‘Bitcoin will reach 20% of Gold’s market cap’ – How and when?

- Bitcoin could hit $150K-$200K in 2025 per industry insiders.

- According to Options traders, the immediate targets were $110K and $120K.

Bitcoin [BTC] could top $150k in the first half of 2025, according to the recent projection shared by Galaxy Research. In fact, the firm added that the world’s largest cryptocurrency could climb as high as $185k by Q4 2025.

Galaxy Research analysts, led by Alex Thorn, cited greater adoption from institutions, corporations, and nation-states as the key catalyst for their projection. The analysts added that BTC would hit 20% of the gold market’s size.

“Throughout its existence, Bitcoin has appreciated faster than all other asset classes, particularly the S&P 500 and gold, and that trend will continue in 2025. Bitcoin will also reach 20% of Gold’s market cap”

Can BTC soar to 200k?

Other crypto firms, such as Bitwise, Blockware, and Steno Research, have also made 2025 BTC projections. For Bitwise, the world’s largest cryptocurrency could top $200k by end-year based on accelerated adoption.

However, Blockware had one of the boldest outlooks. The firm is eyeing $150k for a bear scenario and $225k and $400k targets for base and bullish outcomes. The team’s targets are based on BTC adoption rates and the possible creation of a U.S BTC Strategic Reserve (SBR).

