Bitcoin’s long haul: Exec predicts $150K by 2025 and $1M by 2030

- Per Swan Bitcoin’s CEO, BTC could hit $100,000 by early 2025, then $1 million by 2030.

- Bitcoin power law model echoed the April 2025 BTC price forecast.

Bitcoin [BTC] has been stuck in a boring price consolidation since March. However, most analysts and industry leaders remain bullish, especially from Q4 2024 to 2025.

Leading institutions like Standard Chartered predicted that the world’s largest digital asset could hit $150k by end-2024.

Swan Bitcoin’s CEO Cory Klippsten is the latest to make a BTC price target. During a recent interview with Kitco News, he said,

“I think BTC price might be 100K flat by April 2025…By the end of 2025, we’ll probably have a round trip, and be back down to $125K.”

However, the executive maintained that the largest digital asset could hit $1 million per coin by 2030, citing likely increased education about the asset.

“We’ll have Bitcoin sats to dollar parity, which means $1 million per coin by 2030.”

Klippsten’s target was slightly different from Standard Chartered. The bank projected BTC could hit $200K by the end of 2025, unlike Klippsten’s conservative $125K target.

However, do the common BTC prediction models agree with this outlook?

What does Bitcoin power law model project?

The Bitcoin power law is one of the prediction models widely used by analysts. It attempts to gauge future price targets based on historical price action. It has three price bands: support, resistance, and median level.

In early 2024, the model projected a high of $300K, a low of $20K and a conservative target of $74K. In March, BTC hit a high of $73K, slightly shy of the median target of $74K.

The model targets for early 2025 are $420K, $40K, and $115K. So, Klippsten’s target was almost similar to the model’s median target. For the end of 2025, the median target was $150K and was way below the executives’ projections of $125K.

It’s worth noting that the power law model relies on past price patterns and may be invalidated by blackswan events.

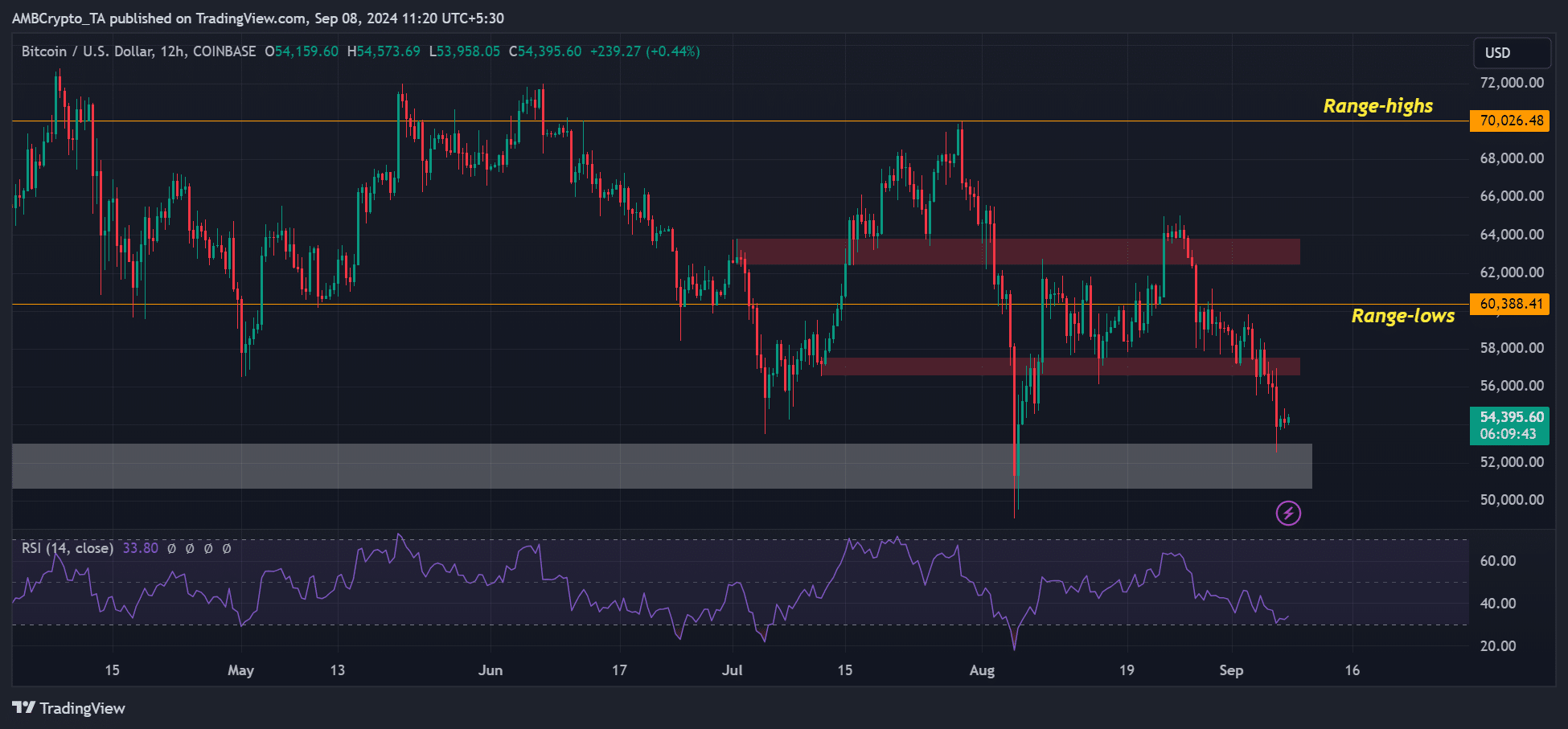

In the meantime, BTC’s recent dump eased above $52K, the same support that stopped early August’s massive decline. According to BitMEX founder Arthur Hayes, a rebound might be likely based on a positive outlook from the macro front. He said,

“With Janet Yellen watching market and releasing a weekend statement, if stuff continues to puke next week $BTC *MIGHT* rise anticipating more dollar liquidity.”

However, the recovery must clear overhead resistances above $57K, the previous range lows at $60K, and another supply zone at $65K. At press time, BTC traded at $54.3K, about 26% down from its record high of $73.8K in March.