Bitcoin’s harsh drop triggers $142M in liquidations – What now?

- BTC has continued to trade below the $61,000 price range.

- BTC saw over $142 million liquidated in the past two days.

Bitcoin [BTC] has experienced declines over the past few days, leading to a significant volume of liquidations. As Bitcoin’s value has decreased, traders and investors have had to navigate these volatile conditions, contributing to the recent swings in market sentiment.

Bitcoin continue declines

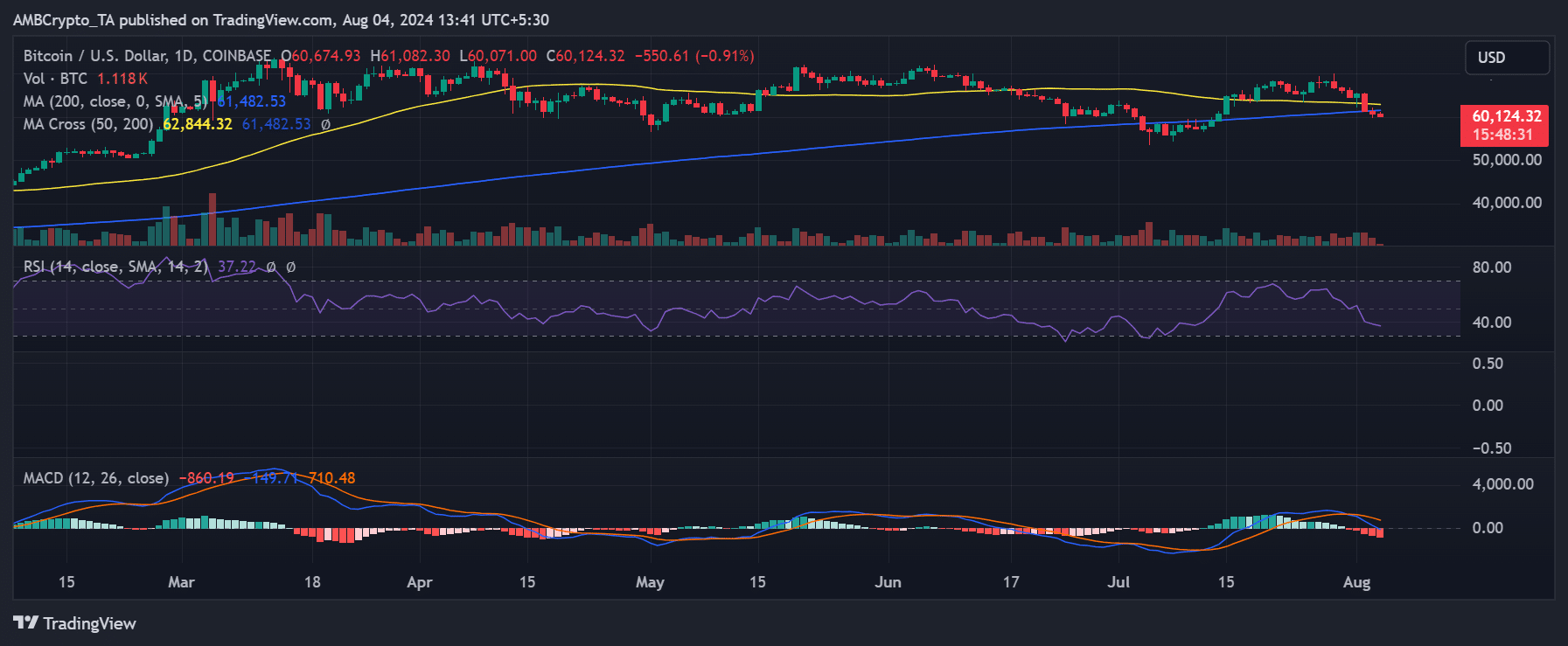

An analysis of Bitcoin (BTC) on a daily timeframe chart revealed its most significant decline in four months.

According to AMBCrypto, BTC dropped by 5.93% on 2nd August, from approximately $65,293 to around $61,418. This was the largest single-day decline since April.

