Bitcoin

Bitcoin: Why this level can make or break BTC’s potential to rebound

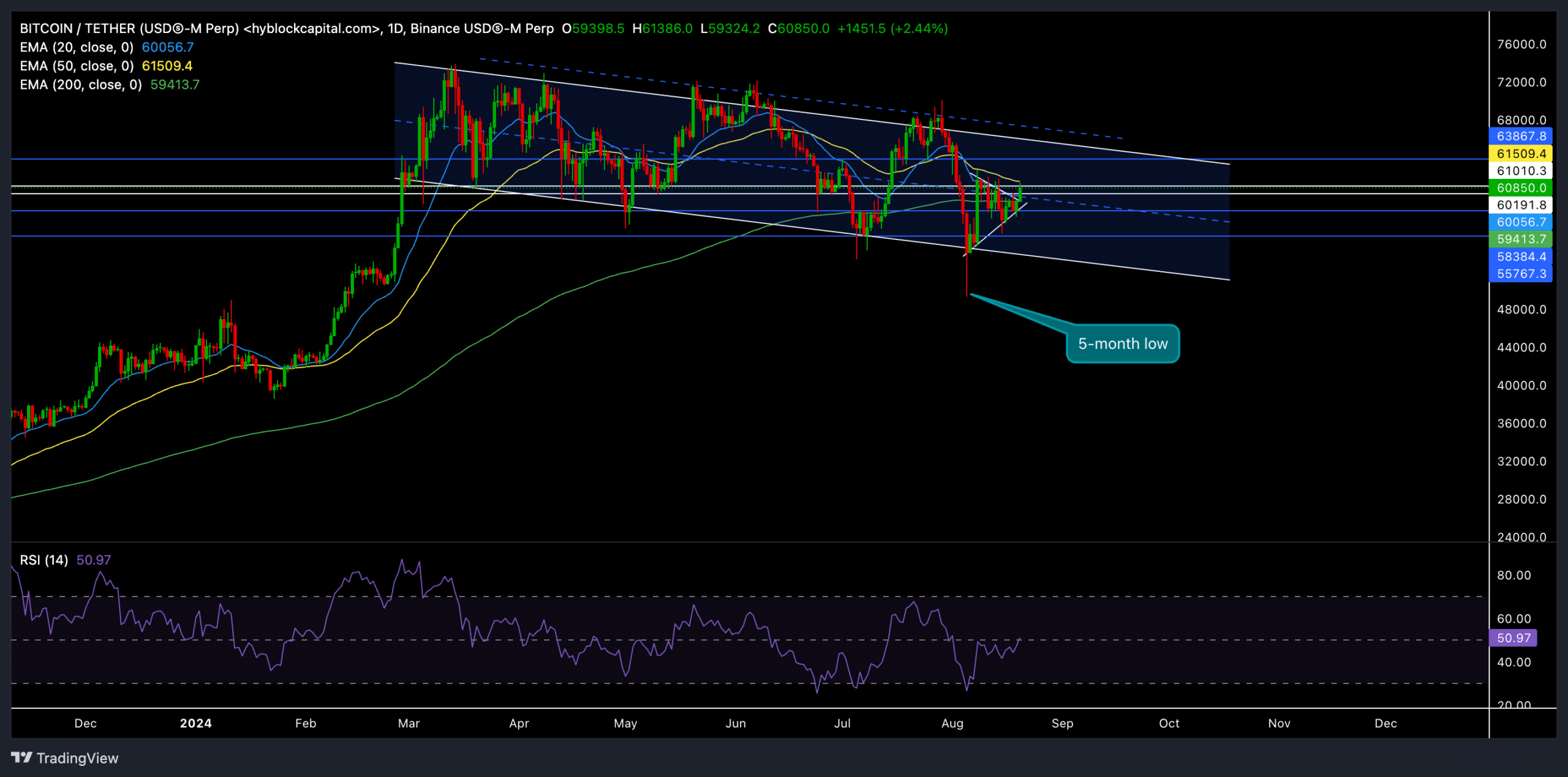

Bitcoin recently reclaimed a spot above its 200-day EMA. Can the bulls continue to exert pressure?

- Traders should watch the $61,500 resistance closely, as a break above this level could confirm a strong recovery.

- Derivates data showed a slight bullish edge, with the long/short ratio favoring the bulls.

The recent price action of Bitcoin [BTC] showed a period of consolidation following a dip to its 5-month low. Despite a spike in volume and a rather modest recovery, Bitcoin remains within a crucial range that could determine its next move.

The price is currently trading at $60,850, up by nearly 2% in the last 24 hours. It recently bounced off a 5-month low, finding support around the $59,413 level, which coincided with the 200-day EMA.

Bitcoin attempts to rebound amid market volatility

The 50-day EMA at $61,509 is a crucial level that the bulls need to reclaim for a sustained recovery.

It’s worth noting that the current price is hovering around these EMAs, indicating a close battle between buyers and sellers.

A break above the 50-day EMA could open the door for further gains, while a failure to hold above the 20-day EMA might lead to another retest of lower support levels.

The RSI (Relative Strength Index) is currently just above the 50 mark, showing a neutral stance. This suggests that Bitcoin is at a critical juncture where the next move could determine the short to medium-term trend.

The recent increase in volume and open interest suggests that traders are positioning for a potential move, but broader market sentiment will play a key role.

Key levels to watch

At the time of writing, the immediate resistance was $61,509 (50-day EMA). If BTC can break and hold above this level, the next target would be the $63,867 resistance level, followed by a potential test of the $66,000 region.

On the downside, the support at $59,413 (200-day EMA) is crucial. A break below this level could lead to a deeper correction, with the next support around the $54-$57K level.

Meanwhile, the derivatives data showed a bullish tilt, with volume up by 21% to $54.88B and open interest increasing by nearly 3% to $30.89B.

The long/short ratio for the last 24 hours stood at 1.0358, slightly favoring the longs.

Read Bitcoin’s [BTC] Price Prediction 2024-25

On Binance, the BTC/USDT long/short ratio was 1.3223—showing that many traders were still betting on a continuation of the recent bounce.

Investors should also monitor external factors such as macroeconomic trends and broader market sentiment, as these will likely influence BTC’s price action in the near term.