Bitcoin: Why we are still in a bull market

Bitcoin and Bitcoin holders sure had a roller coaster ride these past couple of months. Despite a series of FUDs and death crosses, on the back of strong institutional interest, Bitcoin still emerged to be more than just a cryptocurrency and a store of value asset.

Bull market or bear market

After China “banned” mining operations, the after-effects of the news were noted around the world. In fact, its impact was enough to correct Bitcoin’s price for a short while. After the market corrections, social media was filled with speculations on “whether Bitcoin is still in a bear market.” “Is the worst behind us” was a popular question that emerged too.

In the last three days, however, the market took a positive turn with BTC hiking by almost 14%. Looking at BTC’s long-term trajectory, however, the questions about a possible bull or a bear market still persist.

Tops and bottoms

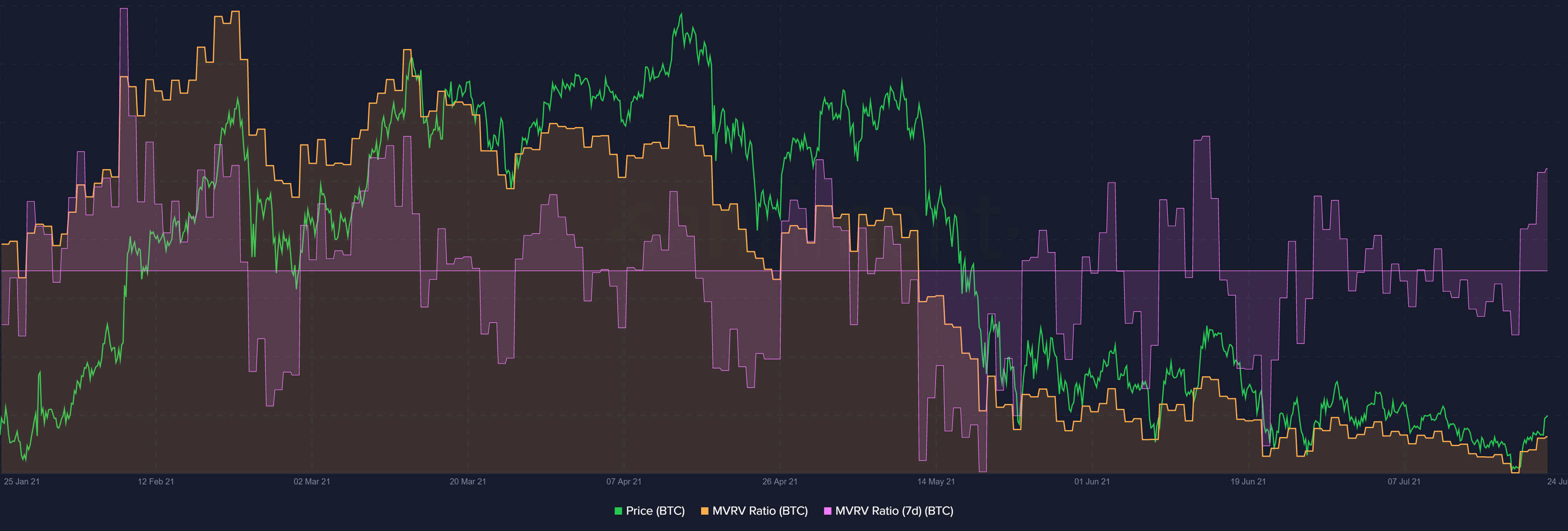

Looking at the MVRV ratio helps gauge an asset’s market tops and bottoms, both current and historical. A look at Bitcoin’s chart for the same revealed that while the market value is a lot lower than BTC’s realized value when compared to its April and May price ATHs, it did improve over the last week.

In fact, the massive price dip in May dragged the MVRV ratio down below the 170%-mark, a level that acted as support all through this year.

Source: Santiment

However, the 7-day MVRV ratio gave a clearer picture of the same peaking to mid-June levels. What it meant was that the exchange-traded price wasn’t below the “fair value.” Additionally, another peak in the ratio in the near term could give us an idea of the price action going forward.

