Bitcoin will ‘explode’ when the Fed pivots, says Robert Kiyosaki

- BTC will explode after the Fed rate cut, according to Kiyosaki.

- The author believed money would flee bonds and other assets to BTC, gold and silver.

The much-awaited Fed pivot event will happen this week, and market pundits have been upbeat lately. The US FOMC (Federal Open Money Committee) is expected to begin its easing cycle on 18th September.

According to Robert Kiyosaki, the author of “Rich Dad Poor Dad,” the Fed pivot will benefit Bitcoin [BTC] and gold. He said,

‘Bitcoin, gold, silver prices about to EXPLODE…When Fed PIVOTS and real assets go up in price, as fake money leaves fake assets such as US bonds, fleeing to real assets such as real estate, gold, silver, and Bitcoin.”

Inflation to rally BTC?

Kiyosaki further urged his followers to buy more BTC before the Fed begins its easing cycle.

“Buy some (more) gold, silver, or Bitcoin…before the Fed pivots and drops interest rates.”

This will be the first rate cut in four years, and market observers will have primed risk assets for potential wins. However, Kiyosaki has previously stated BTC and other real assets will benefit even more because of unsustainable US debts.

On September 13th, Kiyosaki cautioned that the unsustainable US debts can’t be solved no matter who wins the US elections. He stated that the dollar was trash and people were better off saving in Bitcoin and gold than the dollar.

“The dollar is trash. Stop saving dollars, fake money….& start saving gold, silver, & Bitcoin….real money.”

Galaxy’s Mike Novogratz echoed a similar sentiment in March. According to Novogratz, BTC would appreciate as US debts continue to grow at $1 trillion per 100 days.

In short, money inflation will dent the dollar’s value, forcing users to seek alternatives like gold, BTC, or silver. This massive inflation could quickly push BTC to $10 million per coin, noted the author in a July price projection.

In the meantime, BTC was back to $60K after two weeks of struggling below the psychological level.

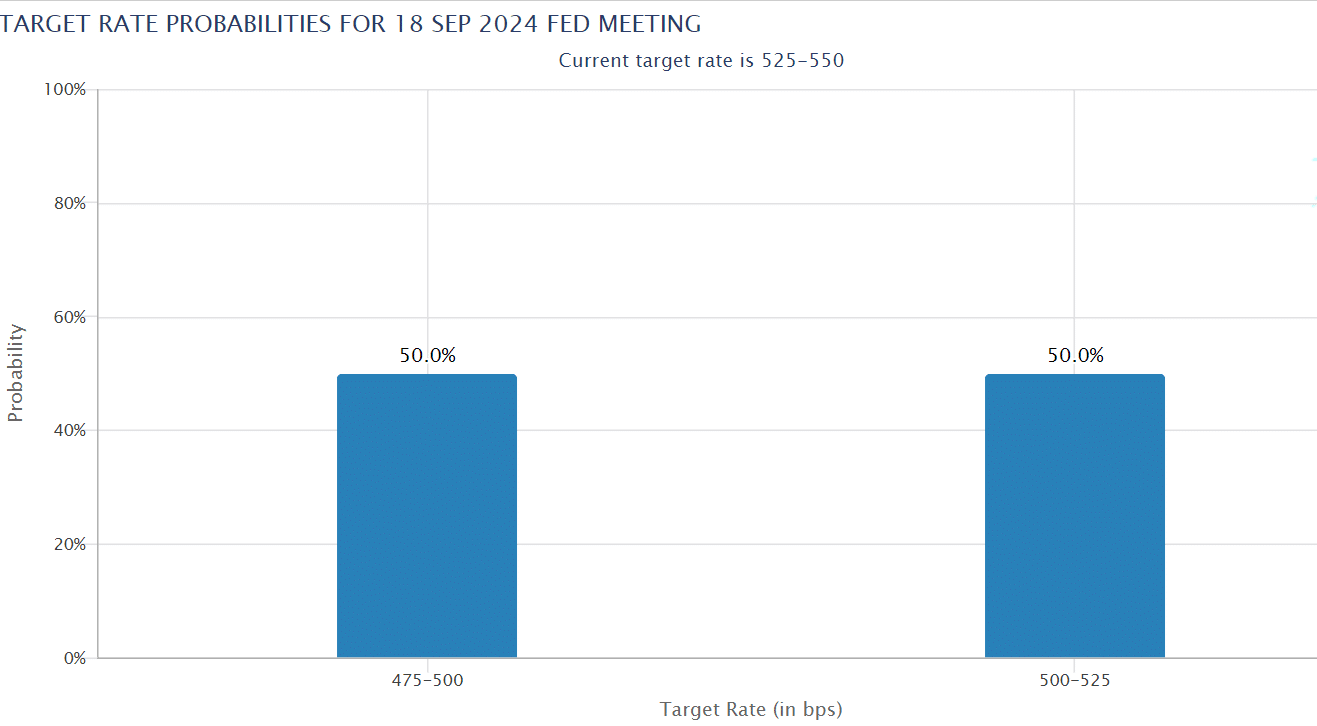

After last week’s US economic data, the markets were pricing a 50/50 chance of a 25/50 bps (basis point) Fed rate cut. How the market will react to the Fed’s pivot in the short term remains to be seen.