Bitcoin: Why you can expect gains in ‘Uptober’ after ‘Rektember’ slump

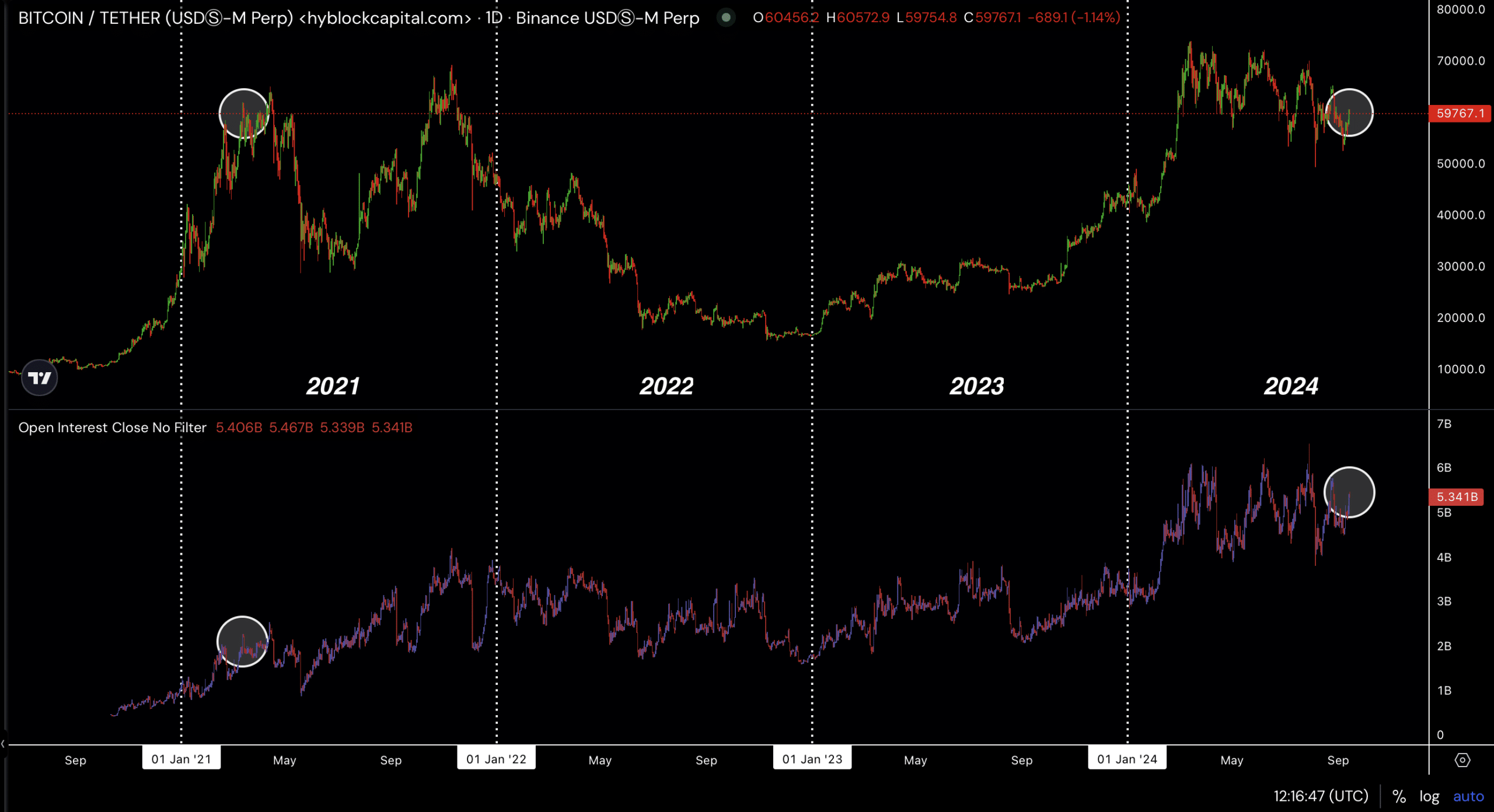

- Bitcoin open interests higher than in 2021.

- Estimated leverage ratio across exchanges reaches a new yearly high.

