Bitcoin’s next move: Retail euphoria can push BTC to $112K, ONLY IF…

![Bitcoin [BTC] social sentiment hit a 2.1 bullish-to-bearish ratio, the highest since Nov 2024.](https://ambcrypto.com/wp-content/uploads/2025/06/Evans-98-min-1200x675.png)

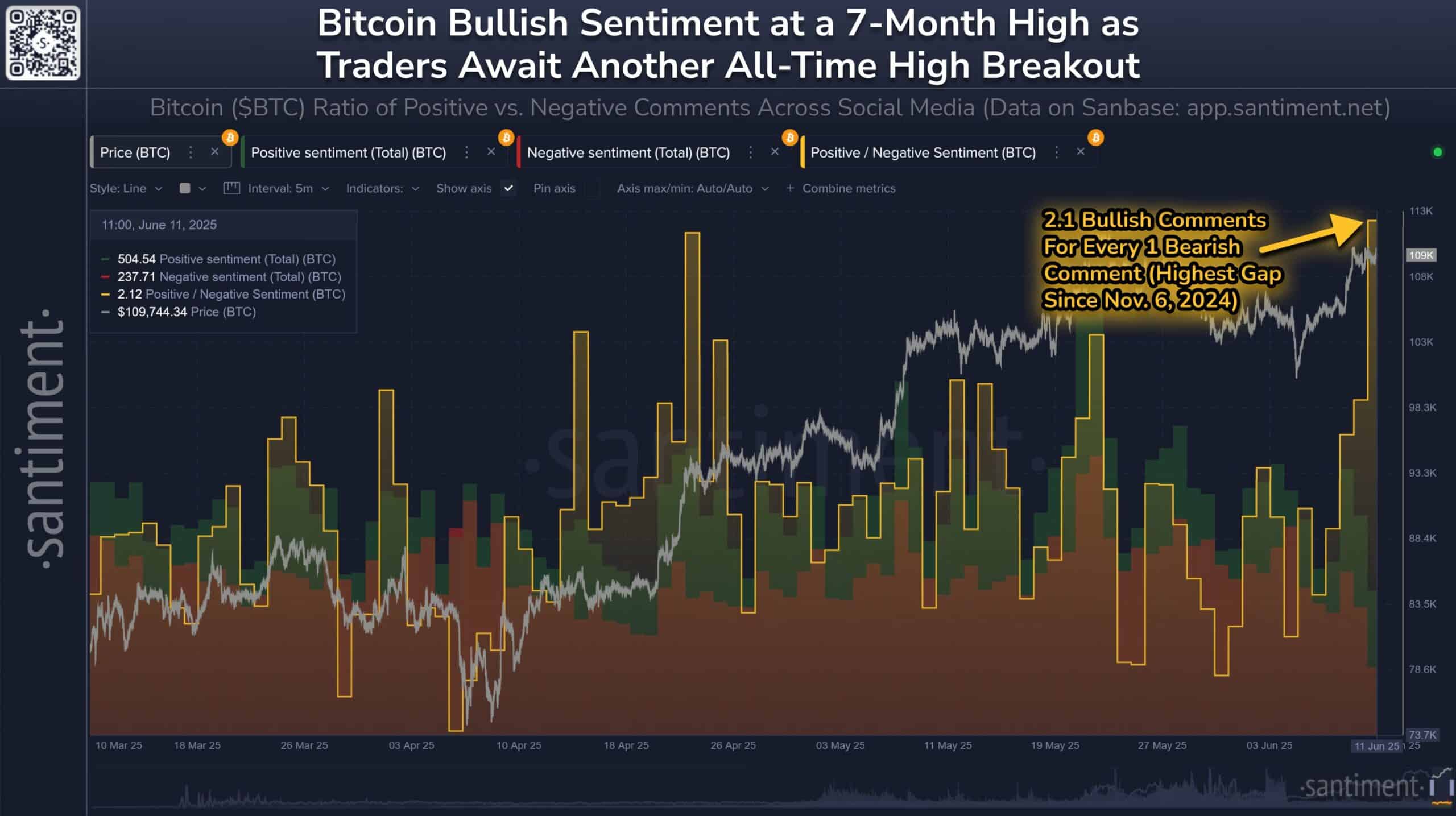

- Bitcoin’s social sentiment hit a 2.1 bullish-to-bearish ratio, the highest since November 2024.

- Analysis of MVRV Ratio, Exchange Reserves, and Liquidation Map revealed possible reversal triggers.

Bitcoin [BTC] saw a wave of retail euphoria as social media sentiment hit a 7-month high.

At press time, BTC traded at $107,927—just 3.6% shy of its previous all-time high.

Naturally, social data reflected this momentum.

Santiment data showed the ratio of bullish to bearish BTC comments has surged to 2.1—the highest since November 2024—revealing strong optimism.

However, as price approaches clustered liquidation zones, the next move will likely depend on how leveraged positions respond to this sentiment-driven momentum.

Are BTC holders too deep in profit for this rally to continue?

The MVRV Ratio sat at 2.27—well above the danger zone of 2.0 that historically precedes distribution phases.

However, the 1.97% decline in this metric over the last day suggests a slight reduction in unrealized gains, possibly due to mild corrections or early profit-taking.

Therefore, while sentiment remains strongly bullish, this subtle dip in MVRV could signal that traders are starting to secure profits, adding a layer of caution as Bitcoin inches closer to $112K resistance.

Will stablecoin firepower fuel the next leg up?

The Stablecoin Supply Ratio climbed 0.98% to 18.21, implying growing dry powder on the sidelines.

This suggests traders may be preparing to deploy capital, especially if BTC clears $108K convincingly. Therefore, fresh capital could boost upward momentum.

However, the current moderate uptick suggests that while stablecoin ammunition is building, the pace remains cautious, highlighting the need for strong conviction to break above critical resistance levels.

Are falling exchange reserves a hidden bullish trigger?

Exchange Reserve dropped to $269.7 billion, falling 1.67% over the past day.

This move often signals a bullish trend, as it suggests that traders are pulling funds off exchanges for long-term storage rather than preparing to sell.

Consequently, this reduced supply could limit selling pressure in the short term.

However, unless accompanied by fresh inflows or rising demand, the supply-side squeeze alone may not be enough to push Bitcoin through major liquidation zones near its previous all-time high.

Could aggressive longs face liquidation above $112K?

According to the Liquidation Heatmap, dense clusters of 50x and 100x long positions lie just above current price levels.

If BTC gets rejected there, a cascade of liquidations could unwind quickly.

On the flip side, if price slices through the $112K mark cleanly, it could trigger a wave of short liquidations and fuel further upside.

Will BTC bullish sentiment break barriers or backfire above $112K?

BTC’s approach to $112K is supported by bullish social sentiment, falling Exchange Reserves, and rising stablecoin power.

However, elevated MVRV levels and dense liquidation zones above current prices pose real risks. If buying momentum slows or leverage unwinds, retail euphoria could quickly turn into panic.

For now, market participants should remain cautiously optimistic—but prepared for volatility as BTC challenges this psychological milestone.