Bitcoin: Why this might not be the ‘dip to buy’

Rooting against Bitcoin during a positive rally could be considered cynical by the hyper-bullish community, but it is important to note down important reversals. After all, the asset unleashed a relentless recovery on July 20th, and from a healthy side of things, ‘rooting’ against Bitcoin now only helps the digital asset in the long term.

In line with that thought, we analyzed a few important signals that surfaced over the past 24-hours, that may act as key insights for the next few days.

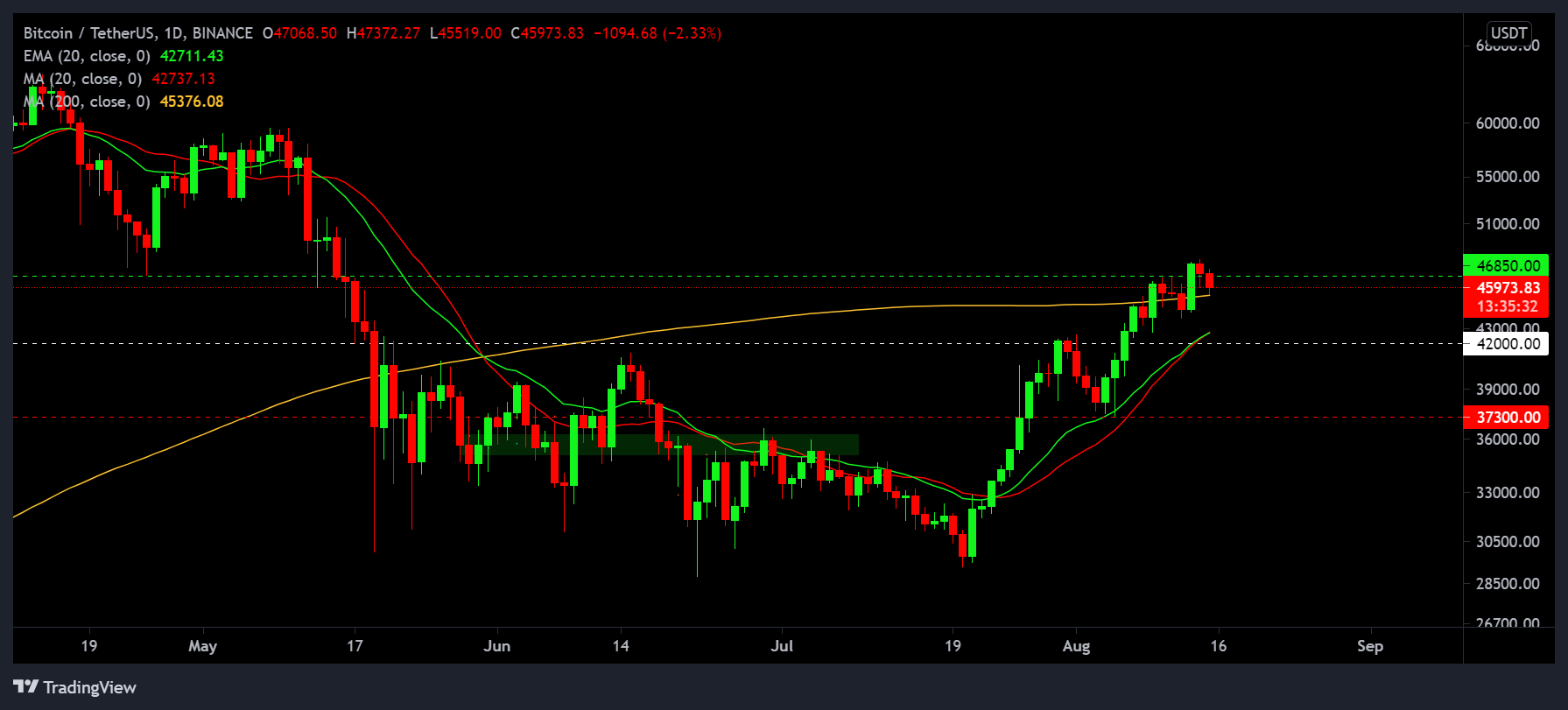

SMA tussle for Bitcoin?