Bitcoin [BTC] and the broader crypto market are recovering from a dip that has persisted for the last five months, following the end of the cycle in March.

Although interest in overall crypto markets appears lower compared to previous market cycles, current prices are similar to those in 2021, when the market experienced a significant dip before surging.

The number of open contracts for BTC is notably higher than in 2021, indicating a potential for price growth if market conditions improve.

While the dip has already occurred, it remains to be seen if Bitcoin will replicate the success of Q4 2021 with a similar surge in late 2024.

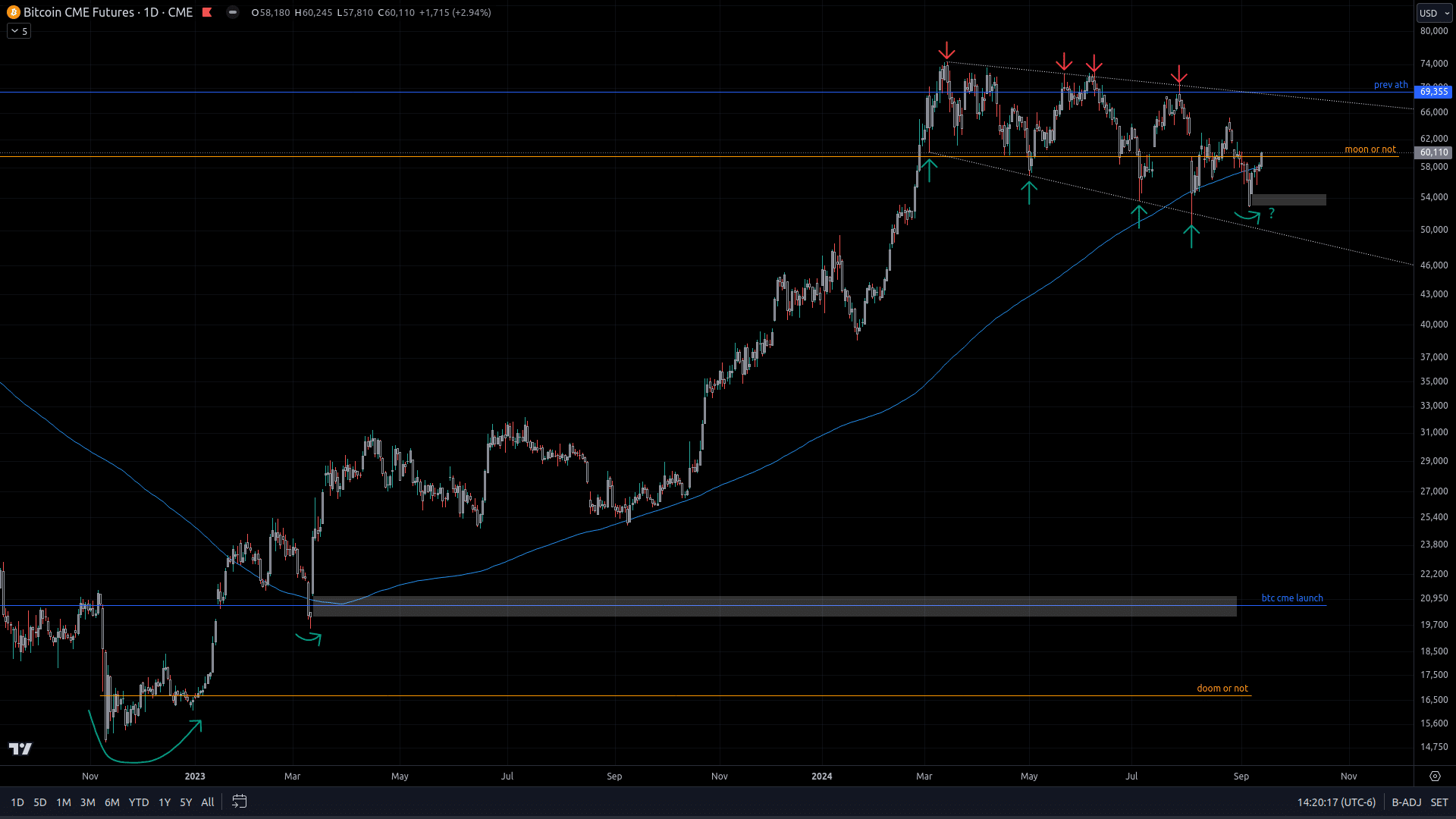

Bitcoin CME price action

Bitcoin’s price action reveals that BTC on the Chicago Mercantile Exchange (CME) is a crucial chart to monitor, especially in the current Bitcoin ETF era.

