Bitcoin’s network mining difficulty (7d moving average) hits new all-time high

Since the start of December 2020, Bitcoin has been on a tremendous bull run. When compared to its valuation on the 1st of December, Bitcoin has grown by close to 90 percent. The growth percentage was a lot higher yesterday, however, especially since corrections have been rampant over the past 24 hours.

Despite Bitcoin’s price dipping on the charts, the cryptocurrency still managed to maintain its position above the key $30k-price level, with BTC holding a press time price of $31,620.

Source: Glassnode

In what is yet another highlight for the ecosystem, according to data provided by Glassnode, Bitcoin’s network difficulty has registered a new all-time high. Taking a look at the 7-day average network difficulty chart provided by the crypto-analytics platform, one can see that BTC’s network mining difficulty (7d moving average) climbed to a new high on the charts.

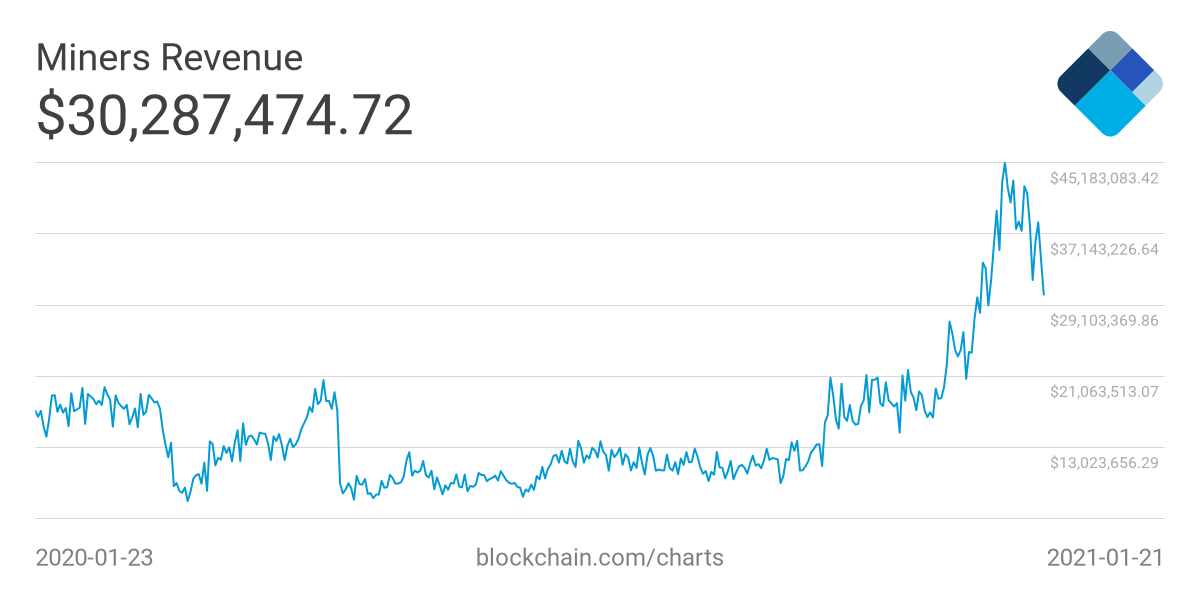

For Bitcoin, the miner demographic is a key group that helps maintain the king coin’s valuation. When miners hold, the price tends to remain stable and even increase. However, data surrounding miner revenue seems to be painting a less than an ideal picture.

Miner revenue over the past few weeks, even when Bitcoin was breaking new records in terms of its price, has fallen substantially. According to Bitcoin’s network data, miner revenue stood at $45.2 million on 06 January. However, it had fallen to just over $30 million, at press time. This might force small-scale miners to sell some of their BTC and such a move tends to have a negative impact on the overall trading price of the coin.

Bitcoin’s mining difficulty and the margins by which it has increased has also been a polarizing and interesting topic on crypto-Twitter. Crypto-analyst PlanB, known for his Bitcoin prediction Stock-to-Flow model, recently pointed out that since 2019, mining difficulty has been flat, when compared to the steep increase the coin’s price has been on.

However, PlanB’s comment was quick to attract the attention of Glassnode CTO – Rafael Schultze-Kraft – who highlighted that in 2020 alone, the network’s difficulty has risen by 50 percent.

#Bitcoin mining difficulty basically flat since end 2019?

Um, nope – not at all.https://t.co/KOAL6s5l9h pic.twitter.com/rlC1gRbzIt

— Rafael Schultze-Kraft (@n3ocortex) January 18, 2021

Around 2 weeks ago, Bitcoin had undergone a difficulty adjustment, one that saw the network’s difficulty rise by over 11 percent. Combined with lower rewards for the network’s miners and increased computational power in sustaining the network and keeping it secure seemed to have become an added burden for BTC’s miners.

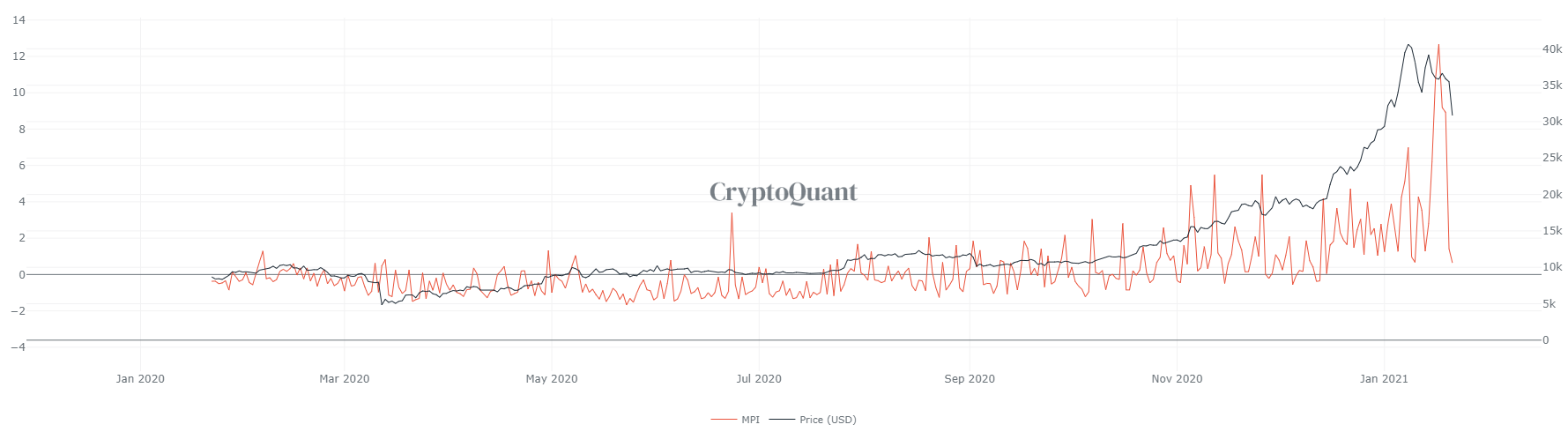

However, such is not the case as of now. Data from CryptoQuant’s Miners’ Position Index (MPI) indicates whether or not sell-offs have begun on the part of BTC’s miners. A value above 2 is generally problematic as this indicates that miners are offloading their coins to keep their operations sustainable. At press time, BTC’s MPI was around 0.6 and underlined that the hodling sentiment is continuing.

Source: CryptoQuant

The fact that miners aren’t selling their BTC is promising for the king coin’s price aspirations and it will require the backing of hodlers, if it wishes to revisit its $40k-valuation in the coming weeks.