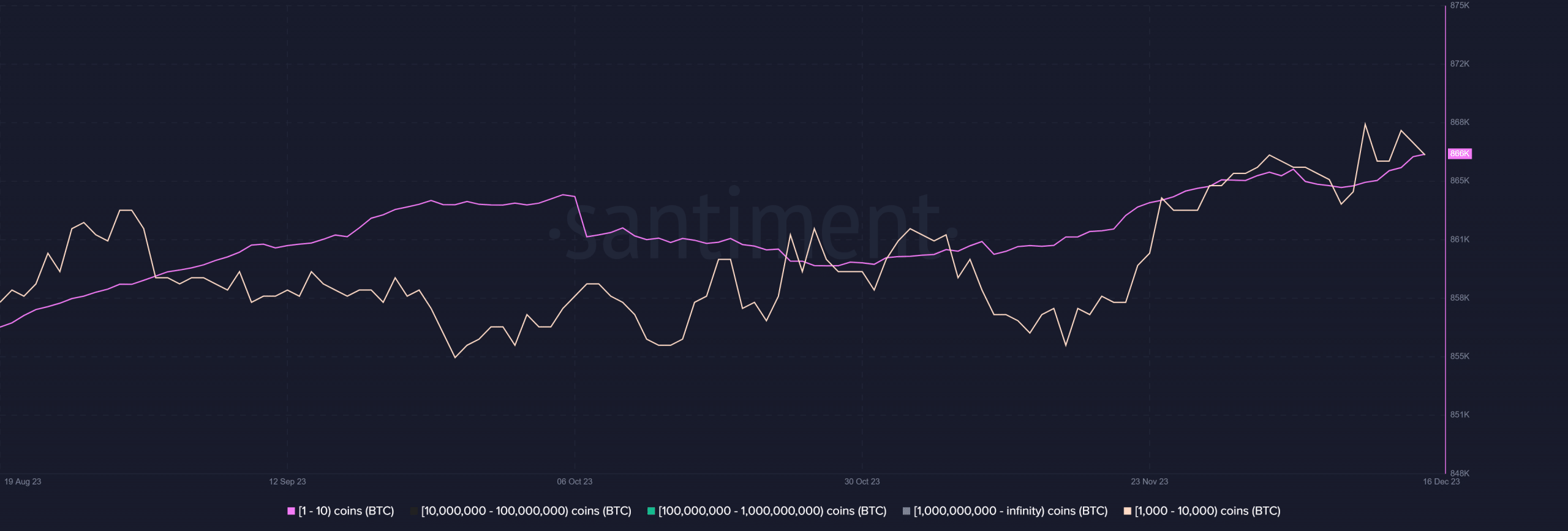

However, a closer analysis of the whale accumulation showed a more nuanced picture. An analysis of the BTC supply distribution on Santiment showed fluctuations in addresses holding 1–10,000 BTC.

The change suggested sell-offs from these addresses at certain points during the week.

On 14th December, the chart showed around 1,932 addresses, but at the time of this writing, that number had decreased to about 1,928.

Despite this slight decline, the overall supply held by these addresses has increased. Around 1,896 addresses were recorded at the same time as the previous month.

More Bitcoin hits exchanges despite accumulation

Based on an analysis of CryptoQuant’s Bitcoin exchange flow, there has been a recent uptick in inflow.

The chart showed a consistently positive exchange flow since 5th December, except for 14th December. This positive flow suggests an increased movement of BTC to various exchanges, signifying heightened selling activity.

This aligns with the observed fluctuation in accumulation patterns within whale addresses.

The amplified inflow has contributed to the lack of impact on the price trend despite ongoing accumulation. At the time of this writing, the exchange netflow was around 805 BTC.

BTC sees a slight recovery

Analyzing the Bitcoin daily timeframe chart showed that there had been a more significant decline in value compared to gains over the past week.

On 15th December, the chart showed a decrease of over 2.5%, with BTC trading at around $41,450.

However, there has been a recent recovery attempt, and as of his writing, it was trading around $42,240, reflecting a modest increase of less than 1%.

Also, despite a bearish flip observed in the Moving Average Convergence Divergence (MACD), the overall sentiment remained bullish.

Read Bitcoin (BTC) Price prediction 2023-24

The Relative Strength Index (RSI) was slightly below 60, indicating a decrease in the bull trend, but the general trend remains bullish.

Whale accumulation may be part of a long-term strategy, suggesting anticipation of a forthcoming price increase.