Bitcoin’s dominance, altcoin season’s odds, and all about this deep market reset

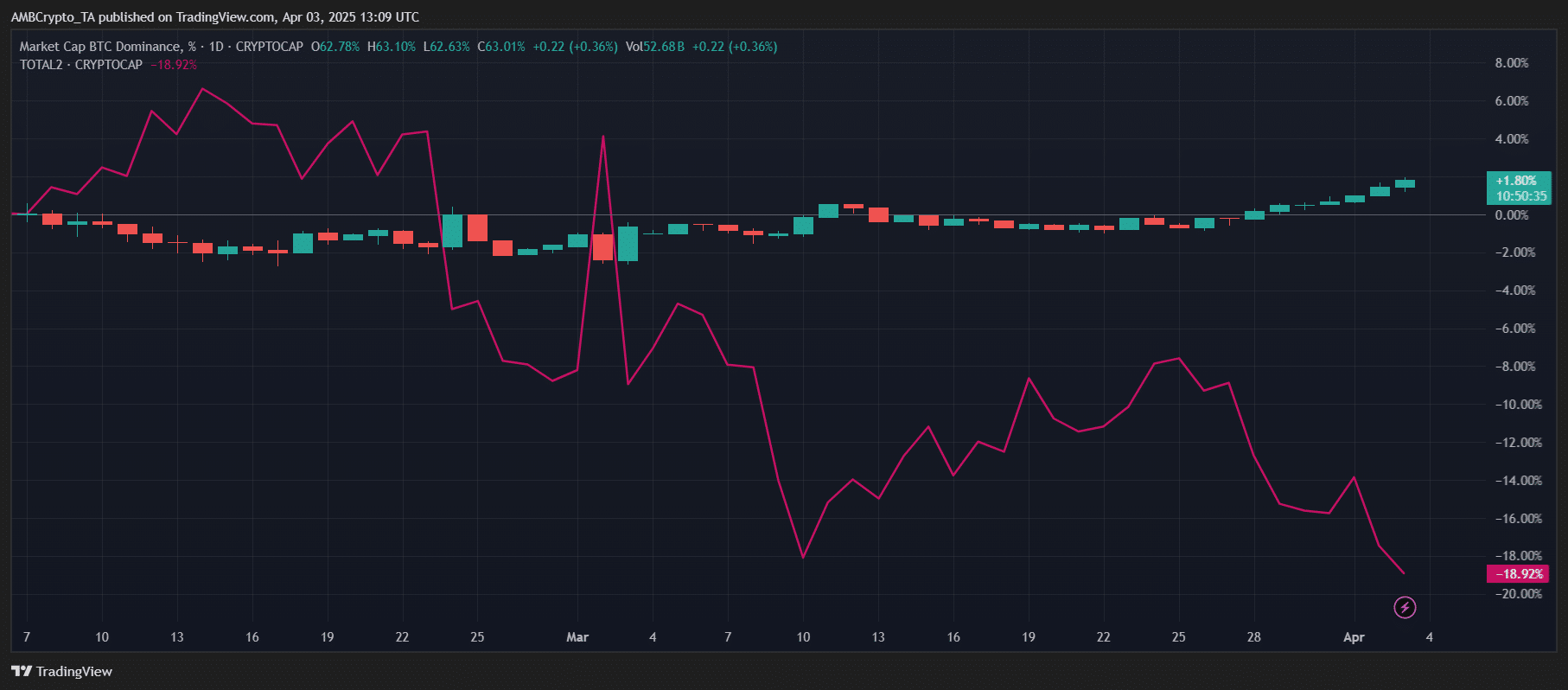

- Bitcoin’s dominance now exceeds 63%, signaling a bearish environment for altcoins across all metrics

- Stablecoin flows hinted at a risk-off phase, delaying any major altcoin breakout

It would seem that Bitcoin [BTC] is now tightening its grip on the wider crypto market.

In fact, with its dominance now over 63%, the latest market structure might be hinting at deep struggles for altcoins.

This shift was highlighted by Alphractal CEO Joao Wedson in a tweet contrasting Bitcoin’s price with an Altcoin Season Index.

At the time of writing, fewer than 25% of altcoins seemed to be outperforming Bitcoin — A textbook Bitcoin Season.

