Bitcoin: Why THESE factors signal a potential end to BTC’s bull market

- BTC has gained by 4.0% over the past week.

- Do these 4 different cyclical signals Bitcoin’s market top?

Over the past day, Bitcoin [BTC] saw a strong uptick to hit $88.7k breaking out of the consolidation. However, since then, the Crypto has retraced to $86k reflecting heightened volatility.

These prevailing market conditions have left stakeholders speculating over a potential market top. Inasmuch, CryptoQuant analyst Burak Kesmeci suggested 4 potential on-chain metrics signaling a potential end of Bitcoin’s bull market.

Do these four cyclicals signal Bitcoin’s market top?

Source: Cryptoquant

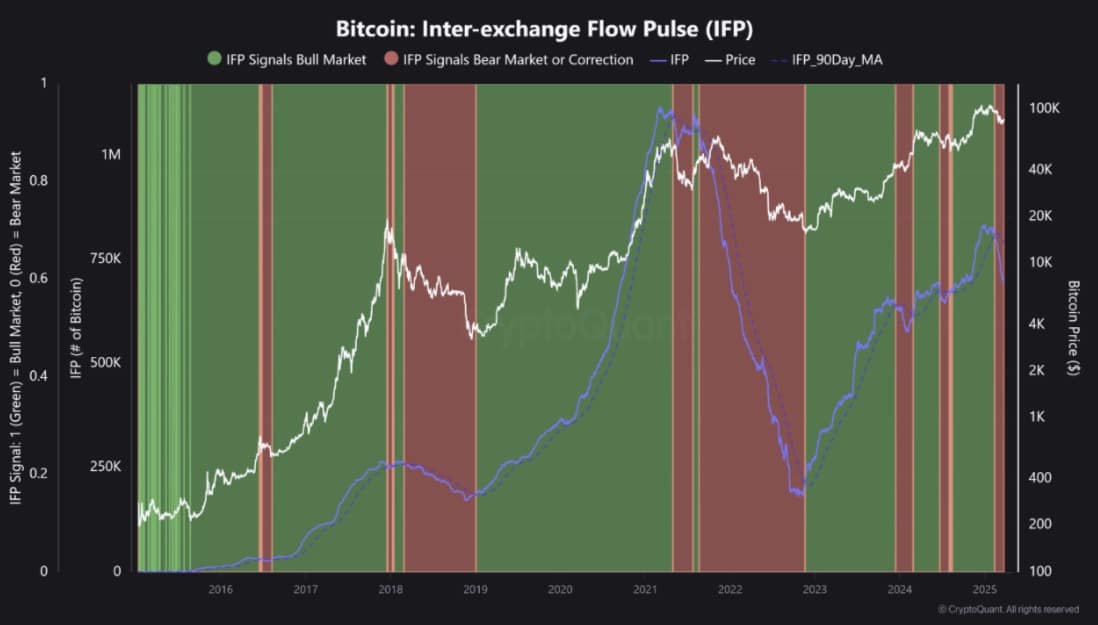

CryptoQuant highlights four indicators suggesting a potential market top, including Bitcoin’s Inter-Exchange Flow Pulse (IFP), which remains bearish.

At the time of writing, IFP stood at 696k, below the SMA90 of 794k. As long as IFP stays under the SMA90, market corrections are likely to persist.

For instance, between December 2023 and February 2024, IFP stayed below SMA90. When it crossed above, BTC surged to $73k.

The Bitcoin CQ Bull & Bear Market Cycle Indicator also signals bearishness. During this uptrend, it has previously displayed weak bearish patterns, similar to the current signals.

At press time, DMA365 was at 0.18, while DMA30 stood at -0.16. With DMA30 below DMA365, it indicates significant bearish momentum. A bullish trend shift cannot be confirmed until DMA30 crosses above DMA365.

