Bitcoin: Why betting against a BTC price rally might not be the way ahead

- BTC logged its largest profit-take ratio day for the first time since 28 March 2022.

- Its price has grown by 5% since the beginning of the year

An assessment of the aggregate amount of coins across all Bitcoin [BTC] transactions on the network that moved in profit or loss revealed that the king coin had clinched its largest profit-take ratio day for the first time since 28 March 2022, data from Santiment revealed.

? #Bitcoin's price has notched up +4.7% in 2023. The small profit opportunities for $BTC have been seized by traders, & yesterday was the 2nd largest profit vs. loss ratio of the past year. The top profit take spike resulted in a -18% the following month. https://t.co/nTkX0TUPWs pic.twitter.com/VGA5CxF0NZ

— Santiment (@santimentfeed) January 10, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-2024

What do the metrics of BTC reveal?

According to the on-chain analytics platform, the recent spike in the profit-take ratio was attributable to the 5% growth in the leading coin’s price since 2023 began. As of this writing, BTC traded at $17,446.89. On 1 January, one BTC exchanged hands at $16,548, data from CoinMarketCap revealed.

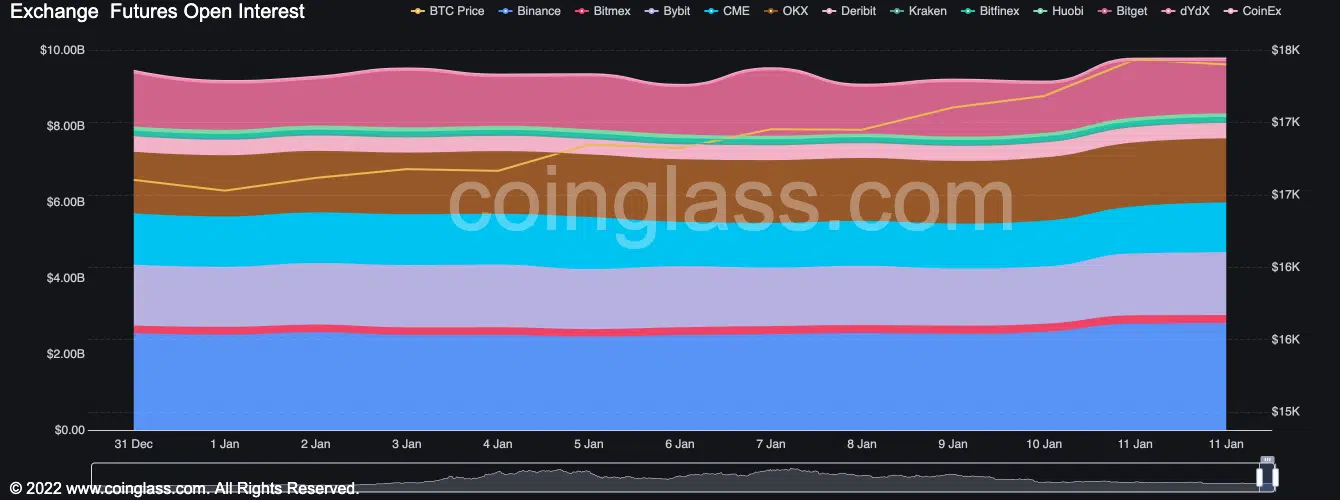

In addition, per data from CoinGlass, there was a surge in BTC’s Open Interest since the beginning of the year. This suggested that there have been numerous contracts open in a bid to profit from BTC’s price growth.

An increase in open interest indicated that more traders were entering the market and opening new positions at press time. This could be an indication of growing investor confidence in the market.

It is also evidence of increased liquidity and volatility in the market. This was because more traders and more open positions typically lead to more buying and selling activity.

With $9.79 billion at press time, BTC’s Open Interest has grown by 7% since the year started.