These ETFs track the price of BTC on the CME, rather than spot Bitcoin. The CME chart currently shows BTC in a descending broadening wedge pattern, a bullish indicator.

Additionally, Bitcoin has reclaimed its 200-day simple moving average, a key signal of market strength.

If a gap on the chart remains unfilled, it could mark the second time since the market’s macro bottom that BTC avoids filling such a gap, reinforcing bullish sentiment.

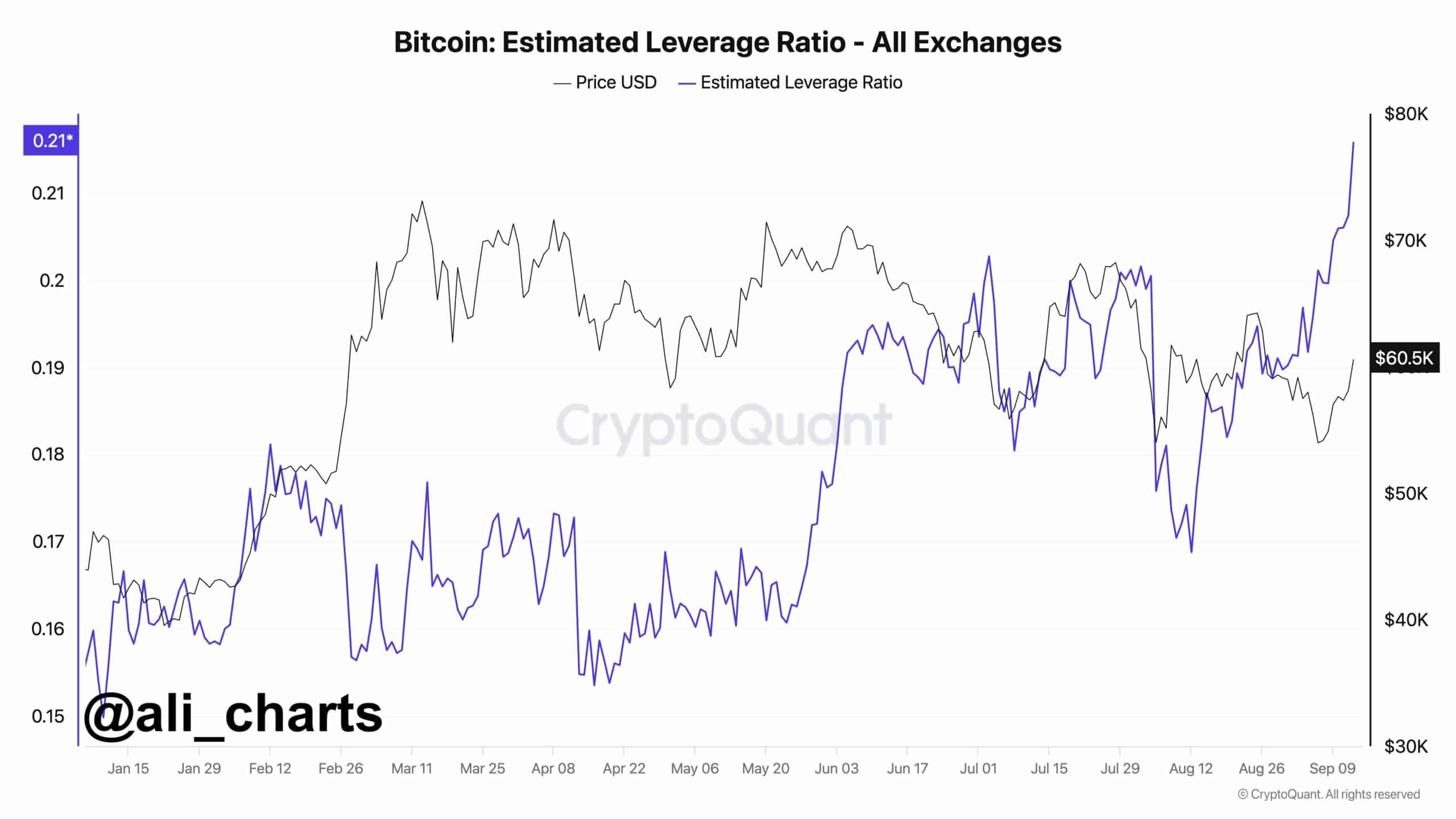

Estimated leverage ratio

Moreover, the estimated leverage ratio across crypto exchanges has reached a new yearly high, according to CryptoQuant data.

This suggests that Bitcoin traders are increasingly taking on more risk, which could be a bullish signal.

