Bitcoin’s bull market is 50% done, but THIS is what’s coming next

- Bitcoin might wait till Q3 or Q4 before the bull run continues

- BTC’s price could hit $101,500 before the end of 2024

Bitcoin’s [BTC] journey to a higher value on the charts might take longer than initially expected. This seemed to be the case after AMBCrypto analyzed a few crucial on-chain metrics.

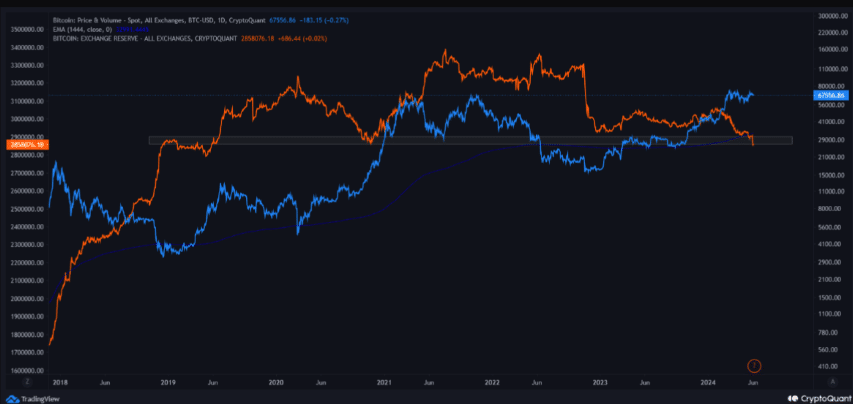

In fact, at press time, it was observed that the number of BTC was falling. This decline could be a sign that most Bitcoin holders are inclined towards accumulating more of the coin, instead of selling.

Has the big money chase taken a break?

Here, it’s worth pointing out that the fall in reserves proved that Bitcoin is in a bull market. However, the metric also suggested that Bitcoin may be 50% away from its potential market top this cycle.

At the time of writing, BTC was valued at $67,937, with the crypto having registered a notable decline from its ATH in March. The falling reserves and price combination indicate that Bitcoin might be hunting for liquidity.

In trading, liquidity hunting happens when market participants seek low liquidity as prices move within a short range. AMBCrypto’s assessment of the market showed that Bitcoin has been moving between $64,000 and $68,000.

This price inefficiency is a sign that BTC might not make a significant upward move till the end of the second quarter (Q2). As such, the bull run might pause and start its next leg in Q3, until the end of Q4 this year.

XBTManager, an analyst on CryptoQuant, also shared a similar thought. In his analysis, he explained,

“Bitcoin is gathering strength for the next rise. When it gathers enough strength, a sharp rise seems to be waiting for us. It seems likely that rises like those in Q3-Q4 will continue.”

This opinion also aligned with the crypto fear and greed index. This index shows if the cryptocurrency is fairly priced, overpriced, or undervalued using market sentiment.

Bitcoin’s price can double

At press time, the metric had a reading of 60 – A sign that greed in the market was not extreme. Therefore, Bitcoin seemed fairly priced on the charts. However, this also indicates that another significant hike might be possible in the mid to long-term.

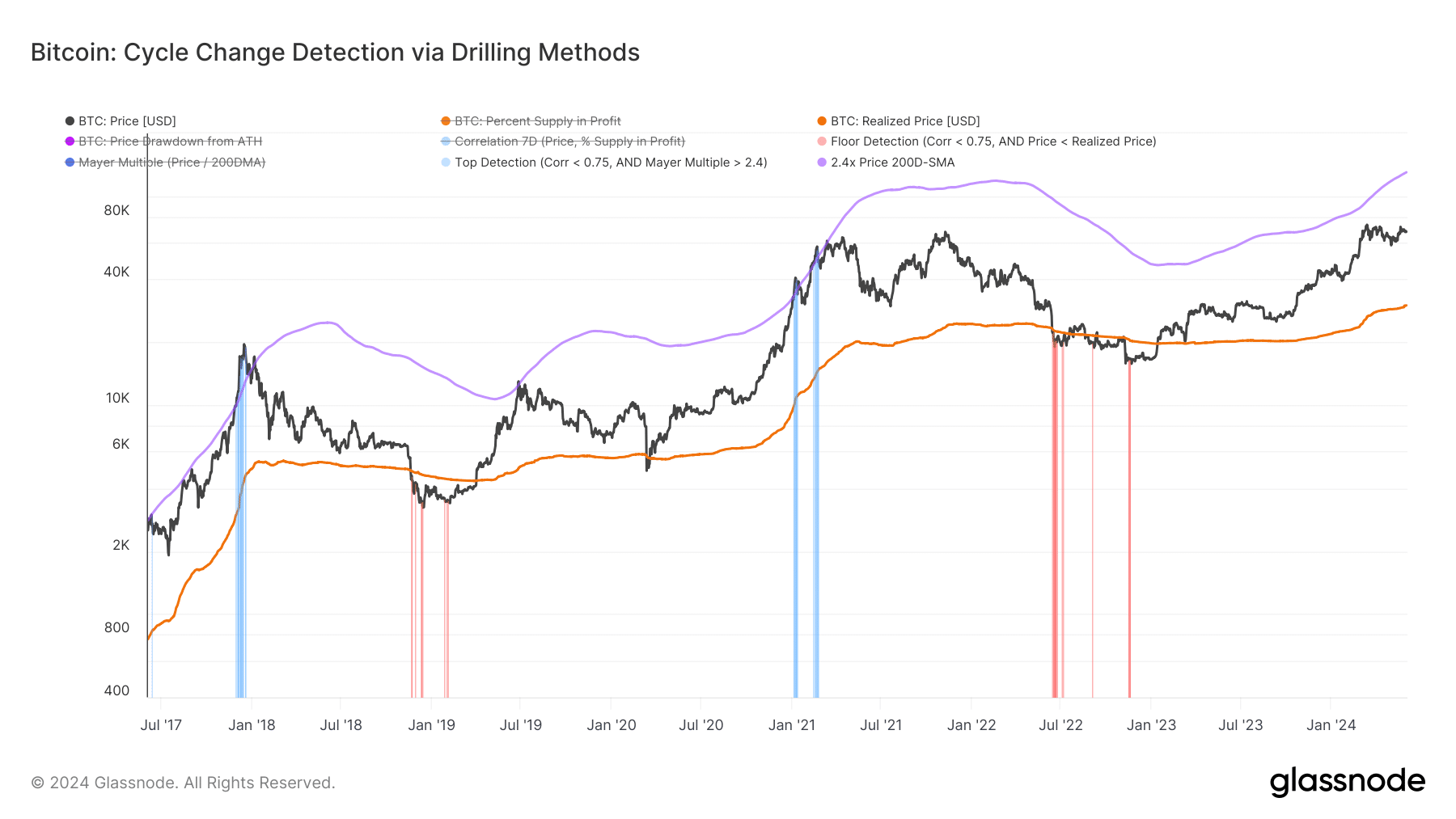

To buttress this bullish price prediction, AMBCrypto checked the Cycle Change Detector. This metric shows if Bitcoin has transitioned into a bull or bear phase.

This metric also uses the correlation between the price and supply in profit. Looking at the chart below, a light blue line would appear if Bitcoin reaches its peak price.

However, if the line is light red, it implies that the price is close to the bottom. At press time, Bitcoin had moved past the bottom.

Is your portfolio green? Check the Bitcoin Profit Calculator

However, there was no blue light (top detector) in sight yet. Going by the signals addressed above, the price of BTC might hit $101,500 between Q3 and Q4 2024.