Bitcoin’s new wave of demand is not out of question – Here’s why

- Bitcoin’s SOPR could repeat history, helping investors stay profitable

- ELR indicated renewed interest in opening BTC derivative contracts

Expecting a short-term Bitcoin [BTC] recovery is something that many market participants may not hope for. However, a pseudonymous CryptoQuant analyst Crazzyblockk has opined that it is not impossible.

How much are 1,10,100 BTCs worth today?

According to the analyst, the position of the Spent Output Profit Ratio (SOPR) offers this potential. As a macro market sentiment indicator, the SOPR measures the degree of realized profits moved on-chain.

BTC: Offering an advantage to holders

Values over 1 of the SOPR suggest that investors are selling at a profit. On the other hand, SOPR values below 1 indicate average selling at a loss. And, at press time, the value of the metric was above.

However, Crazzyblockk’s argument is the longevity that the metric has had in its current position. In fact, the datasets revealed that Bitcoin’s SOPR has stayed above the value since March.

This led the analyst to compare the state in 2017 and 2019 with the SOPR at press time.

Between 2015 and 2016, the SOPR consistently maintained its value above 1. Thus, this led BTC’s price to hit $20,000 in 2017. The analyst also mentioned that the SOPR condition in 2019 was vital to the BTC All-Time High (ATH) in 2021. Crazzyblock added,

“When the number 1 of this data maintain for consecutive months, and the pocket value of these holders moves above this level is a sign of a strong interest in staying in the market and gaining profitability. 2015 and 2019 price cycles are good examples.”

According to the analyst, there is strong interest in the market. Additionally, the current demand is enough to withstand any heavy selling pressure, the analyst added.

Big bets on which direction?

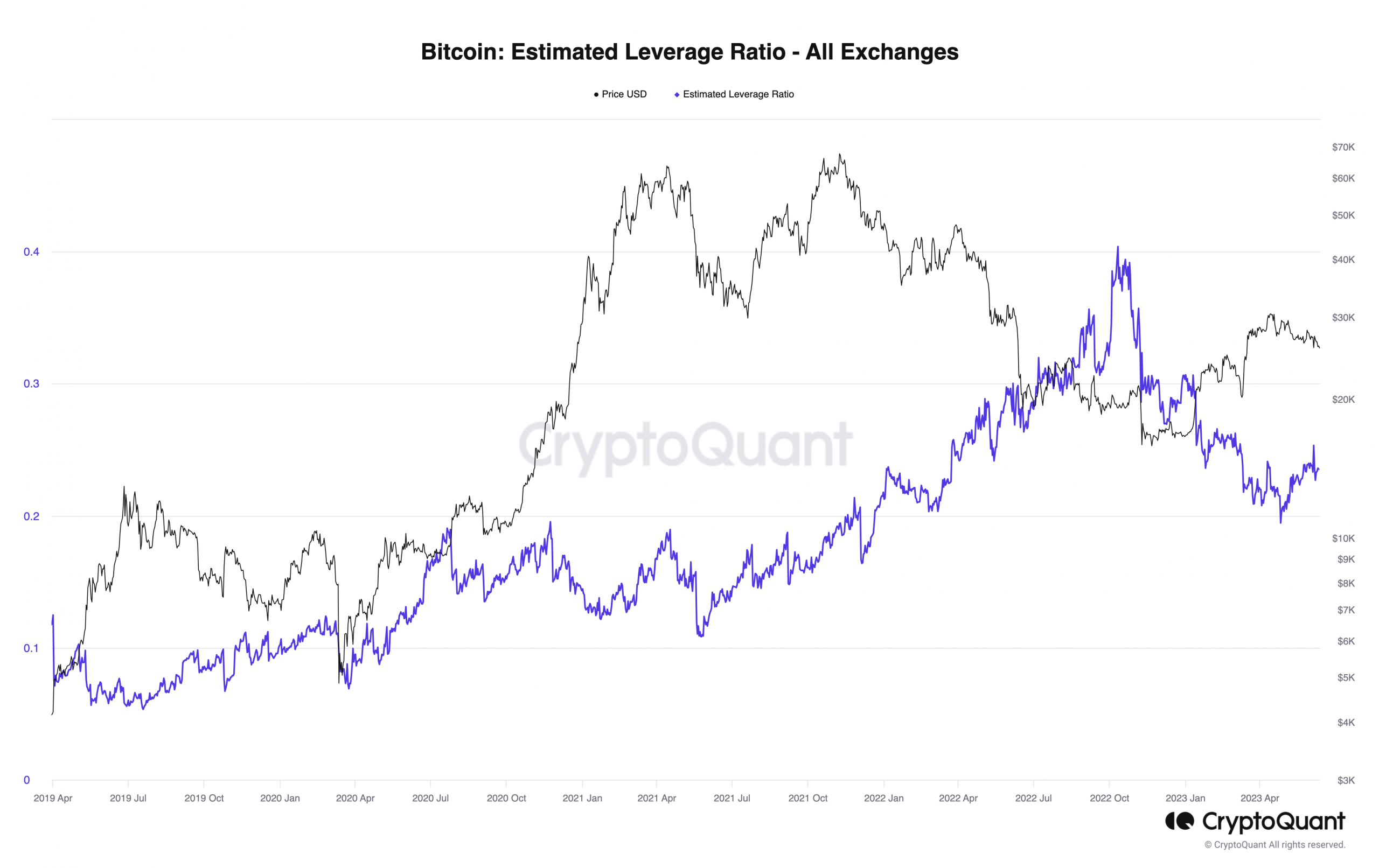

Meanwhile, BTC continued its consolidation over the last 24 hours. Despite that, the Estimated Leverage Ratio (ELR) has been rising.

Typically, the ELR shows how much leverage is used by users. And, it’s calculated by dividing the Open Interest (OI) by the coin reserves. Lower values of the ELR suggest that investors are being cautious of the leverage used.

However, when the ELR hikes, it means that participants are taking big bets on their derivative traders.

Is your portfolio green? Check the Bitcoin Profit Calculator

Whether long or short, the increase also aligns with the aforementioned discussion around the strong interest in the market.

Additionally, oinonen_t, another CryptoQuant analyst, noted that the liquidity collapse in the market has not negatively affected Bitcoin’s strength. Citing rising accumulation and active addresses, the analyst highlighted,

“The current selling pressure is coming from the direction of market makers, who recently dumped a huge number of Binance-related altcoins, collapsing the liquidity. In contrast to the challenging market environment, bitcoin’s technical and fundamental indicators mirror strength”