Bitcoin: Will short-term holders cause problems for BTC’s price?

- Bitcoin’s price fell significantly over the last few days and slipped past the average cost basis of short-term holders

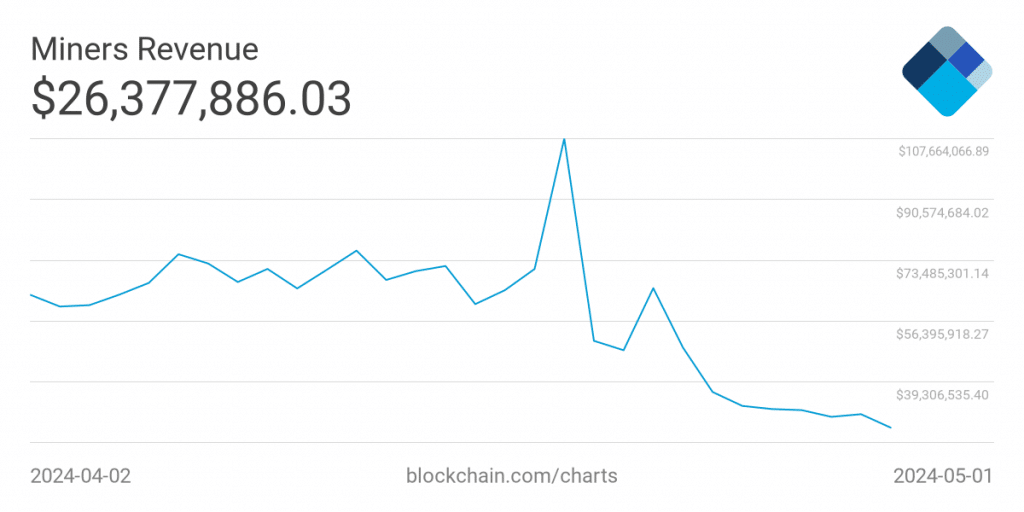

- Miner revenue declined, which could add more selling pressure on BTC miners

Bitcoin’s [BTC] recent dip below the $60,000-mark sent shockwaves across the crypto-sector, leading to extreme uncertainty in the market and massive liquidations.

Will short-term holders show paper hands?

Before recovering a day later, on 2 May, Bitcoin closed at $57,700, slightly below the average cost basis of short-term holders, which stood at $58,500. This meant that the price of BTC fell below the average cost of acquisition for short-term holders.

When this happens, the most immediate consequence is unrealized losses for short-term holders. Since their average purchase price is higher than the current price, they will technically lose money on their investment if they sell. This can lead to panic selling and further exacerbate the market decline.

However, for optimistic short-term holders with a strong belief in Bitcoin’s long-term potential, this price drop can also be seen as a buying opportunity. They can average down their cost basis by purchasing more Bitcoin at a lower price.

It remains to be seen how these short-term holders will be affected by the decline in BTC’s price.

Is your portfolio green? Check out the BTC Profit Calculator

Another factor that can influence BTC’s price and the selling pressure on the king coin, would be the state of miners. Over the past month, the revenue collected by miners has declined significantly. If miners continue to see this trend, they will be forced to sell their BTC holdings to remain profitable. This can increase selling pressure on the miners and can impact BTC negatively in the long run.