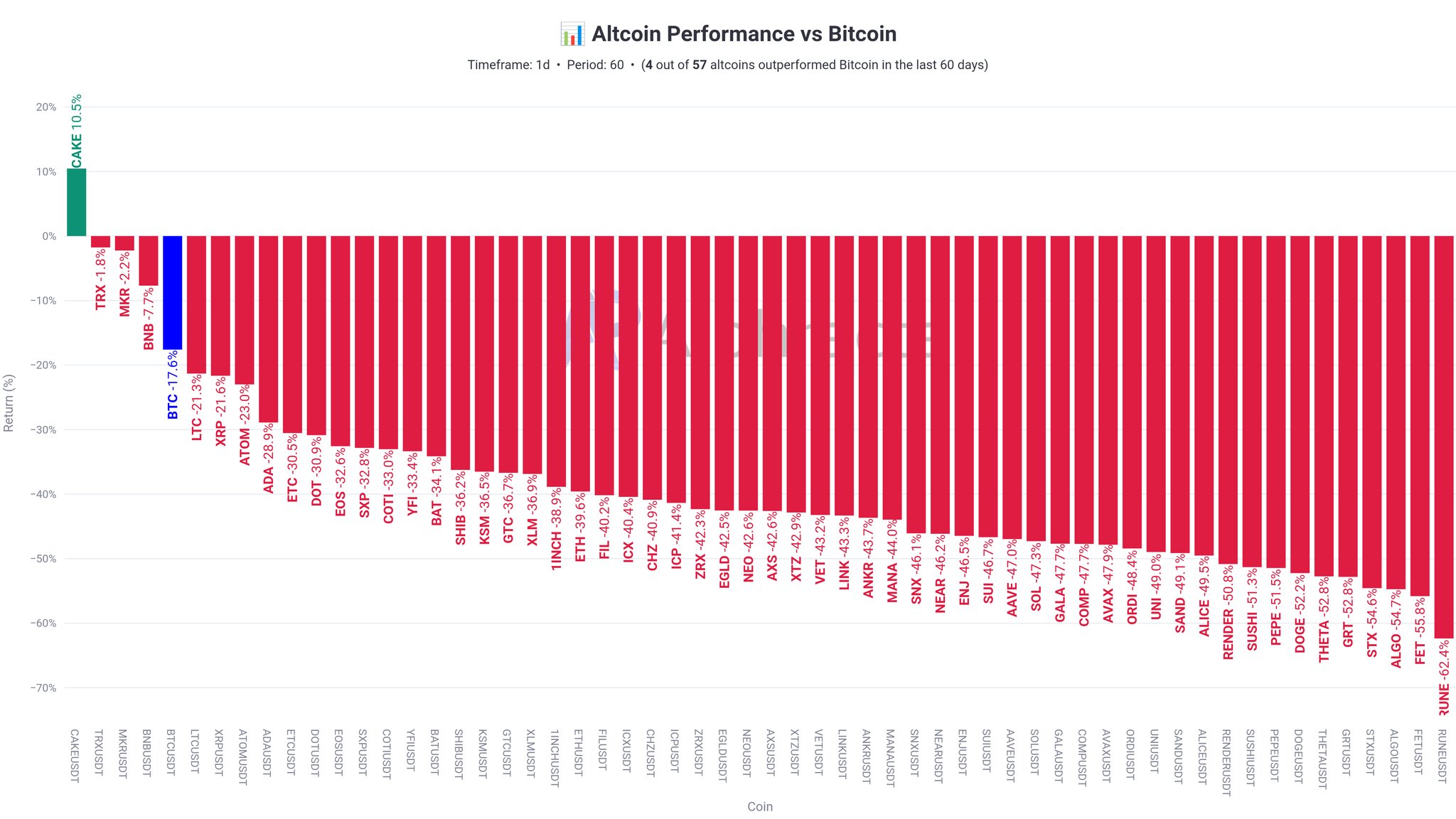

Four survivors in a sea of red

According to Alphractal, just 4 out of 57 altcoins have outperformed Bitcoin, which itself dropped by -17.6% on the charts. Among the few outperformers, PancakeSwap [CAKE] posted the only positive returns with figures of +10.5%.

To put it simply, the underperformance is stark.

Most altcoins returned between -20% and -72%, with JUNE leading losses at -72.4%. Bitcoin, despite its own drop on the charts, still remains a relative safe haven.

