Bitcoin

Bitcoin’s market cycle: What past trends reveal about BTC’s future

The data shows that BTC’s current trajectory aligns closely with the patterns observed in the last two cycles.

- Analysts point to BTC’s historical alignment with previous market cycles, indicating strong potential for a sustained rally.

- Both traders and long-term holders are driving demand, showing growing confidence in the asset’s prospects.

Over the past month, Bitcoin [BTC] has gained an impressive 47.52%, solidifying its position as one of the market’s top performers. In the last 24 hours alone, it has risen by 1.78%, as buying activity shows no signs of slowing.

With bullish sentiment dominating and increasing optimism among investors, BTC appears ready to extend its upward momentum in the coming weeks.

Historical trends indicate BTC is primed for an upswing

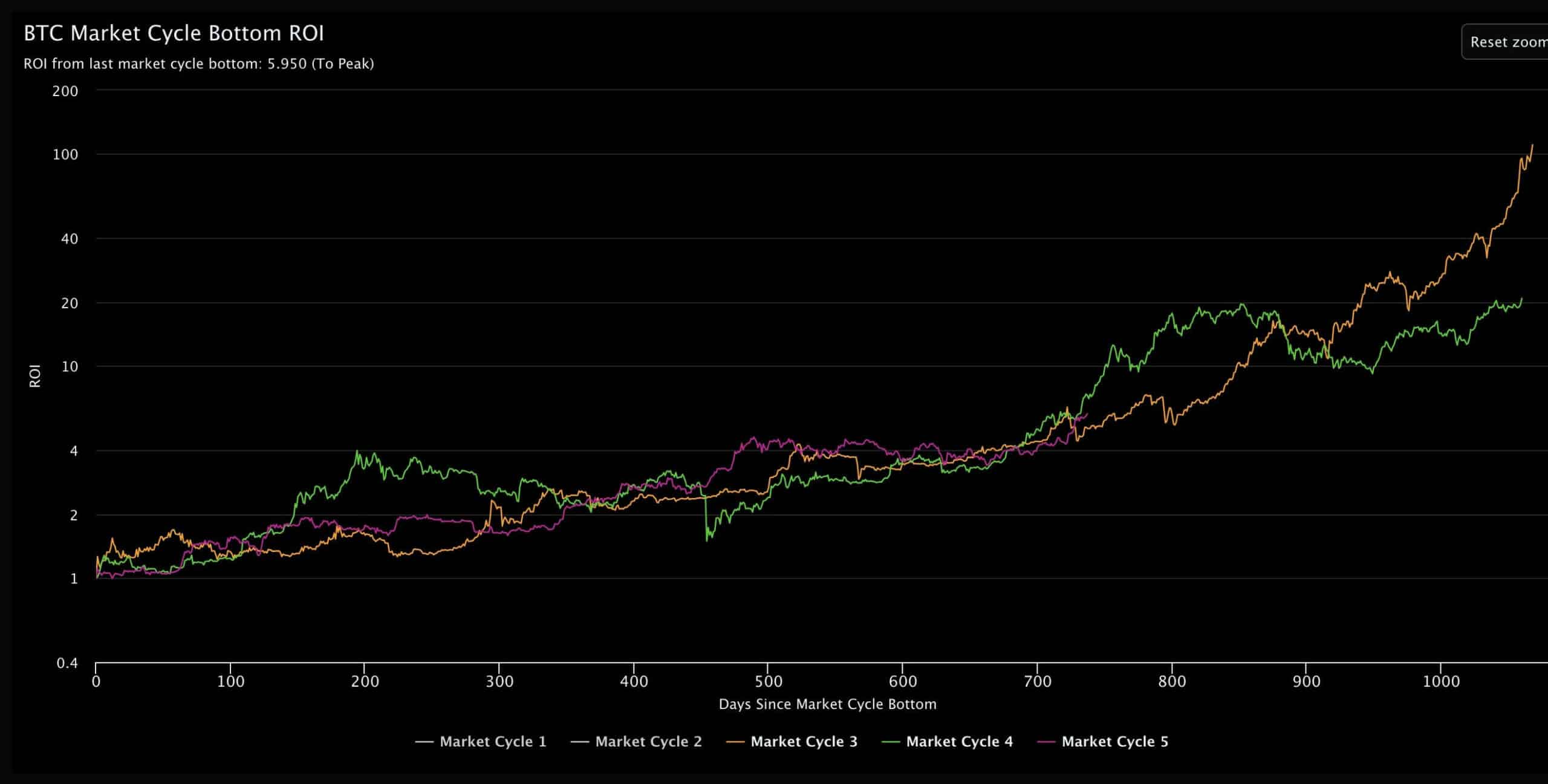

Analysts point to the BTC Market Cycle Bottom ROI

, a dataset tracking Bitcoin’s performance across market cycles, as evidence of its potential for further gains.The data reveals that BTC’s current trajectory aligns closely with the patterns observed in the last two cycles. If this trend holds, Bitcoin could experience steady, incremental growth from its current price levels.

The bull runs of 2017 and 2021 followed similar cycles, suggesting that the ongoing rally might extend into 2025 if history repeats itself.

AMBCrypto conducted further analysis to assess whether current market conditions support this long-term bullish outlook.

BTC prepares for long-term growth as buyer activity increases

Bitcoin (BTC) continues to show strong bullish signals as market participants position themselves for a potential long-term rally.

The Exchange Reserve, which tracks the amount of BTC available on exchanges, has sharply declined. Only 2.516 million BTC remain on exchanges, following a 0.72% drop in the past 24 hours and a cumulative decrease of 2.63% in the last 7 days.

This reduced supply suggests increasing demand, a trend often linked to upward price momentum.

The Exchange Netflow supports this outlook, recording a significant drop of 87.02% over the past day. More than 15,000 BTC were moved from exchanges to private wallets, signaling a preference for holding rather than trading.

Negative netflows—where outflows exceed inflows—typically indicate that investors are preparing for long-term price appreciation.

Adding further confidence is the Fund Market Premium, which has stayed positive, with a current reading of 0.13074 after crossing above the zero mark the previous day.

This metric, which measures the gap between a fund’s market price and its net asset value (NAV), is commonly used for exchange-traded funds (ETFs) and closed-end funds like Grayscale.

A positive premium highlights strong investor demand and reinforces the bullish sentiment.

With declining exchange reserves, reduced netflows, and a positive fund premium, BTC appears well-positioned for sustained long-term growth.

Broader market sentiment fuels BTC’s bullish momentum

The broader cryptocurrency market continues to exhibit bullish sentiment, increasing the likelihood of further gains for Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

At press time, the total crypto market capitalization has risen by 4.63%, reaching $3.3 trillion, with Bitcoin accounting for a significant share at $1.97 trillion. This highlights BTC’s dominant position and growing appeal among investors.

If the crypto market capitalization continues to climb, it could drive additional liquidity into Bitcoin, further solidifying its allure for investors and supporting its upward trajectory.