Bitcoin: Will the Lightning Network’s woes undo BTC’s rally?

- Surging profitability underscored Bitcoin’s potential for sell pressure.

- However, whale activity revealed a standoff between the bulls and bears.

It’s no secret that Bitcoin [BTC] has been enjoying a much-needed rally during the last week or so. While the cryptocurrency has been building up towards achieving a bullish October, that attempt might be about to experience some turbulence.

How much are 1,10,100 BTCs worth today?

Recent reports reveal that Bitcoin’s layer 2, the Lightning Network, has a massive security risk. One of the network’s developers has reportedly blown the whistle on security issues, revealing that Lightning Network has back doors in its code which could pave the way for malicious attacks.

BREAKING:

One of the top #Bitcoin developers recently discovered a massive security risk in the Lightning Network, which triggered him to announce his departure from the project.

He claims theres intentional backdoors in the code that allow attackers to easily get full control… pic.twitter.com/oLiVXk0A2F

— WhaleWire (@WhaleWire) October 21, 2023

But could this discovery be enough to trigger the level of FUD that can curtail Bitcoin’s latest rally? Well, part of Bitcoin’s charm is the safety and immutability that blockchain is supposed to offer.

Any incidents that threaten to challenge those characteristics may have a significant impact on investor sentiment and trigger FUD.

Will a compromised Bitcoin Lightning Network affect the price

Bitcoin has so far not responded negatively to the news. The potential impact is still in the realm of speculation. Nevertheless, millions of people use the Lighting Network, and this could discourage more people from avoiding it.

However, Bitcoin can be traded on other networks, hence traders should not necessarily expect demand to be affected.

What’s interesting about the report is that it comes at a time when Bitcoin has been rallying and could be sensitive to the return of sell pressure. Especially now that the number of buyers has been rising on account of the recent bullish performance.

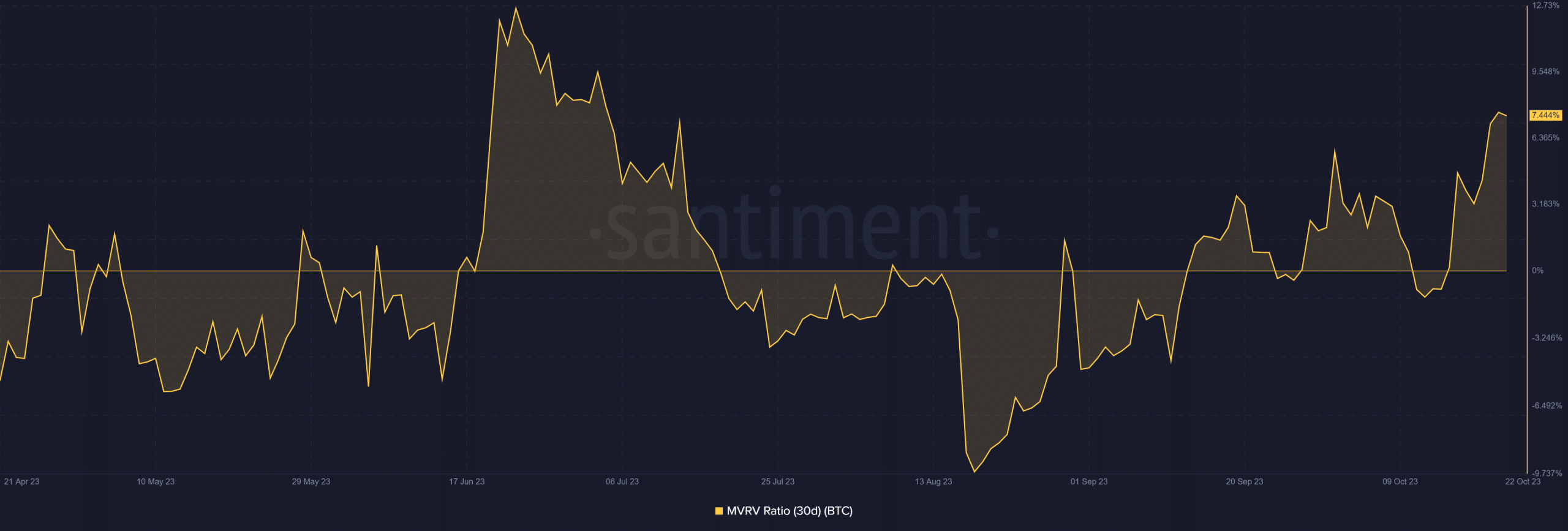

Bitcoin’s MVRV ratio puts into perspective the level of profitability among Bitcoin holders. This metric has been inching closer to its 7-month high. It has been steadily rising for the last two months.

Now that we have established that profitability is approaching a 3-month high, it is important to understand what it means. This signals that Bitcoin experienced a substantial amount of buy pressure during the same period.

It also underscores the fact that there is an incentive to sell in case FUD arises.

Whether Bitcoin could still continue rallying is anyone’s guess. However, recent outcomes may help understand where prices are headed. BTC is still experiencing some sell pressure in the short-term.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Addresses holding between 1,000 and 10,000 (pink indicator) have been contributing to sell pressure in the last four days. The same address category has the lion’s share of circulating supply held by any whale category.

Meanwhile, addresses in the 10,000 to 100,000 BTC (green indicator) have been accumulating during the same period. As such, this has canceled out some sell pressure. However, it will be interesting to see if the balance will tip in favor of either side in the next few days.