Bitcoin’s whale activity peaks, but is selling pressure ahead?

![Bitcoin[BTC]’s Exchange Whale Ratio spikes to yearly high—Will whales trigger a sell-off?](https://ambcrypto.com/wp-content/uploads/2025/03/Renuka-36-1200x675.webp)

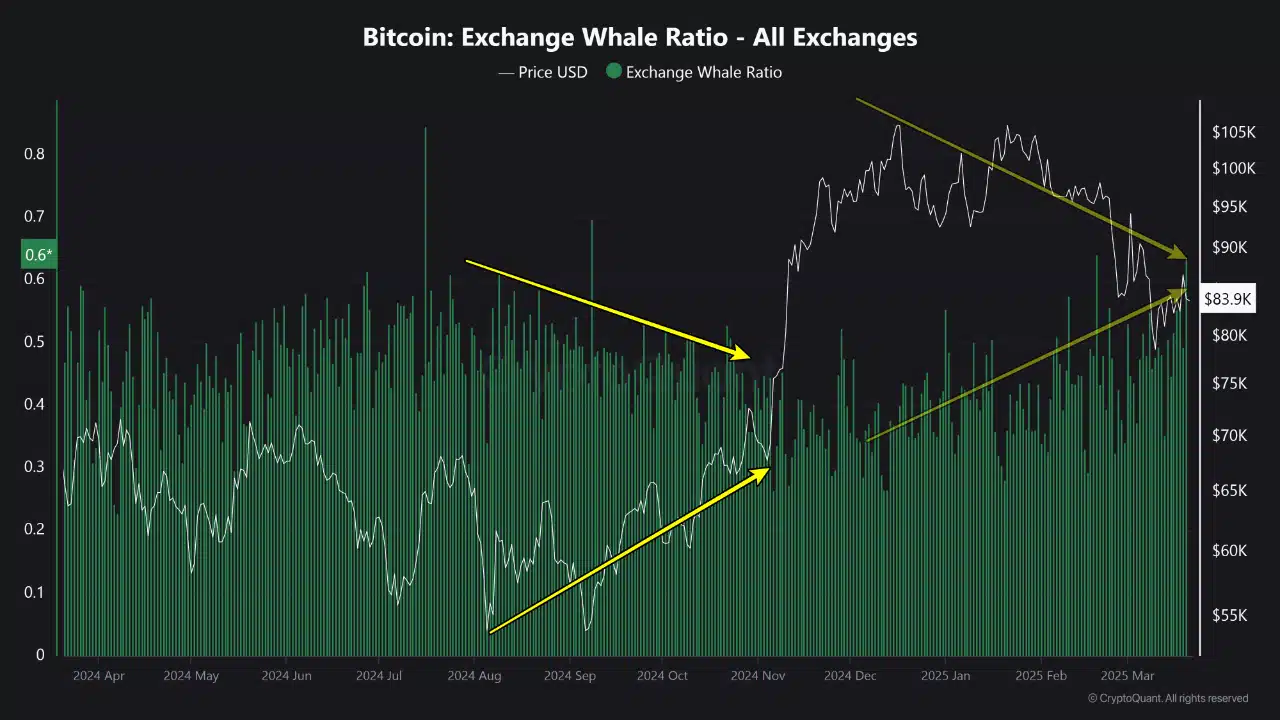

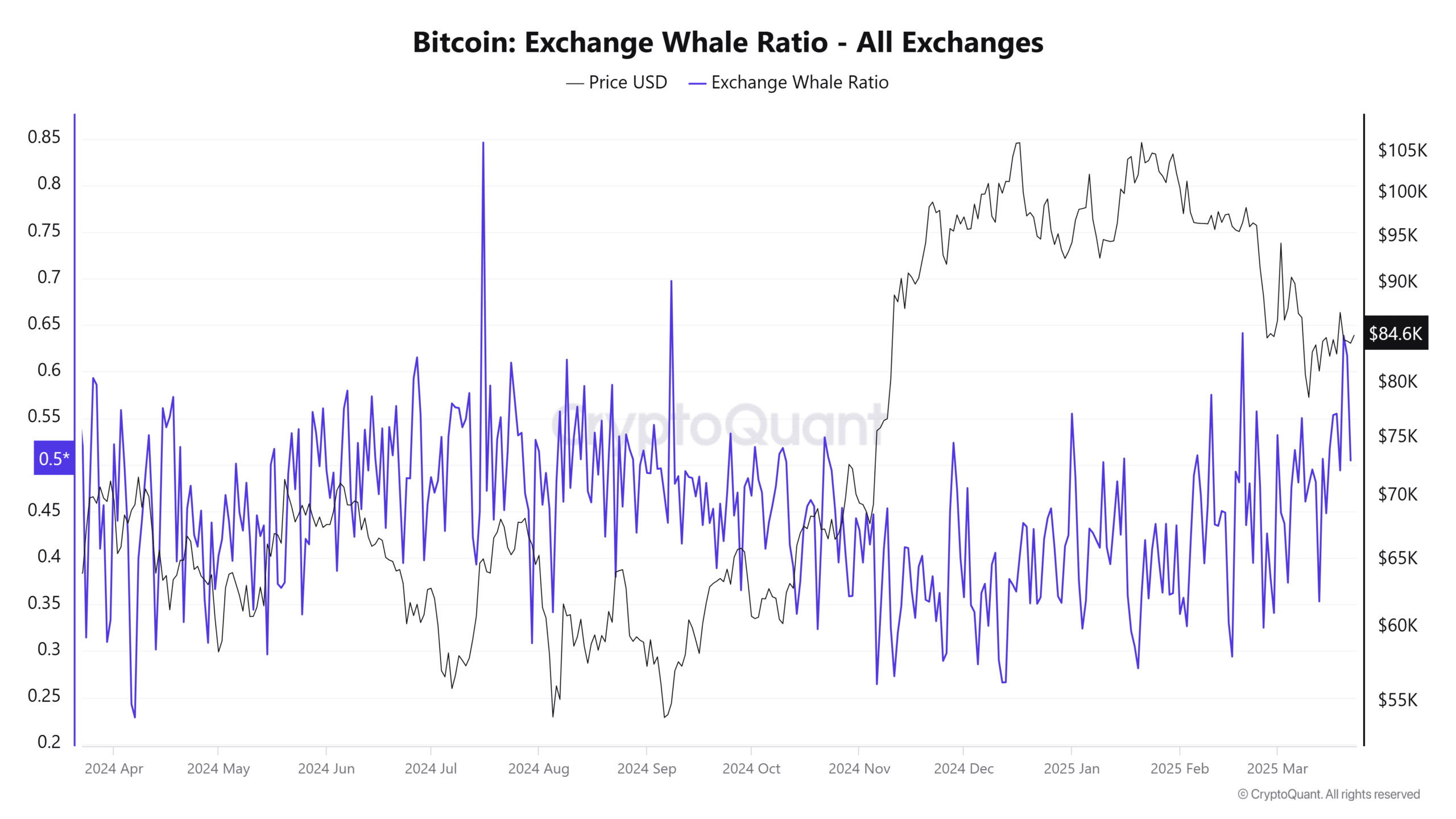

- The Exchange Whale Ratio tops 0.6, signaling increased large-holder activity on exchanges.