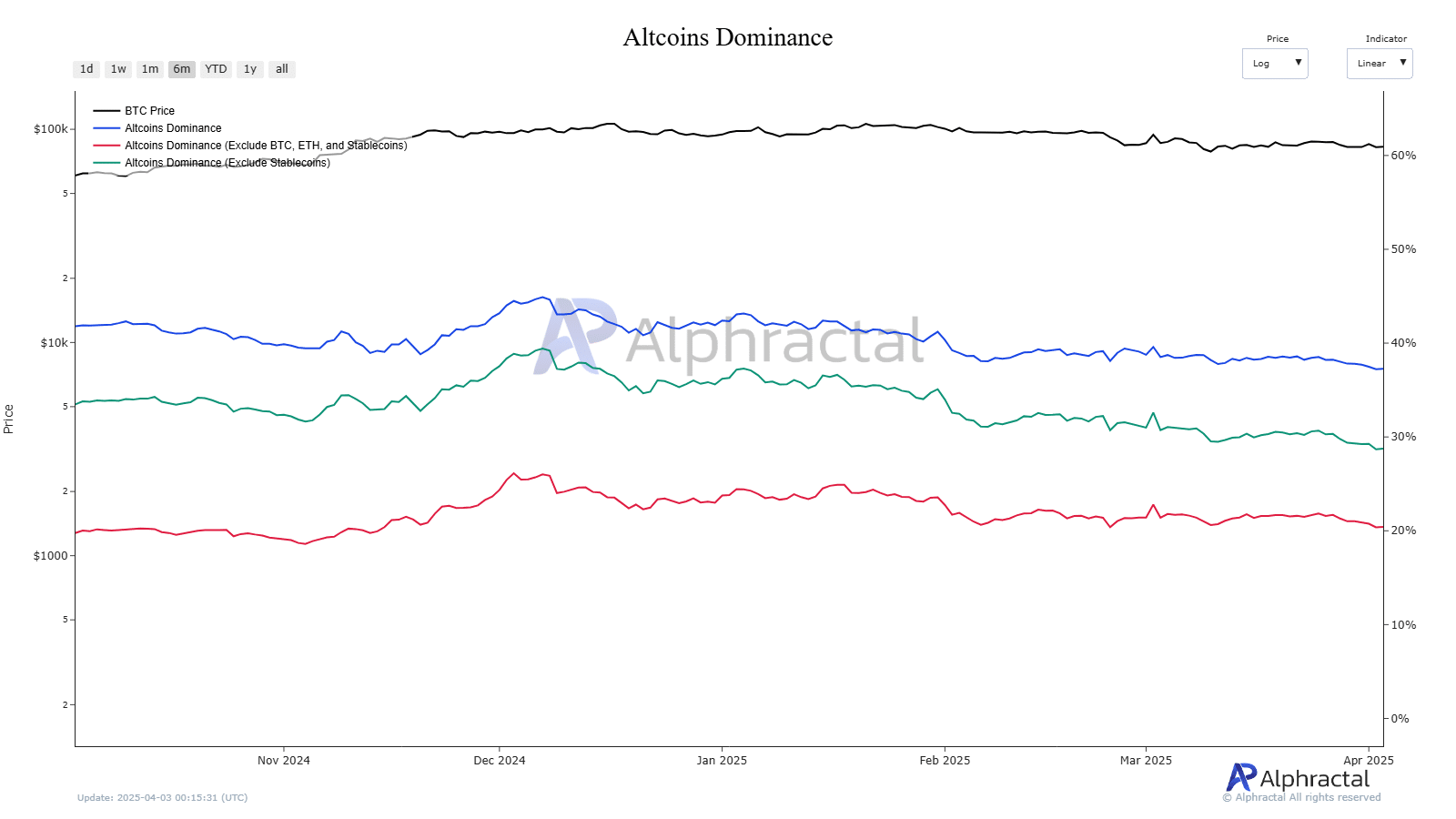

On the contrary, altcoin “dominance” tells us the same story.

Since November, the altcoin market’s share has dropped from 41% to 37%. Excluding stablecoins, it actually slipped from 35% to 28%.

Vanishing act of altcoin credibility

Filtering out Bitcoin, Ethereum, and stablecoins paints an even bleaker picture, with shares for the same falling from 23% to 20%. Given everything that has been happening, the aforementioned decline simply confirms a lack of investor conviction in non-Bitcoin assets.