The Simple Moving Average is an indicator that on a long-term frame has effectively facilitated strong moves for Bitcoin. On 9th August, BTC managed to close above 200-SMA but since then, there has been more of a struggle. Over the past week, BTC hasn’t generated enough ground away from the SMA, and at press time, the asset might close below the resistance once again.

Historically whenever Bitcoin has strongly breached above the 200-SMA, a bullish rally has ensued. Yet, there have been cases when hesitation near the SMA has caused corrections. For Bitcoin, this might just be a lack of momentum needed to push the price above the moving average.

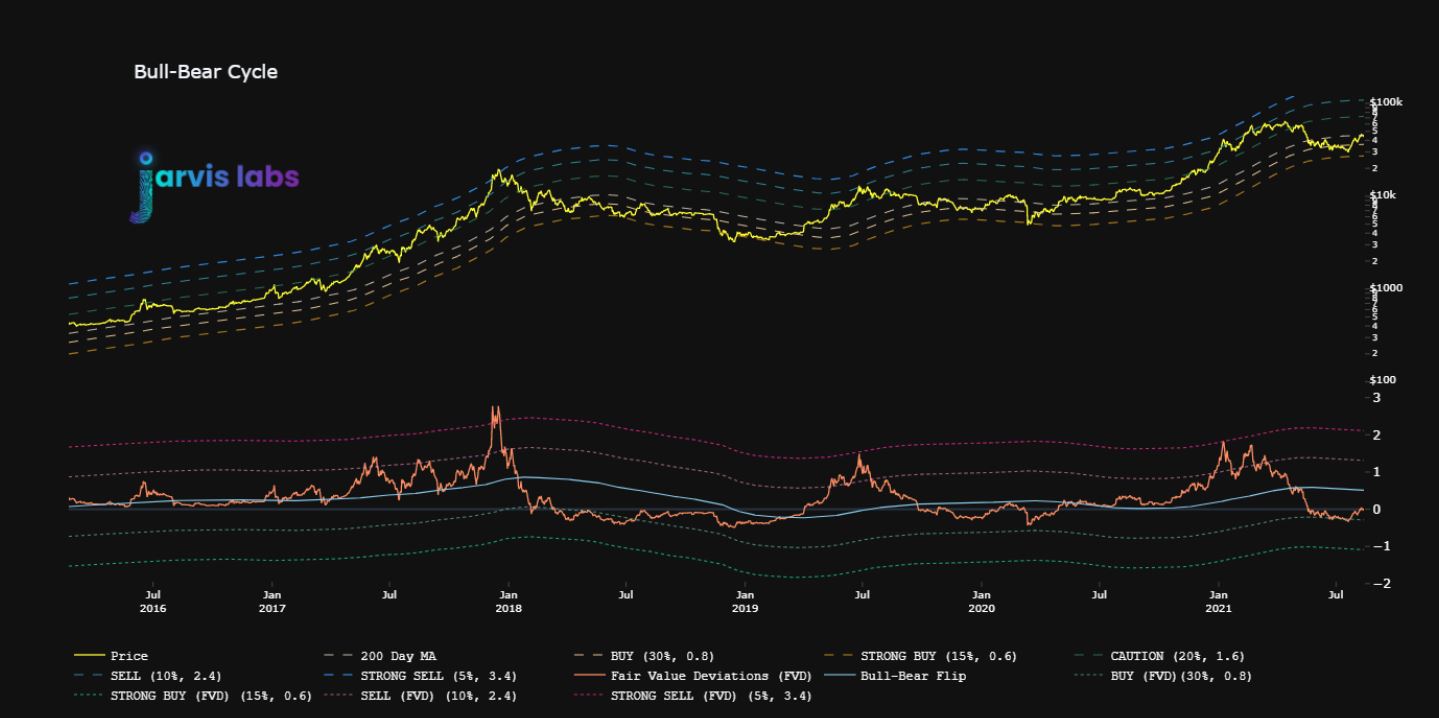

Secondly, according to data, Bitcoin’s fair value deviation is currently under the 0-zero line in the above chart. FVD is a metric created which is identified by keeping the fair value in mind. At the moment, the indicator is largely under the bull-bear flip(zero-line), which suggests that Bitcoin hasn’t really locked in definite bullish momentum in the chart.

