Bitcoin whales gather $157.3 mln BTC in market dip: Bullish signs?

- Bitcoin’s trading volume soared by 37.72% as prices hiked by 1.48% in 24 hours.

- Three whales accumulated 2814 BTC worth $157.3 million.

Over the last months, the crypto market has experienced extreme volatility. Amidst this, Bitcoin [BTC], the largest cryptocurrency, has suffered the most. Over the past 30 days, BTC has dropped by 9.14%.

As of this writing, BTC was trading at $55182. This marked a 1.48% increase over the last 24 hours. At the same period, Bitcoin’s trading volume has surged by 37.72% to $22.6 billion.

Also, its market cap increased by 1.47% to $1.09 Trillion.

Prior to these gains, the crypto was experiencing a sustained decline, dropping by 5% over the past week.

This market dip has created a conducive environment for large holders to buy the dip. When prices decline, whales tend to accumulate, hoping to sell for profit.

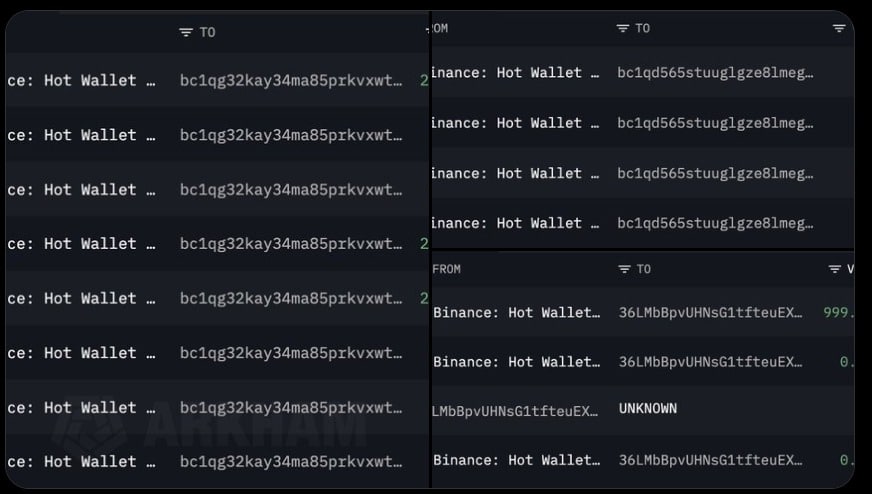

Inasmuch, Lookonchain has revealed how whales have turned to accumulation during the dip.

Whales buying the dip

In their report, Lookonchain has uncovered whale accumulation activities. According to the report, three whales have turned to buy the dip by accumulating 2814 Bitcoins worth $157.3 million since the 1st of September 2024.

Through its X (formerly Twitter) page, Lookonchain reported that,

“Whales are accumulating $BTC after the market drop! Since Sept 1, 3 whales have accumulated ~2,814 $BTC($157.3M) from #Binance at an average price of $55,887.”

For context, whale buying during market downturns signals confidence in the asset’s long-term confidence.

When markets are underperforming, whales use it as accumulating opportunity at lower prices, expecting future gains.

This encourages other investors to enter the market, thus stabilizing the market and reversing the trend.

What Bitcoin’s charts suggest

As noted by Lookonchain, whale activities have increased for the past week.

