Bitcoin’s big change: Miner volume share drops post-halving and that means…

- The volume of Bitcoins contributed by miners has dropped since 19 April

- This has fueled the low rate at which new Bitcoins are created and entered into circulation

The share of Bitcoin’s [BTC] volume contributed to by the miners on its network has declined steadily since the last halving event, according to IntoTheBlock’s latest finding.

Bitcoin’s last halving event occurred on 19 April. Aiming to reduce the amount of BTC in circulation, the event halved miner rewards from 6.25 BTC to 3.125 BTC.

Following the halving, the share of the total $BTC volume coming from miners has started to decrease notably.

This is likely the result of a lower inflation rate, which currently sits at 1.66%. pic.twitter.com/tqUdc8IUNy

— IntoTheBlock (@intotheblock) May 9, 2024

Due to the reduction in the total amount of coins received by miners on the Bitcoin network, their share of the coin’s total volume often craters after a halving event.

IntoTheBlock noted further that the decline in BTC miner rewards has also slowed the rate at which new BTCs are added to the coin’s total supply. In fact. the on-chain data provider found that the prevailing inflation rate was around 1.66% on the charts.

Mining activity on the Bitcoin network

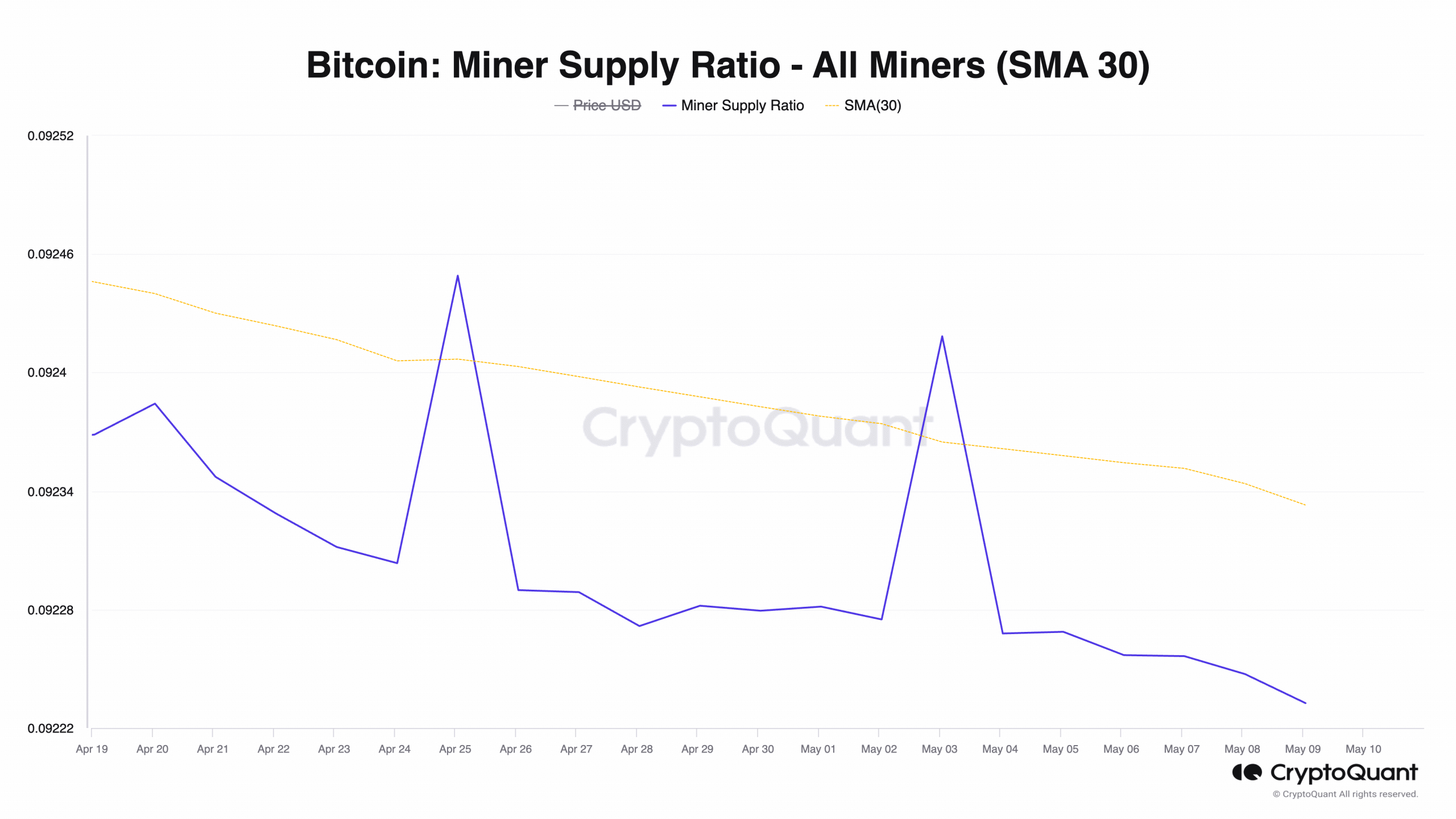

Since the halving event, BTC’s Miner Supply Ratio has dropped slightly, according to CryptoQuant’s data. This metric measures the proportion of new coins added to BTC’s total supply by miners.