Many are rooting for the king coin

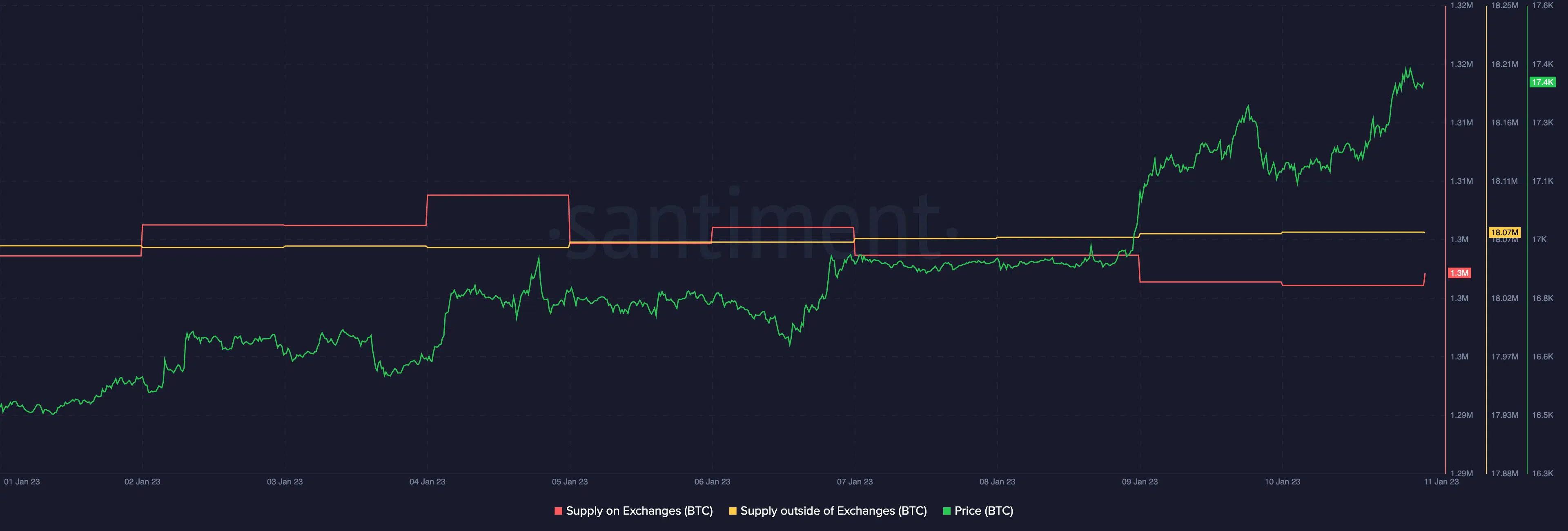

An analysis of BTC’s on-chain activity showed that the number of sell-offs for the coin decreased since the start of the year. Thus, signaling a potentially positive trend for the digital asset’s value.

How many BTCs can you get for $1?

According to Santiment, after a momentary rally in BTC’s supply on exchanges between 1 – 4 January, it has since declined by 1%. The uptick in BTC’s supply on exchanges in the first few days of the new trading year was because of the negative sentiment that many investors harbored at the close of 2022. This caused them to sell off their holdings.

It is trite that when the supply of a crypto asset on exchanges decreases, it typically indicates that more coins are being held by traders and investors rather than being sold in the open market.

Source: Santiment

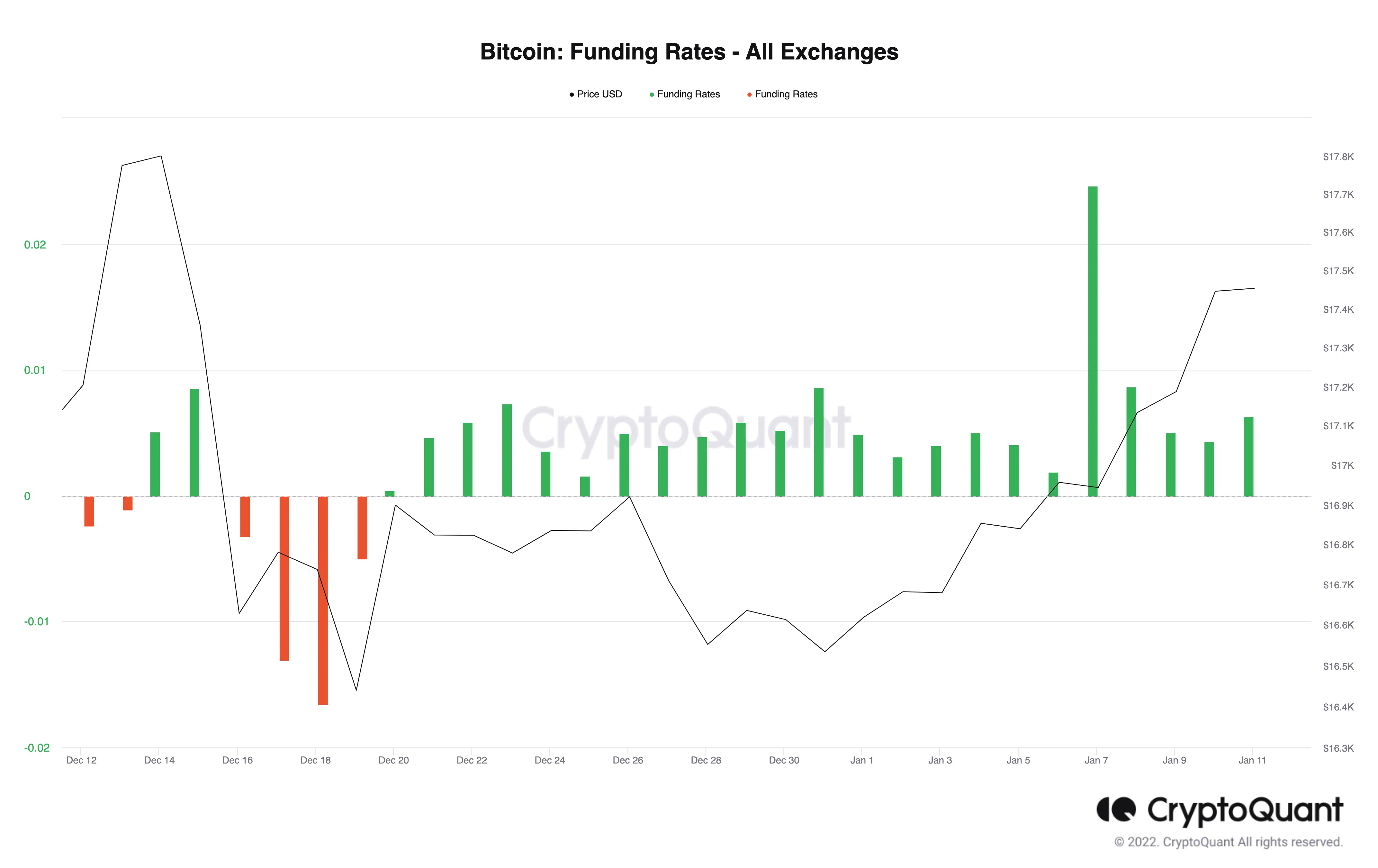

BTC’s funding rates have been positive since the year began, data from CryptoQuant showed. A positive funding rate indicates that traders who have taken long positions, believing the price of the crypto asset will rise, are in the majority.

This is because, in this case, short-position traders are required to pay these long-position traders, marking their dominance in the market.