When traders are willing to risk more on BTC and other cryptos, it often results in higher prices if the market trend confirms an upward move. Increased risk-taking may drive more capital into Bitcoin, pushing its price higher.

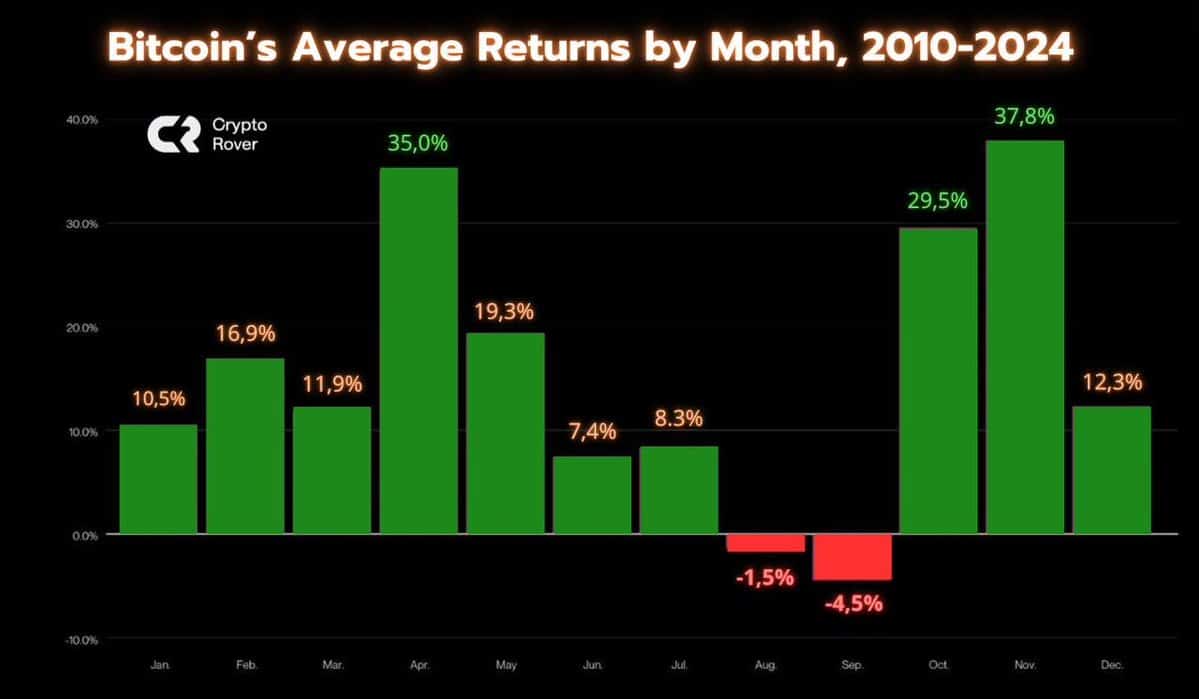

Bitcoin average returns by month

Additionally, data shows that August and September have historically been the weakest months in terms of returns for Bitcoin, with both months seeing the lowest average returns since 2010.

Despite this, traders who can endure what some are calling “Rektember” may look forward to “Uptober,” which has traditionally delivered stronger returns for Bitcoin, as seen in past years.

If history repeats itself, Bitcoin’s price could rise higher in the final quarter of 2024.

