Bitcoin’s latest phenomenon – How it impacts ETFs and BTC’s price

- Why has Bitcoin been selling off right before and at every U.S. market open?

- Bitcoin and its ETFs are set to surge.

Bitcoin’s [BTC] recent phenomenon during the U.S. market open has caught the attention of traders and analysts.

The king coin has been experiencing consistent sell-offs right before and during the U.S. market open, where prices initially pump to shake out shorts followed by a gradual decline to shake out longs, before the actual market move occurs.

This pattern may be driven by factors such as pre-market trading, market sentiment, supply and demand dynamics, and the trading behavior of institutional investors.

This phenomenon has notably impacted Bitcoin ETFs in the U.S.

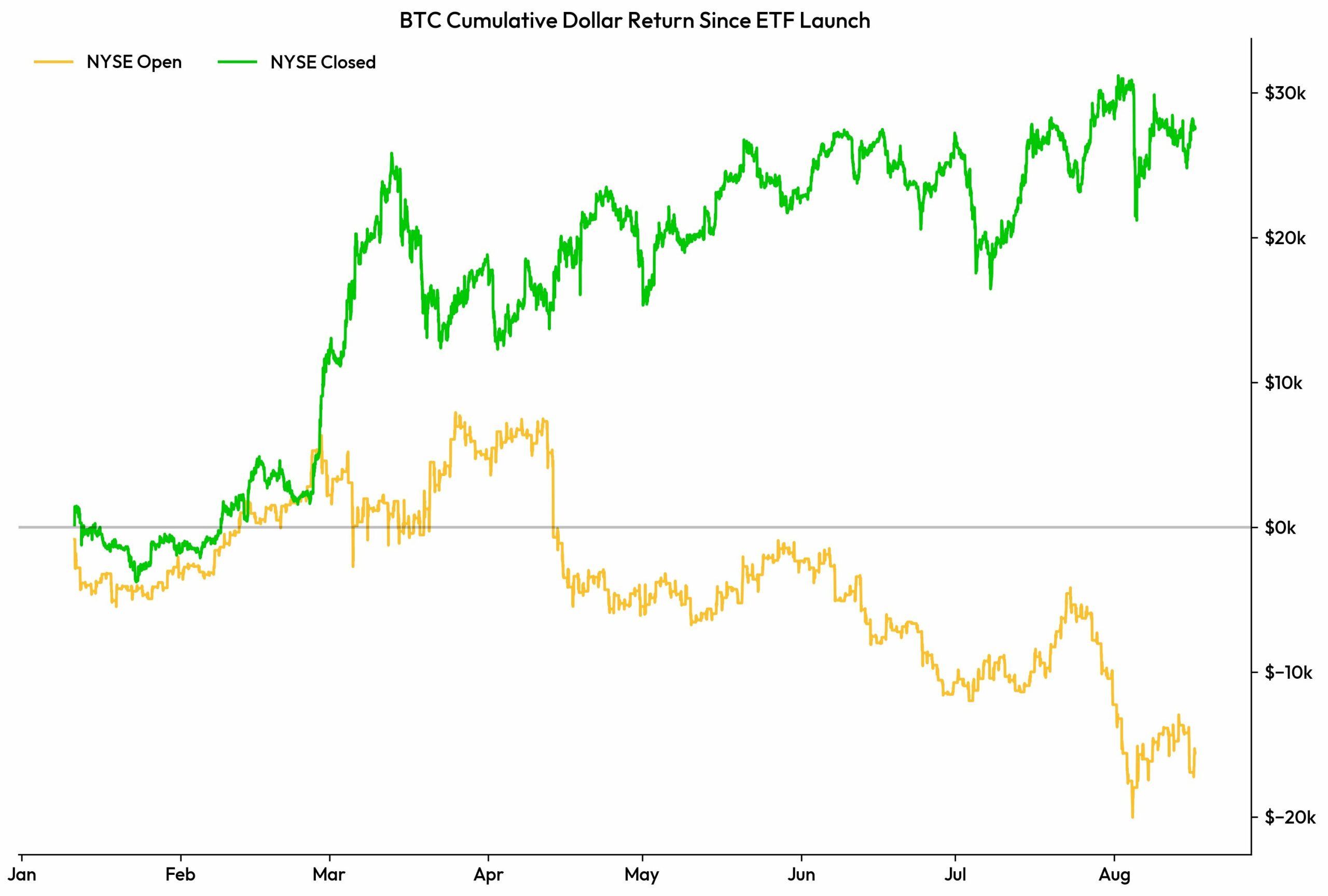

Bitcoin cumulative dollar return since ETF launch

Since the launch of these ETFs, Bitcoin’s cumulative dollar return has shown a distinct pattern: it tends to decline when the NYSE is open and rise when the NYSE is closed.

Traditional finance, now heavily involved in crypto markets, has likely contributed to this trend where the price movements of Bitcoin during market hours are influencing the performance of ETFs.

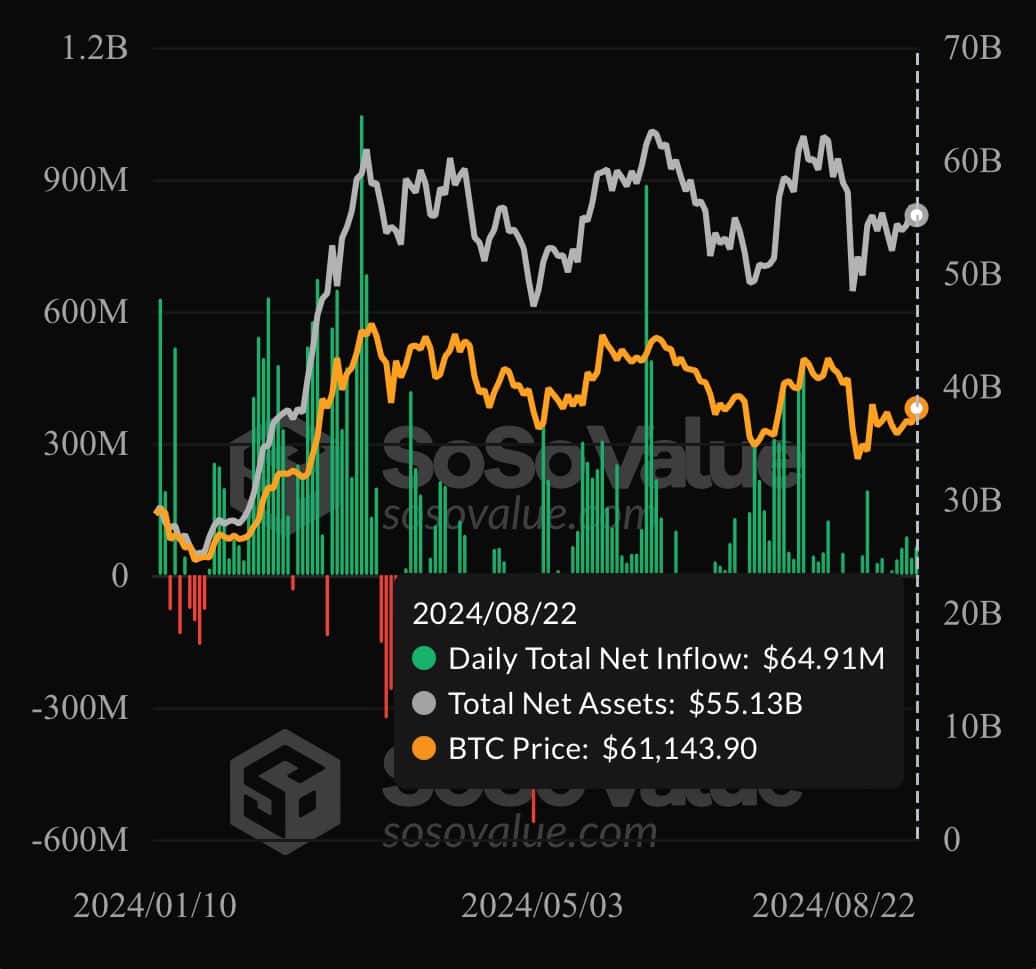

Bitcoin ETF flow & daily trading volume

Bitcoin ETFs recorded $65 million in daily net inflows yesterday, marking the sixth consecutive day of inflows.

