Bitcoin: Why a dip below $63,800 could be trouble for BTC traders

- The latest market fall was not due to Mt. Gox, but because of the market sentiment following ETF approval.

- Traders are using excessive leverage to buy the dip, with a $30 million liquidation pool if BTC falls below the $63,800 level.

During Asian trading hours on 25th July the overall cryptocurrency market experienced a significant decline, with the top asset Bitcoin [BTC] slipping below the $64,000 mark.

Crypto traders seem to be buying the BTC dip

Amid this selling pressure across the market, a crypto analyst made a post on X (previously Twitter) stating that degens are using heavy leverage to buy Bitcoin dip.

According to the post on X, these traders have created a massive $30 million liquidation pool near the $63,800 mark. This means that if the BTC price tanks below the $63,800 level, this $30 million pool will be liquidated.

Besides these traders, BTC whales also seem interested in buying the dip. Recently, an on-chain analytic firm Lookonchain made a post on X that a smart whale had bought 244 BTC worth $16 million.

Additionally, this whale has added a total of 921 BTC worth $60.6 million at an average price of $65,821.

These posts by the analyst and on-chain analytic firm signal that investors and traders are showing confidence in BTC despite its decline of more than 3.4% in the last 24 hours.

Analysts on recent market decline

Looking at this ongoing selling pressure, Ki Young Ju the CEO and Founder of CryptoQuant made a post on X stating that following Mt. Gox creditors’ repayments in all global time zones have passed, the crypto exchange Krakens’ spot Bitcoin trading volume and exchange flows are normal.

Additionally, Young Ju added that any price drop in the market would happen because of market sentiment, not due to Mt. Gox.

This post by the CEO highlights that the recent market fall is likely due to the market sentiment and the continuous BTC and Ethereum (ETH) sell-off by whales and institutions after spot Ethereum ETF approval.

Bitcoin technical analysis and upcoming levels

On the other hand, another crypto analyst made a post sharing an insight that there’s potential for BTC to rebound as the technical indicator is flashing a buy signal on the BTC hourly chart.

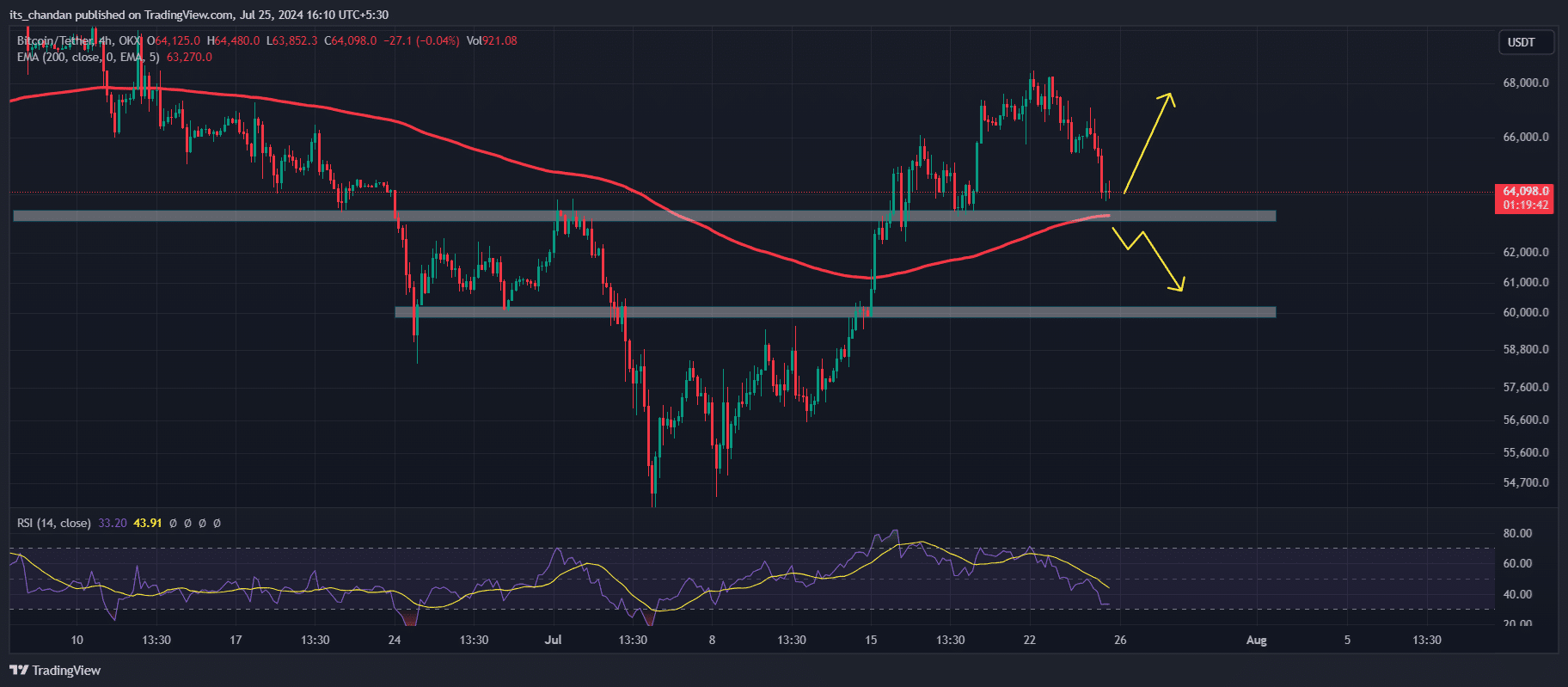

According to expert technical analysis, BTC still looks bullish, holding a support level of $63,350, and continues to move above the 200 Exponential Moving Average (EMA) in the 4-hour time frame.

The BTC price above the 200 EMA signals bullishness on the chart.

Additionally, another technical indicator the Relative Strength Index (RSI) is in oversold sold reason which also signals potential price recovery.

As per price action, if market sentiment remains the same and BTC fails to sustain above 200 EMA and $63,350 level, then we may see a massive sell-off, with BTC price falling to the $60,300 level.

Read Bitcoin’s [BTC] Price Prediction 2024-25

After the $63,350 level, the $60,300 level is the next support BTC may encounter if it fails to hold this time.

As of writing, BTC is trading near the $64,200 level and experienced a 3.4% price drop in the last 24 hours. It also reached an intraday low of $63,770 level. Additionally, trading volume has jumped by 10%, signaling increased participation from investors and traders.