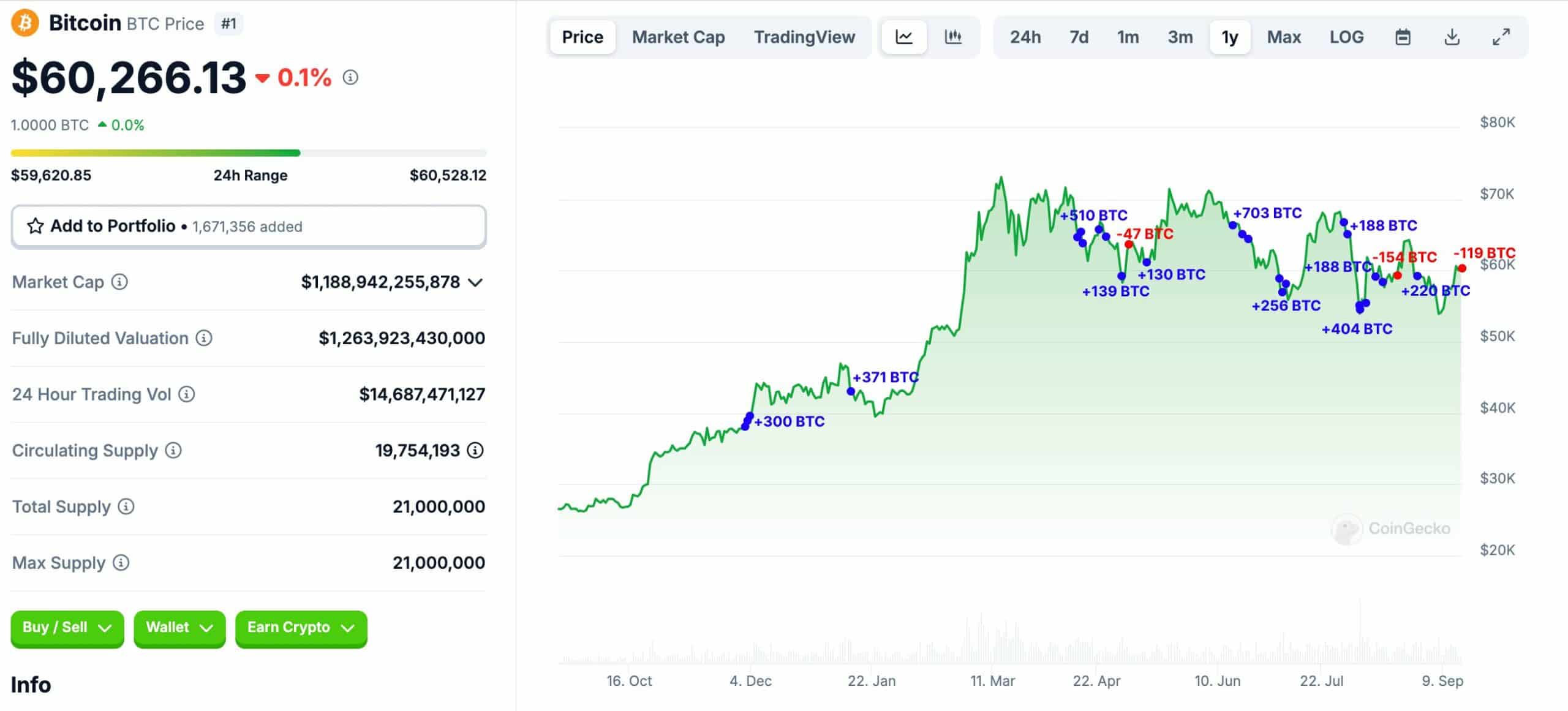

Bitcoin whales take profit

However, not all recent developments are entirely positive. BTC whales are beginning to take profits, as seen when a whale deposited 119 BTC, worth $7.14 million, to Binance for profit-taking.

This whale has withdrawn a total of 3,409 BTC, worth $195.4 million, from Binance since December 2023, with an average price of $57,319.

The whale has already made $10.5 million in profits, which could be a bearish signal if more whales decide to follow suit.

Still, the long-term outlook remains positive as major industry players continue to support Bitcoin.