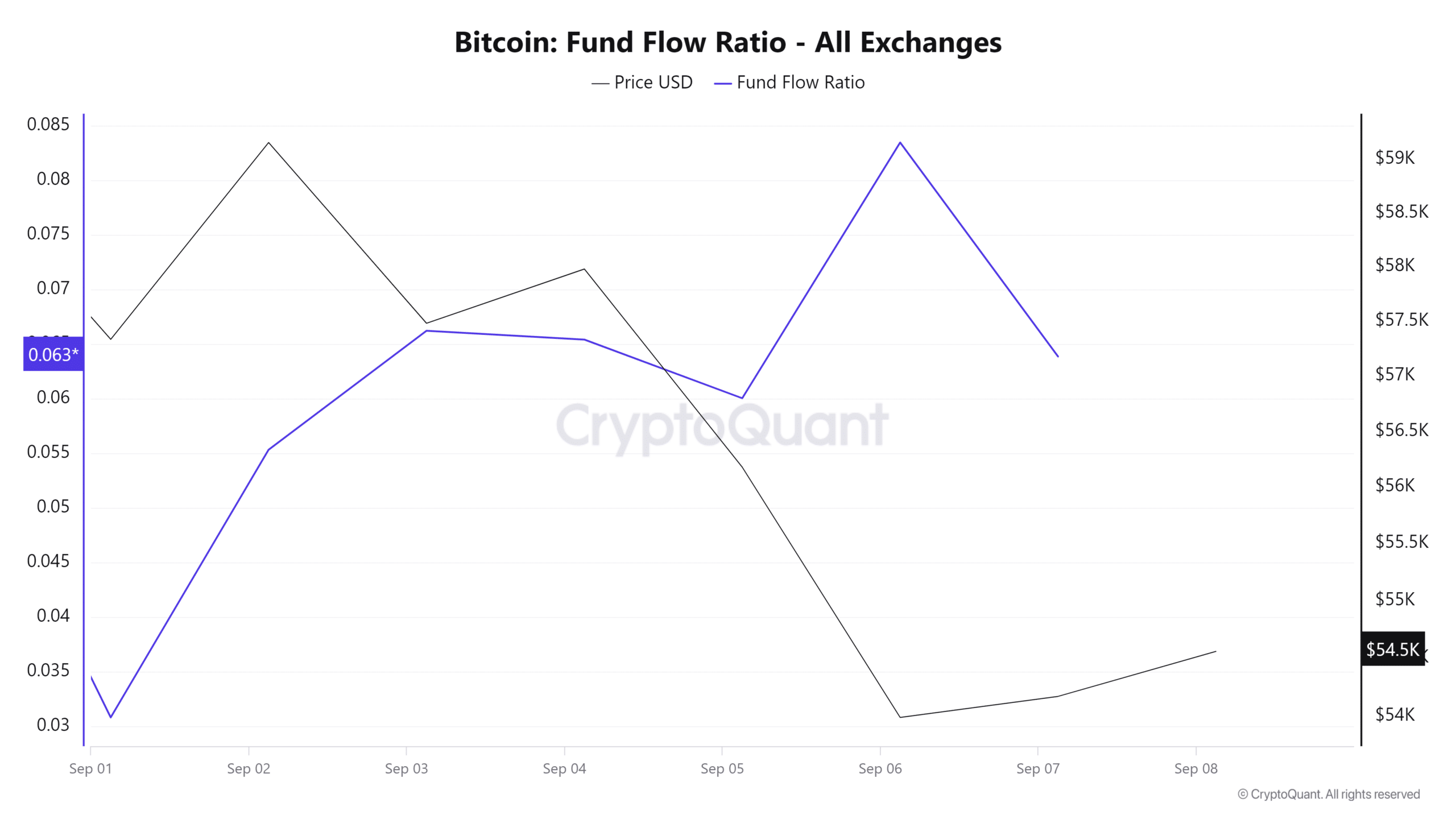

This is further supported by the decreasing fund flow ratio

. According to Cryptoquant, the Fund flow ratio has declined from 0.08 to 0.04 at press time, suggesting that whales were accumulating assets off exchanges — a bullish signal.

This indicated investor confidence in Bitcoin’s future prospects.

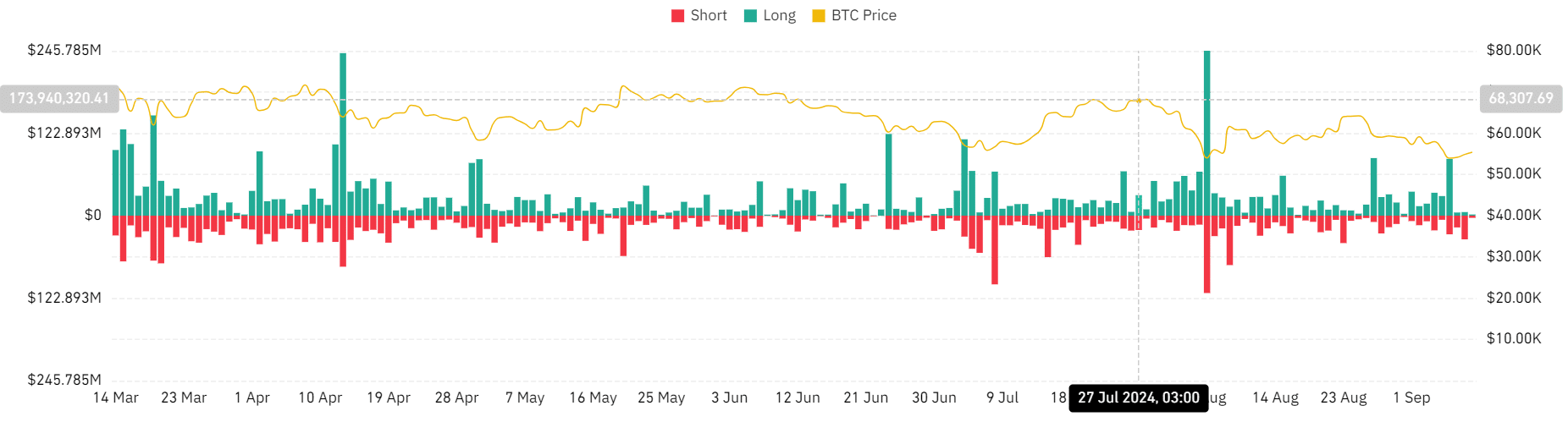

Additionally, short-position liquidation surged to $38.5 million over the past three days, while long-position liquidation declined to $7.3 million.

