Bitcoin: With hedge funds yielding 20% risk-free ROI, what’s in it for traders?

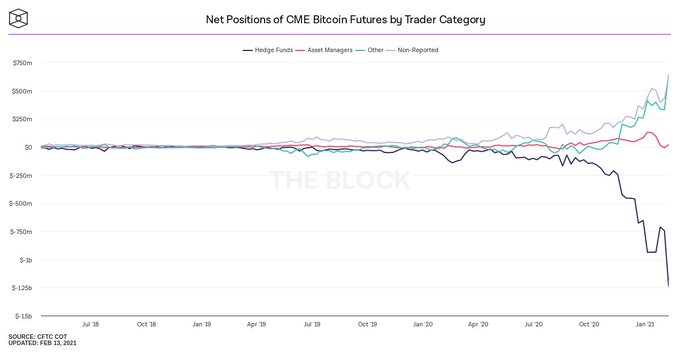

When BTC’s price crossed $50,000 and hit a new ATH on 17 February 2021, net positions on CME Bitcoin Futures showed that institutional investors or hedge funds were possibly short on Bitcoin. After the WallStreetBets episode, institutions now have more appetite for shorting Bitcoin and that is clear from the CME Futures chart as well.

Net positions of Bitcoin Futures have changed considerably over the past two weeks, with the cryptocurrency valued at just under $51,000, at the time of writing.

Net positions of CME Bitcoin Futures || Source: Twitter

Since the CME has represented the interests of institutional investors in the past, this metric can be considered an ideal one for predicting an upcoming trend reversal or correction in Bitcoin’s price. As per the net positions of the CME Bitcoin Futures chart, this could be the 20% risk-free ROI that hedge funds are yielding on $1.25 billion worth of Bitcoin. That would account for 25,000 Bitcoins. Quoting Willy Woo from his recent tweet, hedge funds are,

“HODLing on spot and selling on Futures”

With financial institutions from the traditional side coming across highly volatile assets, it is the gold fractal from the 70s all over again. Pursuing higher returns, institutions short Bitcoin at its ATH. What does this mean for retail traders? Is a supply shock approaching? Will there be a further correction and a price drop below $50,000? Is this the end of the bull run?

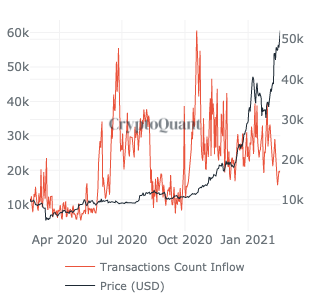

Most of these questions can be answered by the prevalent narrative of supply shortage, coupled with consistent stablecoin inflows to spot exchanges. The supply shortage only gets bigger if the crypto-asset continues to trade above $51,000. A price drop below $50,000 may be a short test on spot exchanges where the trade volume is low and eager profit-takers line up.

In fact, this happened a few times before the recent breakout past $51,000 and a drop may come if stablecoin inflows to exchanges fall. Now, while the first week of February did see such a drop, inflows are now increasing, though at a slow pace.

Source: Cryptoquant

If a supply shock is on its way, in light of the increasing stablecoin inflows to spot exchanges, it is sure to send the crypto-asset into further price discovery above its latest ATH of $52,547.