Bitcoin’s CPI turns positive after 10 days – What does it mean for prices?

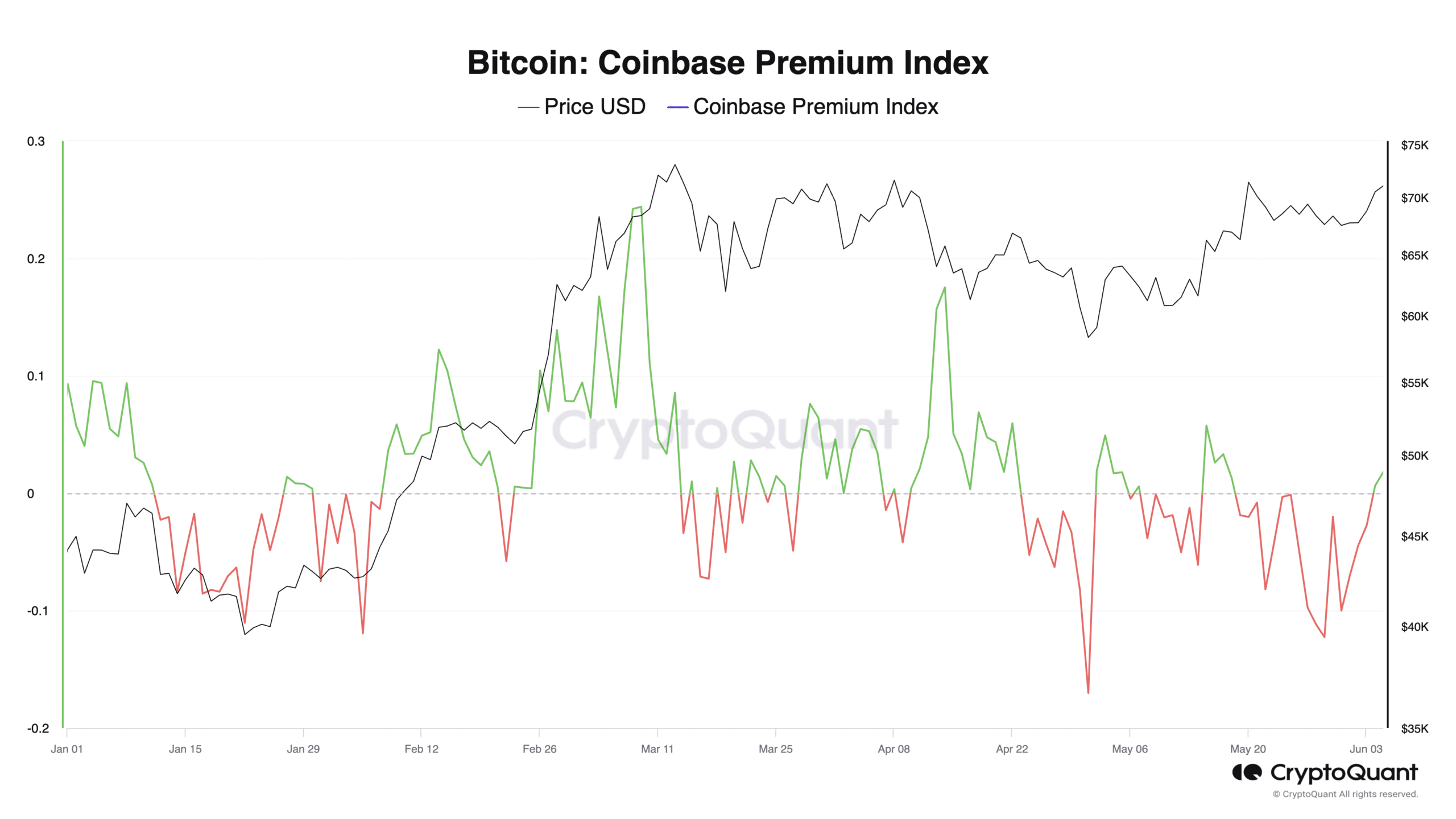

- Bitcoin Coinbase Premium Index is now positive.

- This signals a spike in coin accumulation by US-based investors.

Bitcoin’s [BTC] Coinbase Premium Index (CPI) has turned positive after returning negative values for about ten days, pseudonymous CryptoQuant analyst BQYoutube has found in a new report.

This metric measures the difference between BTC’s prices on Coinbase and Binance. When its value is positive, it suggests that the coin is priced higher on Coinbase compared to Binance. It is interpreted to mean strong buying interest from US-based investors.

Conversely, when it declines, and its value is negative, it signals less trading activity on the US-based exchange.

At press time, BTC’s CPI was 0.006.

