Bitcoin

Bitcoin: Will BlackRock overtake Grayscale as top BTC ETF?

Bitcoin ETFs surge as BlackRock challenges Grayscale. What happens next?

- ETF buzz focuses on Ethereum and Bitcoin, with BlackRock challenging Grayscale’s dominance.

- Bitcoin’s price fluctuates amid ETF excitement, with analysts eyeing potential market shifts.

ETFs seems to have become the talk of the town amid the highly anticipated approval of Ethereum [ETH] spot exchange-traded funds.

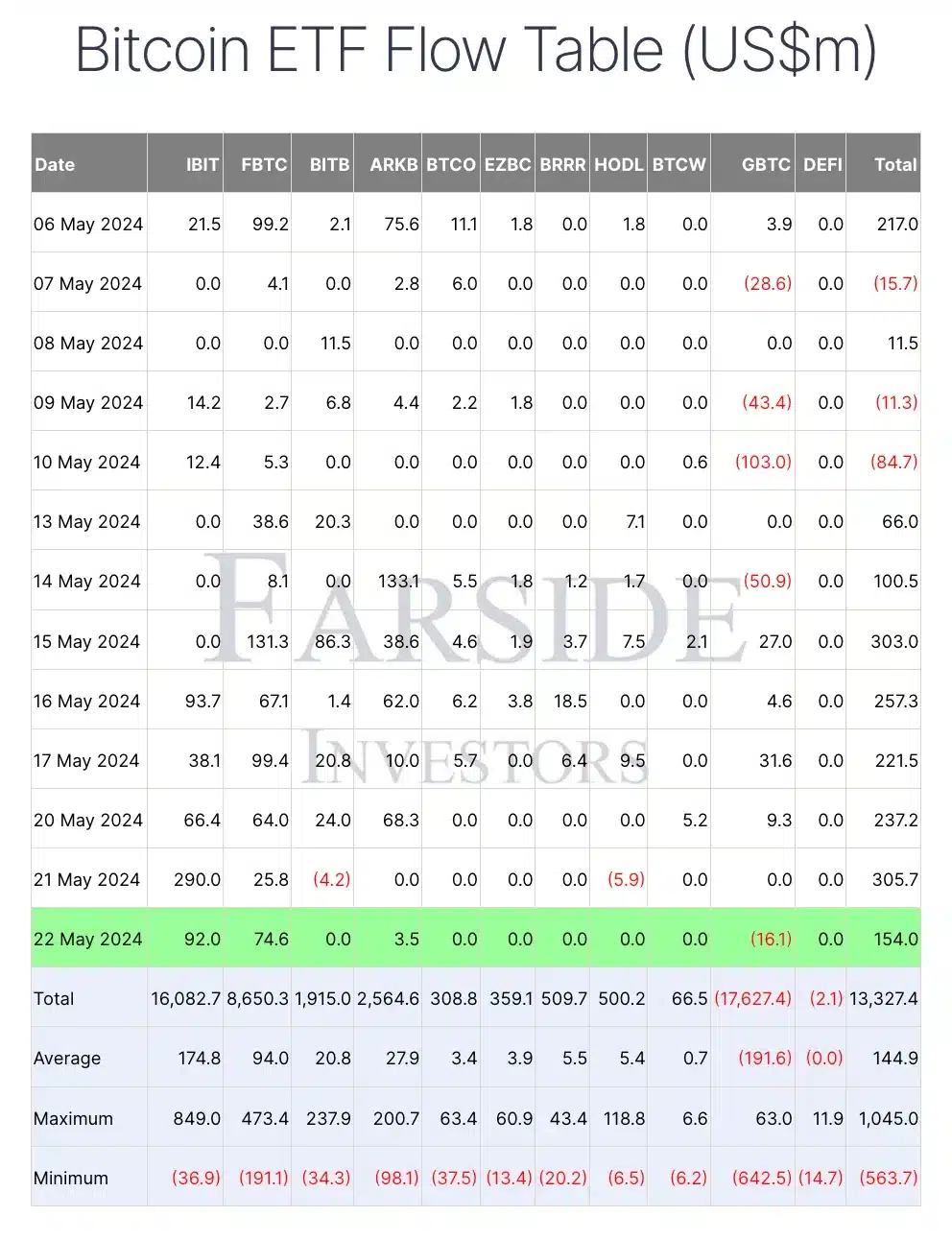

Interestingly, on the 22nd of May, Bitcoin [BTC] spot ETFs saw a net inflow of $154 million, marking the eighth consecutive day of net inflows, according to data from Farside Investors.

BlackRock overpowers Grayscale

The ETF that garnered significant attention was Grayscale’s GBTC, which experienced an outflow of $16.09 million.

In contrast, BlackRock’s IBIT recorded a single-day inflow of $91.95 million, while Fidelity’s FBTC saw an inflow of $74.57 million on the same day.

This has raised a key question among investors: Is BlackRock on the verge of overtaking GBTC as the largest Bitcoin ETF with the most assets under management?

BlackRock steps ahead in Ether ETF approval

Amidst such speculations, BlackRock has made a significant move on ETH ETFs. The SEC recently requested public comments on spot Ethereum ETF applications.

Responding to this, on 22d May, BlackRock and others filed amended 19b-4 forms, removing ether staking provisions that posed regulatory challenges.

Sharing his remarks on the same, an X user said,

“BlackRock seals the deal for me. They’ve only lost ONCE when trying to get an ETF approved. The Ethereum spot ETF is coming!!”

This highlights strong confidence in BlackRock’s ability, given its impressive track record with ETF approvals.

Commenting on the impressive performance of BTC ETFs, HODL15Capital took to X and noted,

“Bitcoin ETFs hit a record high of 850,000 BTC held today. Global ETFs are closing in on 1 million Bitcoin held.”

From the US to the UK

The ETF craze isn’t limited to the US. On 22nd May, WisdomTree announced it received authorization from the UK Financial Conduct Authority (FCA) to introduce Bitcoin and Ethereum Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Despite the impressive performance of Bitcoin ETFs, the leading cryptocurrency retraced from the $70K level this week.