Bitcoin

Bitcoin withdrawals cross 65K as BTC inches closer to $100K: What’s next?

Bitcoin’s $100K milestone nears amidst a supply squeeze.

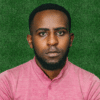

- Bitcoin withdrawals from exchanges have totaled $6.37 billion in the 96 hours.

- Social media mentions of $100K Bitcoin have hit a record high as well.

Bitcoin’s [BTC] rally to a six-figure valuation is a fraction away, and the rally may be fueled further by notable exchange withdrawals.

According to a renowned analyst’s tweet, about 65K BTC, valued at $6.37 billion, have been pulled out of reserve exchanges.

Historically, such significant outflows imply that holders are transferring assets to cold wallets, signaling reduced selling pressure.

A supply squeeze on the exchanges often precedes bullish price actions, as lower availability promotes upward price momentum.

For instance, in earlier BTC cycles, large exchange withdrawals preceded significant price rallies.

The current sustained outflows suggest increased investor confidence in the growing price in the long term, more so as Bitcoin has reached an ATH of $99K.

Bitcoin rising holders and record social mentions

According to AMBCrypto’s analysis of Santiment’s data, the number of Bitcoin holders also surged in the last 24 hours.

This comes at a time when mentions of $100K Bitcoin are soaring on platforms such as X, Reddit, and Telegram. Social media talks about BTC’s six-figure price have reached historically high levels.

Notably, the fear of missing out has amplified, with some traders expecting a rapid rise beyond $100K.

On the other hand, mentions of lower price ranges, such as $60K-$79K, reflected residual fear of correction in the short term.

What next for BTC?

Historically, Bitcoin’s price tends to surge upward after periods of heightened withdrawals and reduced exchange reserves. The next critical milestone would be the psychological barrier of $100K.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

If this bullish momentum continues, it could strongly propel Bitcoin into new highs.

However, while fear of missing out fuels price action, the fear of corrections could trigger a profit-taking at this key phase.