Bitcoin: Why miners continue to get rid of their BTC

- Miners continue to deplete their reserves as selling pressure increases.

- The BTC volume has continued to trend with no significant impact.

Bitcoin [BTC] miners are rapidly liquidating their holdings, leading to a significant decrease in reserves, reaching the lowest levels in years.

Bitcoin miner reserve hits a low

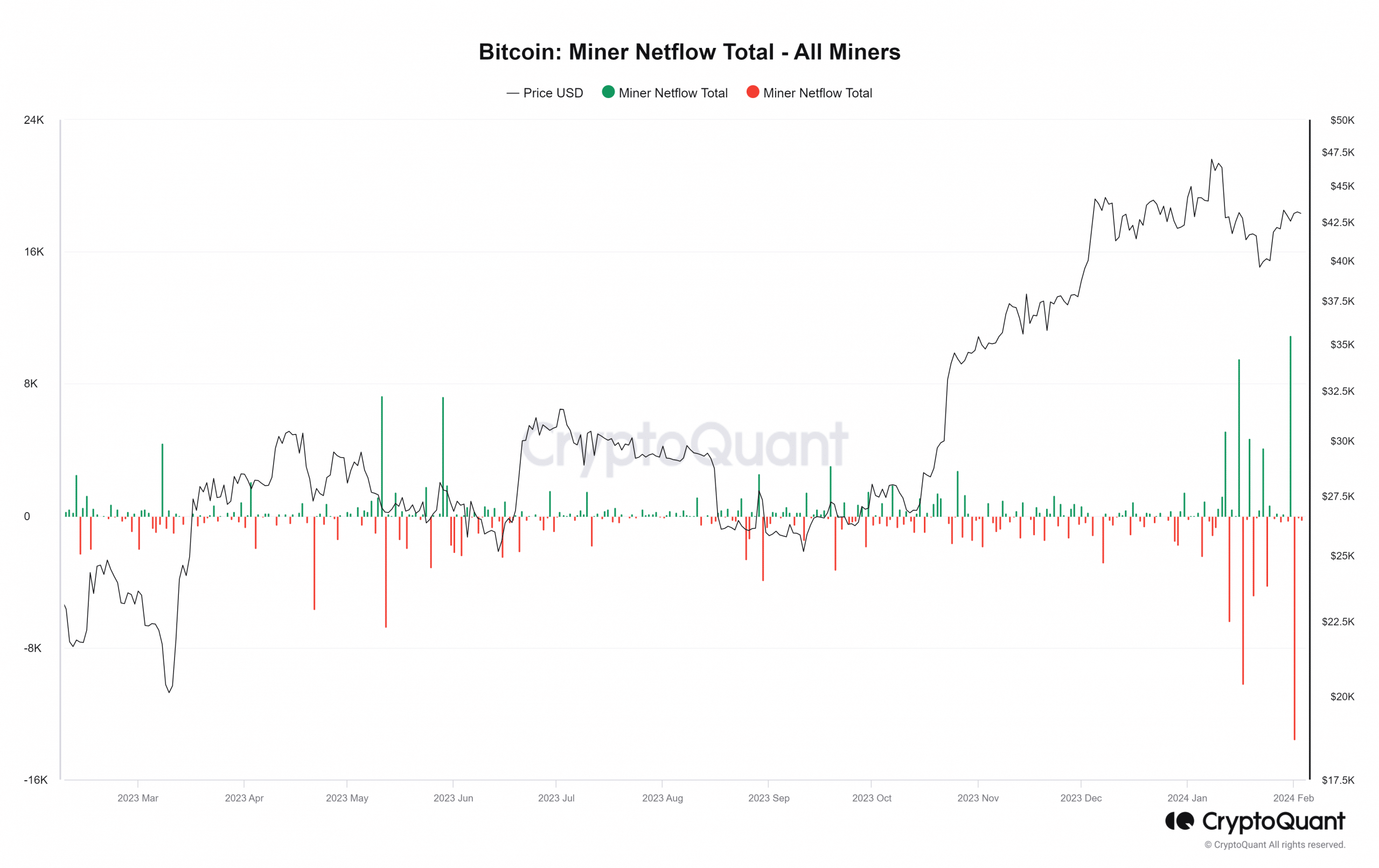

Recent data from CryptoQuant showed a notable increase in selling pressure from Bitcoin miners over the past few weeks. According to analysis, this heightened selling activity has had a negative impact on the Miner Reserve.