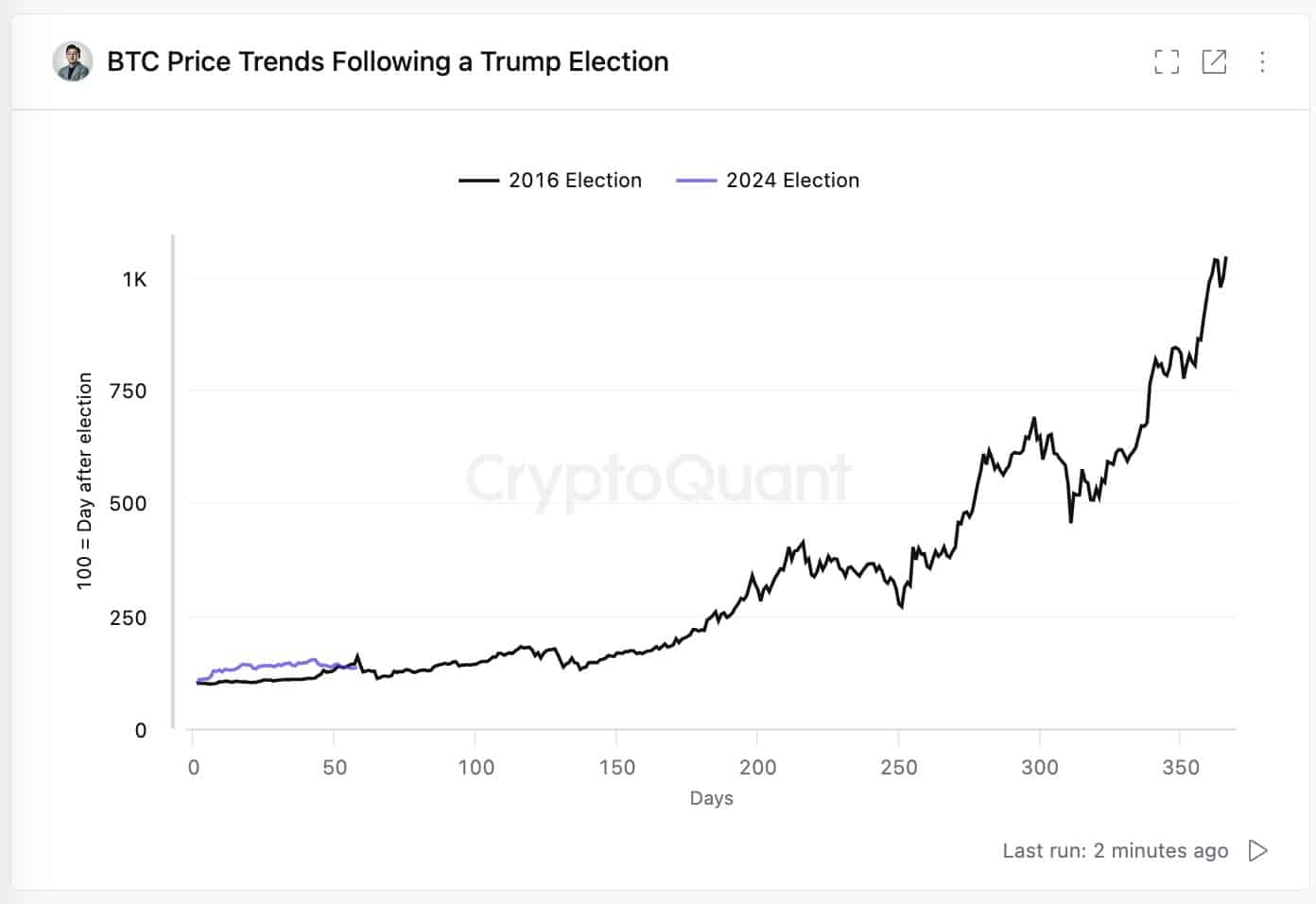

That being said, data also revealed that BTC performed well during the previous Trump administration. This has simply reinforced the bullish expectations around BTC, as noted by CryptoQuant’s founder. He said,

“Trump will make #Bitcoin strong.”

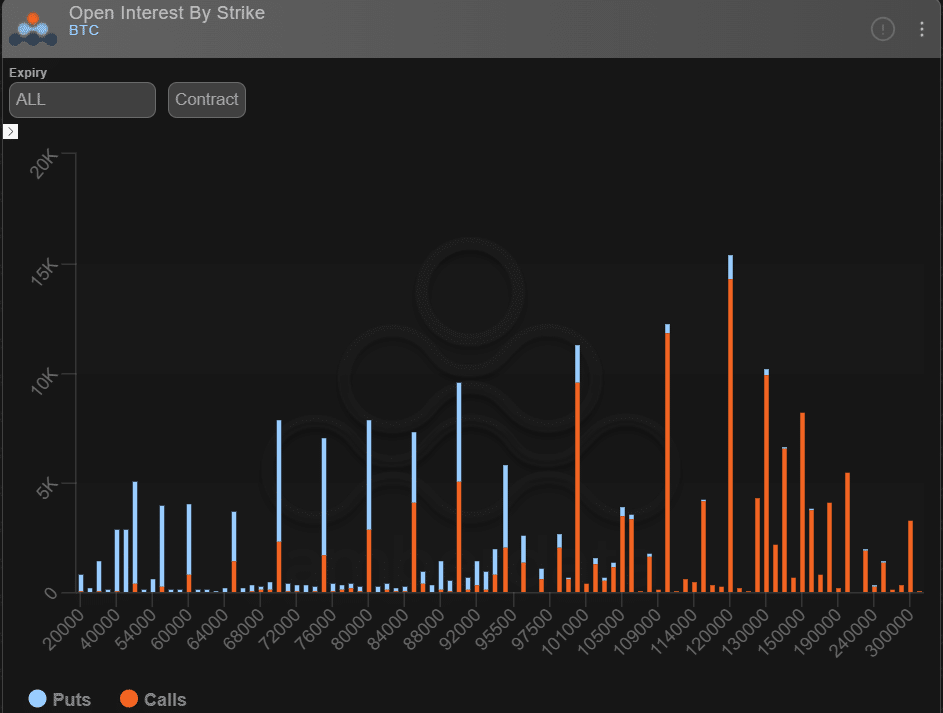

Some of the Options market positioning also suggested that a move to $150k could be likely. However, most bets were parked at $120k as per the Open Interest (OI).

At press time, the other key strike prices targeted by Options traders were $110k, $100k, $130k, and $150k, in that order.

