Bitcoin: Why Uncle Sam’s latest move could mean trouble for BTC miners

- Bitcoin faces more headwinds as the U.S. government prepares for another attack.

- Reportedly, the tax aims at encouraging mining companies to pay for the environmental impact of mining

The U.S. government has been demonstrating more aggressiveness against Bitcoin [BTC] and altcoins in the last few weeks. It is now about to kick things up a notch higher if a recently introduced bill is passed and this time Uncle Sam is going for the underlying technology.

Is your portfolio green? Check out the Bitcoin Profit Calculator

A recent Whitehouse publication about the U.S. President’s budget for the fiscal year 2024 revealed that the government was eying crypto mining. The budget contains a new proposal called the Digital Asset Mining Energy (DAME) Excise tax.

The latter is expected to reportedly apply a 30% tax to crypto mining companies as an environmental cost for the electricity used in crypto mining activities.

The government is attacking proof of work #bitcoin mining. https://t.co/tyQE8i8y5h solves this. https://t.co/1yo1U4JjTe

— Richard Heart (@RichardHeartWin) May 3, 2023

The publication suggested that the tax aimed at encouraging mining companies to pay for the environmental impact of their mining activities. However, such a high tax may actually be aimed at inflicting damage to the Bitcoin proof of work mining system, and potentially to subdue it.

This is because such a hefty tax may force most mining companies in the U.S. out of business or push them to other jurisdictions.

Assessing the potential impact on Bitcoin miners and hash rate

The latest Bitcoin mining data in 2023 revealed that the U.S. accounts for roughly 34.5% of Bitcoin’s hash rate. This means most Bitcoin miners are currently located in the U.S. and most of that hash rate is contributed by companies that specifically focus on crypto mining.

The DAME excise tax will reportedly target institutions engaged in crypto mining. This means Bitcoin’s hash rate may drop significantly if the new tax pushes such companies to a corner, forcing them to halt operations.

Alternatively, many of them might be forced to shift their operations outside the U.S. Individuals running mining operations from home will likely not be affected.

How many are 1,10,100 BTCs worth today

Bitcoin’s hash rate is likely strong enough to withstand a significant hash rate decline. This is because miners in other jurisdictions would pick up the slack. Miner revenue would likely not be affected as much but the high tax would likely eat into mining profitability.

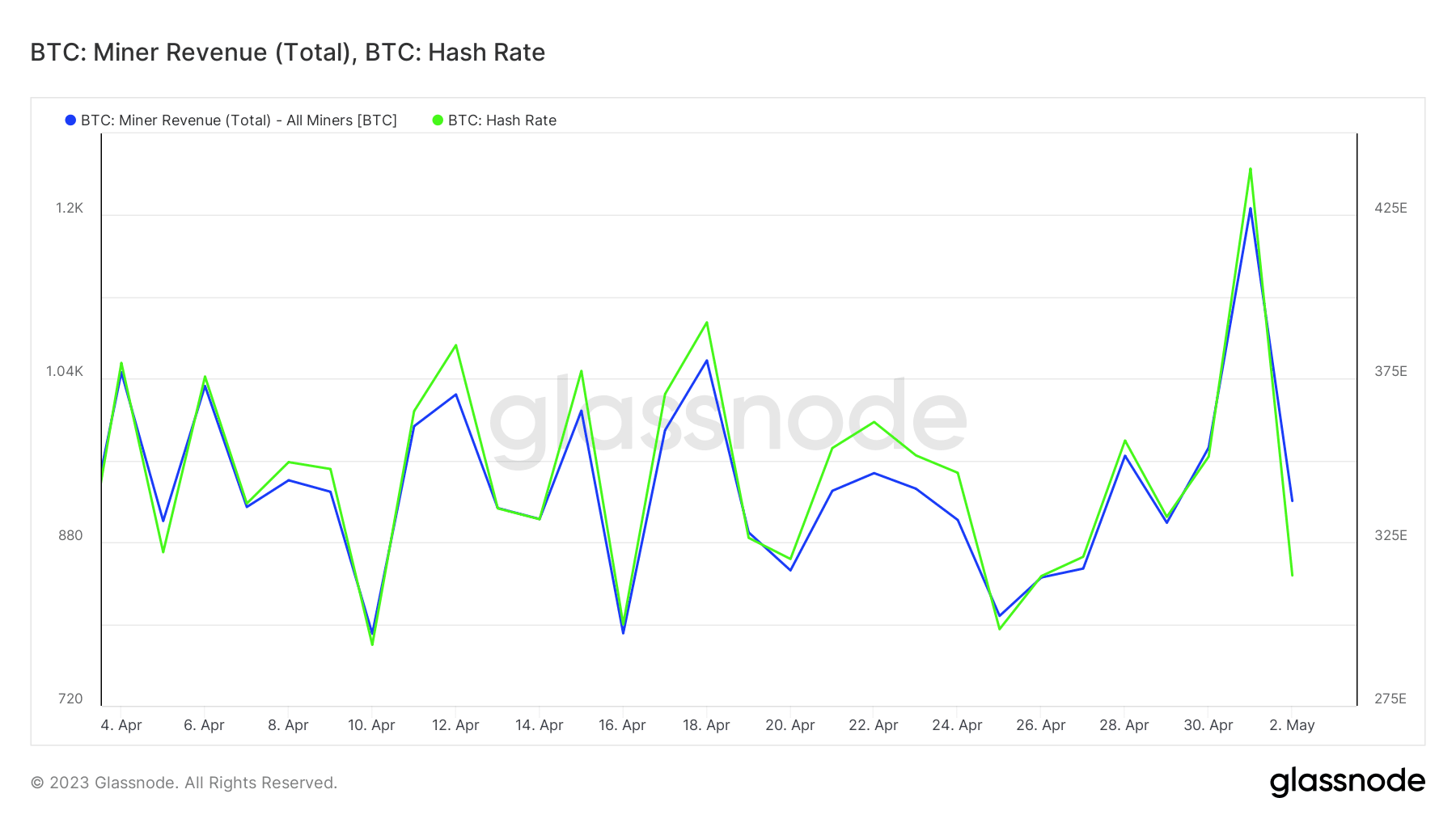

Source: Glassnode

The impact would also depend on crypto mining attractiveness. A recent surge in Bitcoin ordinal inscriptions drove a surge in network activity.

This subsequently led to more miner revenue and encouraged more miner participation, thus pushing up the hash rate. In other words, Bitcoin’s hash rate will balance itself out just as it did when China banned Bitcoin mining.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)