Bitcoin: Whales make risky $1.3 billion bet as BTC tumbles

- BTC has dropped back to the $67,000 price level.

- Some wallets took advantage of its fall in the previous trading session.

Bitcoin’s [BTC] price decline might have been bad news for some traders, but it presented an opportunity for others.

AMBCrypto’s analysis showed that some addresses accumulated a significant volume of BTC as its price struggled over the last two days. Additionally, the supply of Bitcoin on exchanges has continued to decline.

Bitcoin accumulation addresses swell

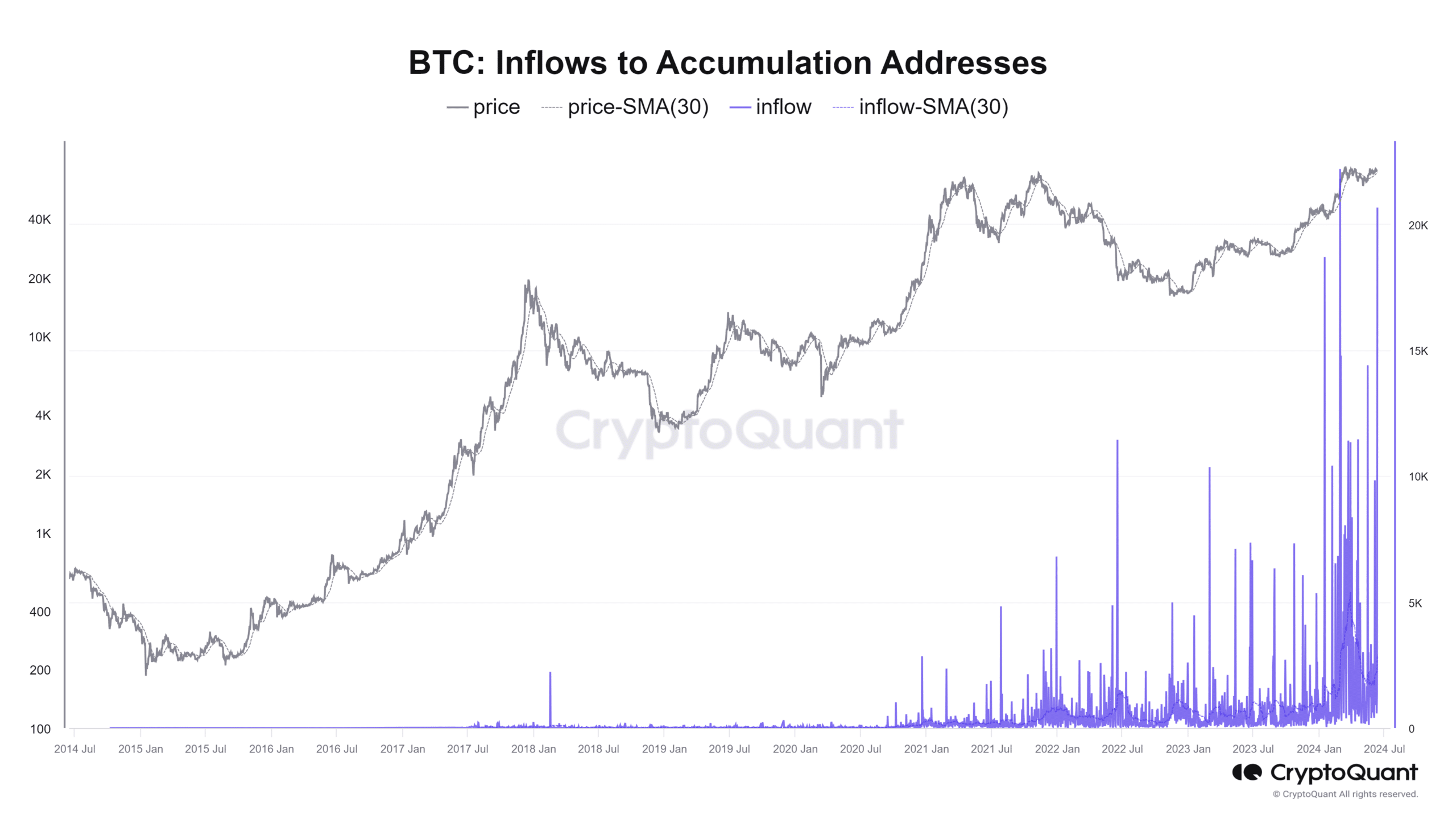

Per CryptoQuant, as Bitcoin was attempting to correct its price, some whales were accumulating. Notably, more than 20,000 BTC were accumulated in whale wallets during this period.

