Bitcoin’s ETF rumor impacts USDT this way

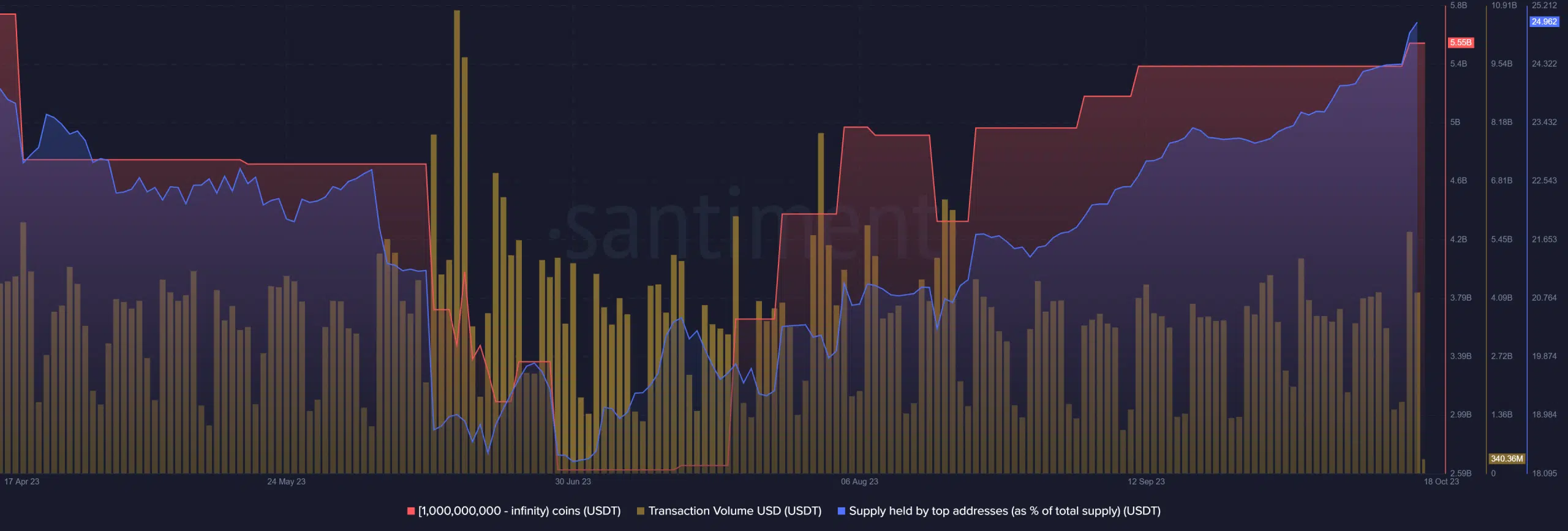

- USD transaction climbed over $5 billion as large wallets accumulated.

- Large wallet accumulation moved close to 25%, with the top 10 wallets holding a quarter of the supply.

The false report of a Bitcoin [BTC] ETF approval had a notable impact on the cryptocurrency community, causing ripples of concern. Tether [USDT], too, experienced a significant effect, with recent data indicating a noticeable increase in a critical metric.

Read Bitcoin’s [BTC] Price Prediction 2023-24

USDT top wallets increase accumulation

On 16 October, the circulation of false information regarding the approval of a Bitcoin spot ETF triggered notable spikes in several key metrics related to Tether’s USDT that hadn’t been observed for several months.

According to data from Santiment, this news spurred increased accumulation by the largest wallets.

Furthermore, it caused a surge in the on-chain transaction volume of the stablecoin, with the Transaction Volume surpassing $5.6 billion. This marked the highest Transaction Volume for USDT since August. As of this writing, the Transaction Volume remained above $5.5 billion.

Additionally, the misinformation led to a considerable increase in accumulation by the largest wallets associated with the stablecoin. According to Santiment’s metric, the top 10 wallets held more than 24% of the total supply at press time.

This level has not been seen since March, as observed from the chart data. Moreover, wallets containing 1 billion USDT or more collectively held over 5 billion USDT during this period.