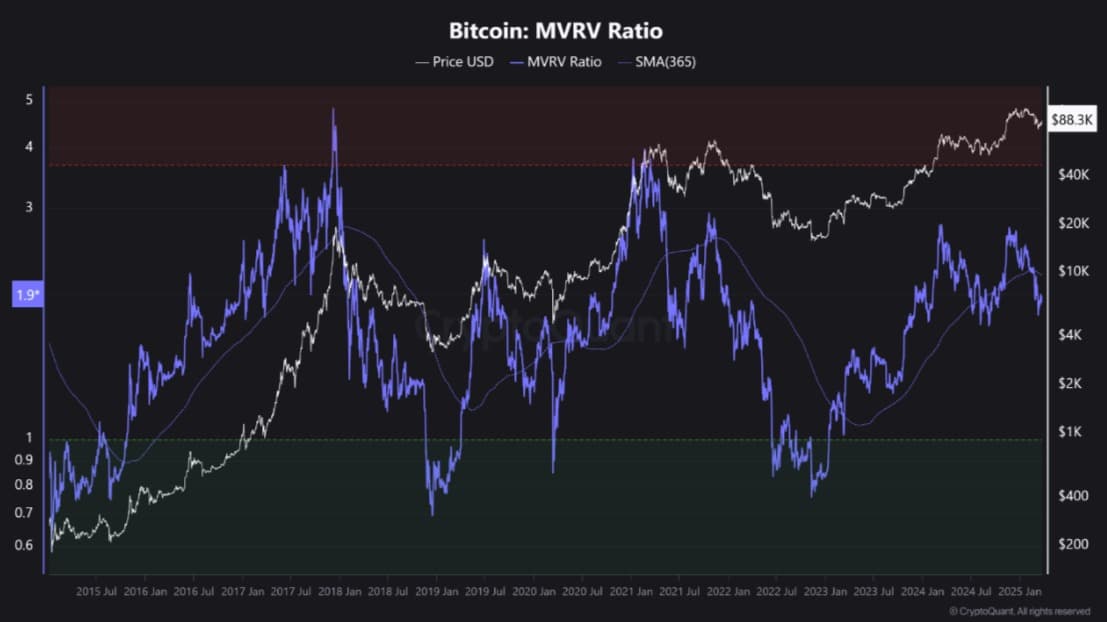

Thirdly, Bitcoin’s MVRV Score remained below its SMA365, indicating a potential continuation of the correction. Historically, when the MVRV score stays under the 365-day moving average (SMA365), selling pressure tends to increase.

In the current bull cycle, Bitcoin last dropped below this support level during the August 5, 2024, carry trade crisis. After the crisis ended, the MVRV score reclaimed SMA365, signaling a recovery.

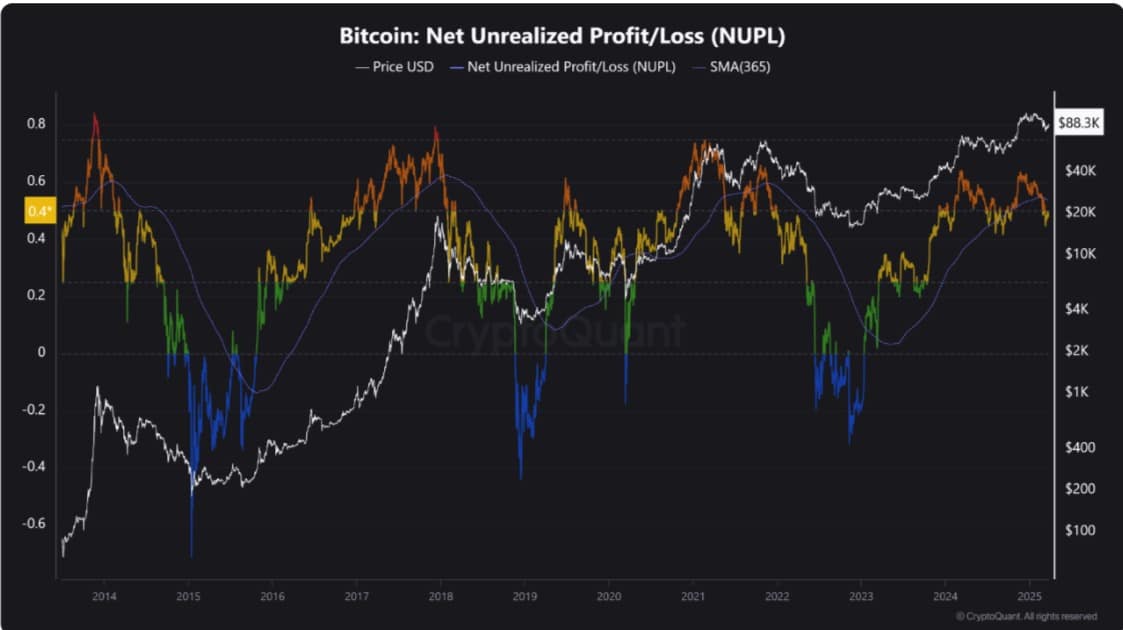

Finally, Bitcoin’s NUPL remained below its SMA365, indicating ongoing bearishness. While NUPL alone cannot confirm the end of the bullish trend, a recovery would require NUPL to climb above SMA365.