Over 14,000 BTC, equivalent to about $600 million, left the reserve in the last few days. This reduction marks the lowest level the reserve has experienced since July 2021.

Also, the latest analysis of the reserve showed it currently holds about 1.83 million BTCs. Notably, the reserve continued to decline further at the time of this writing.

Outflow dominates Bitcoin’s miner netflow

Analyzing the Bitcoin Miner netflow, it has shown consistent outflow dominance since the beginning of February. The last notable inflow was on 31st January, recording almost 11,000 BTCs.

However, the trend has predominantly been outflow since then, reaching its peak with a volume of over 13,500 on 1st February. This outflow on 1st February marked the highest single daily volume observed over a year.

Understanding netflow values is crucial; a positive netflow indicates an increase in the reserve, while a negative netflow signifies a decline.

The netflow data provides a clearer perspective on how miners have been selling their holdings and the attempts of inflow to counterbalance this activity.

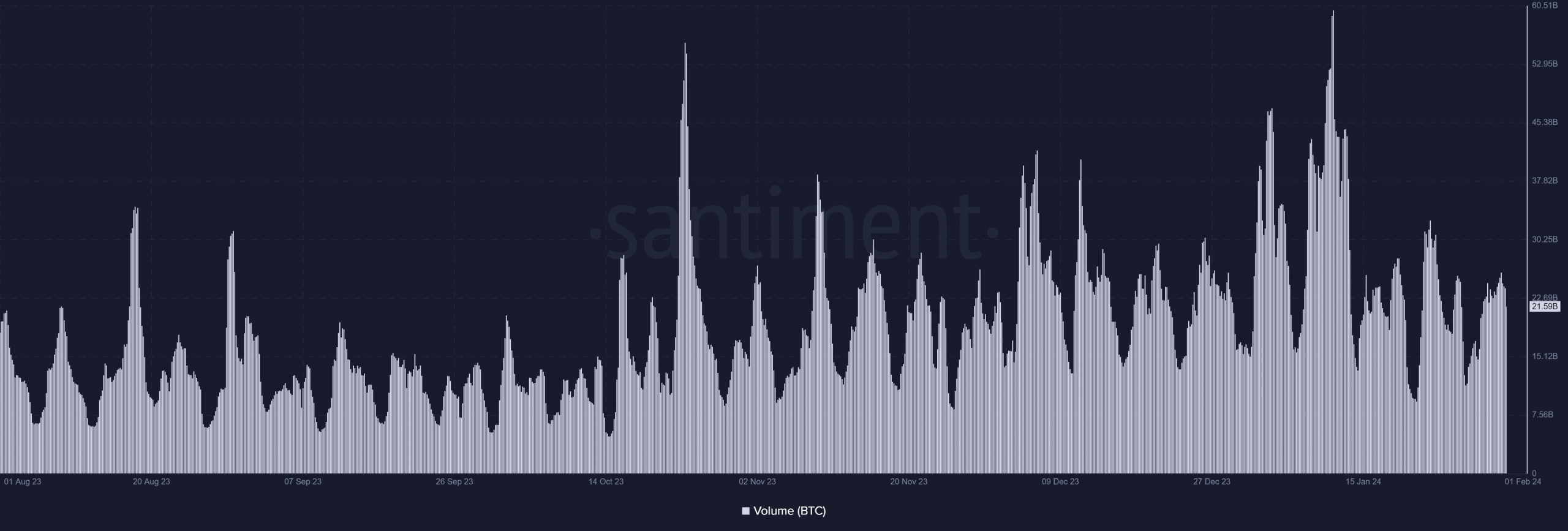

Bitcoin volume trend remains the same

Analyzing the Bitcoin volume data showed a lack of significant trends in the last few days. Over the past three days, the highest recorded volume reached around $26 billion.

At the time of this writing, the volume was around $22 billion. This suggests that despite the substantial decline in the volume of miner reserves recently, it has not influenced the overall volume trend.

How much are 1,10,100 BTCs worth today

Furthermore, as of this writing, Bitcoin was trading above $43,000. The daily timeframe chart showed a slight decline in its current trading position.

However, it has shown upward trends over the last two days.