USDT flow shifts to negative

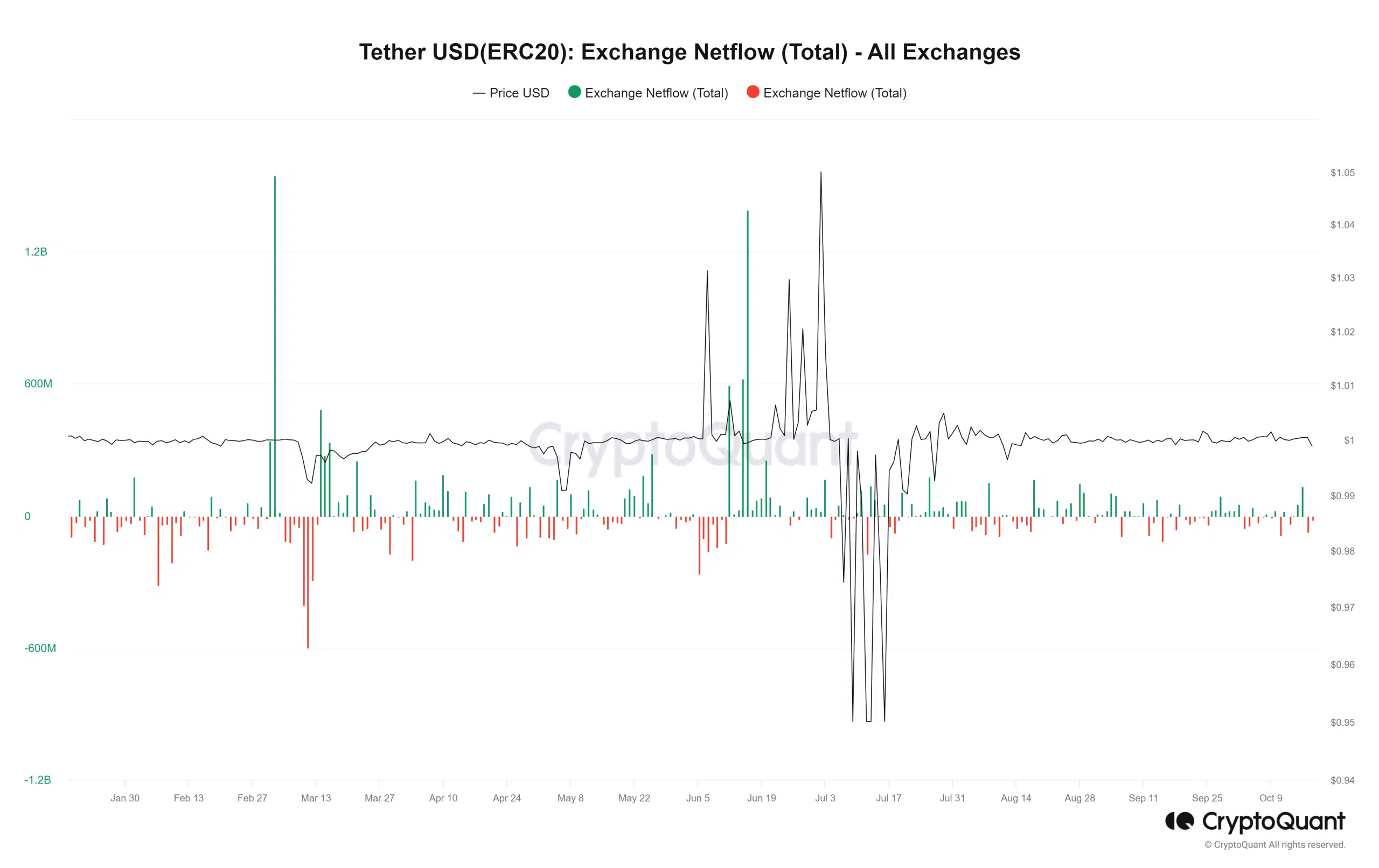

According to data provided by CryptoQuant, the events of 16 October initially led to a noticeable surge in the movement of USDT to cryptocurrency exchanges. However, the flow has since reversed direction, turning negative, as clearly illustrated on the flow chart.

By 17 October, the chart depicted an outflow exceeding 73 million. Also, at the time of composing this text, the outflow remained in negative territory, with over 20 million being withdrawn.

Is your portfolio green? Check the BTC Profit Calculator

What the accumulation and negative flow could mean

Interpreting this flow pattern alongside the accumulation metric, it appeared to suggest a flight to safety in response to increased market volatility.

With the corresponding rise in the price of Bitcoin and the subsequent minor decline, traders seem to be accumulating more USDT to safeguard their assets and prepare for potential market turbulence.