This trend highlighted an increase in both net flow and daily trading volumes, with total net assets now reaching $55.13B.

For instance, the BlackRock spot Bitcoin ETF ($IBIT) recently recorded a trading volume of $758 million, contributing to a total daily volume of $1.4 billion for ETFs, as Bitcoin Archive noted on X (formerly Twitter).

This surge in trading activity has supported Bitcoin’s price, allowing it to retest key levels which means if a higher low is established around $67k, the king coin could continue its upward trend, targeting $70k.

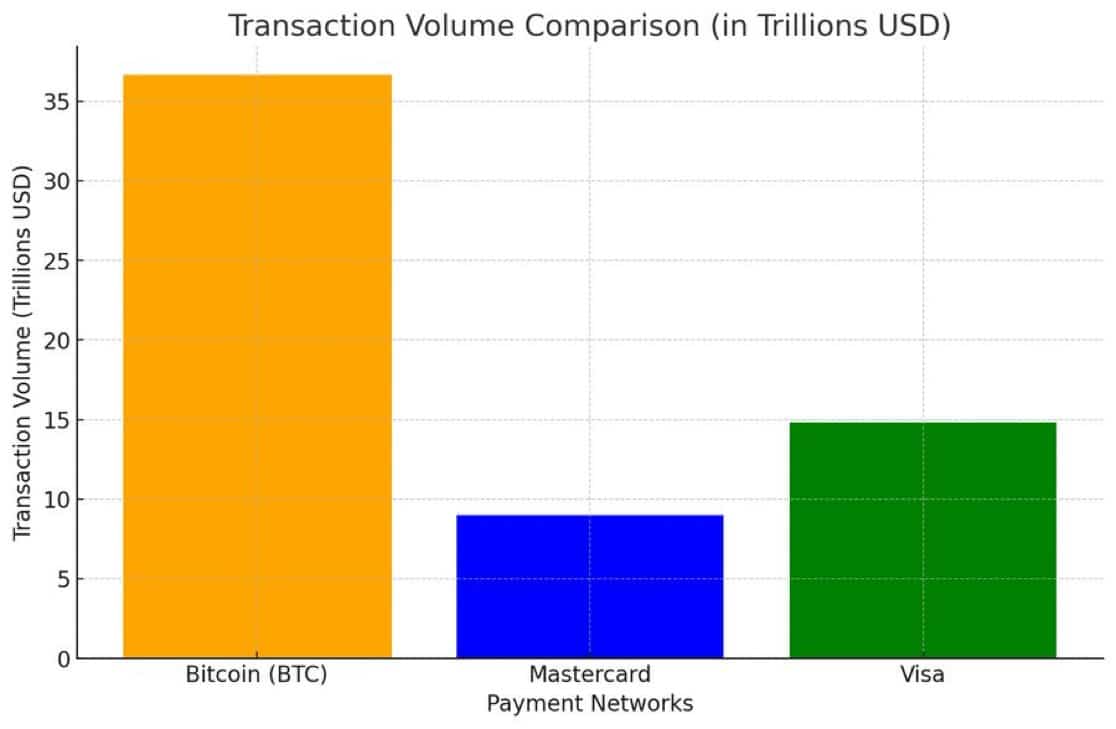

Transaction volume comparison

Additionally, Bitcoin’s transaction volume also remained robust, with the network processing $36.6 trillion in 2023, surpassing both Visa and Mastercard combined.

However, ETF holders miss out on this direct participation in Bitcoin’s transactional growth, as their holdings are tied to custodians and represented by paper shares.

This limitation in ETF structures needs addressing, but it doesn’t diminish Bitcoin’s long-term prospects.

