Bitcoin: Whales, retailers take different approaches as BTC struggles

- Institutional investors have accumulated over 67,000 BTC in the last 30 days, while retail traders continue selling off.

- BTC was trading at over $67,000 at press time.

Bitcoin [BTC] has experienced positive price trends over the last few days but hasn’t stopped retail investors from selling off their holdings.

Despite the price increase, retail traders continue offloading their BTC, while institutional investors have been quietly accumulating.

Bitcoin whales continue accumulating

Recent data from CryptoQuant revealed that while retail investors have been selling, institutional wallets have been accumulating Bitcoin.

Over the past 30 days, institutional wallets have amassed over 67,000 BTC. The accumulation brought their total holdings to over 3.9 million BTC.

The sell-off by retail investors is likely due to the sideways price movement that Bitcoin experienced in previous weeks before the recent uptrend.

These price stagnations often lead retail investors to lose confidence and sell their holdings, anticipating buying back at higher prices once market sentiment improves.

On the other hand, institutional players accumulating during the downturn are expected to distribute their BTC when the price increases.

Ongoing selling pressure

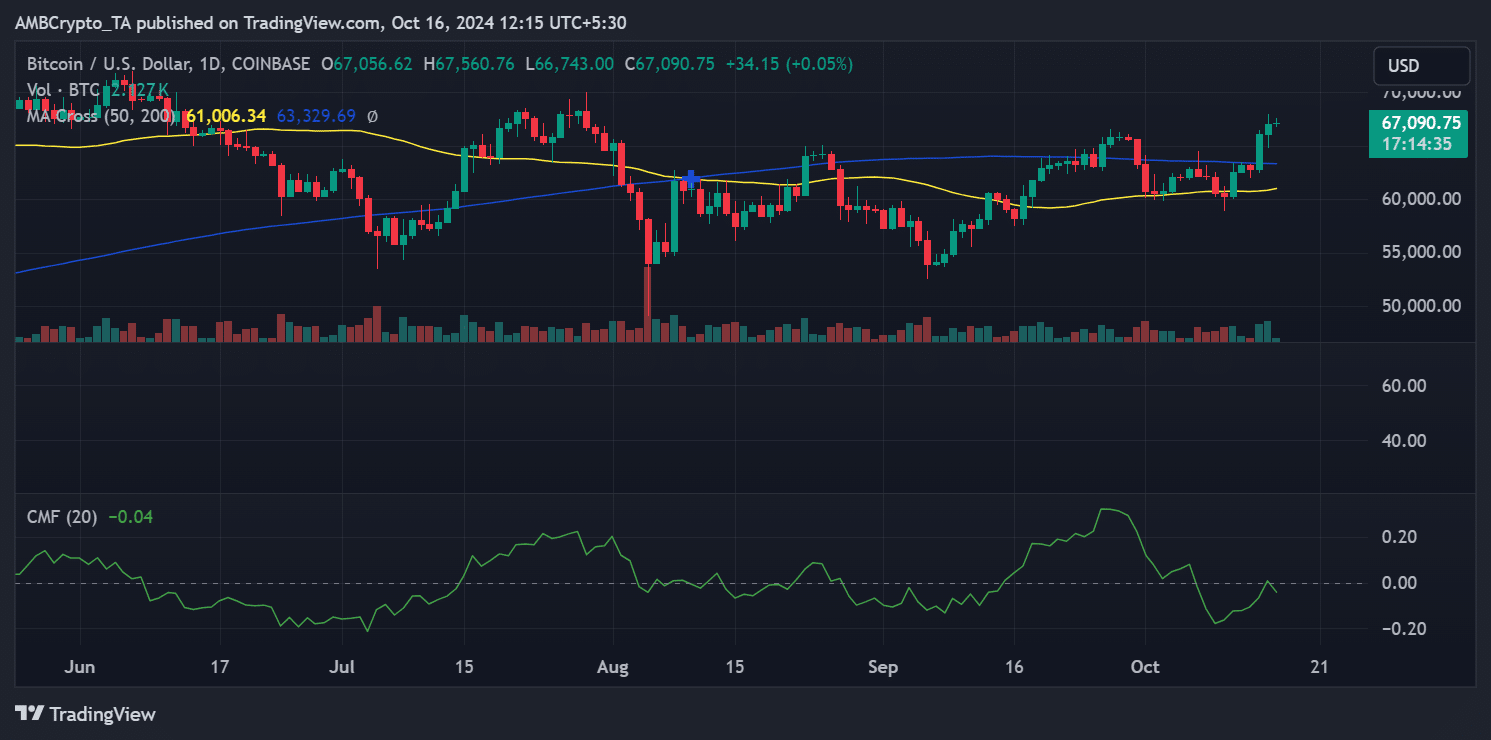

AMBCrypto’s analysis of the Bitcoin Chaikin Money Flow (CMF) showed that selling pressure continued to dominate despite the recent price rise.

As of this writing, the CMF stood at around -0.04, indicating slightly more selling pressure than buying pressure.