As of this writing, NUPL was at 0.49, while SMA365 stood at 0.53. Without an upward flip, corrections are likely to persist.

Collectively, these four metrics suggest Bitcoin is facing significant turbulence in the short to mid-term. However, none indicate an overheated market or a cycle-top scenario. This situation mirrors the carry trade crisis of August 5, 2024, when macroeconomic conditions drove Bitcoin lower.

Trump’s tariff policies and growing uncertainty have similarly weighed on macro indices and Bitcoin. A similar pattern was seen a year ago—once macro pressures eased, Bitcoin staged a recovery.

If history repeats, improving macroeconomic conditions could pave the way for a sustained Bitcoin rebound.

What BTC charts suggest

While the CryptoQuant analysis shows a worrying trend, AMBCrypto’s analysis suggests that the market top is not yet and key players remain bullish.

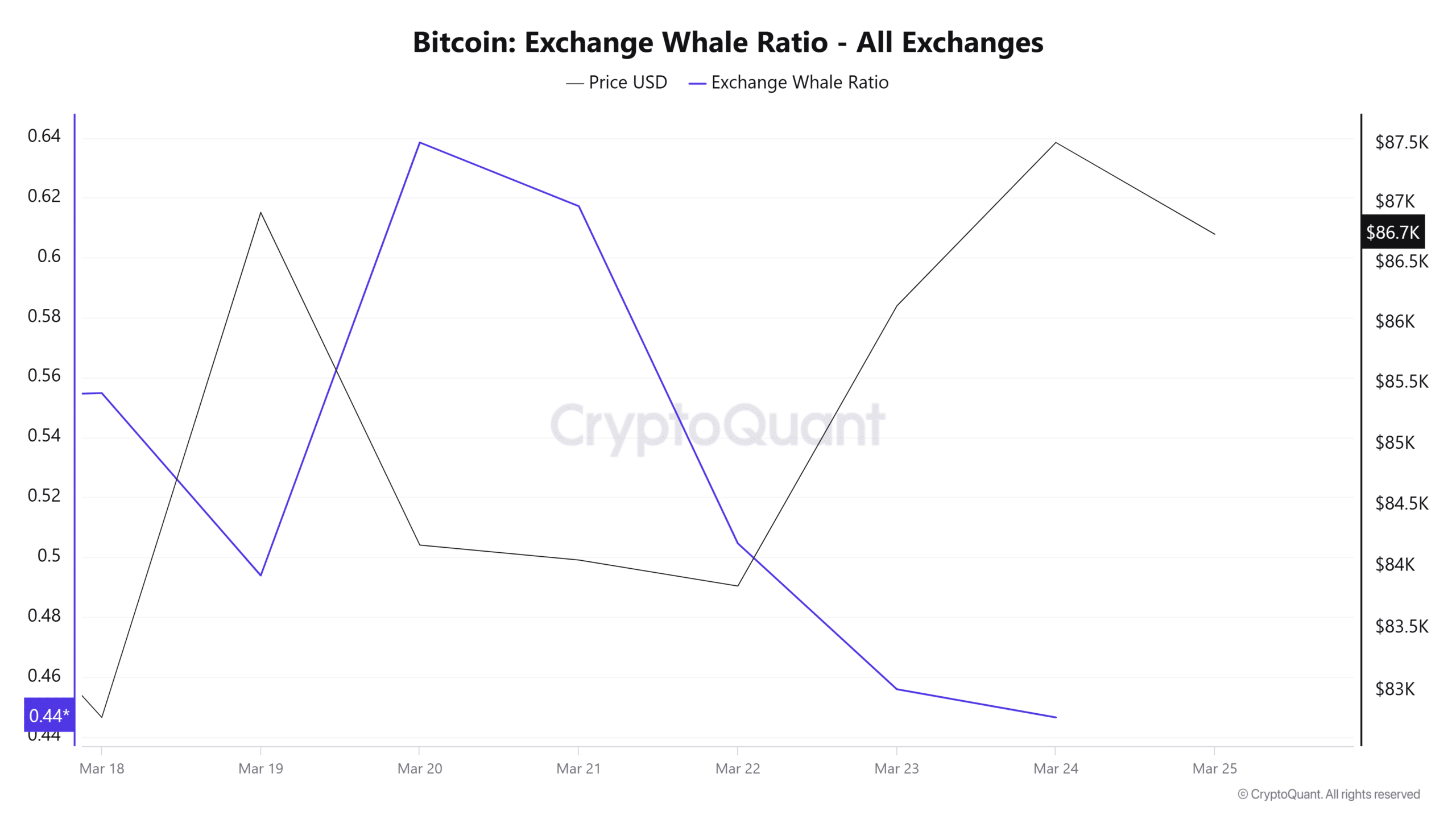

For starters, Bitcoin whales remain bullish as evidenced by a declining Whale exchange ratio. When this sees a sharp dip, it suggests that whale are holding their positions and are not transferring BTC to exchanges to sell.

