Bitcoin’s $198M whale position could spark a rally—Here’s what to expect

- Bitcoin traded into a major support level on the chart and could see a significant rally from here.

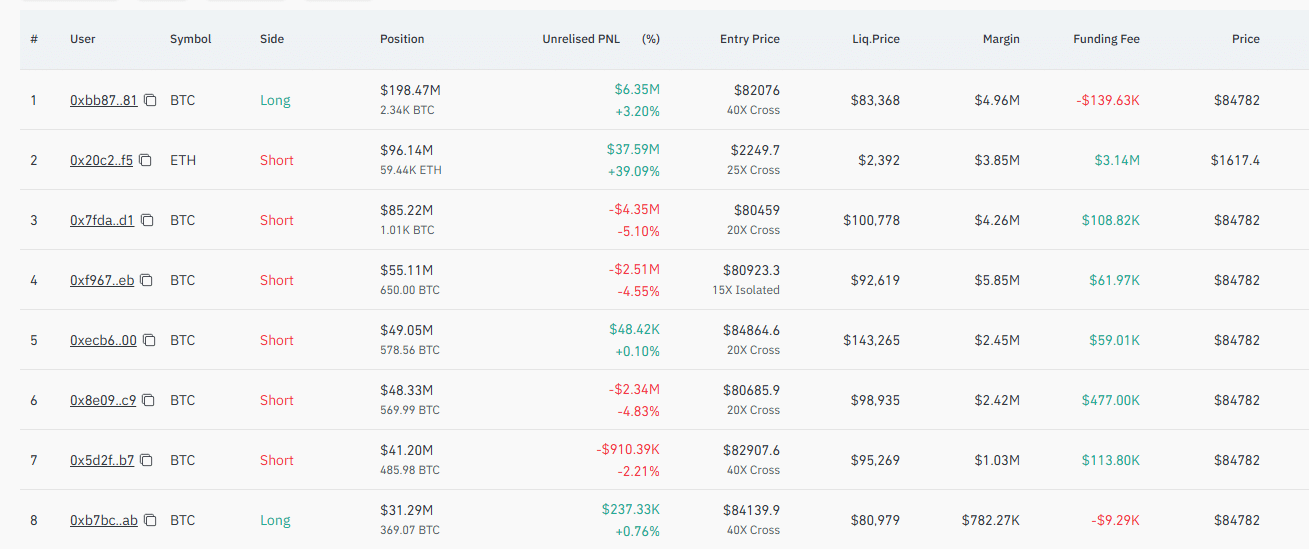

- A whale opened a $198.11 million long position, but short traders in the market are holding back and pushing against the price.

Bitcoin’s [BTC] market movement has remained slow despite trading into a key support level, and despite the whale’s large position, the asset had climbed only 1.42% in the past 24 hours.

However, analysis shows that while the bulls’ presence is clear, negative market sentiment pushing against a possible rally looms and could impact the price.

Bitcoin hits historic supply, eyes a bounce

Over the past month, Bitcoin has entered a critical support zone on the chart, a level that has historically triggered significant rallies.

As indicated on the chart, this zone has consistently fueled major price surges. If Bitcoin successfully holds this level for the fifth time, it could spark a substantial upward movement, potentially driving the asset’s price to $150,000 or beyond.

This bullish sentiment and the potential for a market rally have been intensified following a Hyperliquid whale opening a $198.11 million long position, expecting the asset to see a major price run-up.

The gradual surge in the past day has led to $5.99 million in unrealized profit, with a funding fee of $142,110.

The broader derivatives market supports this bullish narrative, suggesting the possibility of a rally.

Buying volume in the market remained high, with a press time reading of 1.035, indicating more buyers than sellers—which could push the asset higher.

How are traders channeling liquidity?

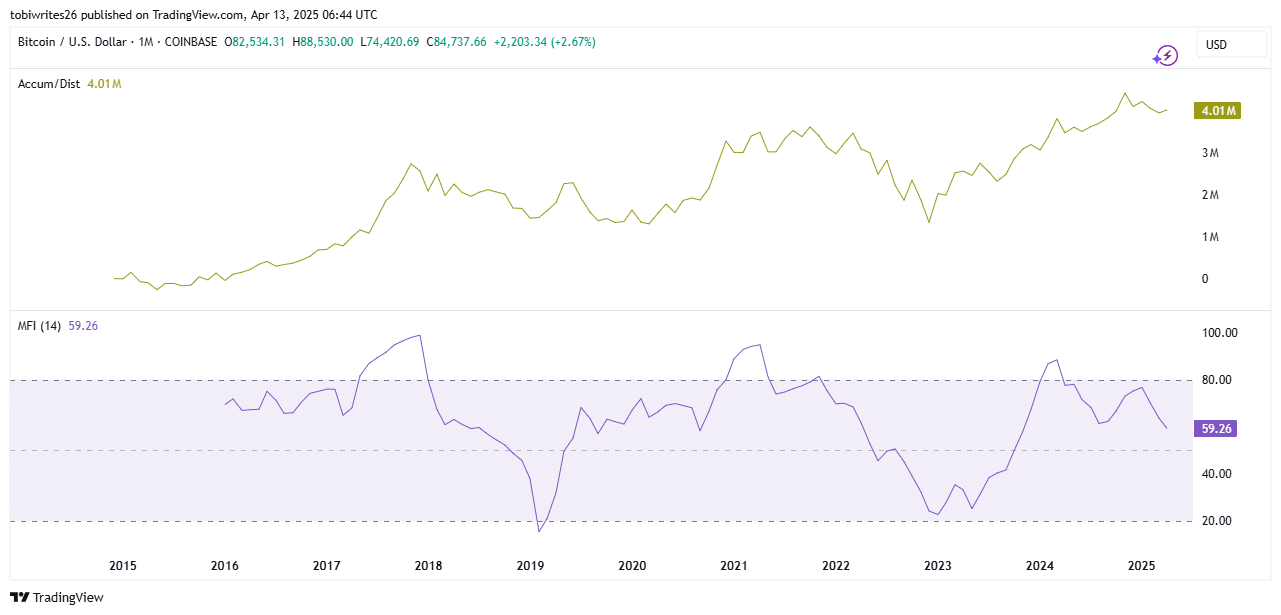

To understand the depth and trend of market movement, AMBCrypto studied the flow of liquidity into the market.

Using the Accumulation/Distribution indicator, it shows there has been a gradual accumulation of Bitcoin, implying that traders are buying the asset steadily.

Accumulation volume reached $4 million worth of Bitcoin.

Despite a decline in liquidity flow, the Money Flow Index (MFI) on the chart remains bullish at 59.26. This indicates that traders are capitalizing on the dip, signaling optimism for the asset’s prospects.

If liquidity flow improves, Bitcoin could potentially rise further, extending its current gains.

Short traders are feeling the heat

This gradual rise in Bitcoin’s price hasn’t favored short traders.

At the time of writing, $56.41 million worth of short contracts had been forcefully closed, compared to $13.25 million in long positions—highlighting the possibility of a market rally.

A study of Bitcoin’s Funding Rate confirms the tendency for a rally.

With a rate of 0.0098%, a positive Funding Rate could imply that long traders are paying fees to maintain their positions and avoid price disparity between the spot and futures markets.

Bitcoin currently remains in a favorable position for a rally, but this will only materialize if broader market sentiment continues to align with current bullish indicators.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)