Bitcoin whales realize $1.8B in profits: Will the momentum hold?

- BTC has declined by around 1% at press time.

- Short-holders remain in profit despite the decline in the last 24 hours.

Bitcoin [BTC] has recently lifted the mood of the crypto market, breaking through the $60,000 price barrier and moving closer to another key resistance level. This surge has enabled some whales to secure significant profits and liquidated numerous short positions.

Bitcoin whales take profit

An analysis of Bitcoin’s daily chart shows that it broke its short-term resistance on 17th September. This resistance, formed by its short-term moving average (yellow line), was overcome when BTC gained over 3%, reaching around $60,300.

Bitcoin experienced consecutive uptrends following this breakout, closing the last trading session at approximately $63,362.

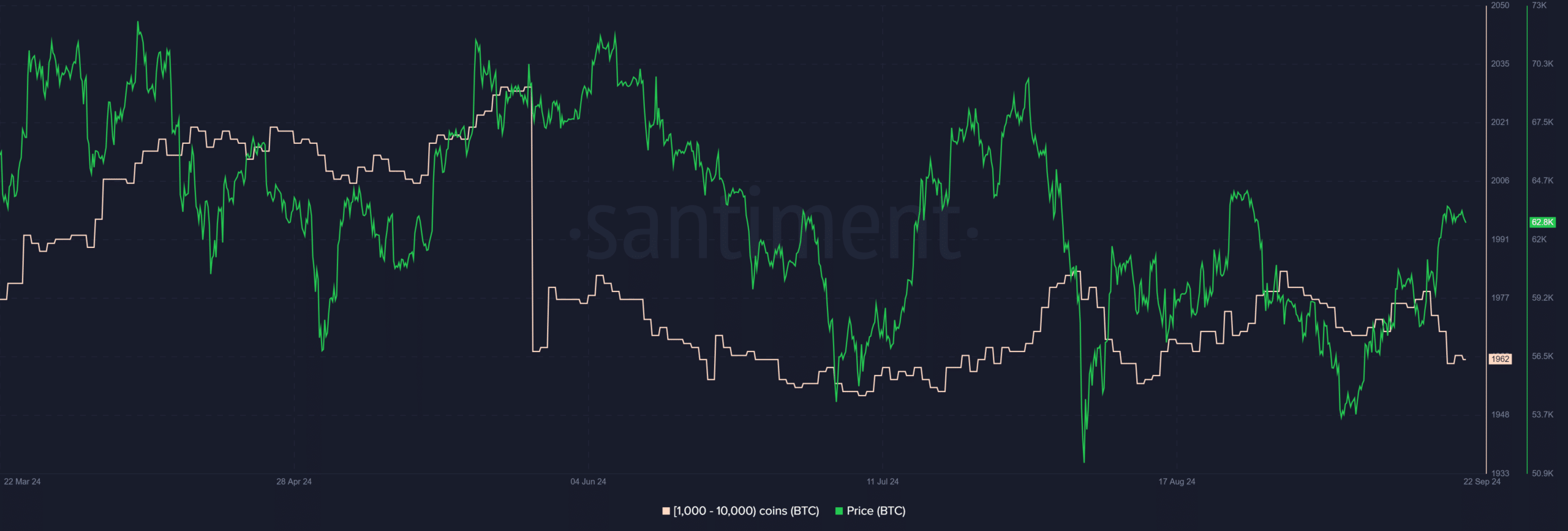

Data from Santiment indicates that this price increase prompted some BTC whales to realize profits. In the past 96 hours, these large holders sold over 30,000 BTC, worth around $1.86 billion.

Despite this significant sell-off, Bitcoin remains bullish, as evidenced by its Relative Strength Index (RSI), which has stayed above 60.

