Bitcoin: Which groups profited as BTC hit $100K? Looking into…

- The 6–12 month holder cohort contributed to Bitcoin’s recent price stagnation below $100K.

- Declining whale transactions and reduced Open Interest suggested potential short-term sideways movement.

Bitcoin’s [BTC] price performance over the past few weeks has remained subdued, with limited upward movement, despite market anticipation for a year-end rally.

Since mid-December, Bitcoin has failed to sustain levels above the $100,000 mark, fluctuating primarily between $94,000 and $95,000.

This price range reflects a 5.8% decline over the past week. At the time of writing, Bitcoin is trading at $95,657, marking a further 2.5% drop within the last 24 hours.

Who profited during the $100,000 range?

Amid this market stagnation, analysts have turned their focus to investor behavior better to understand the factors behind Bitcoin’s price movement.

A CryptoQuant analyst, Yonsei Dent, has highlighted insights from the Spent Output Age Bands (SOAB) indicator.

This metric tracks Bitcoin sales activity based on the holding periods of investors, offering a clearer picture of selling pressure across different market participants.

The data reveals that holders with the 6–12 month period have been the most active sellers during the recent Bitcoin rally, primarily capitalizing on profits made during the market’s upward surge earlier this year.

Interestingly, these investors, who likely bought Bitcoin around the time of the spot ETF launch in early 2024, have been a significant source of selling pressure, contributing to the current price stagnation.

However, long-term holders—those who have held Bitcoin for over a year—appear to have sold relatively little during this period.

Additionally, the Binary CDD (Coin Days Destroyed) indicator shows a decline in older Bitcoin sales in December compared to November.

Thus, many long-term holders remain optimistic about future price increases and are holding onto their positions.

Mixed sentiment in the market

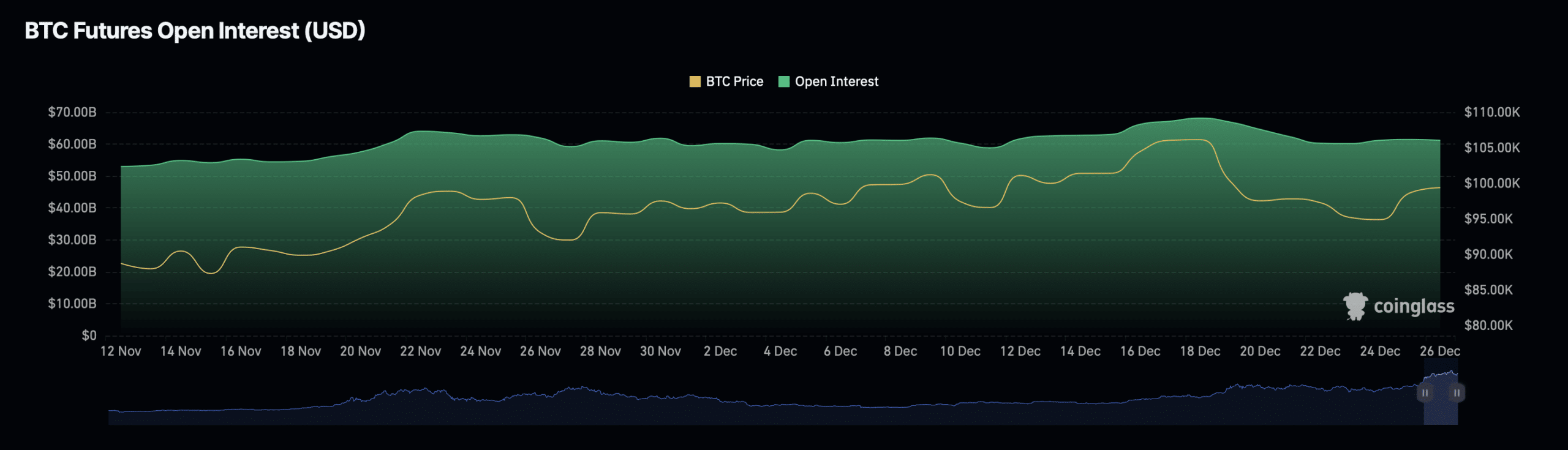

Also, Bitcoin’s Open Interest provided additional insight into the market’s direction.