A study of inflow into accumulation addresses showed that accumulation spiked during the period when BTC’s price fell, indicating strategic moves by these addresses.

This suggests that some traders were taking advantage of the lower prices to increase their holdings.

An analysis of the accumulation showed that it was worth over $1.3 billion, with the price of BTC around $67,000.

This significant accumulation highlighted the strategic buying by whales during the recent price decline.

Bitcoin on exchanges declines further

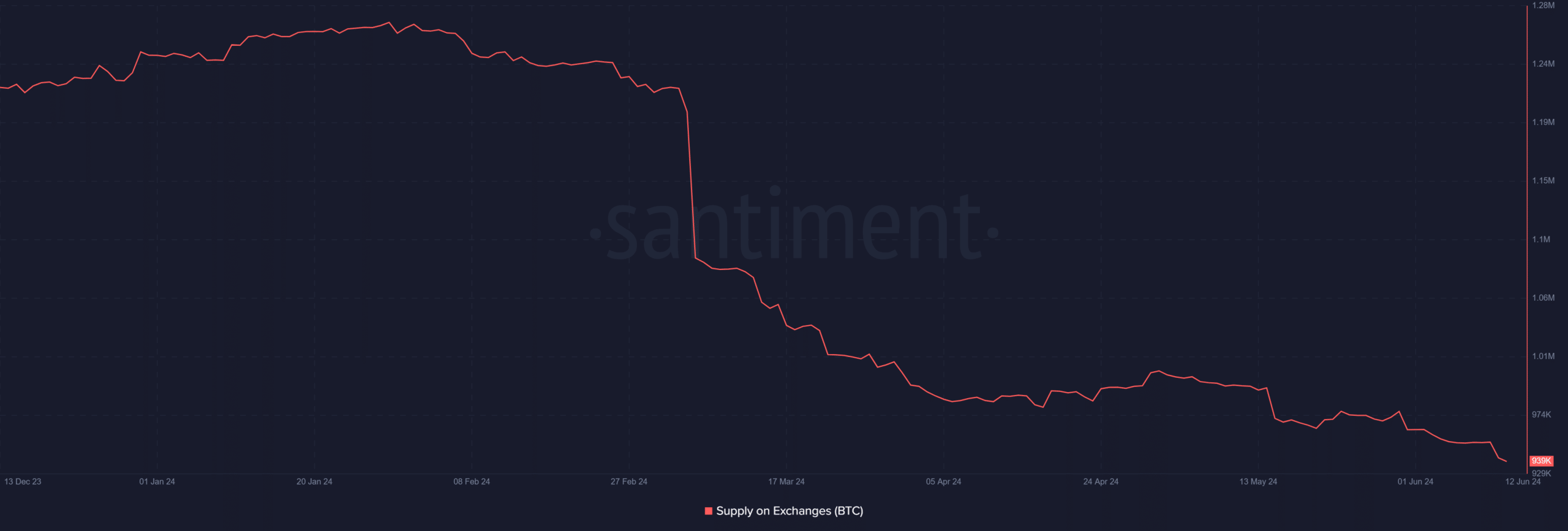

AMBCrypto’s look at Bitcoin’s Supply on Exchanges showed that while accumulation increased, the supply on exchanges declined.

Data from Santiment indicated a notable drop in BTC supply on exchanges between the 10th of June and the time of this writing. The chart showed that on the 10th of June, the Supply on Exchanges was 954,000.

However, as of this writing, the Supply on Exchanges had dropped to around 939,000. According to Santiment, this is the lowest supply of BTC on exchanges since 2021.

This decline aligns with the accumulation trend and serves as a bullish signal.

