Bitcoin’s $11.8 billion Options to expire soon – Bearish 2025 to come?

- Bitcoin Options expiry can be significant, as the expiration of large numbers of contracts can lead to sharp price movements

- Call options were dominant at press time, with $7.9 billion in Open Interest indicating a bullish sentiment.

Bitcoin’s [BTC] Options market is currently in a state of suspense as the high-stakes expiry on 27 December approaches. With bulls eyeing the $100k target following a surge in capital flow post-election, the Open Interest has skyrocketed – Hitting a new high of $50 billion.

However, reaching $100k and maintaining it are two different challenges. While the current bullish sentiment, driven by a mix of micro and macroeconomic factors, suggests a potential new all-time high, the Options market must be closely watched.

The $11.8 billion worth of end-of-year call and put orders set to expire could significantly influence Bitcoin’s price action in the coming days.

Bitcoin Options show bias with call order dominance

Bitcoin, at the time of writing, was trading under $90k, with its market dominance exceeding 60%. Over the last 24 hours, some price correction seemed to be taking shape too.

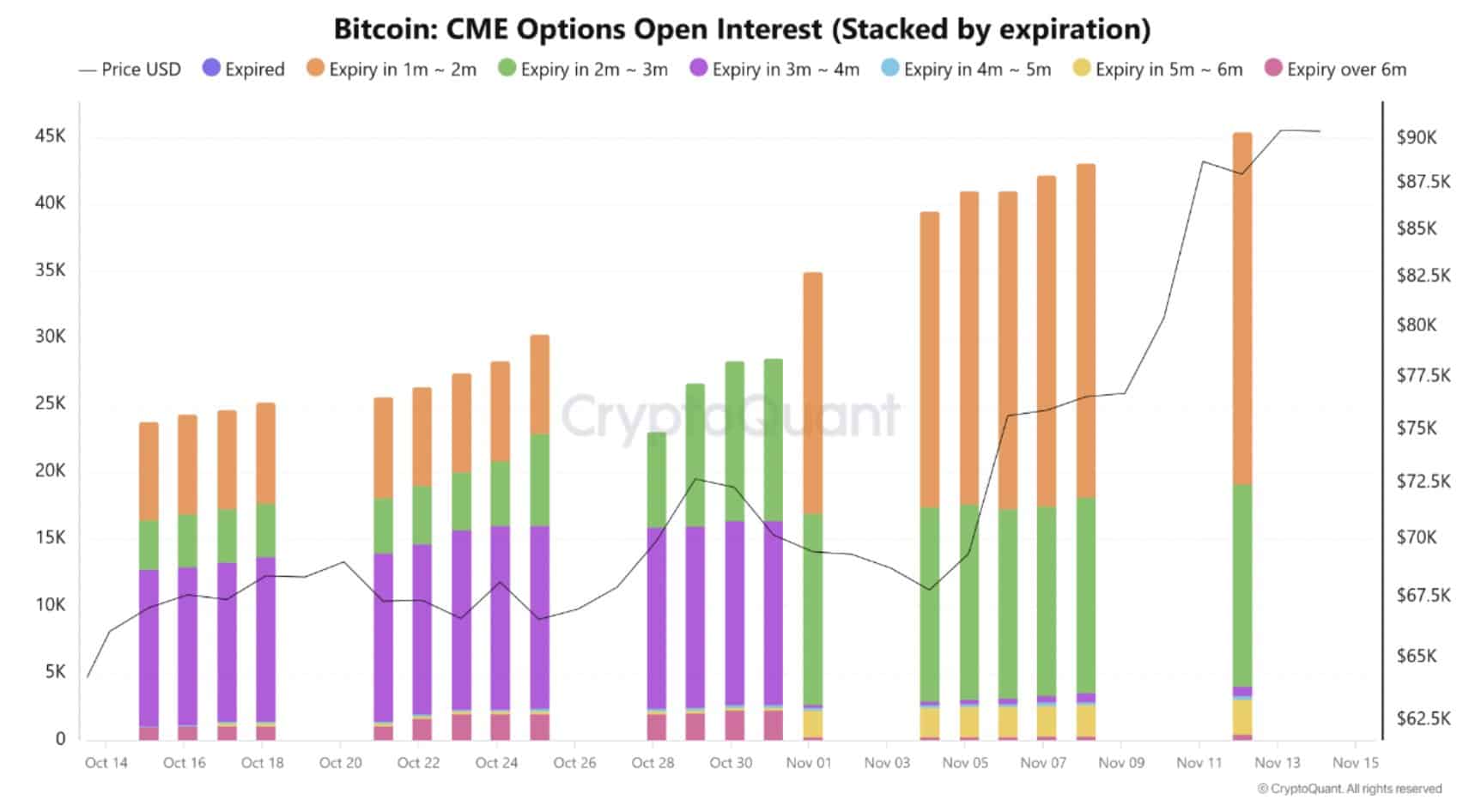

In the Options market, Deribit led with a 74% market share, while CME and Binance each held around 10.3%. This concentration of activity on Deribit highlighted where the majority of betting on Bitcoin’s price movement is happening.

According to Coinglass data, calls (bets on the price going up) make up nearly 70% of the orderbook, signaling strong bullish sentiment. In fact, many investors appear to be betting on Bitcoin reaching $100k, expecting further upside.

However, if Bitcoin hits the $100k target, a significant amount of Options contracts (worth $11.8 billion) will expire, with the majority of these being Call Options (bets on the price going up).

Consequently, traders who hold these Call Options are likely to exercise them or sell to lock in their profits. This can create selling pressure, especially if many traders decide to exit at once.

Therefore, maintaining the $100k price level largely depends on how these contracts unfold. A temporary pullback could occur in two scenarios – When Call Option holders exercise their contracts and when Put Options begin to dominate.

Can Bitcoin hit $100k amid growing volatility?

Though Bitcoin hit a temporary dip after five days of consistent uptrend, mainly due to miner selling, long-term holders continue to maintain their positions. This, even as the market becomes increasingly over-leveraged with derivatives.

As more traders enter the Bitcoin Options market, with a high number of stakes set to expire before the end of this quarter, volatility is hitting new highs each day.

Despite this volatility, Bitcoin has continued its upward momentum, indicating that long positions are still dominating the market across various indicators.

Simply put, the market hasn’t overextended yet. Despite the RSI being in extreme ‘overbought’ territory, miners offloading, and weak hands exiting for short-term gains, the impact on Bitcoin’s price hasn’t been drastic – Something that would typically be expected in such conditions.

This means that the bulls are holding strong, and the $100k target is within reach. In fact, if Bitcoin hits this target before the end of the month, it wouldn’t be surprising.

Read Bitcoin (BTC) Price Prediction 2023-24

However, a shadow of uncertainty still looms in the Options market where $11.8 billion worth of contracts will ultimately decide whether Bitcoin enters the new year on a bullish or bearish note.

The latter seems more likely, given the high stakes associated with the $100k price target and the call orders set to expire as volatility rises in the days ahead.