Bitcoin

Bitcoin whales start cashing out: Should you press the panic button?

Miniature addresses holding less than 0.1 unit of BTC rose 0.6% in the past two weeks.

- Wallets holding over 1,000 Bitcoins fell by nearly 5% over the last two weeks.

- There was a sharp spike in the movement of previously idle Bitcoins.

Bitcoin [BTC] made a new all-time high (ATH) past $73,000 in the last 24 hours, even as an intense battle between bulls and bears unfolded around the crucial level at press time.

The king coin has moved up steadily since topping its previous bull cycle’s peak, and was up more than 70% since the start of 2024, according to CoinMarketCap

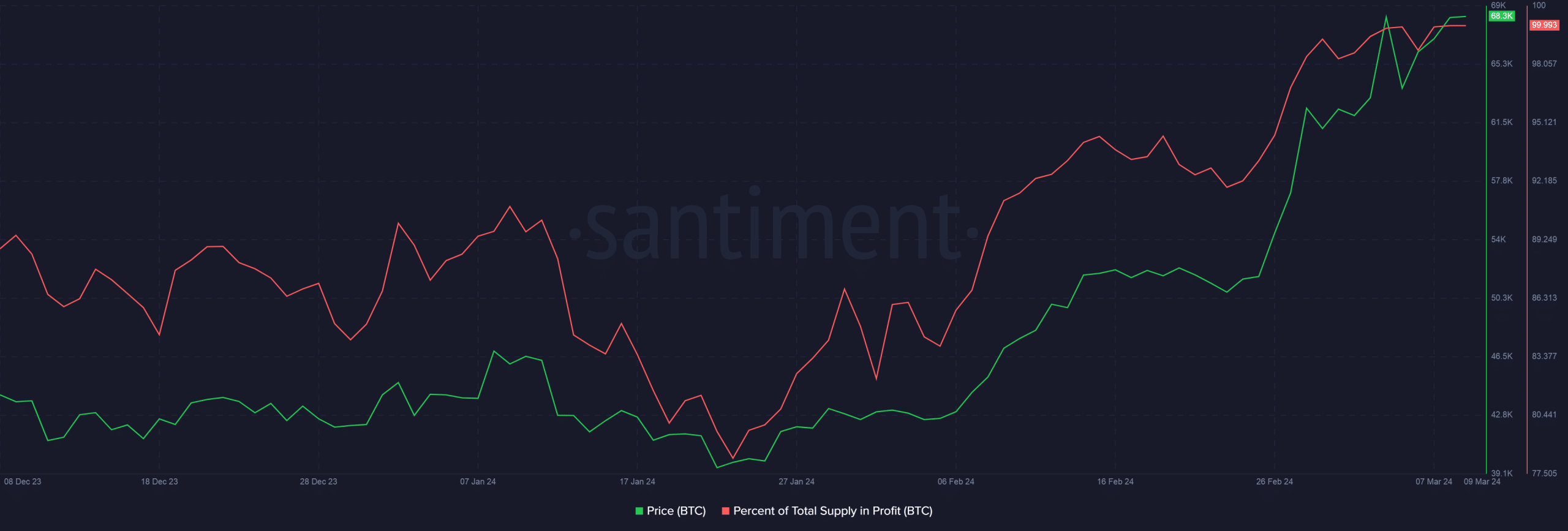

.Because of the price surge, the entire Bitcoin supply was in profit at press time, as per AMBCrypto’s examination of Santiment data.

Whale addresses fall sharply

Such was the temptation that even big whale investors couldn’t resist from cashing out.

Wallets holding over 1,000 Bitcoins fell by nearly 5% over the last two weeks. Additionally, the cohort storing 10–1,000 coins also shrank 0.5% in the same period.

It was quite probable that many of these investors would have placed limit orders slightly above the previous high of $69,000. When this level was hit, it triggered sell-offs.

On the other hand, miniature addresses holding less than 0.1 units of BTC rose 0.6% in the past two weeks. This was a sign of retail investors re-entering the market.

Dormant supply starts moving on-chain

The increased whale dumping could also be linked to the dramatic spike in the movement of previously idle coins.

AMBCrypto noted that coins that haven’t moved over the last 2–3 years suddenly started getting transacted in the last two weeks.

A lot of these investors holders would have acquired Bitcoins during the last bull cycle. They waited patiently for price recovery and started to distribute as the market gained bullish strength.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Whales’ exchange interaction is not alarming

While profit-taking by whales often raises alarms in the broader market, the situation was not yet dire enough to warrant panic.

As per AMBCrypto’s scrutiny of CryptoQuant’s data, whales accounted for just 36% of the total Bitcoin inflows to exchanges, suggesting that whales were not mass-dumping coins.