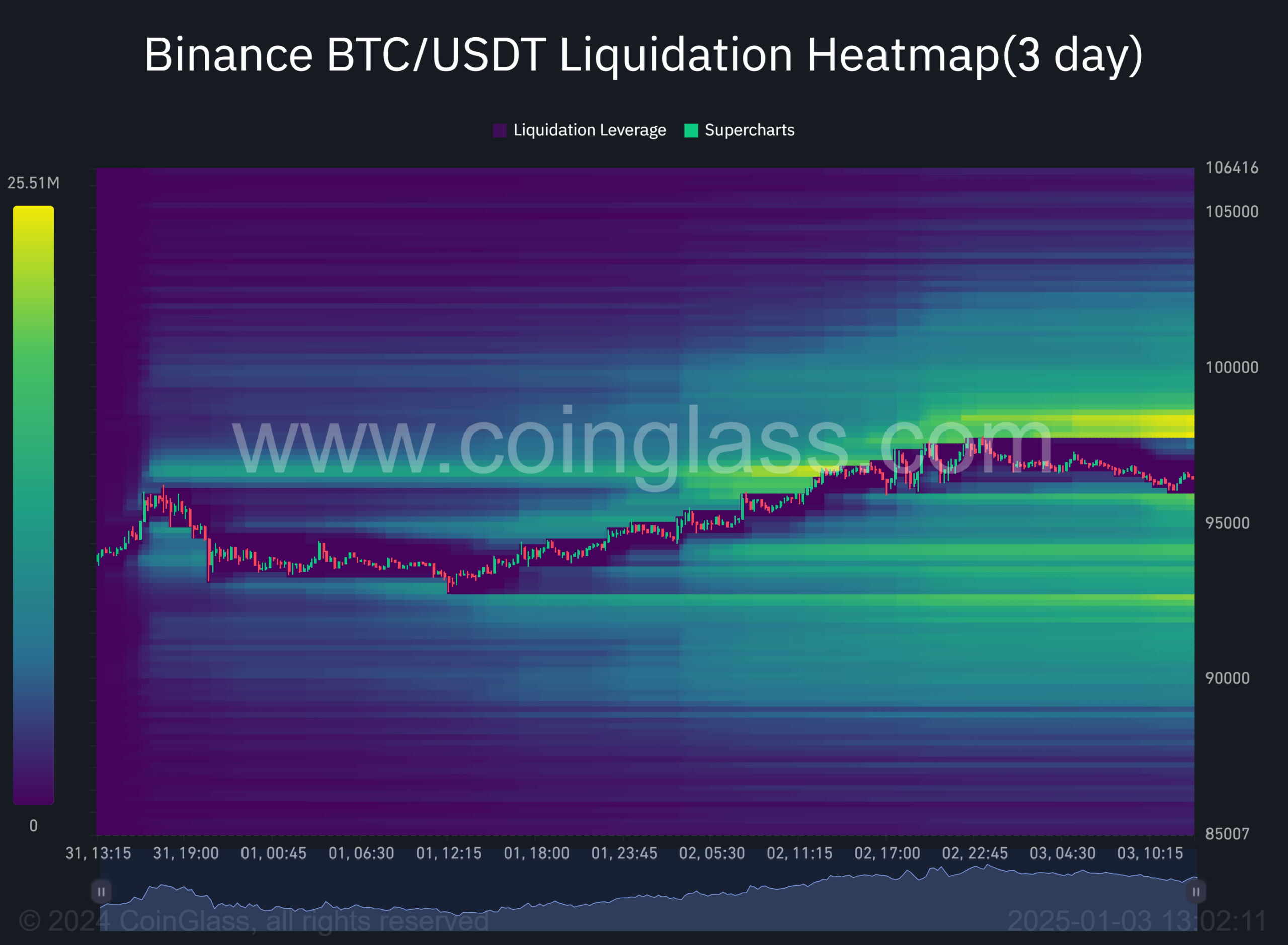

In the meantime, BTC recovered by 5% from its recent lows of $91.5k, before stalling at $97k on the price charts.

Read Bitcoin [BTC] Price Prediction 2025-2026

Since most of the recent price action appeared to be driven by a liquidity hunt, the massive short positions (overhead, bright yellow zone) at $98k could soon be a price magnet. If so, the price could hit $98k or retest the $100k psychological level.

![Solana [SOL] - Is there any good news after trading volume hits 2024 low?](https://ambcrypto.com/wp-content/uploads/2025/03/Solana_Abdul-400x240.webp)