A negative CMF suggests that Bitcoin is still being distributed, with more sellers than buyers in the market.

When the CMF is below zero, it signals that selling activity is stronger than buying, which can create downward pressure on the price.

If the CMF moves back into positive territory, it would confirm that buying pressure is increasing, potentially supporting further price growth.

However, if the CMF remains negative or falls further, it could indicate a weakening buyer interest, leading to possible price consolidation or even a pullback in the coming days.

Mixed Bitcoin exchange flows as price picks up

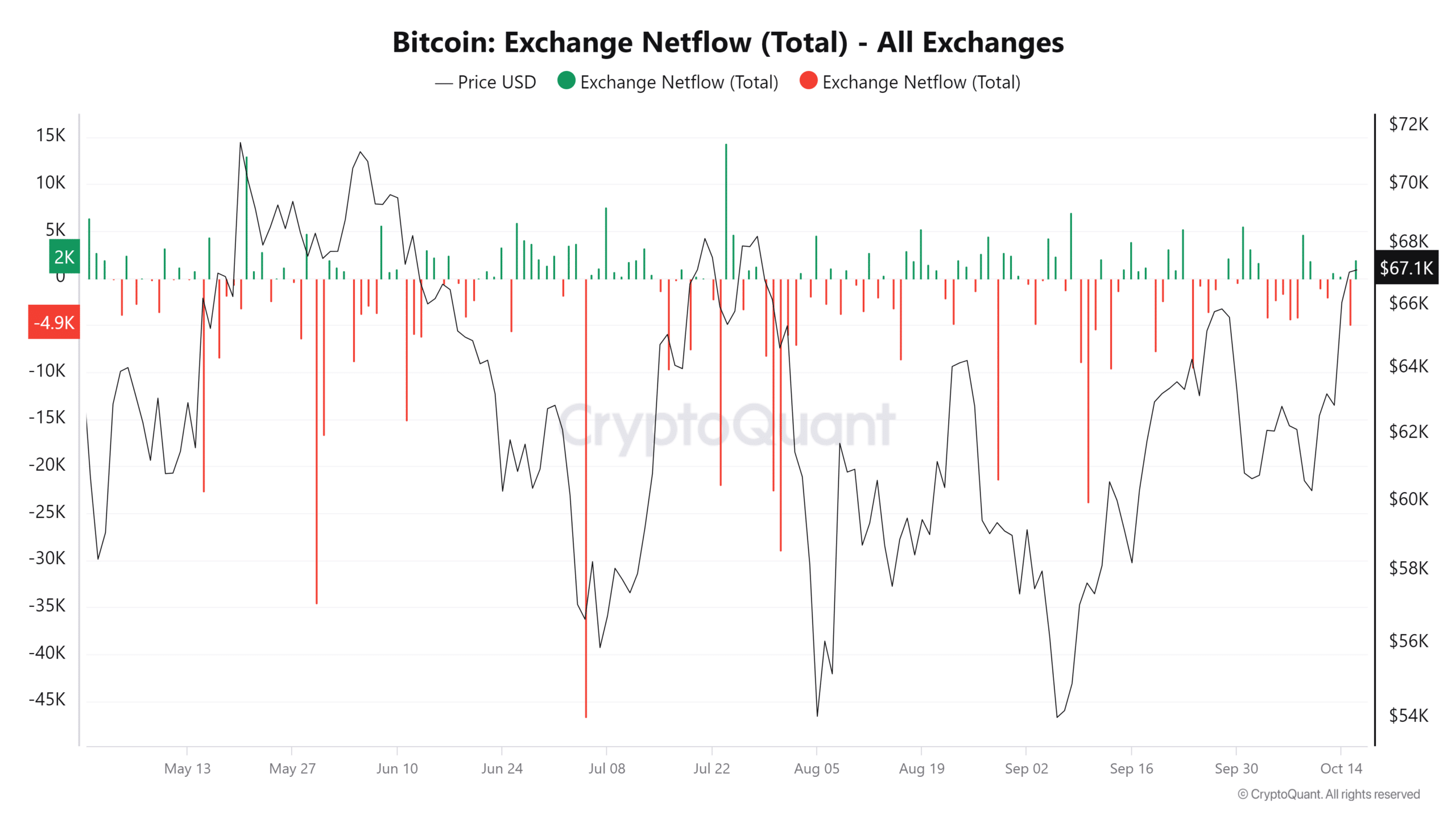

Over the last 24 hours, Bitcoin has seen fluctuating exchange flows as the price continues to trend upward.

Data shows that BTC experienced more outflow in the previous trading session, with a negative flow of almost 5,000 BTC.

This means more BTC was being moved out of exchanges than in, which can signal a bullish sentiment as investors withdraw their holdings to store or trade elsewhere.

Is your portfolio green? Check out the BTC Profit Calculator

However, as of this writing, the flow has turned positive again, with over 2,000 BTC flowing back into exchanges.

This mixed exchange flow suggests that traders are reacting to the changing market sentiment, balancing between holding and selling as Bitcoin’s price momentum continues.