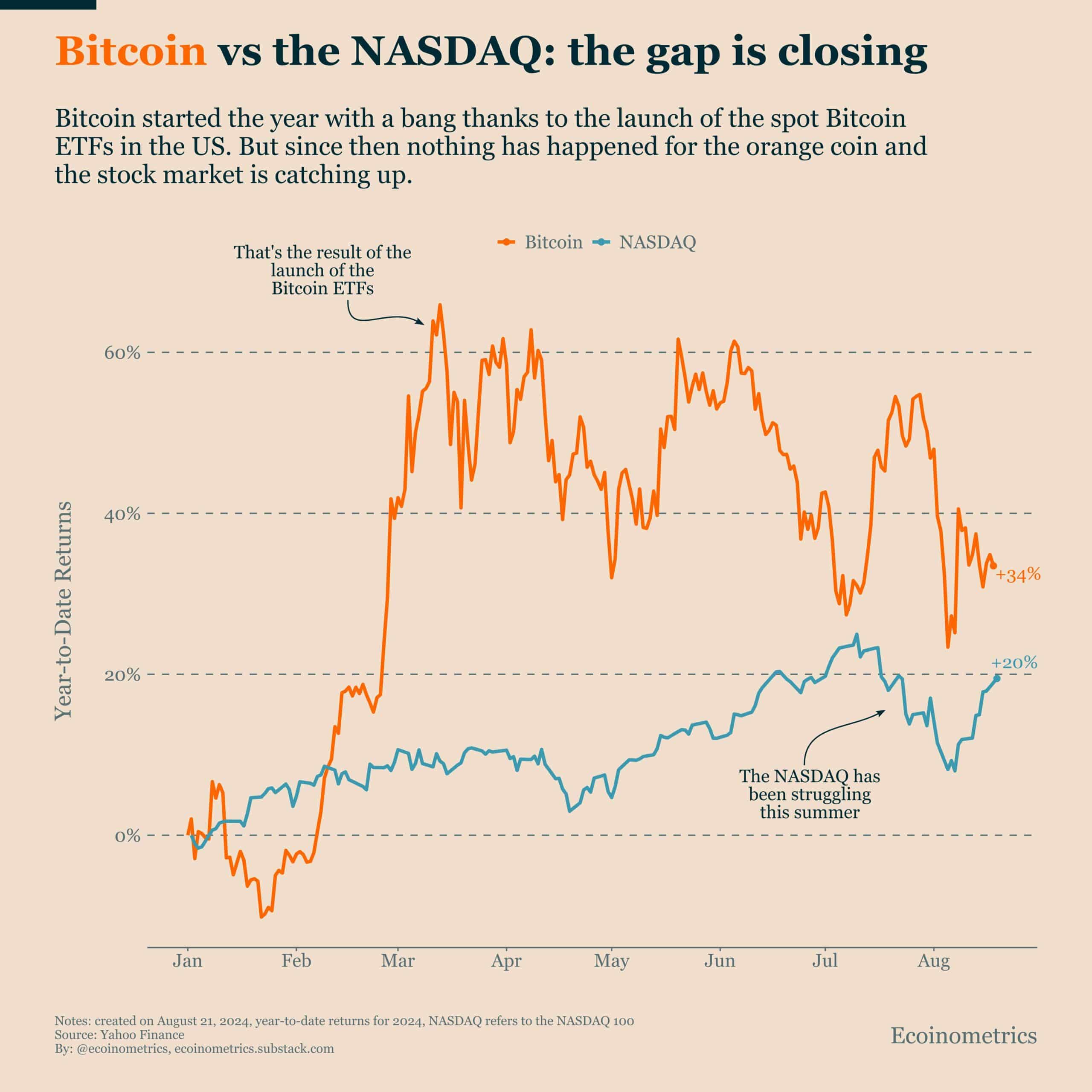

Bitcoin still outperforms stocks in year-to-date returns

Moreover, Bitcoin continued to outperform traditional stocks in year-to-date returns, with a 34% gain compared to NASDAQ’s 20%.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Although the gap has narrowed recently, the ongoing recovery in crypto markets suggests that Bitcoin’s future gains could be substantial, especially if more bullish drivers emerge.

Despite a relatively quiet year, the early boost from the ETF launch and the potential for further market catalysts indicate that Bitcoin’s price could rise significantly in the near future.