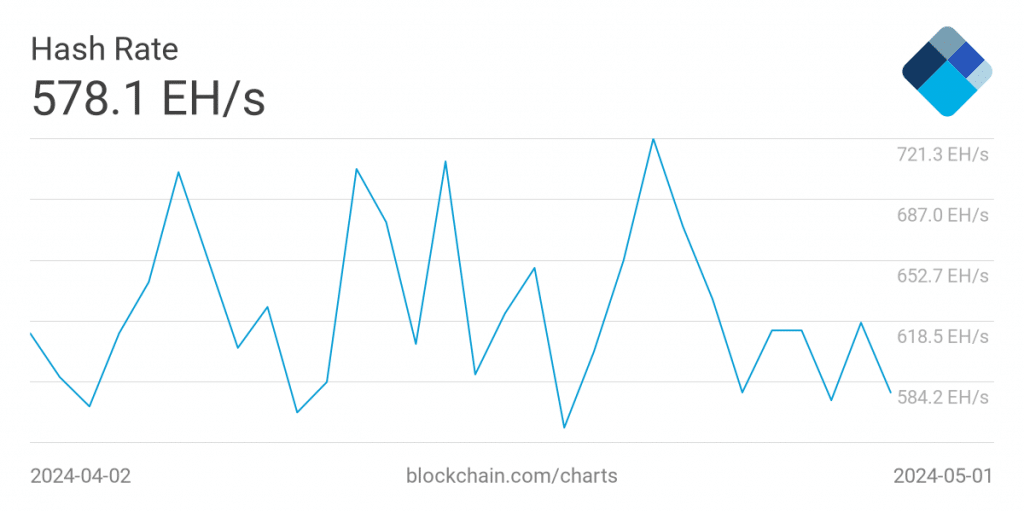

The total hashrate for Bitcoin fell materially as well. For miners who remain active, a lower hashrate can mean less competition. This can translate to easier block discovery and potentially higher profits, especially if the price of Bitcoin stays the same.

Only time will tell whether Bitcoin miners can remain profitable in the future.

Activity on the network

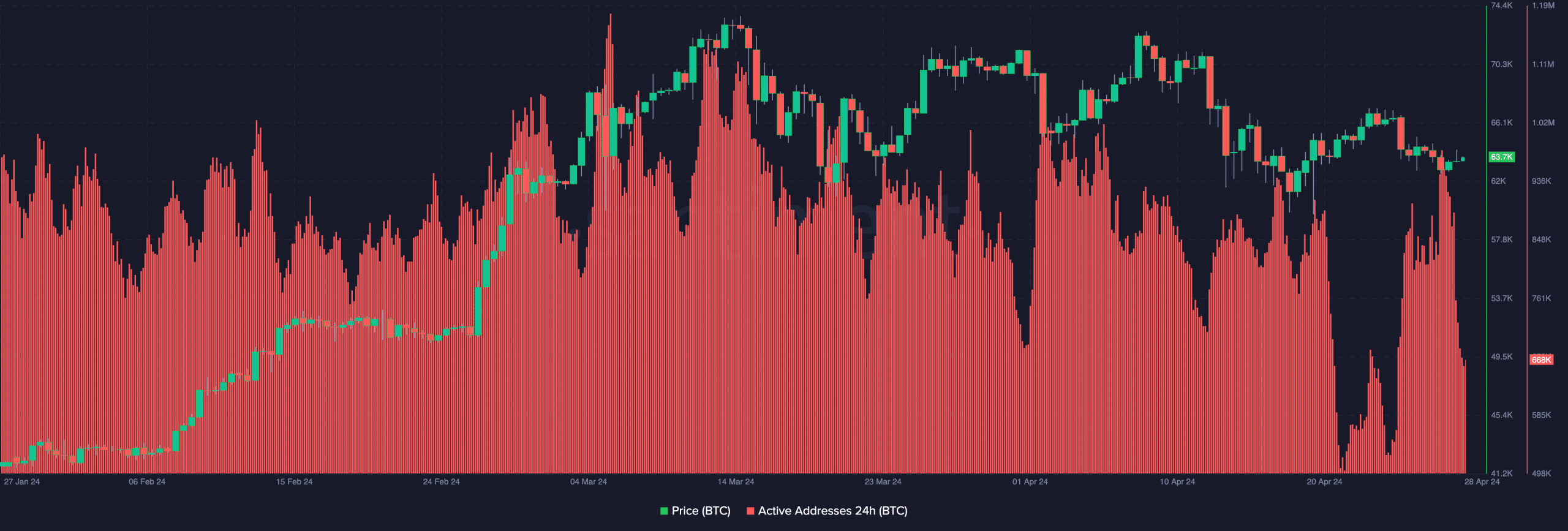

Finally, a factor that will play a huge role in helping miners stay afloat will be the overall activity on the Bitcoin network. This, because miners can collect transaction fees due to the activity.

AMBCrypto’s analysis of Santiment’s data revealed that the activity on the network has remained the same over the last few days – A positive for BTC in the long run.