Bitcoin: Why now is the best time to stockpile BTC

- BTC was up by nearly 10% over the last seven days.

- Buying pressure was high, and indicators also looked bullish.

Bitcoin [BTC] has finally gained upward momentum as its value went above the $47,000 mark. This sparked excitement in the community as investors expected the king coin to reach new highs. Amidst that, a key BTC indicator flagged a buying signal, suggesting that investors should consider accumulating.

A look at Bitcoin’s weekly journey

Bitcoin managed to once again turn bullish as it painted its weekly and daily charts green. According to CoinMarketCap, BTC was up by more than 9.5% in the last seven days.

In fact, in the last 24 hours alone, its value surged by over 3%. At the time of writing, BTC was trading at $47,454.25 with a market capitalization of over $931 billion. Thanks to the price uptick, the coin’s social volume spiked, meaning that its popularity has increased in the recent past.

Additionally, bullish sentiment around the coin also went up lately, which was evident from the rise in its weighted sentiment.

Meanwhile, Ali, a popular crypto analyst, recently posted a tweet highlighting a key BTC metric. As per the tweet, the Super Trend just flashed a buy signal on the Bitcoin monthly chart, a tool known for its precision in predicting BTC bull markets.

The Super Trend just flashed a buy signal on the #Bitcoin monthly chart, a tool known for its precision in predicting $BTC bull markets.

The four buy signals it has issued since #BTC inception have all been validated, leading to gains of 169,172%, 9,900%, 3,680%, and 828%,… pic.twitter.com/83GtqJNryW

— Ali (@ali_charts) February 8, 2024

Historically, since the start of BTC, the indicator has provided four validated buy signals, which have resulted in gains of 169,172%, 9,900%, 3,680%, and 828%, respectively.

Therefore, AMBCrypo took a closer look at BTC’s state to understand whether investors have started to accumulate more BTC.

Bitcoin accumulation is rising again

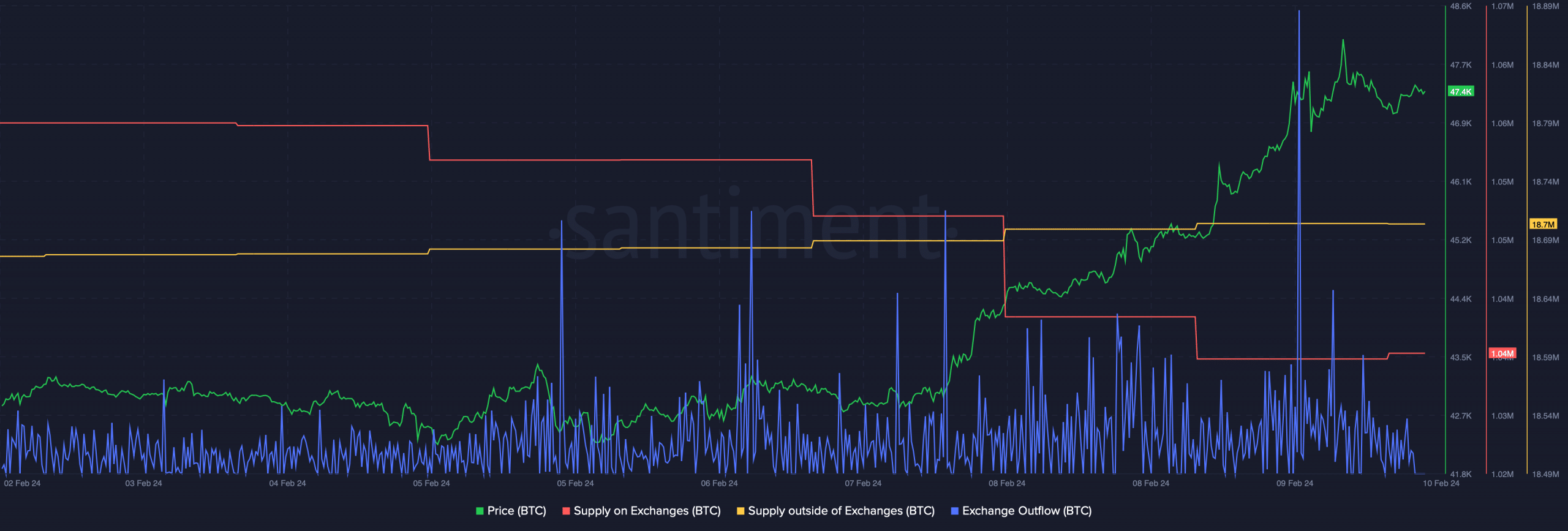

Our analysis of Santiment’s data clearly showed that investors were actually buying BTC. The king of cryptos’ supply on exchanges sank last week while its supply outside of exchanges increased, indicating high buying pressure.

Its exchange outflow also spiked, further establishing the fact that buying pressure was high.

Since buying pressure was high and Bitcoin’s price action was bullish, we then checked its daily cart to see whether the uptrend would last. An analysis of BTC’s daily chart revealed that BTC’s Chaikin Money Flow (CMF) went up sharply.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Its MACD also displayed a clear bullish advantage in the market. These indicators suggested that the possibility of a continued price uptrend was high.

However, the Relative Strength Index (RSI) was about to enter the overbought zone. This can increase selling pressure on Bitcoin, which can result in an end to the bullish price action.