Bitcoin MVRV shows a 5% profit

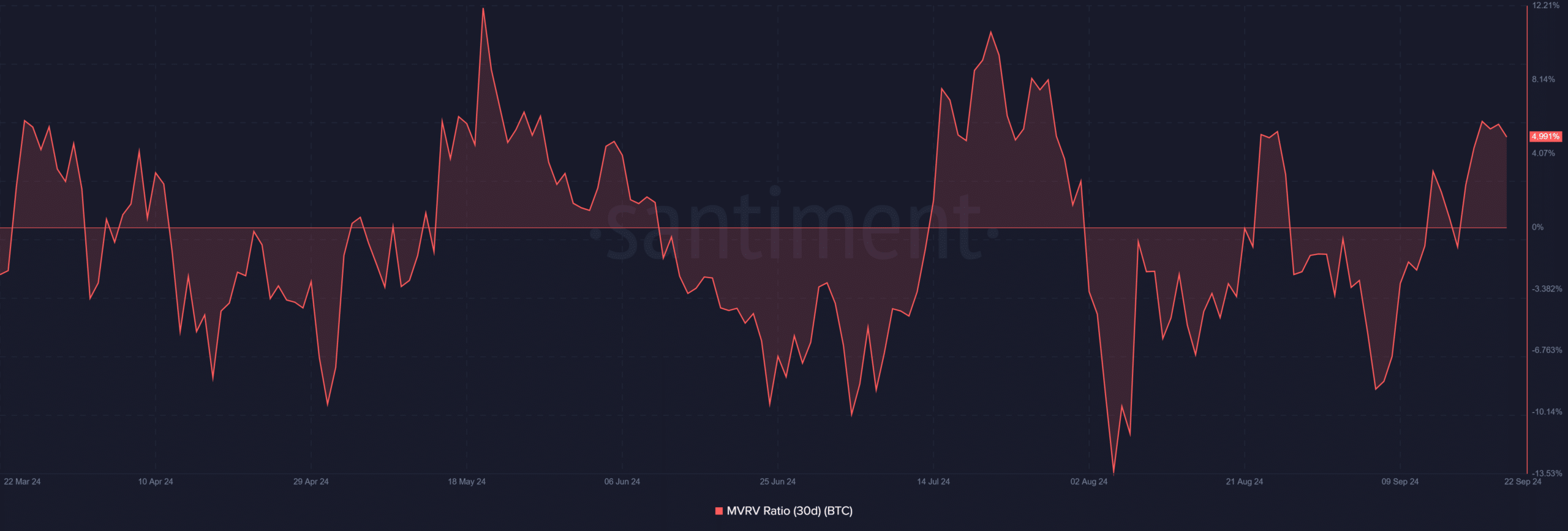

Short-term Bitcoin holders have moved into profit due to the recent price appreciation. Analysis of the 30-day Market Value to Realized Value (MVRV) ratio from Santiment showed it crossed above zero on 17th September and is currently nearing 5%.

This means that holders within this timeframe are averaging nearly a 5% profit, aligning with the profits realized by whales in recent days.

Short positions face increased liquidations

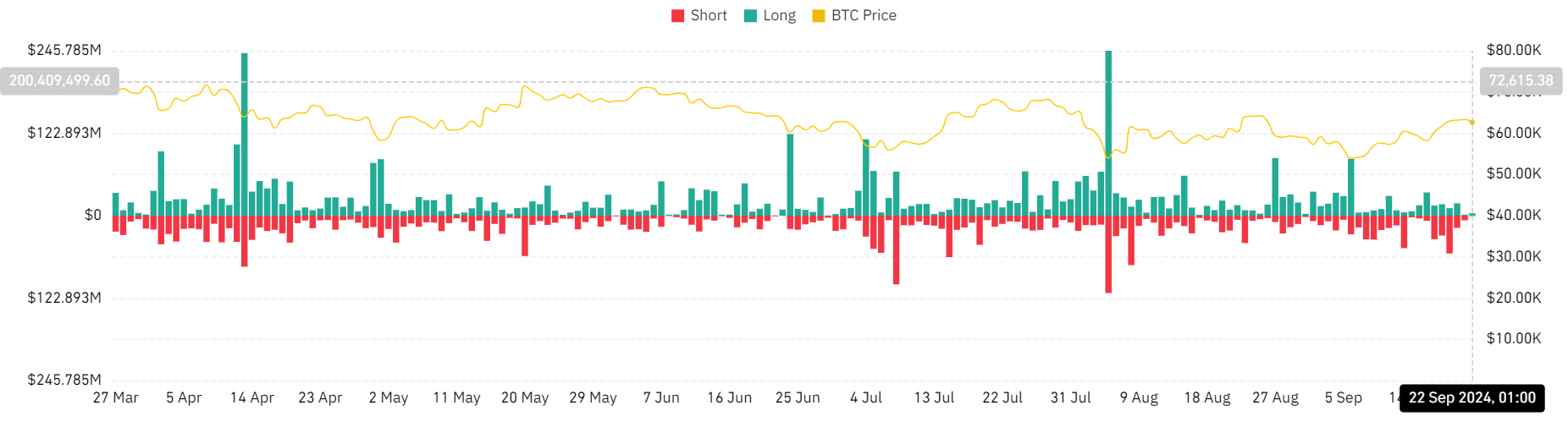

Since Bitcoin’s uptrend began, there has been a significant increase in the liquidation of short positions. Analysis from Coinglass reveals that over $146 million worth of short positions were liquidated between 17th and 21st September.

In contrast, long positions saw liquidations of around $63 million during the same period.

Read Bitcoin (BTC) Price Prediction 2024-25

Additionally, the BTC funding rate has remained positive over the past few weeks, indicating that more buyers are entering the market compared to sellers—a positive sign for Bitcoin.

This trend may help Bitcoin absorb selling pressure from whales taking profits.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)