When it declines in this manner, the share of new coins being added to BTC’s total supply by miners on the network falls. At press time, the value of this metric was 0.09, having fallen by 0.1% since 19 April.

Furthermore, there has been a minor decline in BTC Miner Reserves since the conclusion of the halving event. With a figure of 1.8 million BTC at press time, this has fallen by 0.11% since 19 April.

This metric measures the amount of coins held in affiliated miners’ wallets. Its value indicates the reserves that miners are yet to sell.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This is evidence of the fact that although some miners on the network have sold some off their coin holdings to book profits after the halving event, there has not been any significant selling activity.

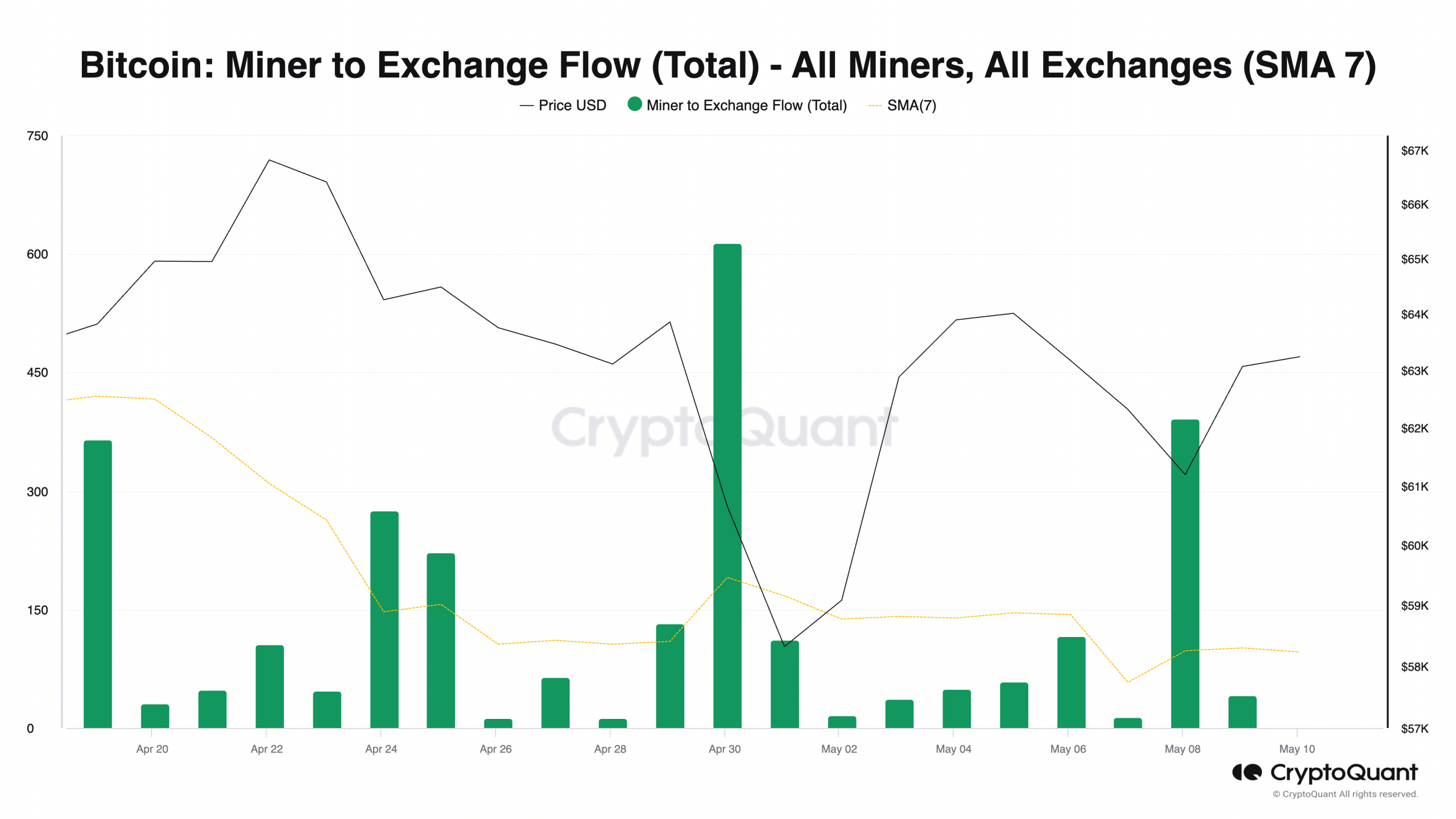

This was confirmed by the drop in the coin’s Miner to Exchange Flow. Assessed using a seven-day moving average, this has cratered by 76% since the last halving event.

Finally, the Miner to Exchange Flow metric measures the amount of BTC flowing from miners to exchanges. When this metric declines, it means that miners are selling fewer coins.

The decline noted in BTC’s Miner to Exchange Flow revealed that the miners on the coin’s network have continued to maintain a bullish outlook, despite its recent price performance.