Bitcoin

Bitcoin whales refuse to sell—Is $100K closer than we think?

What’s driving the whales to hold on to BTC?

- Bitcoin whales continued to accumulate despite the price surge, signaling long-term confidence in its potential.

- Bitcoin ETFs saw massive inflows, boosting market confidence and raising questions about future trends.

The post-election impact on the crypto market has been undeniable, with Bitcoin [BTC] experiencing a remarkable surge. BTC was trading at $93,515.07, at press time, nearly a 30-fold increase in a month as per CoinMarketCap.

As the cryptocurrency nears the psychologically significant $100,000 mark, many are speculating that it could hit this milestone at any moment.

Bitcoin whales’ move signals…

However, despite Bitcoin’s impressive rally, its largest holders, often referred to as “whales,” have not cashed in on the gains.

Instead, they continue to accumulate Bitcoin at these elevated price levels. This hinted at a potentially bullish outlook for the digital asset moving forward.

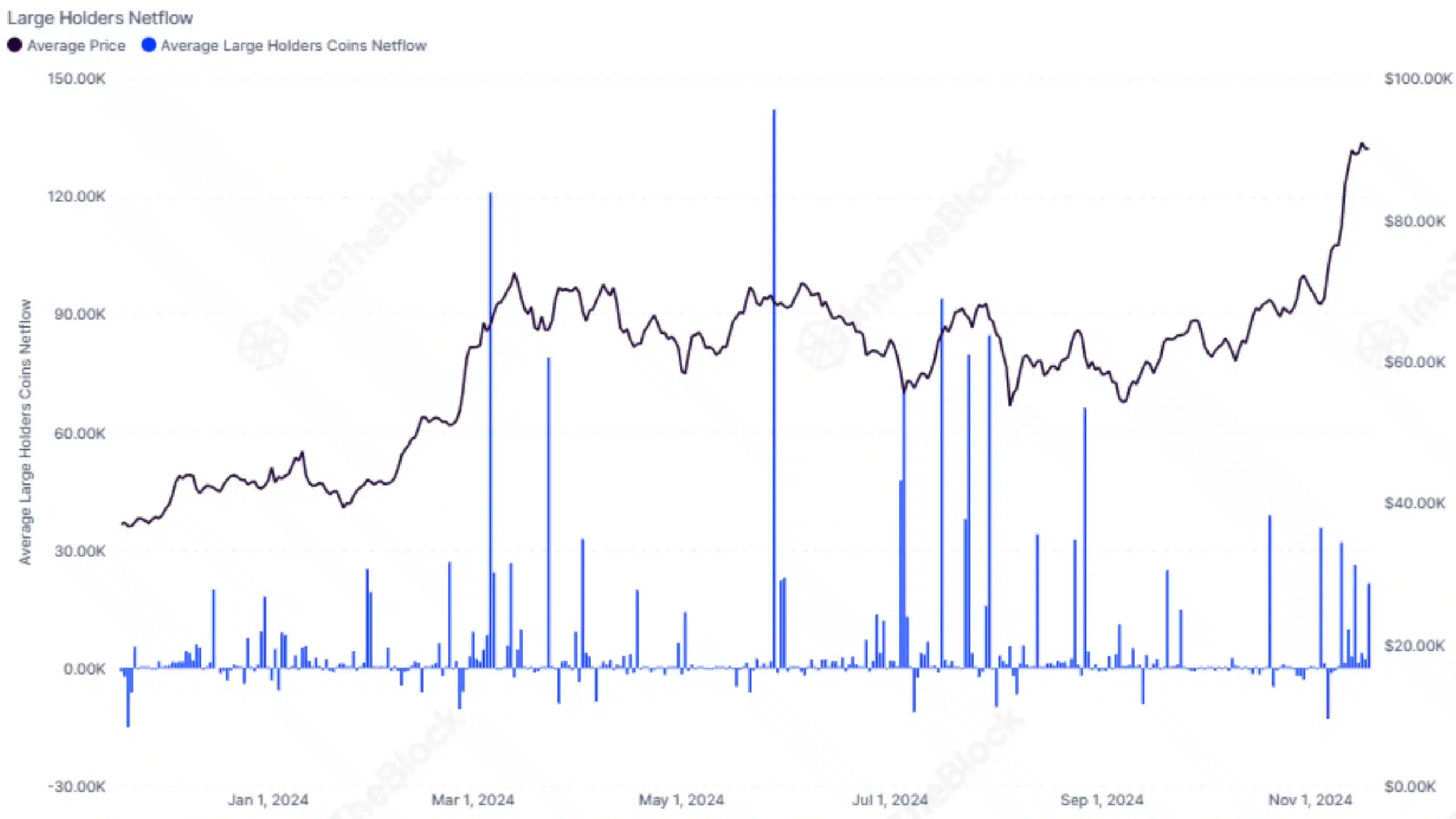

Data from on-chain analytics firm IntoTheBlock revealed that net outflows from the largest Bitcoin wallets have remained remarkably low throughout the year.

This suggests that the whales were not selling their positions despite Bitcoin’s impressive price surge.

Rather, they are continuing to accumulate, signaling strong confidence in the long-term potential of the cryptocurrency and further indicating that these large players may be positioning themselves for even greater gains in the future.

Bitcoin’s long-term viability

Further supporting this bullish outlook, AMBCrypto’s analysis of IntoTheBlock data shows that 100% of Bitcoin holders are currently holding tokens worth more than their original purchase price.

This means all BTC holders are “in the money,” a clear indication of widespread profitability.

Conversely, there were no holders in the “out of the money” category, reinforcing the prevailing optimistic sentiment around Bitcoin. This suggests a potential for further price increases shortly.

However, in light of this exponential rise, some traders are urging caution, warning of potential risks ahead.

Crypto inflows spike

This follows a week when cryptocurrency investment products experienced a remarkable $33.5 billion in inflows. Over $2.2 billion flowed in just the past week.

The growing momentum in cryptocurrency investment products, with assets under management reaching a record $138 billion, highlights increasing confidence in the market.

Bitcoin ETF also makes news

Bitcoin ETFs are seeing significant inflows, with $816.4 million entering BTC ETFs on the 19th of November, according to Farside Investors.

A recent 13F filing from a prominent Wall Street firm revealed $710 million in spot Bitcoin ETFs holdings, including a substantial stake in BlackRock’s iShares Bitcoin Trust.

As Bitcoin’s dominance rises, it will be fascinating to see how these developments shape the cryptocurrency landscape. These changes will influence the strategies of both institutional and retail investors.