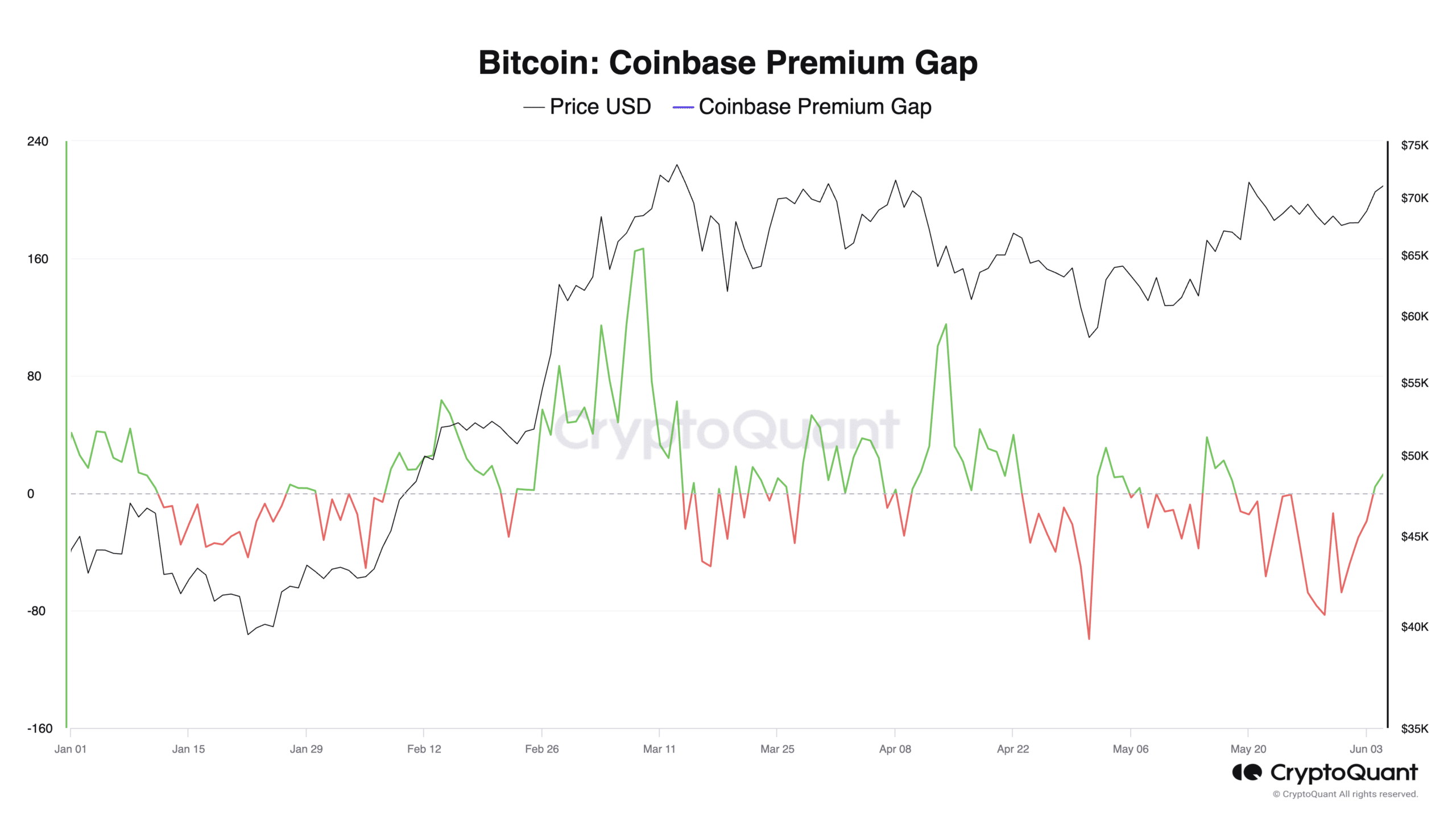

Confirming the resurgence in activity from US-based BTC holders, BTC’s Coinbase Premium Gap was 4.48 at press time.

According to CryptoQuant data, this was the first time the metric had returned a positive value since 18th May.