By the end of trading on 3rd August, BTC had slipped further to about $60,674, marking a 1.24% decline and falling below the $61,000 price range.

As of this writing, the decline continues, with Bitcoin trading at around $60,143, representing an additional nearly 1% decrease. These consecutive declines caused BTC to break its support level, which was maintained by the long moving average (blue line) at around $61,000.

Additionally, the Relative Strength Index (RSI) has dropped below 40, indicating an intensifying bearish trend.

Long Bitcoin liquidations continue

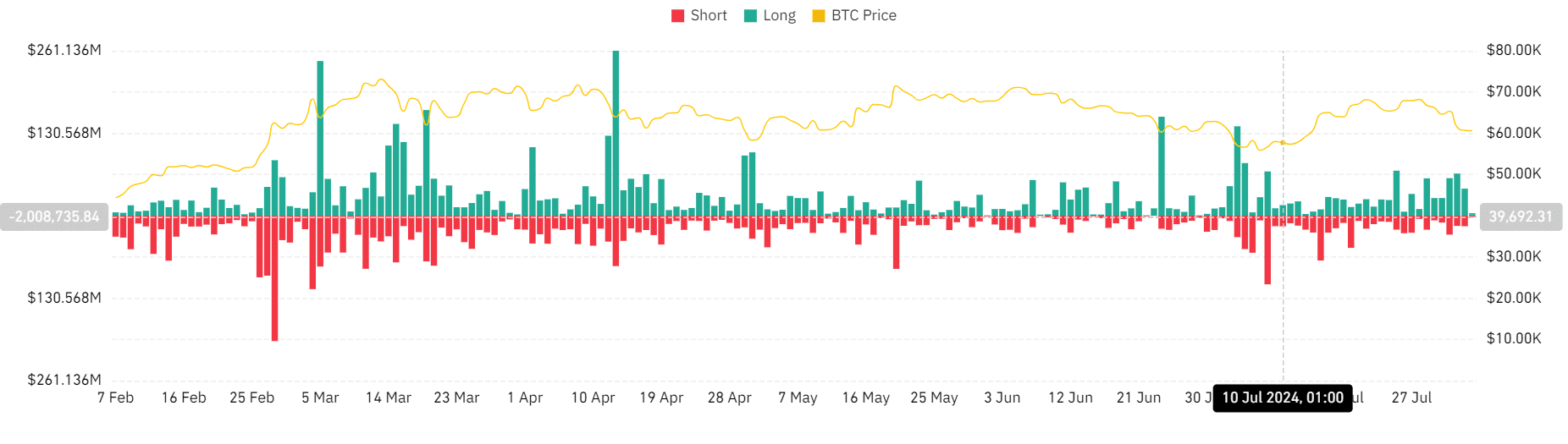

In the past seven days, Bitcoin has experienced a notable dominance of long liquidation volumes.

Over the last two days, the total liquidation volume exceeded $142 million. On 3rd August, the liquidation volume was nearly $60 million, with long positions accounting for almost $43 million.

The total liquidation volume in the previous trading session reached approximately $83 million, with long positions making up nearly $67 million.

Additionally, the funding rate has exhibited volatility over the past few days.

At the end of the most recent trading session, the funding rate significantly dropped to around 0.0036% from approximately 0.008%.

However, it saw fluctuations in the last eight hours, rising again to around 0.008% before dropping back to about 0.004%. These movements indicate considerable uncertainty and volatility in the market, affecting both liquidation volumes and funding rates.

New addresses see mixed movements

As Bitcoin’s price attempts to stabilize, the number of daily new addresses has also shown volatility.

In the last three days, there has been a notable decline in the number of new addresses.

Read Bitcoin (BTC) Price Prediction 2024-25

According to data on Glassnode, the number of new addresses was around 334,000 at the beginning of the month, following a slight spike at the end of the previous month.

However, this number has since declined to approximately 304,000 as of this writing. This decrease in new addresses may reflect a cautious sentiment among potential new participants in the market amid the current price instability.