The trend indicated that fewer BTC coins are available for sale, suggesting that a sharp price decline is unlikely in the near future. It also shows a strong belief in a higher future price among holders.

BTC sees a brief rebound

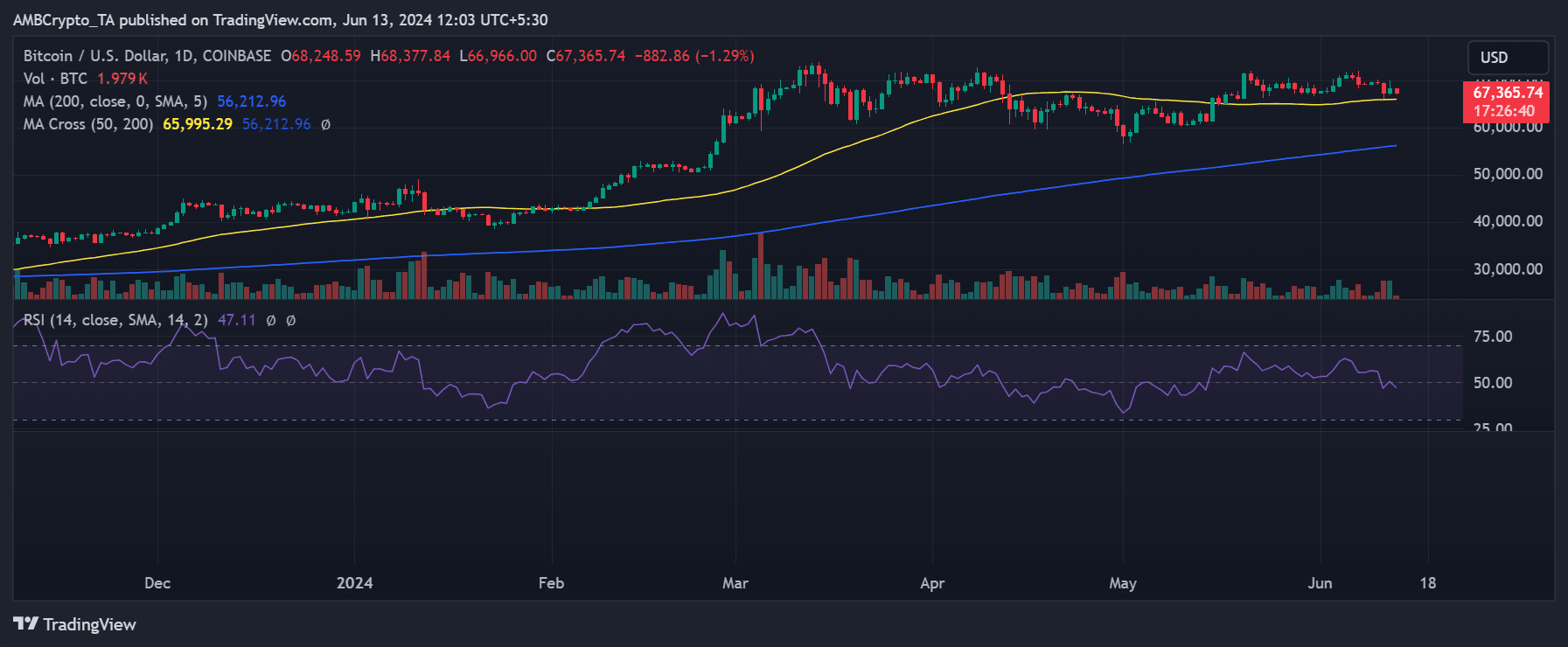

AMBCrypto’s examination of Bitcoin on a daily time frame showed a brief rebound at the end of trading on 12th June. The chart indicated that Bitcoin increased by over 1%, trading at around $68,248.

Additionally, at some point in the previous trading session, its price rose to the $70,000 price range.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As of this writing, Bitcoin has lost most of its gains and has returned to the $67,000 price range. It was trading at around $67,350, with a decline of over 1.3%.

As it has been doing for days, it remains close to its support levels. The support level, indicated by its short moving average (yellow line), is around $66,000 to $65,000.