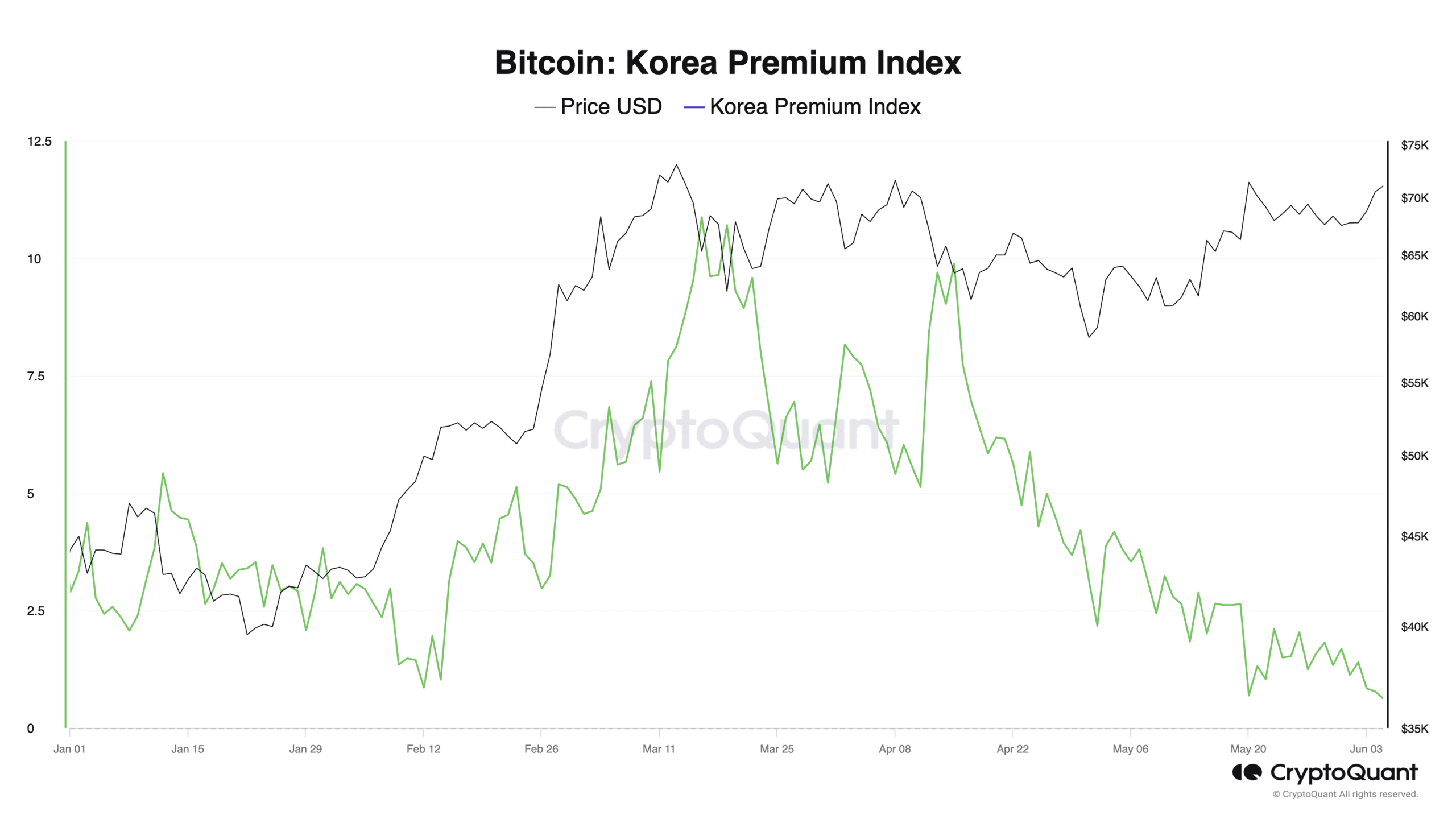

BTC traders in Korea look away

Although BTC’s Korean Premium Index (KPI) has trended downward since 15th April, it remains above the zero line. Also referred to as the Kimchi Premium, this index measures the gap between BTC prices on South Korean exchanges and other exchanges.

At 0.78 at press time, BTC’s Kimchi Premium was at its year-to-date low, signaling that regional demand for the coin by Korean investors is at its lowest since the beginning of the year.