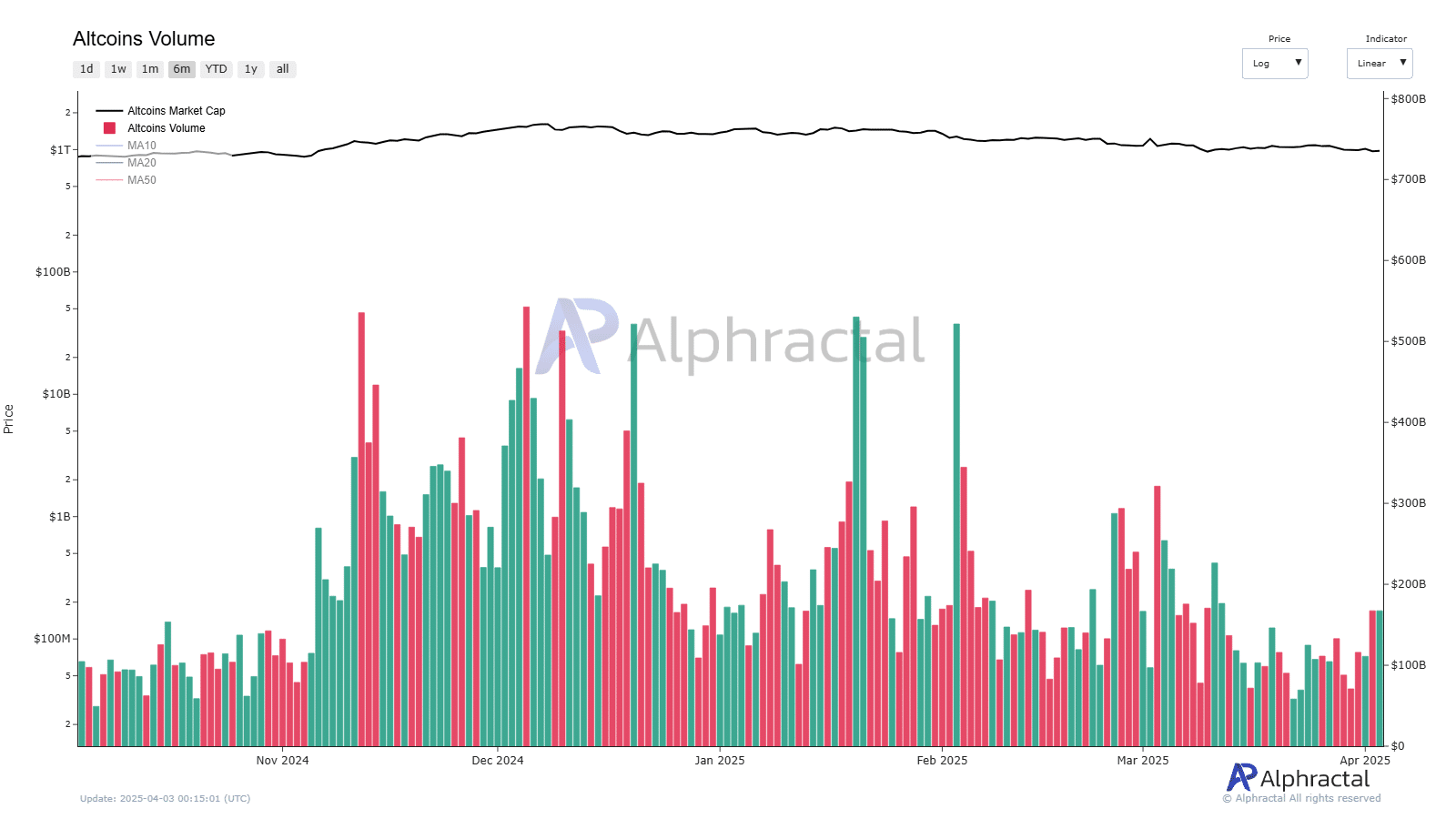

Momentum in trading has also vanished lately.

On 05 December, the altcoin market cap peaked at $1.43 trillion, with volume at $542.63 billion. By 03 April, however, those numbers fell to $975.64 billion and $137.31 billion, marking 32% and 296% drops, respectively.

These figures painted a picture of waning investor confidence.

Spikes in December were not sustained. And by March, the trend was clearly southbound across both price and participation.

Bitcoin’s rise in dominance also coincided with clear signals from the Stablecoin Supply Ratio (SSR).

When peaks turn to warnings

23 February stands out as a turning point because both Bitcoin’ss price and the SSR peaked simultaneously.

Bitcoin peaked at $96,209, alongside a 16.03 SSR. Within three days, however, both reversed sharply. By April, BTC fell to $81,800, and the SSR dropped to 14.21.

This alignment can be seen as a sign of how liquidity shifts signal trend exhaustion. Importantly, despite Bitcoin’s own losses, its market dominance rose, not fell.

Every indicator leads to the same conclusion – Altcoin seasons are rare, brief, and fragile. Bitcoin’s dominance, now past 63%, reflects a consolidating market where capital flows into perceived safety.

Bitcoin or bust?

Short-term optimism around altcoins exists. However, data also revealed that without a structural shift in dominance and liquidity, any rallies may remain isolated and brief.

For now, the smart money appears to be staying parked in Bitcoin, or waiting on the sidelines.