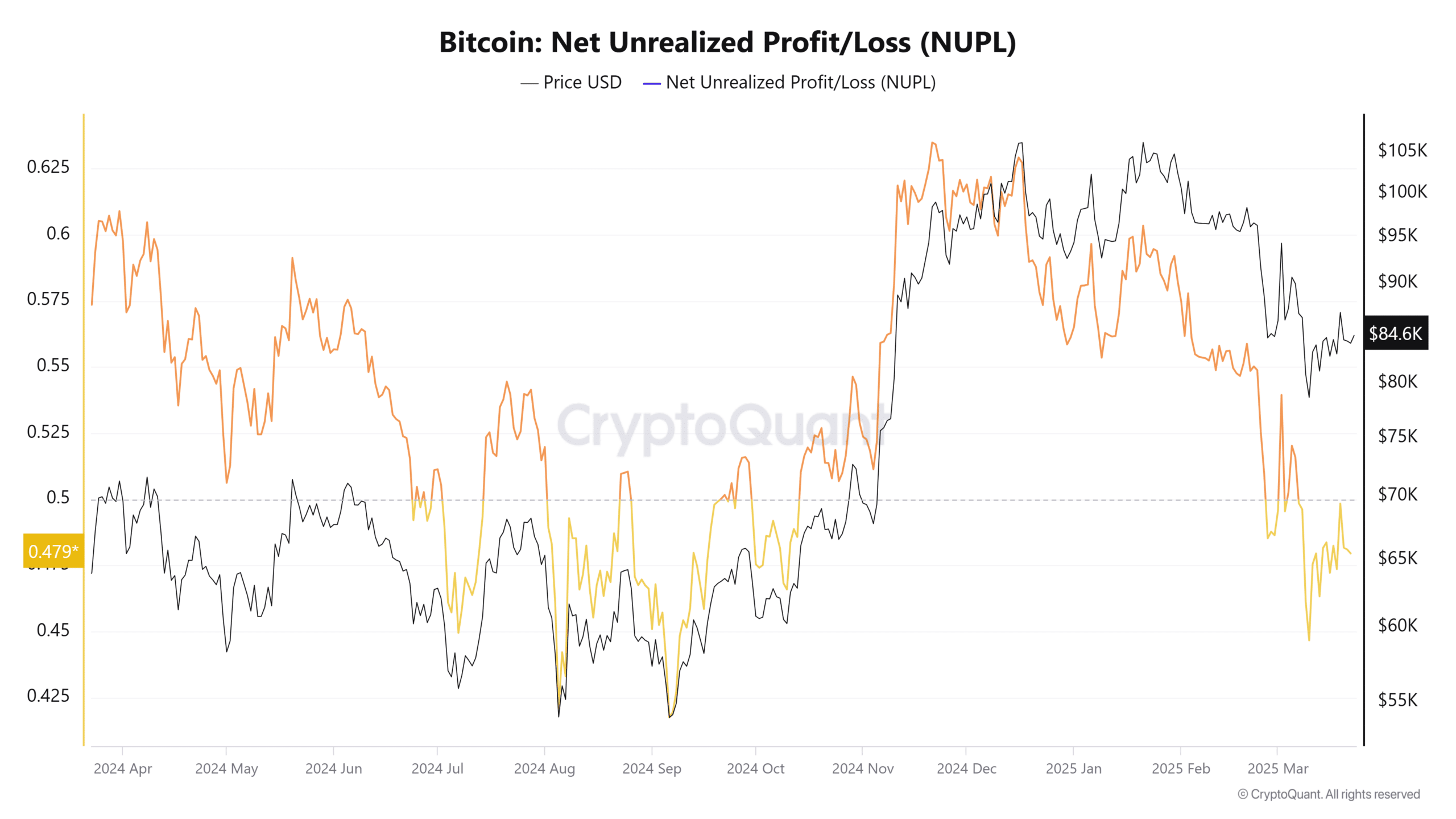

- BTC’s NUPL cooled from euphoria, but the market remained in net profit territory.

The return of heightened whale activity has pushed the Exchange Whale Ratio, a key Bitcoin [BTC] metric, to its highest level in months, raising concerns about renewed selling pressure.

According to CryptoQuant, the Exchange Whale Ratio (EWR) has surged past 0.6. Historically, large holders distribute when EWR exceeds this threshold.

CryptoQuant analyst said,

“This behavior is often interpreted as these big players actively reallocating their assets, potentially signaling forthcoming selling pressure in the market.”

The metric, reflecting top-10 exchange inflows, has climbed since Q4 2024. The timing of these movements aligns closely with a major turning point in Bitcoin’s price action.

How the Exchange Whale Ratio reflects Bitcoin whale activity

Bitcoin reached an all-time high of $106,128 on the 17th of December.

Since then, the asset has entered a correction phase, sliding by approximately 20% to $84,619 as of the 23rd of March.

The timing of this pullback overlaps with a series of sharp EWR spikes, most notably in late 2024 and March 2025.

This 20% correction aligns with notable EWR spikes in late 2024 and March 2025. During Bitcoin’s climb from $55,000 to over $100,000, EWR rose while price rallied.

Although whale inflows did not peak at the exact price top, they steadily increased ahead of it, hinting at early profit-taking.

Interestingly, a December EWR reading of 0.36 saw whale inflows climb even as prices retreated. This divergence, where rising whale activity meets falling prices, often indicates distribution.