On this note, it is interesting to look at recent data shared by CryptoQuant, with the analyst claiming that Bitcoin “remains in the bull market,” despite the near 50% corrections.

Analyzing the MVRV cycle, it can be deduced that since 2013, periods during which Bitcoin has declined heavily were the best times for buying the dip prior to hikes. This finding supports the assertion that “Bitcoin is still in a bull market” since it can catalyze buying pressure.

Source: CryptoQuant

What’s more, it can also be argued that in most end-of-cycle tops, the top was signaled only after the first correction and a touch of the green box, signaling good buying momentum in the middle of the bull run. However, in a bear market, the MVRV looks for the blue, identifying it as the “bottom.” This zone might usually be seen during halvings (historically it happened in all cycles).

Are the good days back again?

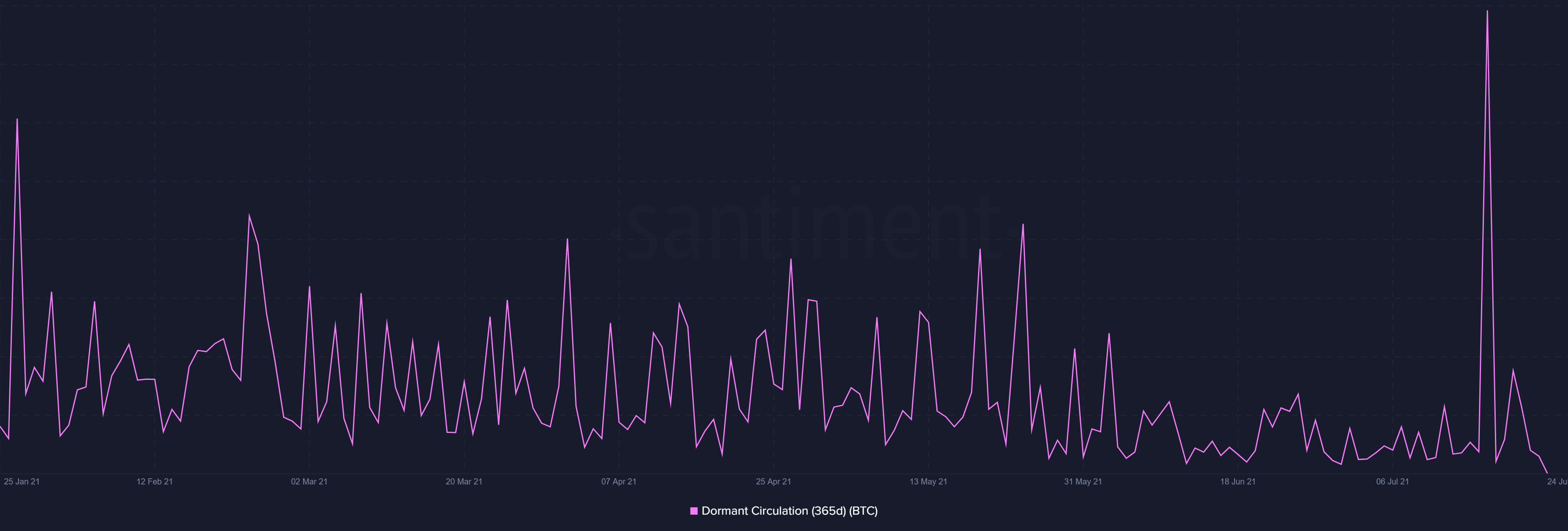

Finally, another interesting trend over the last couple of days has been the rise and fall of dormant circulation (365days). The metric peaked on 17 July, but it came down steeply, falling to an all-time low at the time of writing. What this finding means is that fewer old hands are releasing their Bitcoins into circulation, preferring to HODL instead.

Source: Sanbase

Looking at the current trend in the light of the price hike, it can be concluded that we are indeed in a bull market. For the short-term maybe, but a bull market nonetheless.