This reflects optimism with large entities expecting prices to rise further.

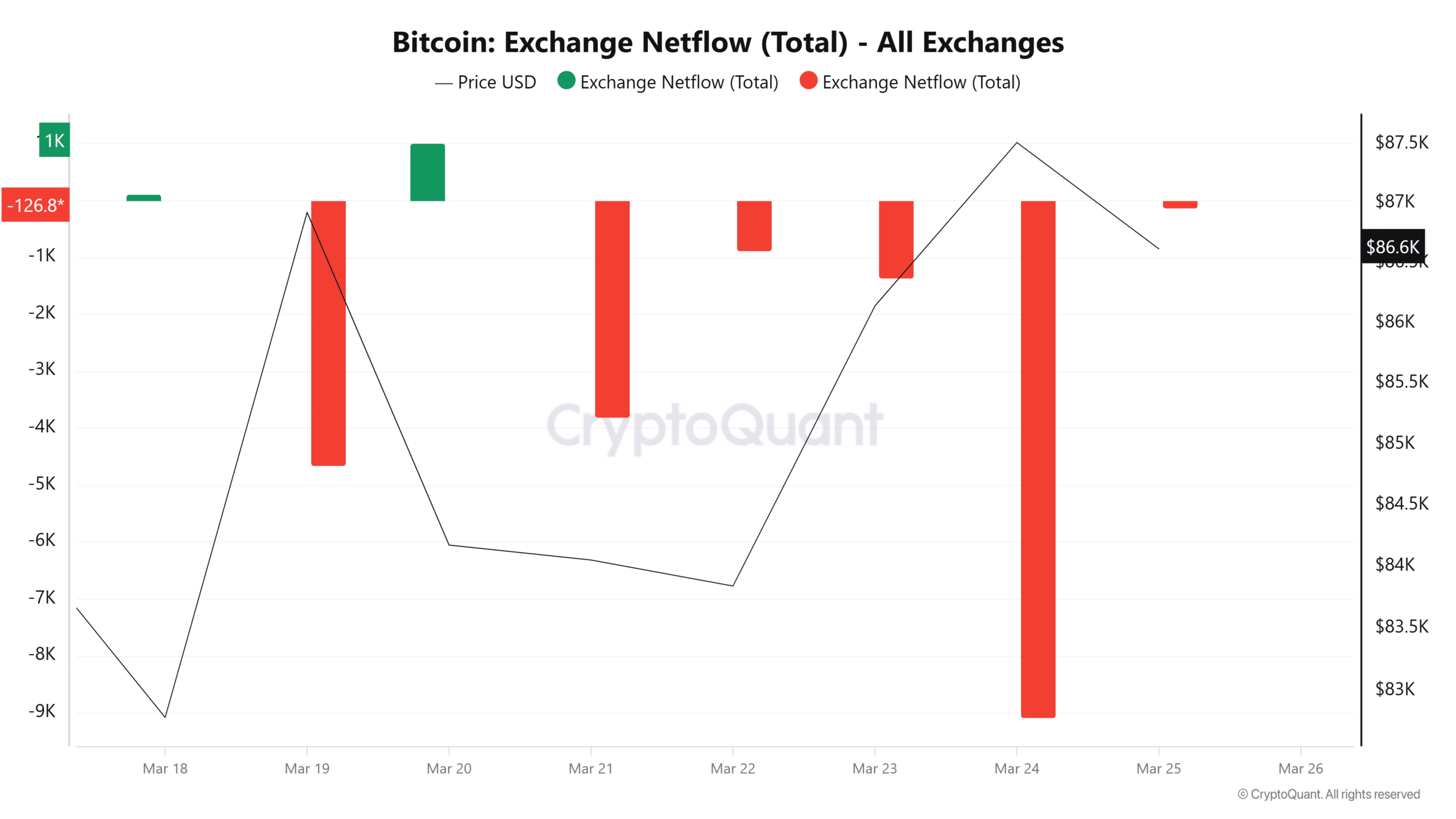

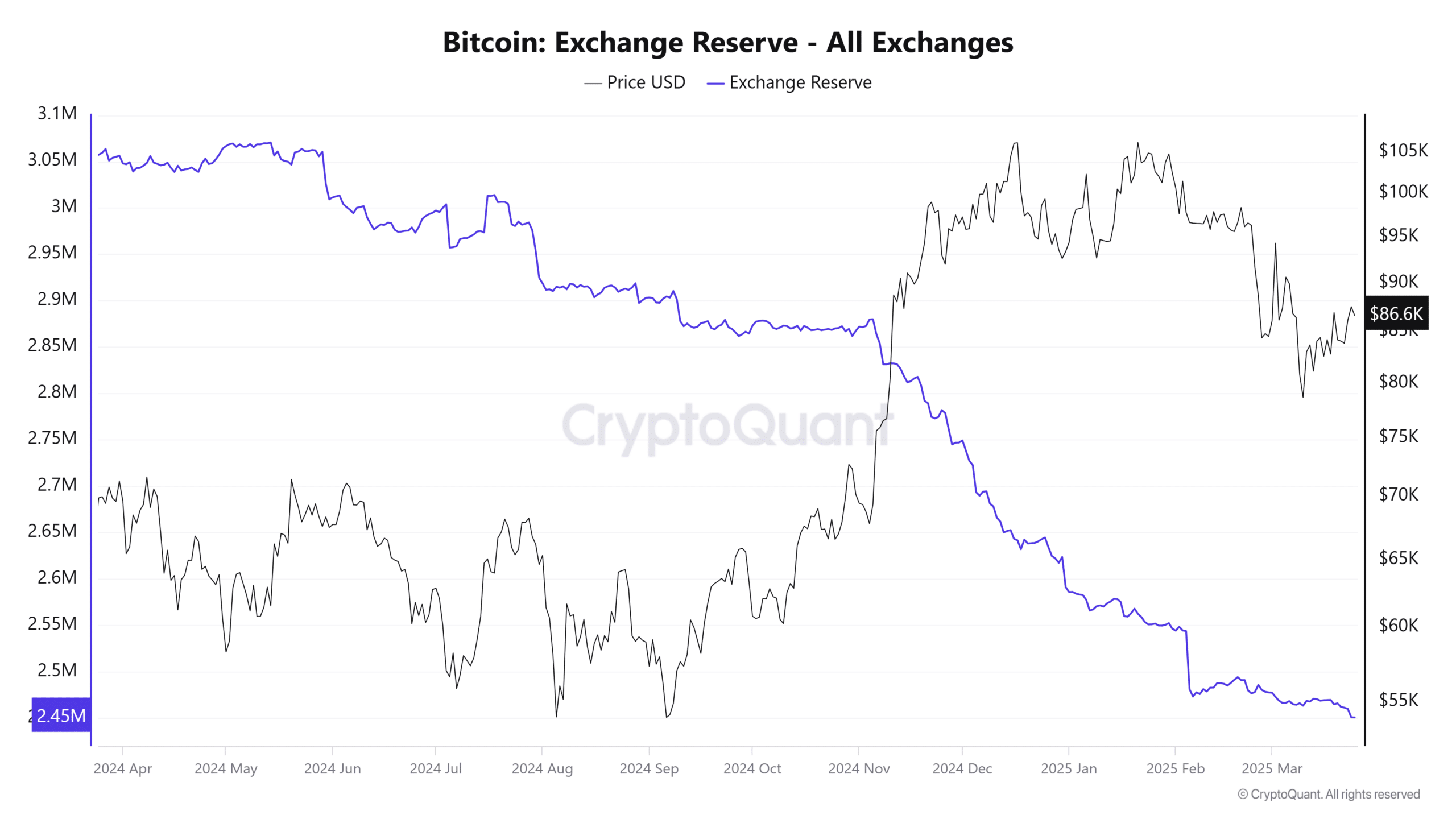

This trend is perceived across market participants. We can see this as Bitcoin’s exchange netflow has remained negative for five consecutive days.

A five-day run of negative netflow suggests that buyers have taken hold of the market, with BTC experiencing a surge in accumulating addresses. If buyers feel the market is nearing the top, they will behave differently.

The increased outflow has led Bitcoin’s exchange reserves to drop to a yearly low. This decline suggests fewer transfers into exchanges, as previously noted. As long as exchange inflows remain low, prices are expected to recover when market conditions improve.

In summary, while some indicators point to a potential end of the bull market, we are not there yet. There is still room for growth, with both whales and retail investors maintaining a bullish outlook.

If this sentiment persists, BTC could reclaim the $90k level. However, if a correction occurs, BTC might fall to $85,222.