Open Interest represents the total value of outstanding Futures contracts and serves as a barometer for market sentiment and liquidity.

According to data from Coinglass, Bitcoin’s open interest has decreased by 0.69%, reaching a valuation of $60.68 billion.

Bitcoin’s Open Interest volume has also dropped by 1.45% to $94.14 billion.

These declines indicate a reduction in speculative trading activity, suggesting that traders are exercising caution amid Bitcoin’s stagnant price movements.

Lower Open Interest often signals reduced market participation, which can limit significant price swings in the short term.

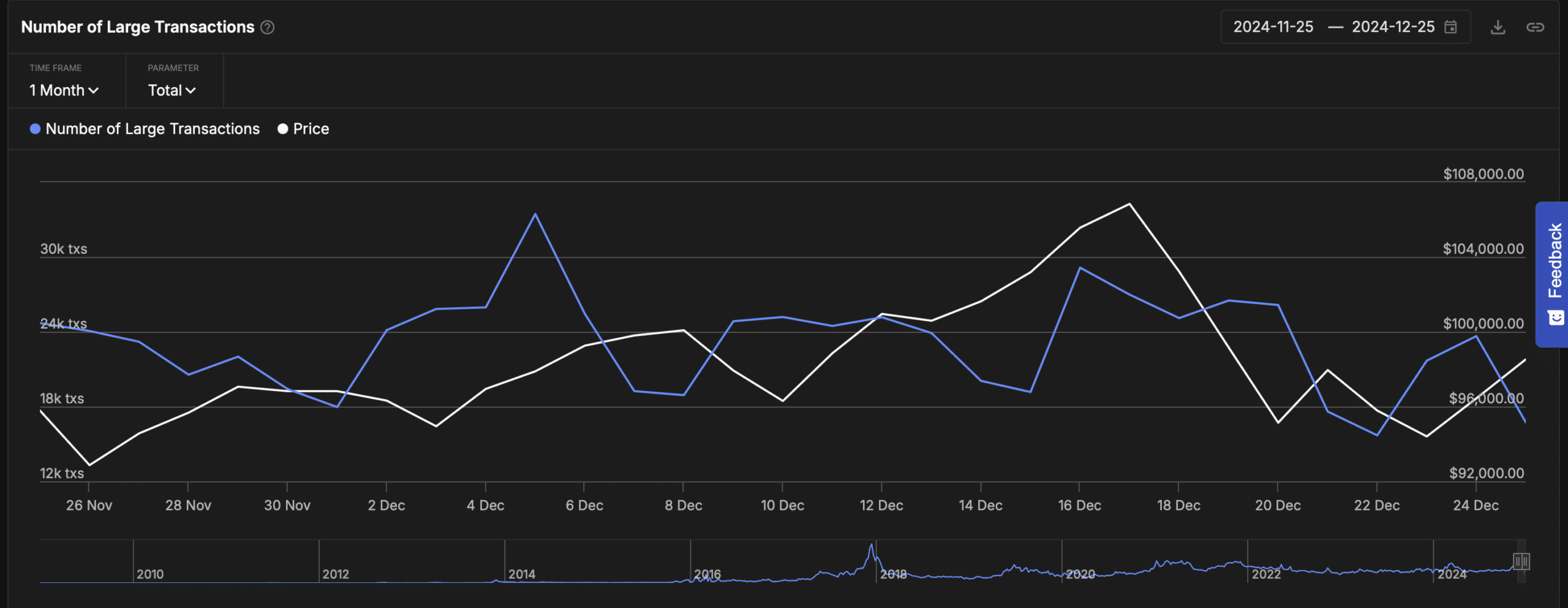

Meanwhile, Bitcoin’s whale transaction activity, has shown a sharp decline over the past month.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

Data from IntoTheBlock revealed that transactions exceeding $100,000 have decreased significantly, dropping from nearly 40,000 transactions at the start of December to just 16,700 as of the 25th of December.

Whale transactions are often seen as a strong indicator of institutional or high-net-worth investor activity, and a decline in these transactions suggests reduced market confidence or a temporary pause in large-scale accumulation.