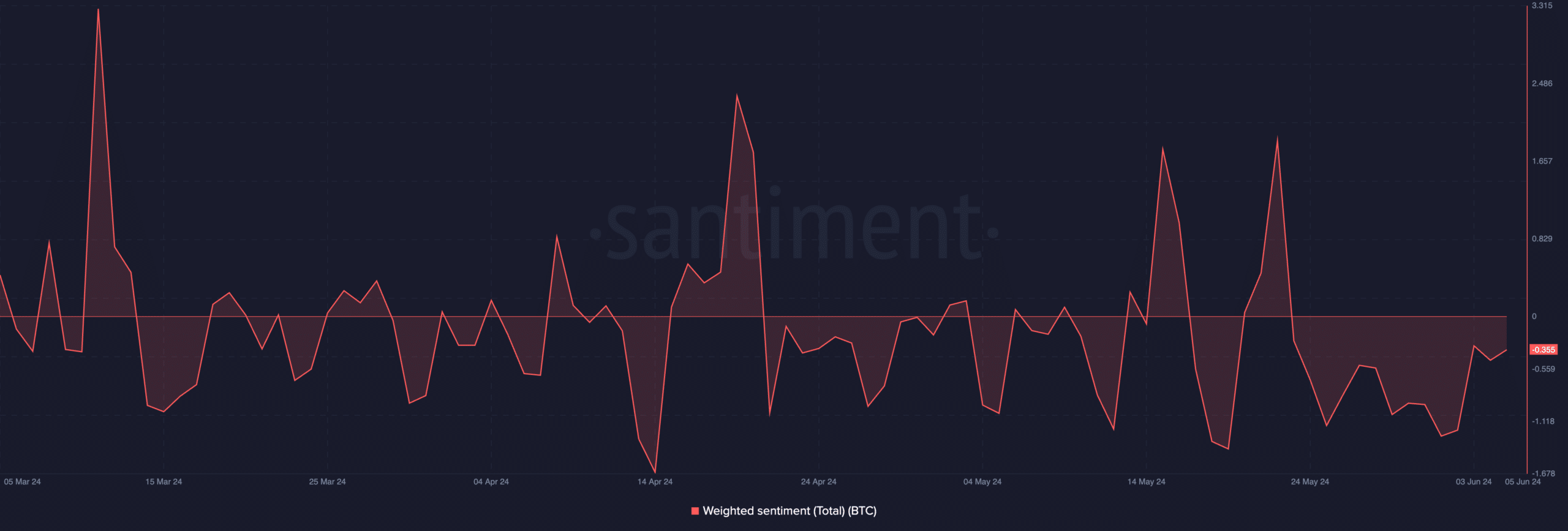

Negative sentiment follows the coin

At press time, BTC exchanged hands at $71,148. Its price has risen by 10% in the past 30 days. During that period, the coin traded briefly at $71,315 on 21st May before witnessing a pull back.

However, despite BTC’s recent price rally, negative sentiment trails the coin. At press time, its weighted sentiment was -0.355. In fact, the value of this metric has been negative since 24th May.

This indicates that despite its price rally in the past few weeks, there is still a bearish bias toward the leading coin among market participants.

This has been the case even with the daily profits made by coin holders.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

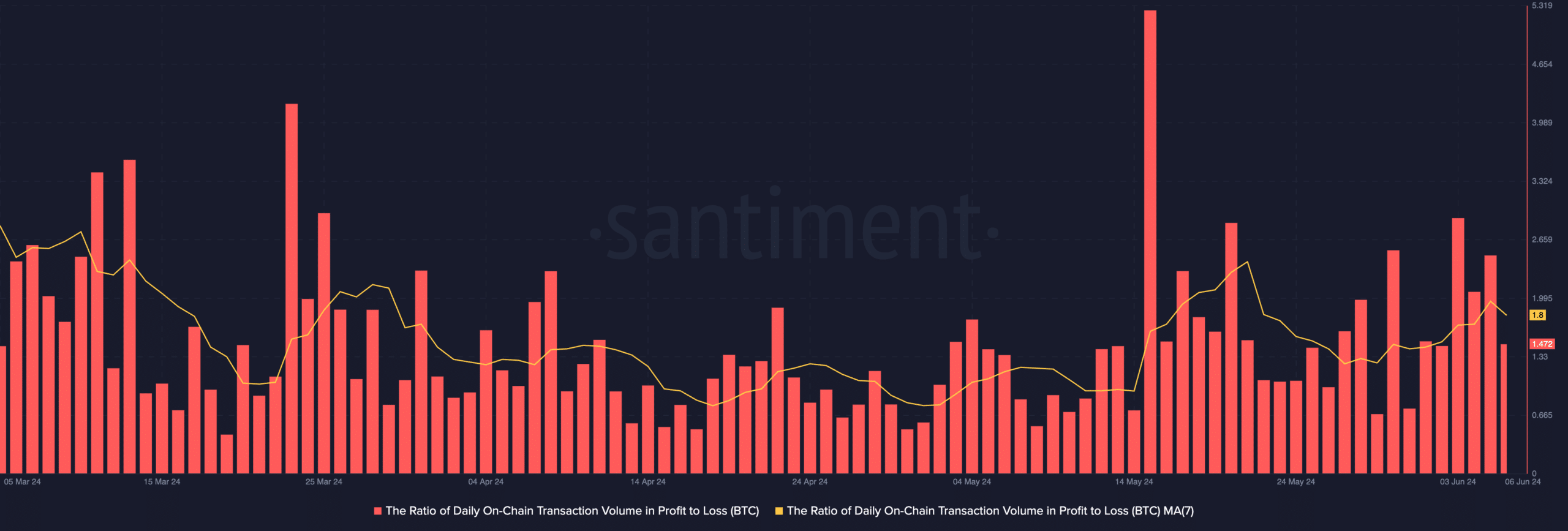

AMBCrypto assessed the daily ratio of BTC transaction volume in profit to loss (using a seven-day) moving average and returned a value of 1.8.

This showed that for every BTC transaction that ended in a loss in the past few weeks, 1.8 transactions have returned a profit.