Thus, those betting against the market were forced out of their positions, while long position holders were willing to pay a premium to hold their trade.

Such a scenario suggests that the markets were rising, with those betting on downturn being liquidated.

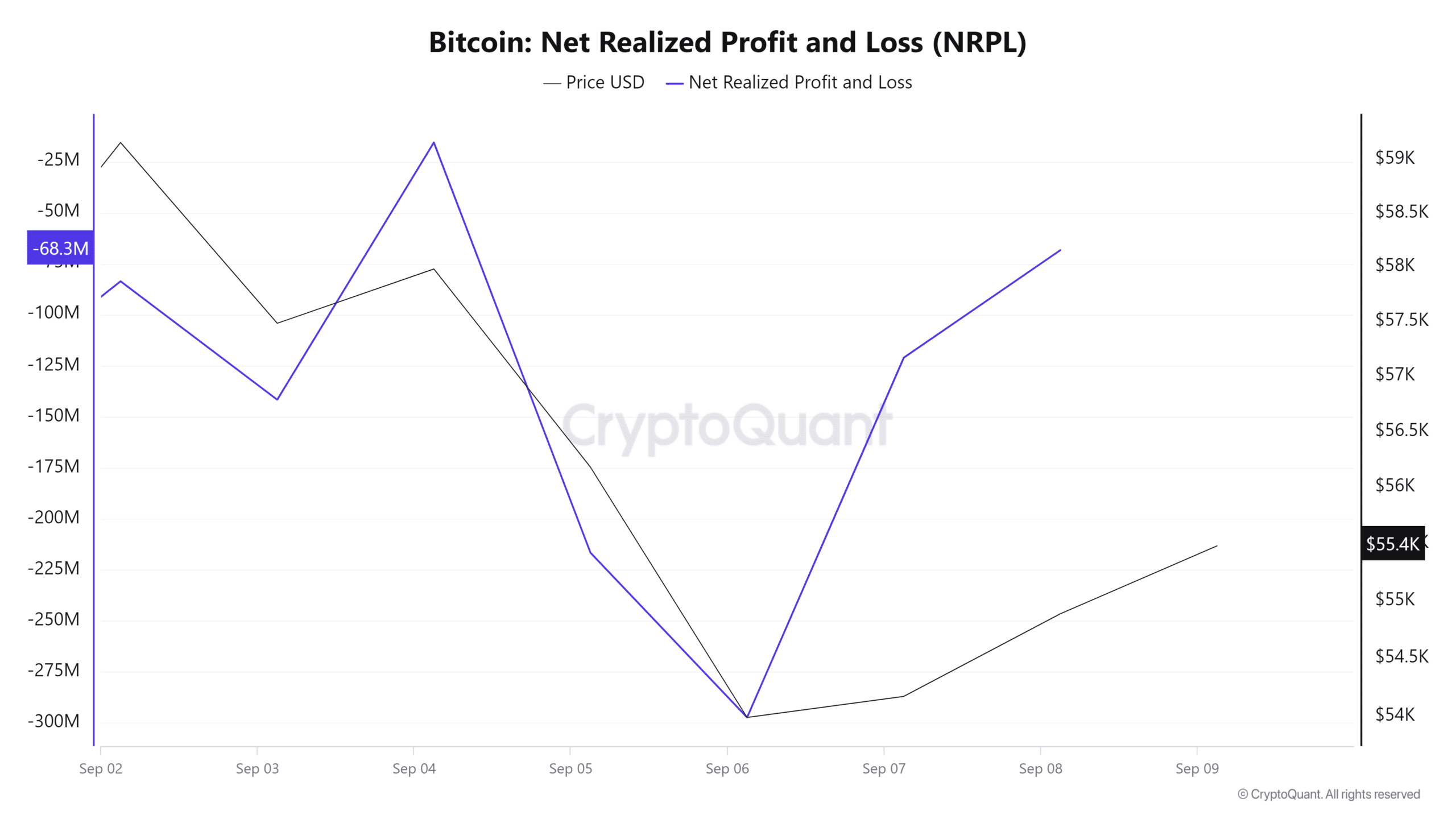

Finally, Bitcoin’s Net realized profit and loss has reduced from -297.2 million to -68.3 million at press time. While the NRPL was still negative, it reduced drastically, suggesting that buyers are entering.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This accumulation from whales or institutions helps in stabilizing the market through buying activity.

Therefore, based on increased buying activity arising from whale activity, BTC is well-positioned for further gains. If the current market sentiment persists, the BTC trend will reverse and hit $58272.