Bitcoin

Bitcoin’s looming supply crunch – Is that good news for you?

U.S Bitcoin ETFs are inching closer to holding 6% of Bitcoin’s total market capitalization.

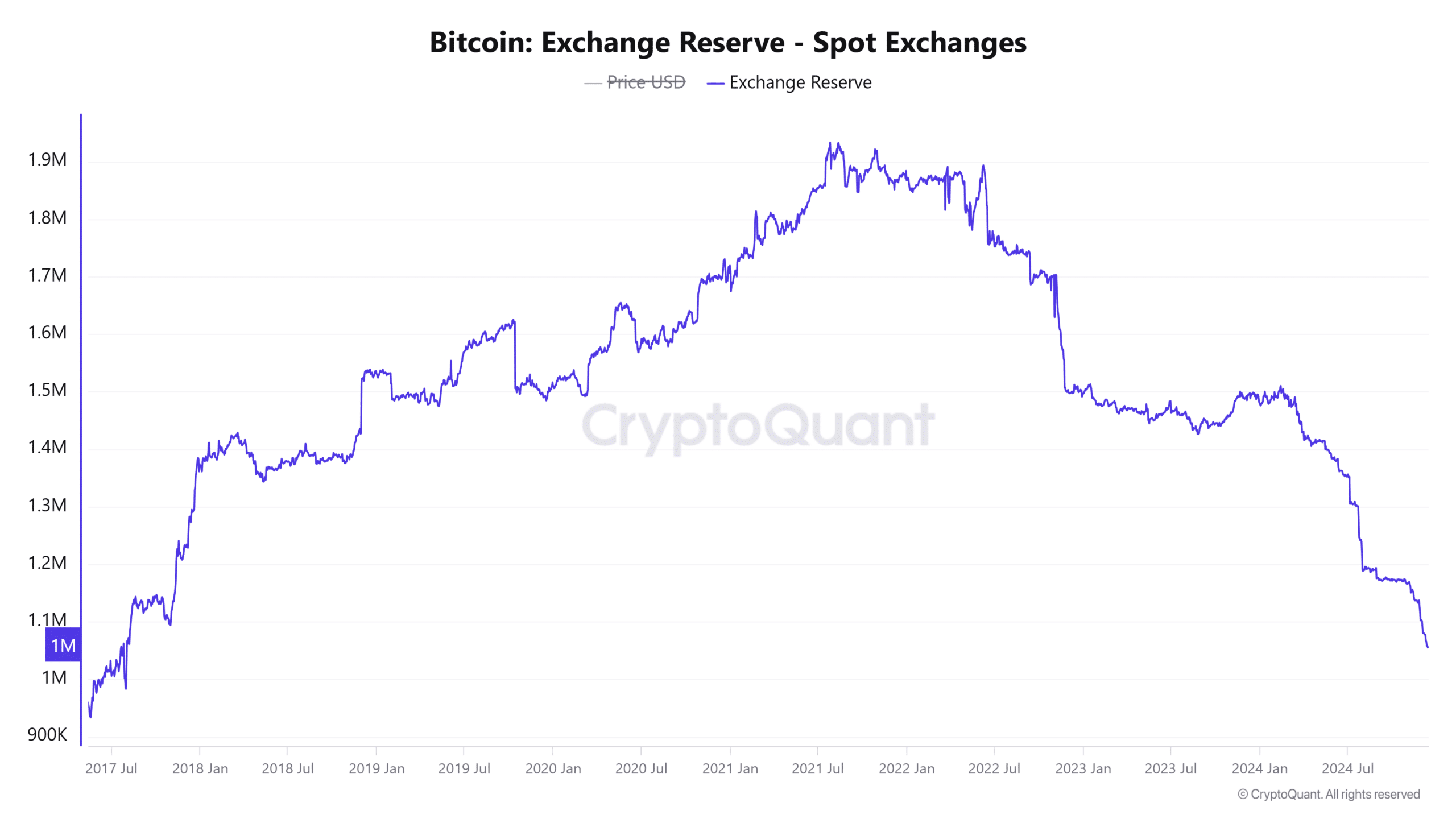

- Bitcoin reserves on spot exchanges have dropped to their lowest level since 2017

- Rising institutional demand amid the falling supply could trigger a prize squeeze

Bitcoin (BTC), at press time, was trading at $101,718 on the charts following gains of 1.6% in 24 hours. As expected, the king coin continues to be the most dominant crypto in the market, with a market capitalization of >$2 trillion.

Alongside these recent gains though, demand for BTC has surged too. This has created a market imbalance due to falling supply. If these trends persist, Bitcoin might be facing a potential supply squeeze, one that could push its price higher.

Bitcoin spot exchange reserves hit a 7-year low

Data from CryptoQuant highlighted the drop in Bitcoin’s supply after spot exchange reserves fell to their lowest level since mid-2018. In fact, the Bitcoin held on spot exchanges now stands at 1,055,716 BTC.

These reserves have recorded a steep drop over the past month amid Bitcoin’s rally past $100,000 to new all-time highs.

According to 10X Research, Coinbase, which has the highest Bitcoin reserves, recorded 72,000 BTC in outflows in the last 30 days. These outflows comprised nearly 10% of the exchange’s Bitcoin balance.

29,000 BTC was also withdrawn from Binance within the same period, while Kraken’s outflows accounted for more than 7% of its total Bitcoin holdings.

The exchange netflow data for the last 30 days also revealed that Bitcoin has recorded 22 days of negative netflows from spot exchanges. This is further evidence of a scenario where traders have not been keen on selling.

Additionally, this data suggested that most traders are choosing to hold Bitcoin despite its recent gains – A sign of their long-term bullish outlook.

Rising institutional demand

The unwillingness to sell has been met with a spike in institutional demand, as seen in the inflows to spot Bitcoin exchange-traded funds (ETFs).

According to SoSoValue data, the total inflows to spot Bitcoin ETFs in the last three weeks have surpassed $5 billion. These assets are inching closer to holding 6% of Bitcoin’s total market capitalization.

Inflows to these ETFs have also been positive for the last 12 consecutive days.

If these inflows persist, it could trigger an additional supply squeeze on Bitcoin that could push the price higher.

Binary CDD shows….

Long-term Bitcoin holders are known to sell whenever the market hits a local top. As AMBCrypto reported, this cohort started selling Bitcoin earlier this month, causing the rally to stall.

The Binary Coin Days Destroyed (CDD) has been at 1 over the last five days. This implied that long-term holders may still be taking profits.

If this cohort is selling, it could lead to Bitcoin avoiding a potential supply squeeze if the coins being sold are enough to absorb the buy-side pressure.