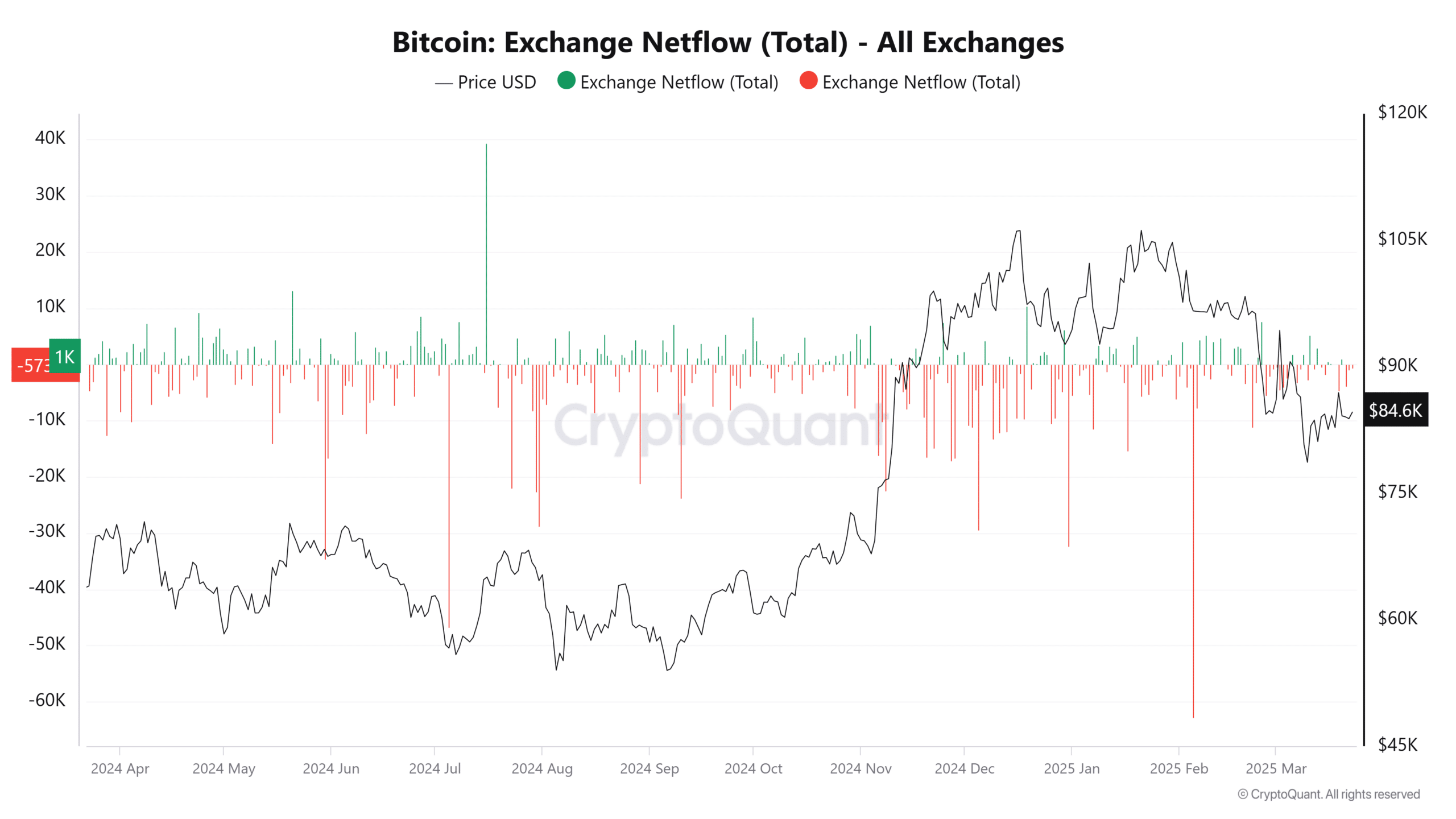

While the EWR reveals who are acting, netflow data clarifies how.

Who’s moving the money?

Exchange netflows have shifted from bullish outflows to signs of redistribution, according to the data.

Between April and October 2024, monthly outflows typically ranged from 30,000 to 60,000 BTC. However, this trend began to change in Q4.

For example, on the 24th of November, net inflows surged to +7,033 BTC as Bitcoin neared $68,000. Although the price continued to rally, this inflow indicated early movers were realizing profits.

On the 17th of December, the day of Bitcoin’s all-time high, netflow showed a withdrawal of 1,531 BTC. This was smaller compared to previous accumulation phases.

In the post-peak period, netflows became volatile. While not outright bearish, moderate netflows combined with a high EWR suggest whales are still transferring coins to exchanges, albeit at a reduced scale.

The Net Unrealized Profit/Loss (NUPL) ratio offers further insights into overall market sentiment.

Profit booked, but what’s next?

The NUPL ratio, which measures unrealized gains within the network, climbed from 0.442 to 0.627 between August and December 2024, reflecting widespread profits and fueling Bitcoin’s rally.

By March 2025, NUPL declined to 0.480, surpassing a 21% price drop with a 23.4% decrease. This suggests the market remains profitable but has entered a phase of realization.

Crucially, NUPL’s sharper decline compared to the price correction—23.4% vs. 21%—indicates that whales and long-term holders were among those realizing gains.

Despite this pullback, the metric continues to hover above bearish territory, signaling that the market remains profitable overall.

Bitcoin: A pause… or a pivot?

Whales are shifting assets, profit-taking is underway, and volatility persists.

Yet, with NUPL in profit and netflows stabilizing, the market appears to be holding its ground—cautiously balanced between distribution and resilience.