The position of the BTC with respect to the indicator isn’t bearish either, but it is at a range, where corrections can definitely be expected.

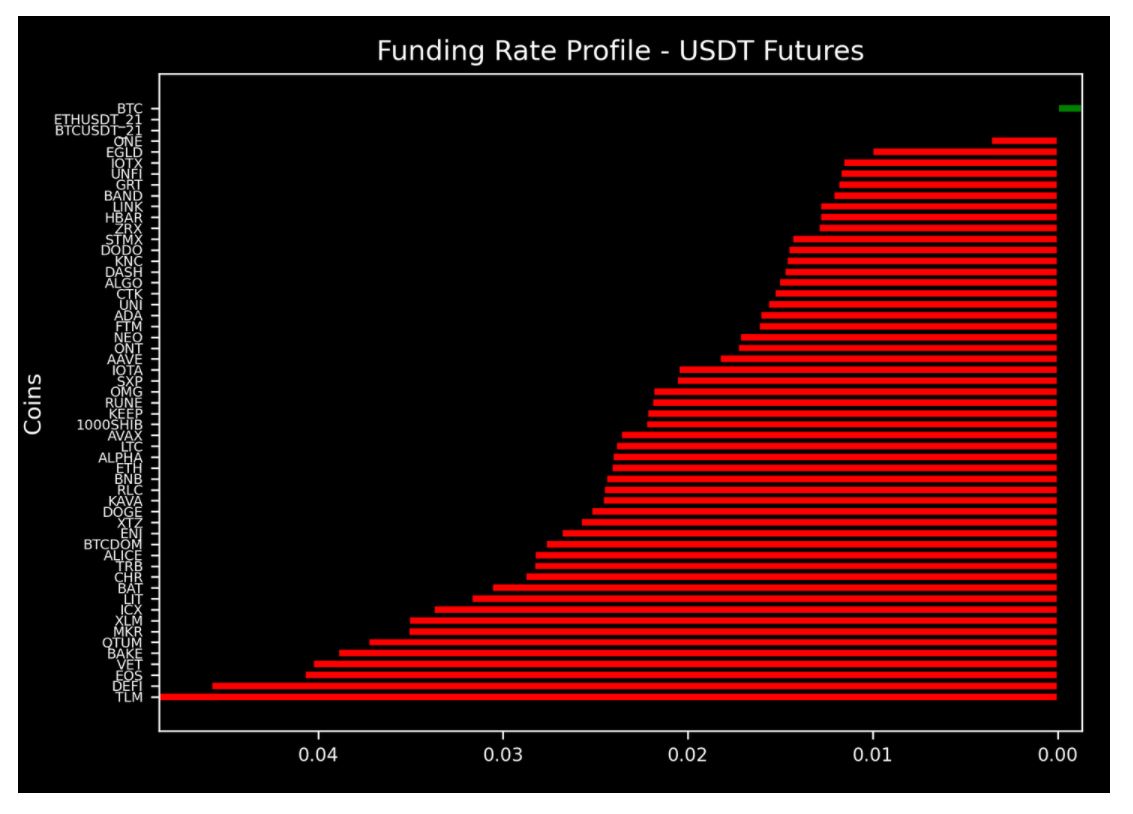

Funding Rate dilemma for Bitcoin?

Yes, the funding rate is still positive but it is no longer at an adequate range. With the rates rising for other altcoin pairs, an aggressive correction should be expected in the short term. If the chart is observed closely, Bitcoin’s funding rate has turned mildly negative, which means the selling pressure is already starting to build on different exchanges.

Can the market still rally?

Bitcoin’s market has rallied for 2 weeks so there is no doubt that it will rally again. It might rally from the current position, but right now, it is short of momentum. With the market strongly consolidating the past week, BTC is at a breakout week; it’s either $42k support or $50k jump.